- BONK has retraced part of its July recovery gains

- Fed rate decision could drive a relief rally, but there seemed to be an overhead obstacle

As a seasoned researcher with a knack for deciphering cryptocurrency market trends, I’ve seen my fair share of rollercoaster rides, and BONK has certainly been one wild ride this July! The memecoin’s performance is a classic case of ‘two steps forward, one step back.’

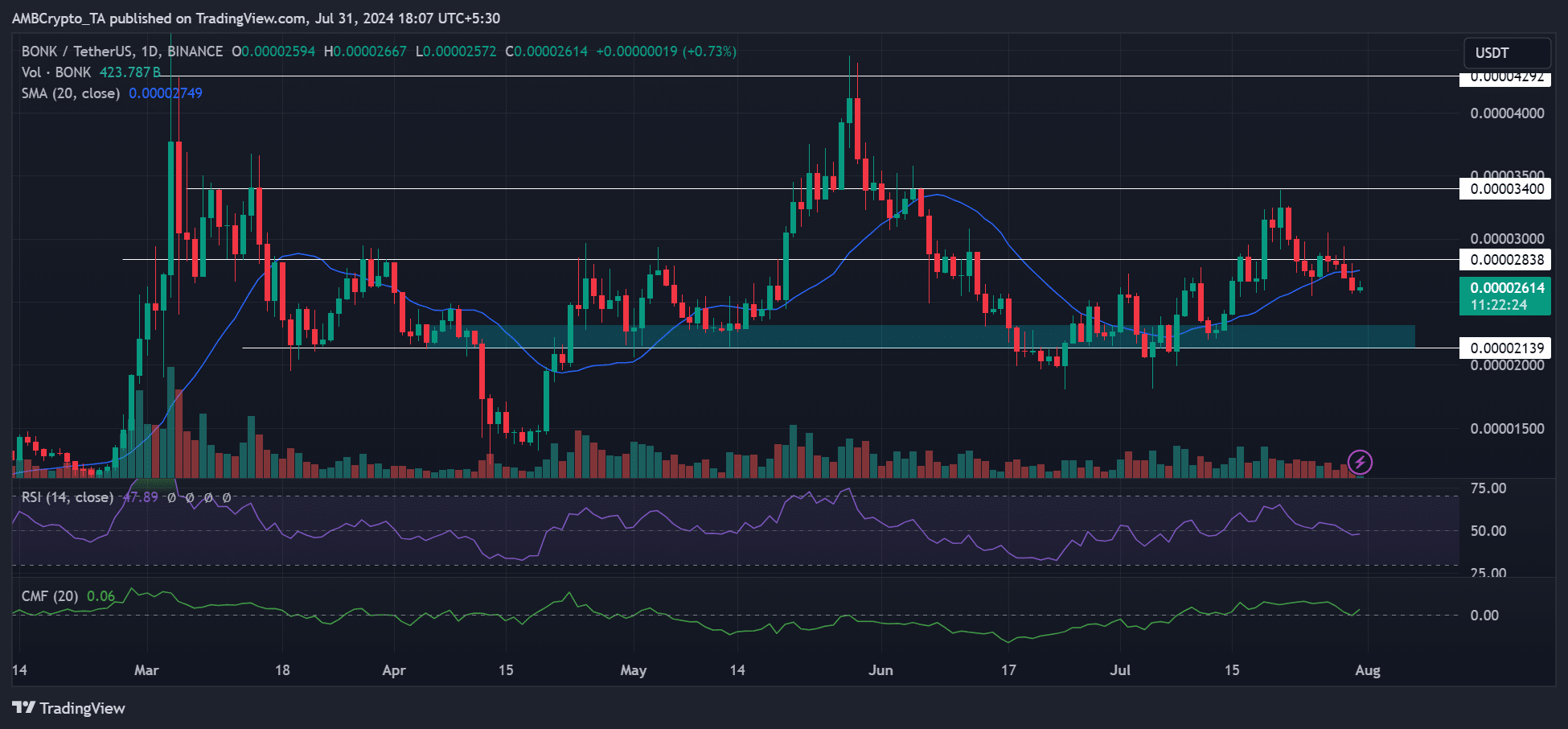

In July, BONK showed a combination of strong and weak performance. Initially, it soared by 50% from $0.00002 to $0.000034. However, towards the end of the month, it gave back some of its monthly gains, with its price dropping to $0.000026 as of press time.

