- BONK’s price now testing a key resistance level at $0.00002940

- Metrics flashed mixed signals for the immediate future

As a seasoned crypto investor with years of experience under my belt, I’ve seen my fair share of market fluctuations and price movements. With BONK’s price now testing a key resistance level at $0.00002940, I find myself watching the charts closely to gauge the next move.

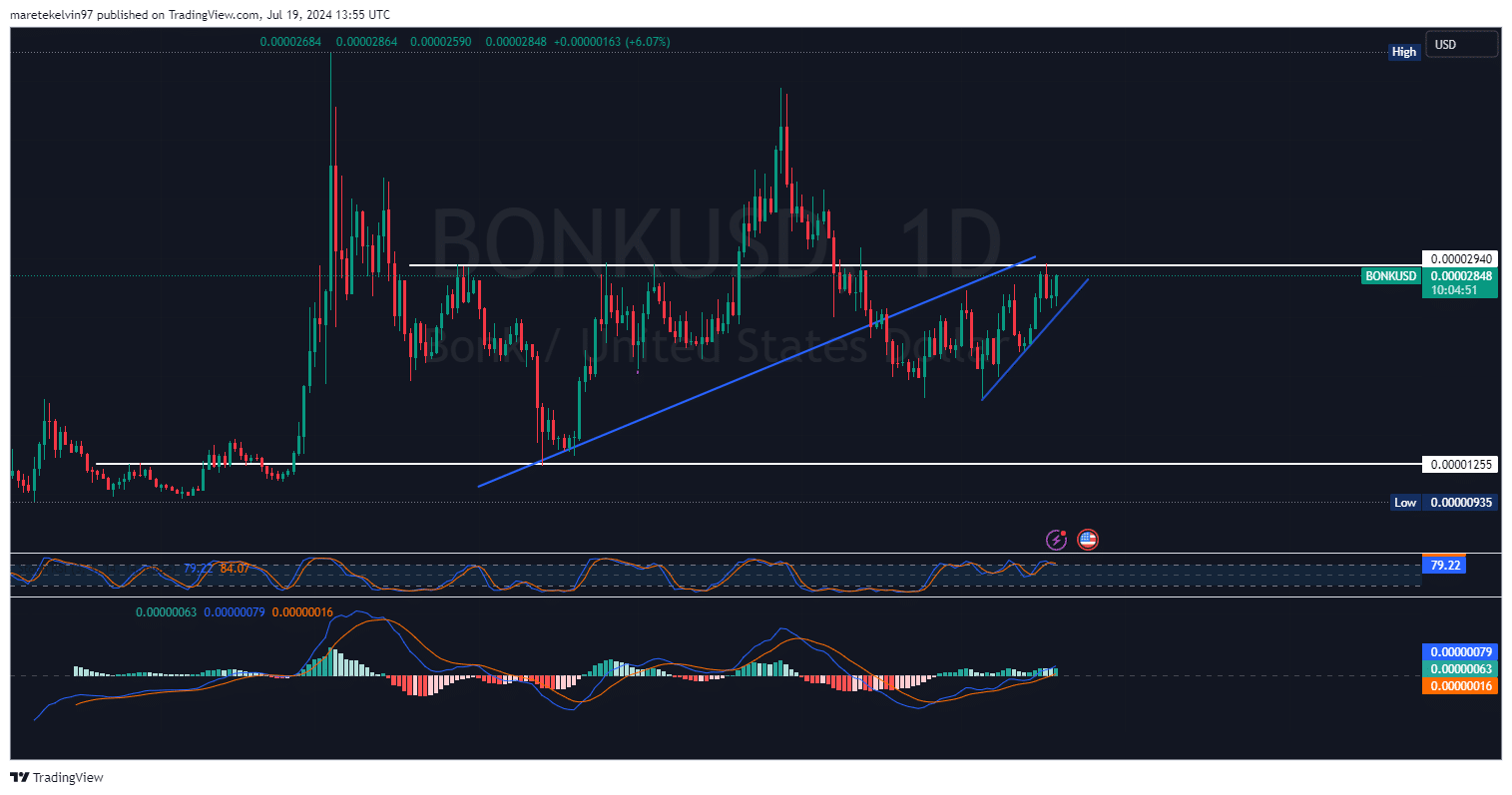

The price of BONK has been stabilizing since July 14th, adhering to a strong bullish trend that’s been gradually converging. On the graph, we can see that a pennant formation is almost ready to break out, with the upward price movement meeting at the significant resistance level of $0.00002940.

At the current moment of reporting, the value of the memecoin stood at $0.00002862 after experiencing a 4% increase within the last 24 hours. Furthermore, its market capitalization grew by 5% to reach an impressive $1.97 billion during this timeframe.

At $0.00002940, BONK’s resistance point is significant for its upcoming price action. The market seemed hesitant around this mark, with the price oscillating near it. Keen observers of BONK are on high alert at this juncture since a decisive breach could trigger a potential price spike.

Should we encounter difficulty surmounting this level, there’s a risk of a retreat ensuing. The importance of this barrier is underscored by the fact that it has been challenged on numerous occasions.

