- Bonk tests key resistance at $0.00002250, while RSI signals potential overbought conditions.

- Volume and open interest surges suggest sustained market interest and potential for further gains.

As a seasoned researcher with over a decade of experience in analyzing cryptocurrency markets, I’ve seen my fair share of wild rides and unpredictable trends. Bonk’s recent surge has piqued my interest, given its impressive 14.65% gain at press time and the accompanying volume surge.

In a recent development, the cryptocurrency known as Bonk (BONK) has garnered considerable interest due to its notable 14.65% increase in value, currently valued at approximately $0.00002287 per coin.

Given the robust market dynamics and increasing curiosity within the community, there’s speculation whether this latest surge might herald a more significant expansion.

However, can Bonk hold key resistance levels and sustain this upward momentum? Let’s break it down.

Can Bonk break resistance?

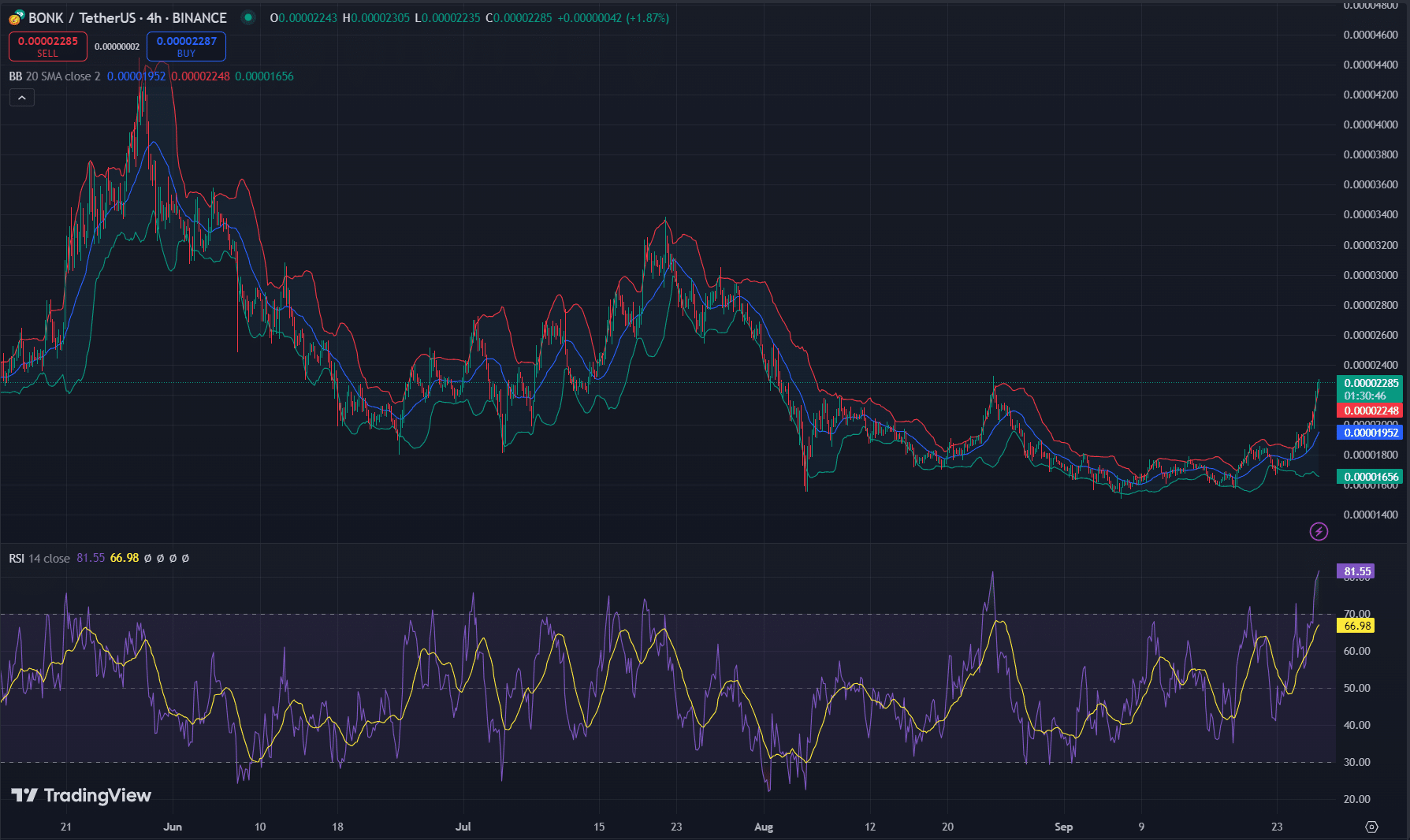

As a researcher studying the market dynamics of Bonk, I’m pondering if Bonk will manage to surpass its current resistance or experience a correction. At the moment of analysis, Bonk was probing a significant resistance point at approximately $0.00002250.

The chart shows tightening Bollinger Bands, which often indicate a potential breakout.

On the other hand, Bonk hasn’t been able to surpass this stage previously. If it fails to break through this barrier, a temporary drop might occur.

Furthermore, the Relative Strength Index (RSI) stands at 81.55, indicating that the market may be overbought.

Consequently, a correction might occur if Bonk cannot push higher from here.

Keep a close eye on the $0.00002200 mark, traders, because if it is sustained, it might indicate that the upward momentum in the market will persist.

