-

BONK has surged by 17% in the past 24 hours, signaling a continued bullish trend.

The increase in trading volume alongside the price surge enforces the strong bullish momentum.

As a seasoned crypto investor with a few bear market cycles under my belt, I’ve learned to remain cautiously optimistic during sudden price surges like BONK‘s recent 17% increase in just 24 hours. The bullish trend is evident, but it’s crucial not to overlook potential risks or be blinded by short-term gains.

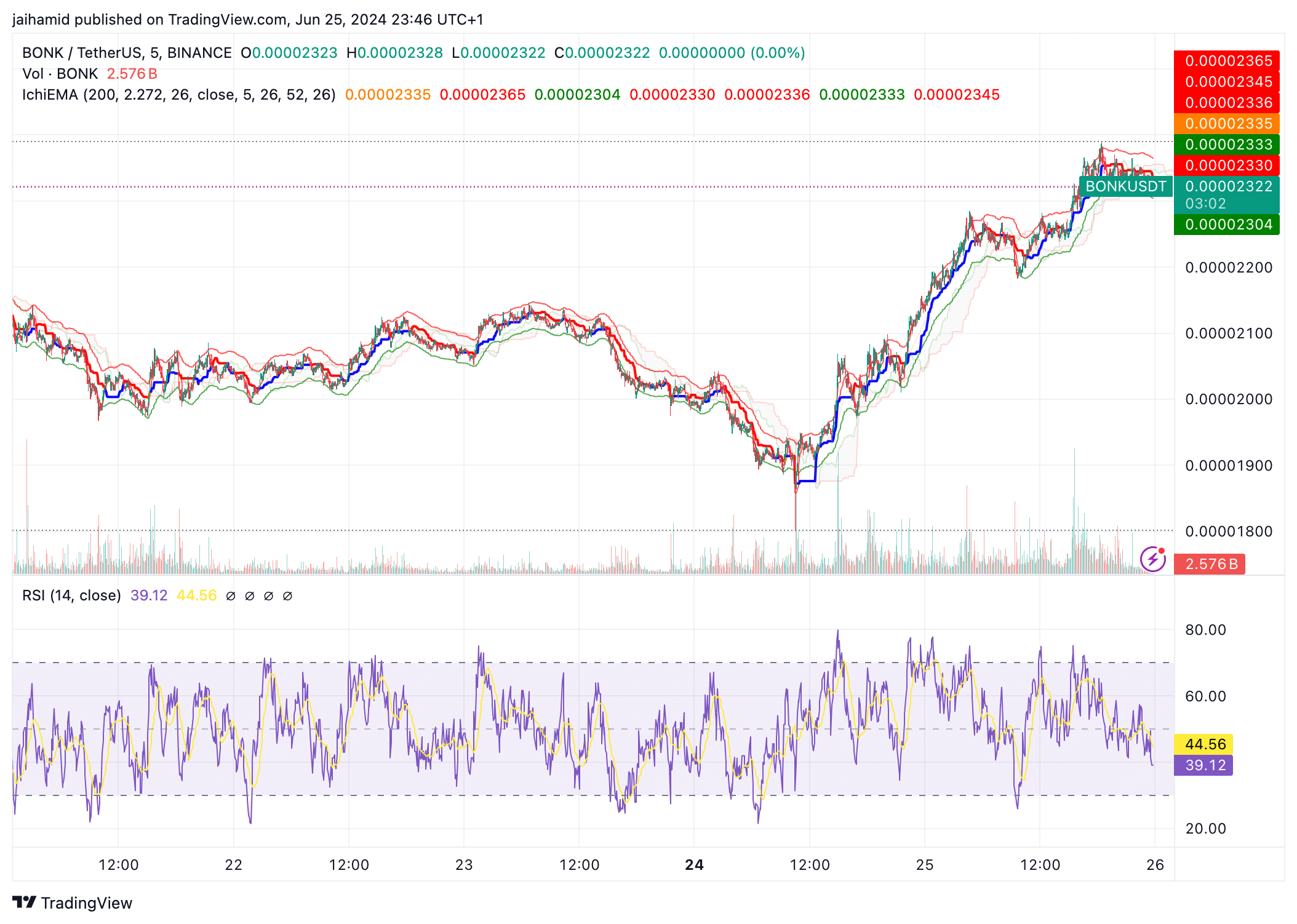

On the 25th of June, there was a dramatic and substantial price rise for Bonk, with a 17% increase observed within the last day. This surge in value can be attributed to elevated trading volumes.

