-

BONK saw a bullish breakout as Bitcoin also surged past the $70k resistance.

With sentiment turning bullish across the market, BONK might embark on another strong rally.

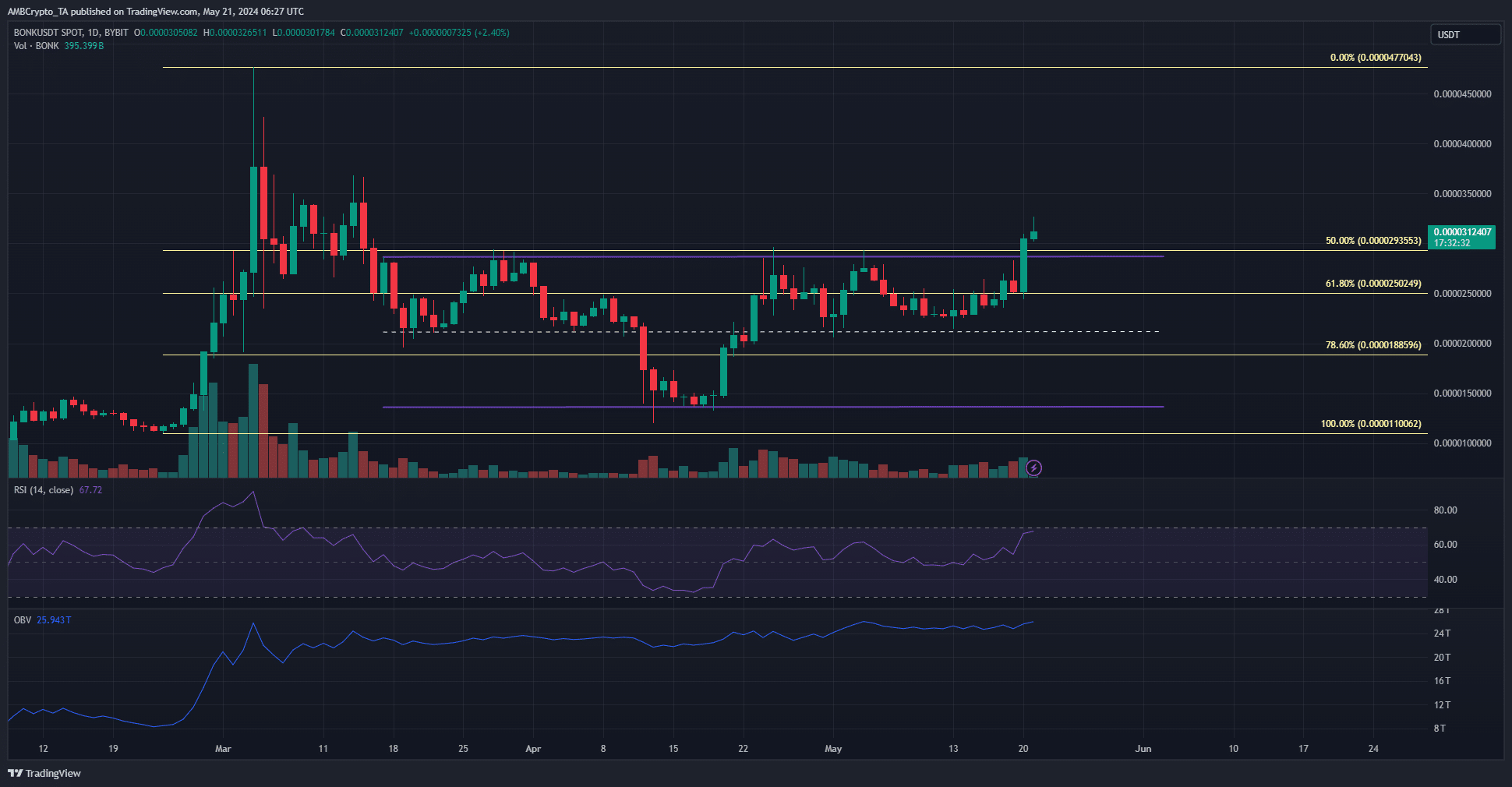

As a seasoned analyst with extensive experience in the cryptocurrency market, I have closely monitored Bonk’s (BONK) recent price action and identified some intriguing developments. While the bullish breakout past the two-month range highs was encouraging, the lackluster trading volume left me somewhat skeptical about the potential for a strong rally to the $0.0000477 resistance.

Bonk [BONK] managed to break out past its two-month range highs. In doing so, it flipped its market structure on the 1-day timeframe bullishly. The buying pressure was not strong, as noted in an earlier AMBCrypto analysis.

As an analyst, I’ve identified the $0.0000315 zone as a significant area of liquidity with potential for bearish reversal. Given that the prices are currently trading within this range, let’s examine Bonk’s technical indicators to forecast the price trend in the coming days.

Momentum was with the bulls but the trading volume was not

It was very promising when Bitcoin (BTC) surpassed its previous highs, with prices reaching above $70,000. This significant move suggested a strong upward trend for the entire market and a change in investor attitude.

