-

BONK hit a familiar long-term roadblock.

Demand was flat across spot and Futures markets

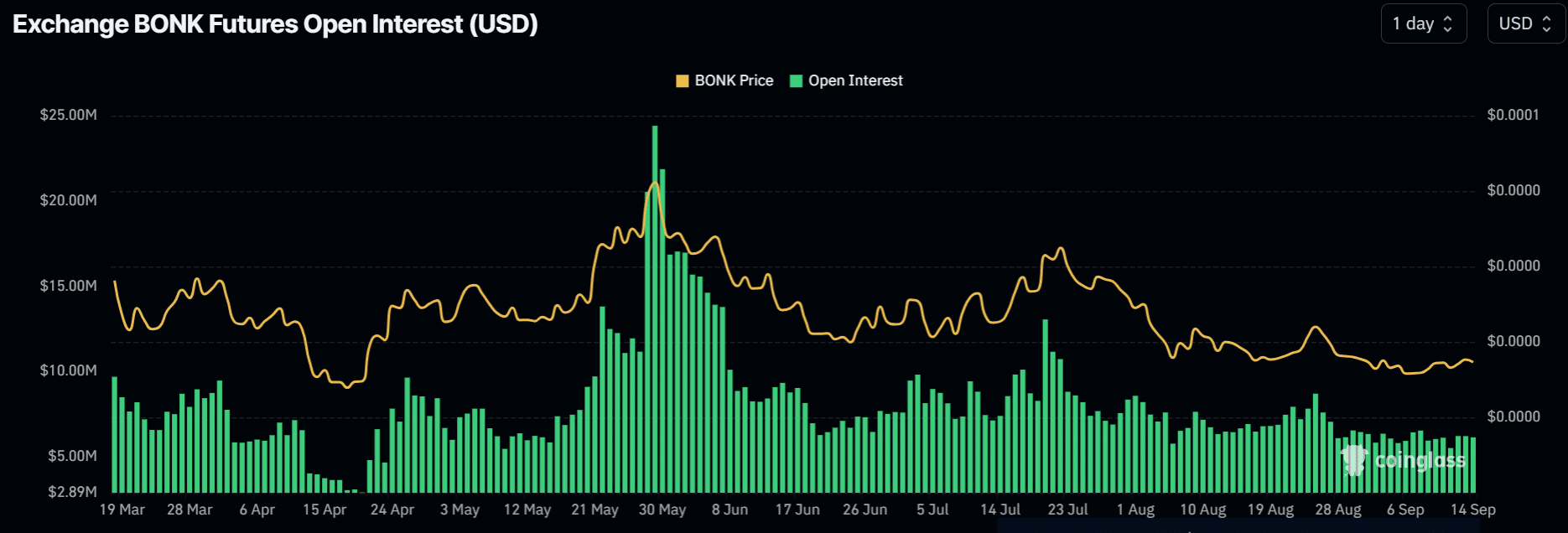

As a seasoned researcher with years of experience in the crypto markets, I find myself standing at a crossroads when it comes to Bonk (BONK). After the recent surge of memecoins following Bitcoin’s [BTC] $60k spike, BONK has shown potential, ranking second in Open Interest (OI) on Saturday. However, the road ahead seems bumpy for BONK, as it struggles to clear its long-term trendline support and faces stiff competition from other memecoins like dogwifhat [WIF] and Pepe [PEPE].

Over the past two days, as Bitcoin‘s [BTC] price soared to $60k, there has been a significant surge of interest in memecoins within the market. On Saturday, these memecoins even took the second spot in terms of Open Interest (OI), with an increase of 6% as reported by Coinglass. This growth could potentially benefit not only the memecoin category but also coins like Bonk [BONK].

Conversely, alternative meme tokens such as Dogwifhat (WIF) and Pepe (PEPE) saw greater trading activity compared to BONK. This may potentially slow down BONK’s momentum, particularly because it has encountered a significant obstacle on its price chart.