In simpler terms, the cost of BONK is presently higher than its Ichimoku Cloud, implying a robust uptrend. The cloud functions as a protective barrier below in this scenario, meaning that so long as the price stays above the cloud, the bullish trend will persist.

Are the bulls back?

The price rise is accompanied by a significant uptick in trading activity, underscoring the buying power of the market.

With an RSI of approximately 44.56, the asset isn’t showing signs of being overbought or oversold. In simpler terms, this condition suggests that potential for further price increase exists without imminent worry of a correction caused by overbuying.

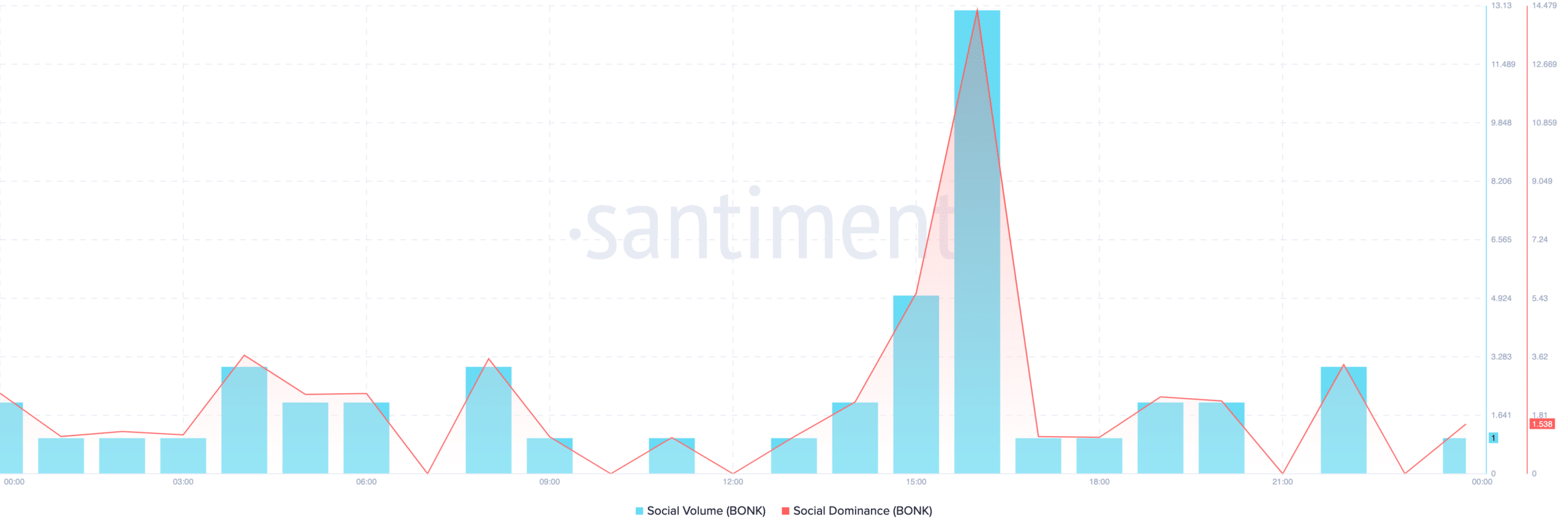

There has been a significant rise in social buzz and influence for BONK. With heightened interest comes the potential for price spikes, but it also exposes the asset to a higher risk of volatile trading based on speculation.