The retreat below a crucial resistance level caused the memecoin to revert to its common quarterly price zone. Notably, the short-term upward momentum, as indicated by the 20-day Simple Moving Average, was broken, implying that sellers were dominating the market.

Nevertheless, following the FOMC’s declaration, volatility could potentially ensue. Is it possible that the Fed’s rate decision could trigger a rally aimed at relieving market uncertainty?

Will FOMC boost BONK?

Anticipation in the market was for the Federal Reserve rate to stay the same during its July decision, with strong possibilities of a reduction in September. A more accommodating Federal Open Market Committee (FOMC) could potentially present an opportunity for BONK investors to recover gains. If BONK reaches its immediate resistance at $0.000028 in such a scenario, potential increases of up to 9% might occur.

Yet, any hawkish remarks from the Fed chair could potentially diminish September rate cut expectations, causing BONK to plummet even further. In a hawkish situation, a revisit of the previous range low and bullish order block (marked cyan) at approximately $0.000020 might have provided support.

In simpler terms, the demand zone might provide an attractive opportunity for investors who are waiting to buy (sidelined bulls) and see any possible price increase in Bitcoin (BTC), particularly if BTC approaches its high of $70,000 again.

The neutral readings on the RSI (Relative Strength Index) and CMF (Chaikin Money Flow) further reinforced the’ calm before a storm’ narrative – A sign that buying and capital flows were flat.