What tale do social volume and whale activity tell?

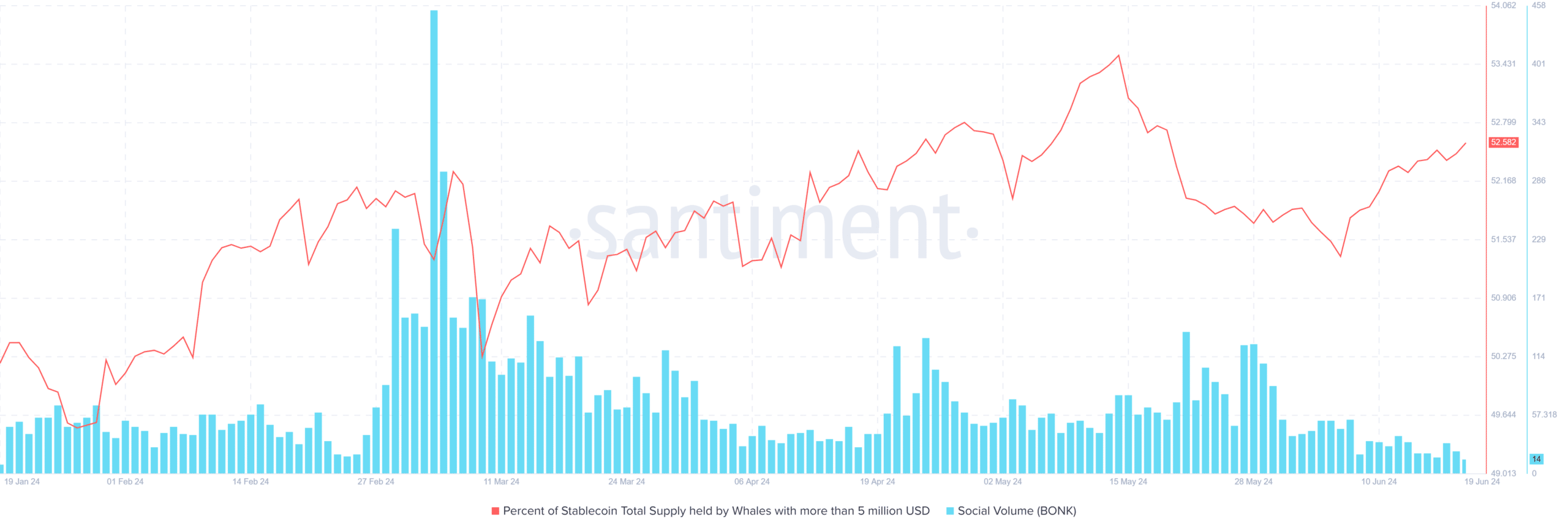

Based on data from Coinglass, there’s been a noticeable decrease in social buzz. This downturn in social activity coincided with the market’s recent correction, which preceded the recent 10% price surge.

As an analyst, I’ve noticed an increase in whale activity on BONK, with over half (52%) of the total supply being held by players with more than $5 million at the current market snapshot. This could be indicative of a substantial market shift given the considerable influence these large players wield over the overall market trend.

Liquidations share a clue

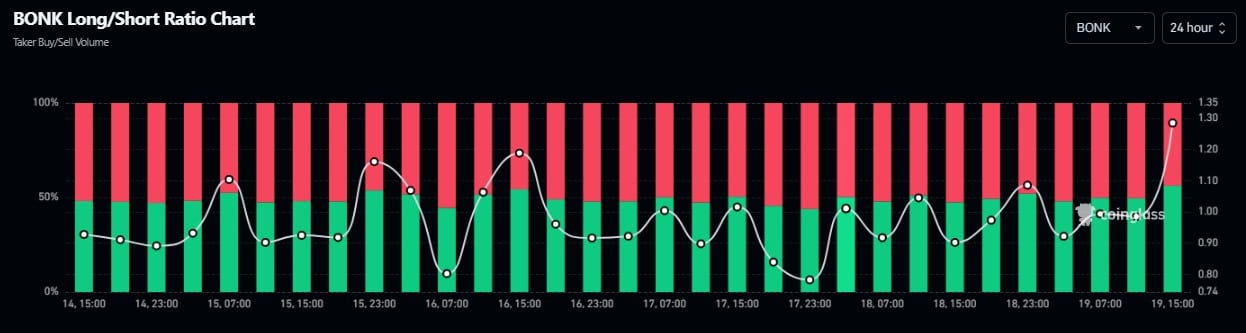

The data from Coinglass concerning BONK’s liquidation prices indicated a moderate level of liquidations. This implies a well-balanced market with minimal extreme leverage.

There’s another way to look at it though.

Based on AMBCrypto’s examination of liquidation figures, the long-to-short ratio of BONK has been shifting between positive and negative values. Such shifts in long and short positions might indicate market instability or ambiguity.

When I penned this down, BONK was nearly touching a significant resistance mark on the price charts. If the buying power manages to push it past this barrier, the memecoin’s value could potentially soar upwards. Nevertheless, it would benefit from stronger confirmation from its ambiguous performance indicators.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2024-07-20 14:15