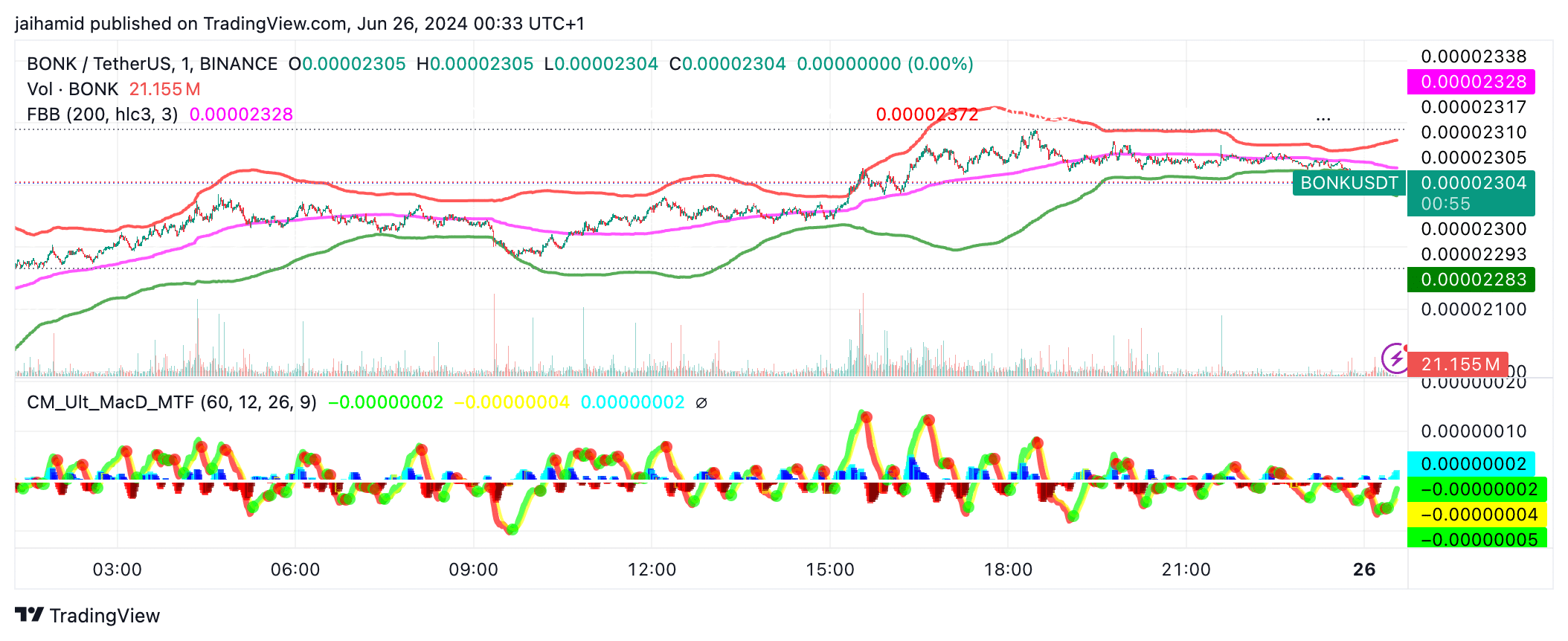

The MACD chart by BONK‘s CM, which is based on the Moving Average Convergence Divergence indicator, displays the relationship between two moving averages – the 12-period and 26-period exponential moving averages. The shifts of this chart around the zero line represent the variation between these averages. The appearance of red dots signifies a bullish crossover, while green dots indicate bearish crossovers.

The MACD line frequently crossing above and below the signal line indicates an energetic market where traders may encounter numerous opportunities for entering or exiting positions.