Can BONK clear this roadblock?

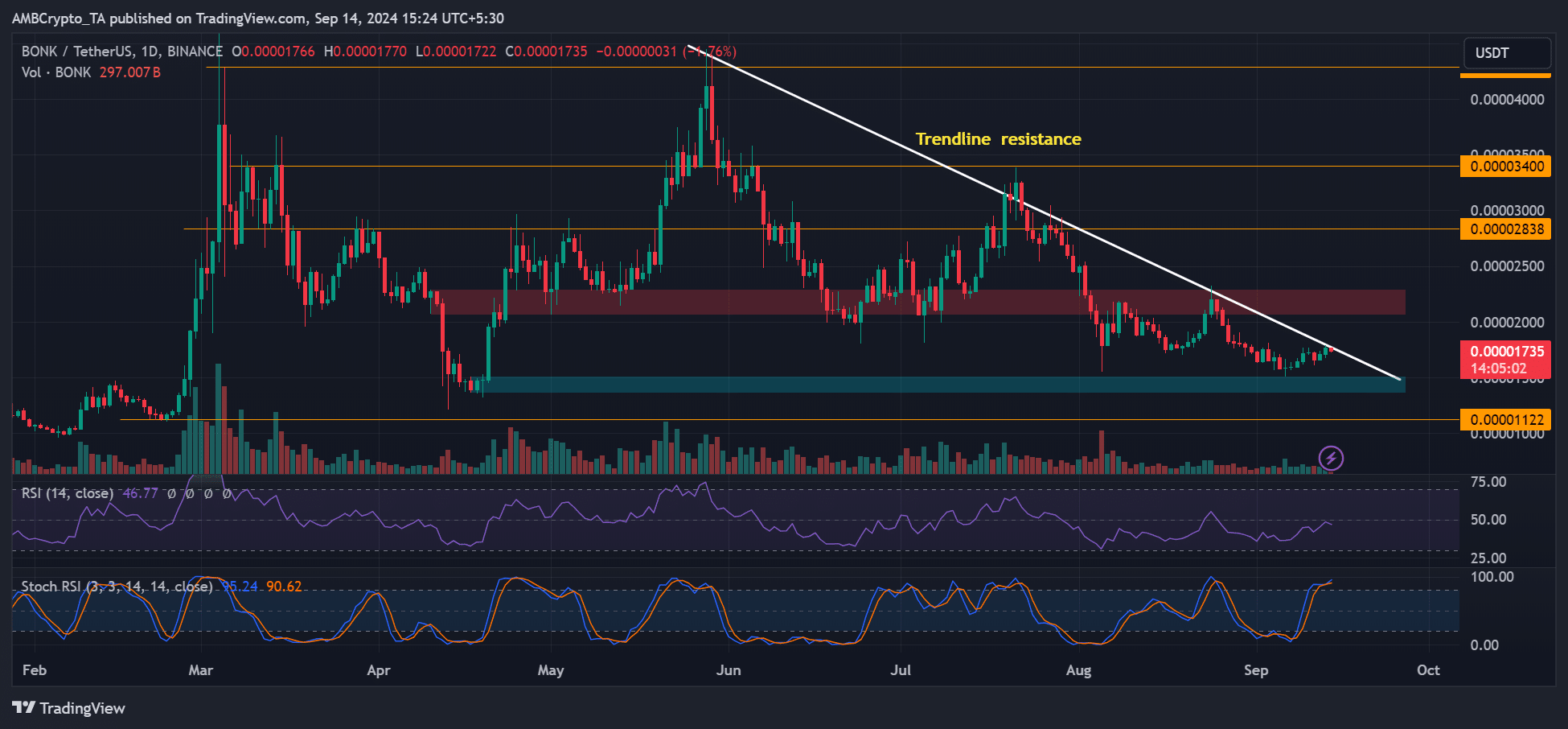

Following a decline in Q2 for memecoin BONK, it’s been having trouble surpassing its crucial long-term trendline support since then. The attempted comeback in July and August was halted by resistance, and now at the time of this press release, September’s uptick has once again met a barrier around $0.000018.