The daily Relative Strength Index (RSI) for BONK demonstrated robust upward trending. On the other hand, the On-Balance Volume (OBV) inched its way up gradually. However, the trading volume fell short of expectations, significantly less than during the late February surge.

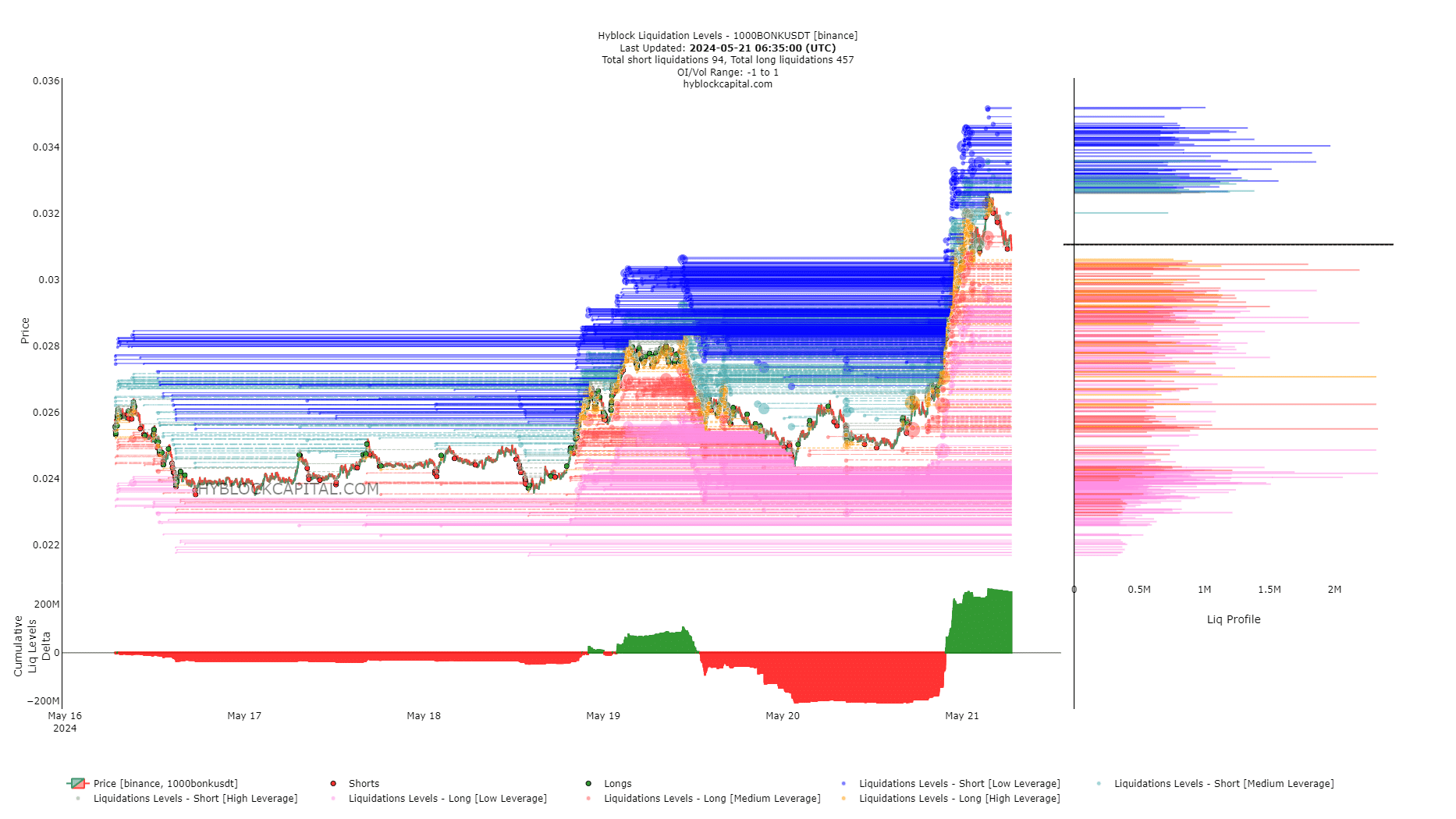

Based on current market analysis, the predicted bullish price of BONK at $0.0000477 may not hold up. A closer look at the liquidation levels chart could provide more insight into the short-term market sentiment and liquidity.

A liquidity hunt is likely in the near term

In simpler terms, when the total difference between buying and selling prices of a security’s liquidations is significantly positive, it often indicates that a downward price movement may soon affect those who entered late and held large positions with excessive leverage.

Realistic or not, here’s BONK’s market cap in BTC’s terms

At the prices of $0.0000301 and $0.0000272, there were significant concentrations of sell orders and were consequently pivotal points in light of the market trends.

The cluster between $0.0000289 and $0.0000295 is worth exploring further. Therefore, it’s likely that BONK will encounter these price levels within the next 24 to 48 hours.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-22 01:11