- The bearish market structure of BONK showed a 20% price drop could commence

- A short squeeze could take place before the downward move continued

As a seasoned researcher with years of experience navigating the volatile world of cryptocurrencies, I must say that the current bearish market structure of BONK is reminiscent of a rollercoaster ride. The 20% price drop we might be witnessing soon seems imminent, but it’s always wise to keep an eye out for the unexpected twists and turns in this digital landscape.

Over the past week, BONK has plummeted by 13%, mirroring the downward trend seen in other memecoins. The Fibonacci retracement level at 78.6% was breached by sellers, and there seems to be a possibility that it might reach the lows of April as well.

Although the temporary increase in prices suggested a brief rebound might occur, the prevailing bearish influence seems poised to cause approximately a 20% further decline in prices.

BONK loses the 78.6% retracement level – Will it fall to late February lows?

Last week saw the 20-day and 50-day moving averages crossing paths in a pattern suggesting a bearish outlook, indicating an ongoing downward trend. Additionally, the Moving Average Convergence Divergence (MACD) supported this view by signaling that the downward momentum was stronger at that time.

According to the upward trend in February and March, Fibonacci retracement lines (shown in yellow) were drawn. In April, the 78.6% level around $0.0000188 was surpassed, but BONK managed to bounce back a week after that incident.

On both the 5th and 16th of August, resistance held firm under selling pressure, leading some optimists to hope for a repeat of past events. However, the A/D line has been trending downward, potentially diminishing prospects for an immediate rebound.

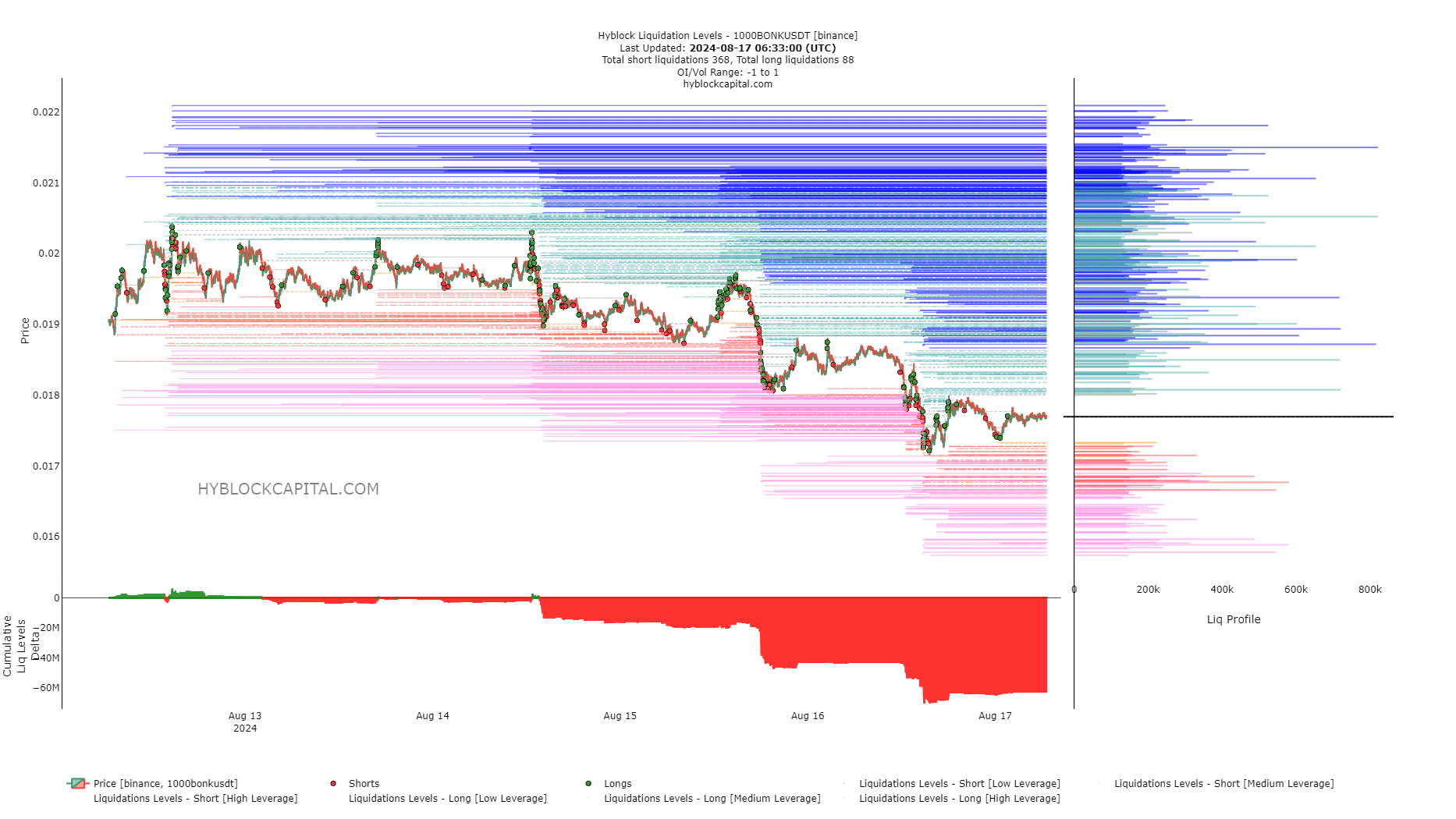

Liquidation levels showed where swing traders can bid

In simpler terms, the delta for liquidation levels indicated a significantly high number of short positions opened. This implied a potential ‘short squeeze’ or a price increase could occur as these short positions were being forced to buy back the asset due to market movements.