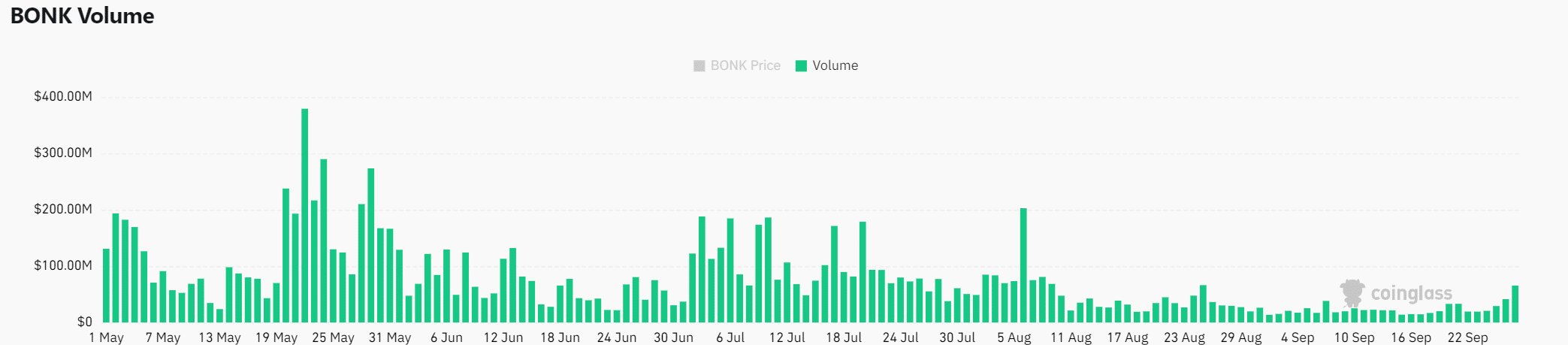

On-chain analysis: volume surge

In the past 24 hours, Bonk’s trading volume skyrocketed by an impressive 96.26% to reach a staggering $99.88 million at the time of reporting. This substantial jump suggests that traders are showing greater enthusiasm towards Bonk.

Furthermore, a large quantity combined with rising prices generally indicates a high level of conviction in the asset’s value.

Thus, if Bonk’s volume spike persists, it might trigger further price fluctuations. Given its market activity and liquidity, it is a coin worth monitoring for the upcoming phase.

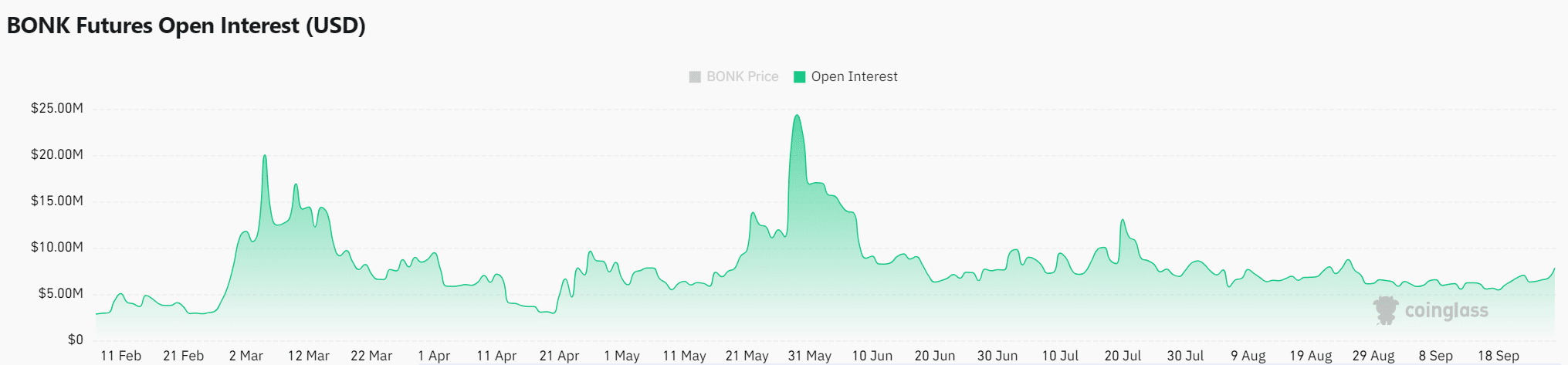

Open Interest: What does it mean for traders?

The current level of engagement in Bonk futures trading has increased significantly, amounting to approximately $12.87 million as reported by Coinglass, representing a surge of 67.02% at the moment of reporting.

The level of Open Interest signifies the overall count of active contracts, and an increase suggests a heightened level of speculation about Bonk’s potential price movement.

Furthermore, a rise in Open Interest typically indicates greater market involvement and more substantial trader dedication.

As a result, many people think that Bonk’s current rally might continue, offering additional chances for traders who are aiming for long-term profits.

Bonk’s impressive surge, supported by increased volume and rising open interest, suggests the coin could be on the verge of a larger breakout.

Read Bonk’s [BONK] Price Prediction 2024–2025

If the price doesn’t surpass the resistance levels, there might be a brief reversal. So, traders need to keep a close eye on the market.

If Bonk maintains its strength, it has the potential to spearhead the upcoming surge in meme coins. This rise would be fueled not only by the general excitement in the market but also by technical signals.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-09-28 02:16