The doubt about BONK‘s recovery was strengthened by the indicators on the stochastic Relative Strength Index (RSI), which showed overbought conditions, and a neutral reading from the RSI itself. If Bitcoin stays below $60k, this obstacle might lead to another price rejection for BONK.

If so, a price rejection at the obstacle could drag the price to $0.000015 support (marked cyan).

If BONK manages to break through its trendline resistance, there’s a possibility that it could jump by 16%. This upward movement might take it to a price range higher than $0.000020, which is the current supply zone.

BONK demand stagnates

In July, BONK‘s OI reached a peak of $13 million, but since then it has been steadily decreasing and is currently holding below $10 million in both August and September. This trend suggests a decrease in investor interest and a stable demand from the Futures market.

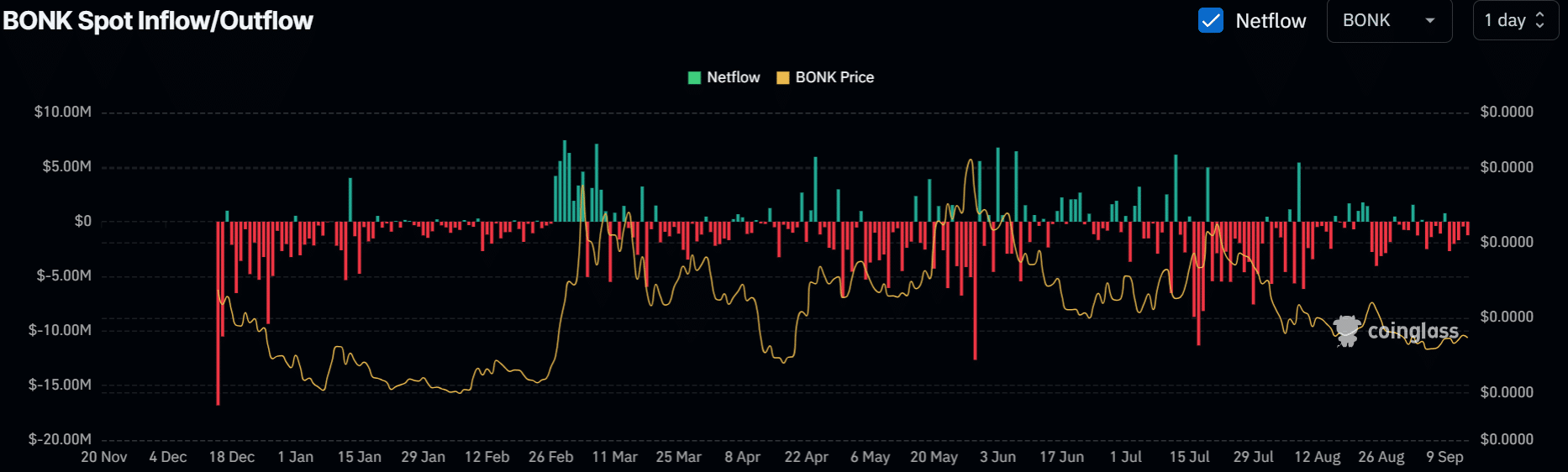

Besides a subdued interest, the memecoin experienced significant withdrawals in August and September on the trading platforms. This trend only served to solidify investors’ cautious stance and indicated a weak demand for purchases from active traders.

Over the past week, there have been approximately $8 million worth of withdrawals from centralized exchanges regarding the memecoin.

A subdued market interest might pose a challenge for stock BONK, potentially making it difficult for bullish investors to surmount the long-term barrier they aim to conquer.

If it’s the case, the region around 0.000015 might provide reduced purchase opportunities for investors anticipating a potential market recovery starting from October.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-09-15 00:07