The notable liquidity pockets that could be targeted were at $0.0000188 and $0.00002.

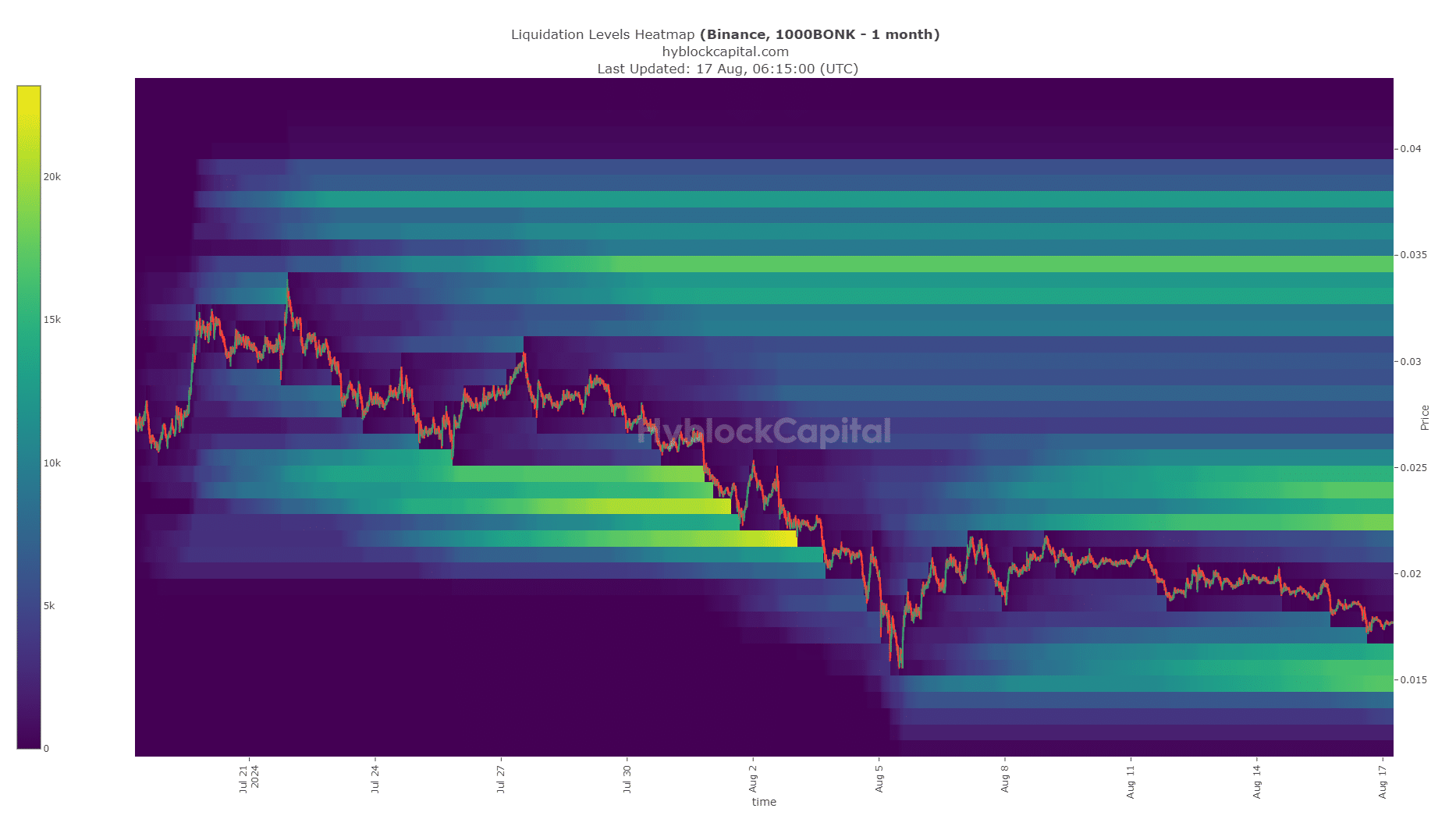

Short position openers among swing traders might find these levels useful, as they indicate substantial liquidity at the $0.000015 level, a detail emphasized by the liquidation heatmap over the past month.

Realistic or not, here’s BONK’s market cap in BTC’s terms

It’s quite probable that the powerful magnetic area will attract BONK to itself prior to a potential bullish shift, which would then initiate movement toward the next significant liquidity pool at $0.0000225.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-08-18 20:07