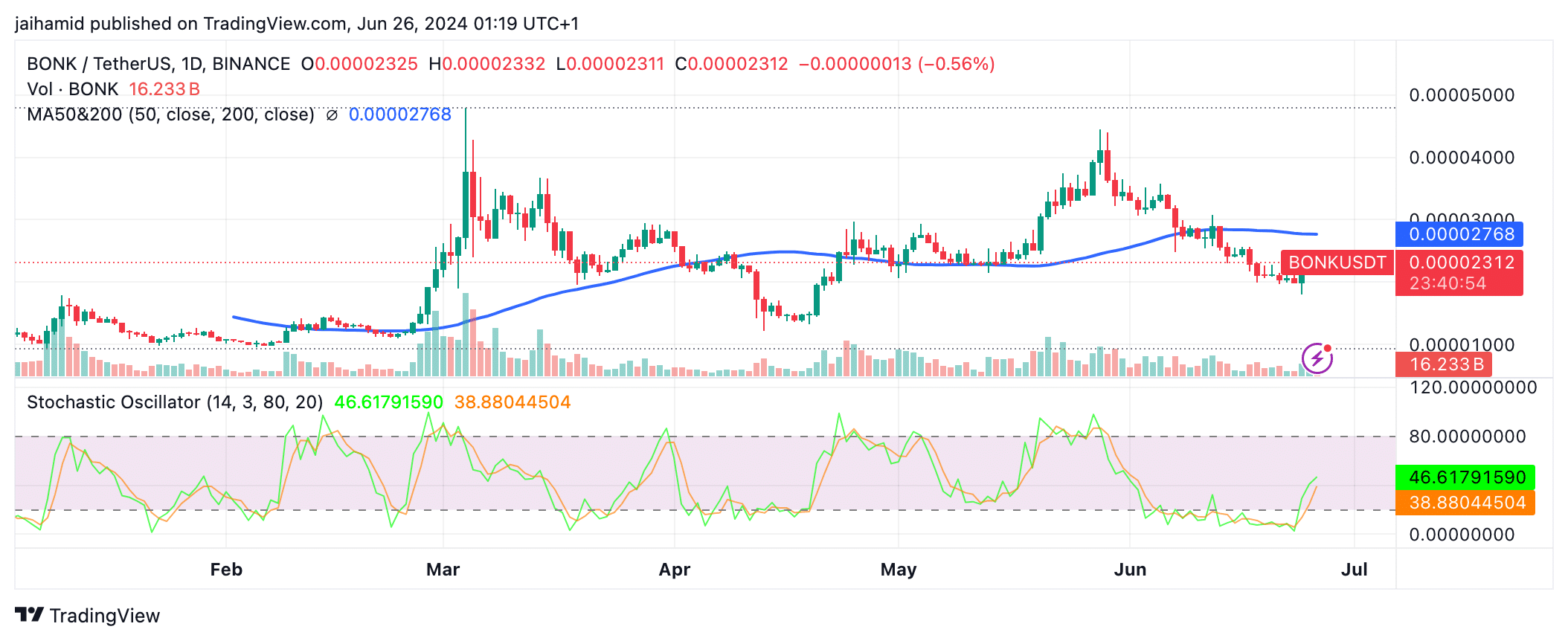

In simpler terms, when the price remains below the 200-day moving average for an extended period, it indicates a bearish outlook in the long term. Keep an eye on the level at 0.000002768 (the 200-day moving average) as a significant resistance in the short term.

As an analyst, I would observe that the market may be showing signs of potential support near the recent lows. It’s essential to keep a close eye on the Stochastic indicator, as a confirmed buy signal could emerge if the indicator continues to cross upward and enters the overbought territory.

As a researcher, I’ve discovered that the record-breaking price for Bonk was $0.00004547, which was hit on March 4, 2024 – approximately four months ago. At present, the value has dropped by a significant 49.48% compared to this historical peak.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-06-26 12:07