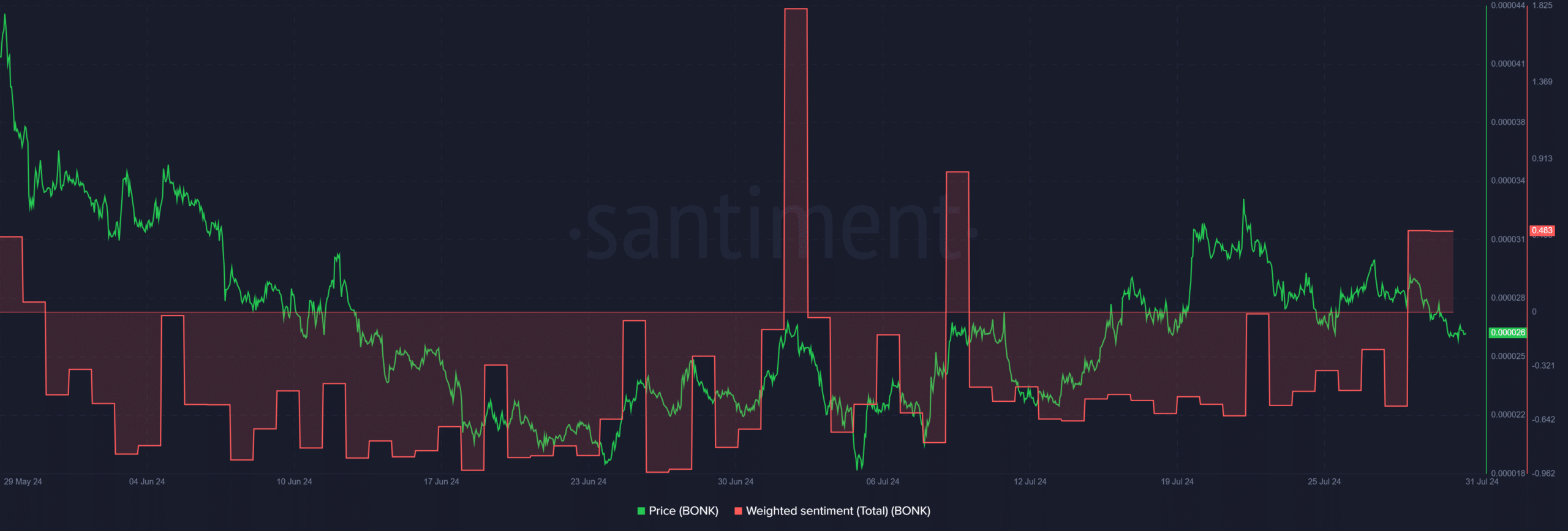

BONK market sentiment was positive

Over the past few days, I’ve noticed an intriguing disparity between market prices and sentiment. Despite the recent dip in prices, there seemed to be an overwhelming optimism among participants. This bullish outlook suggests that they foresee a positive movement for the memecoin in the near future.

Read BONK price prediction 2024-2025

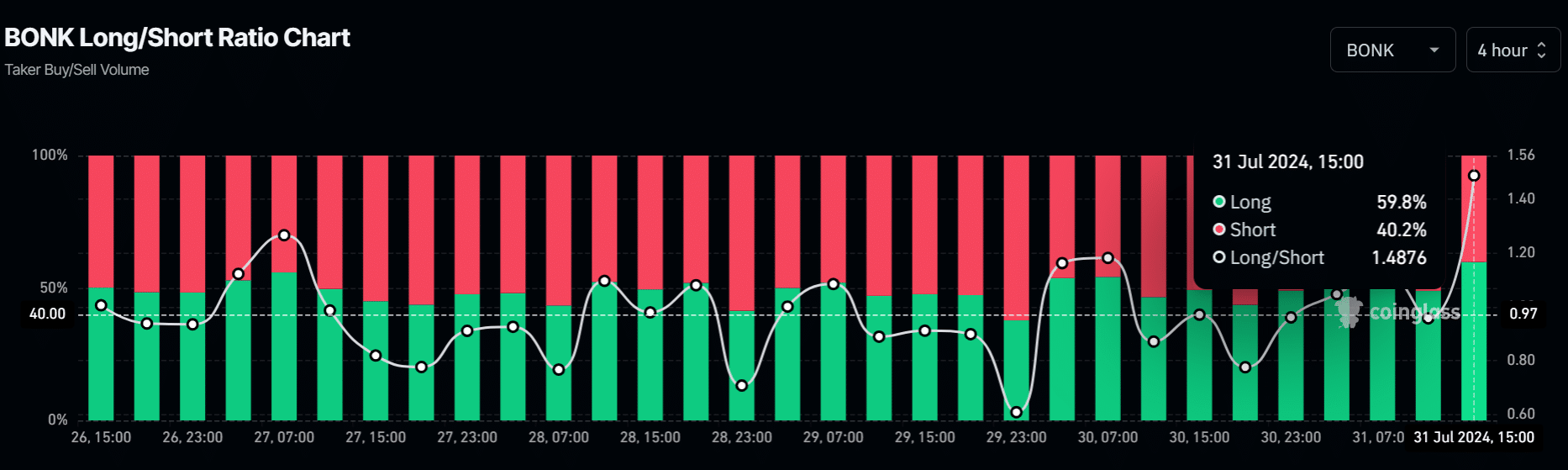

As a seasoned trader with over a decade of experience under my belt, I have learned to trust the trends and patterns that unfold in the Futures market. In my personal journey, I have seen countless instances where positioning on the market can provide valuable insights into the direction that an asset might take. Recently, I’ve been keeping a close eye on BONK, a memecoin that has garnered attention due to its rapid growth and potential for further gains.

Despite this, the $0.000028 resistance continues to be significant. If the anticipated recovery fails to surpass it, BONK might move downward.

Read More

2024-08-01 08:08