- BONK rebounded from critical support, showing strong fundamental demand

- Increased Open Interest and stabilization in liquidation levels suggested growing investor confidence

As a seasoned crypto investor with battle scars from countless market cycles, I find myself intrigued by BONK’s recent performance. The rebound from critical support and the rising open interest suggest that there might be a growing demand for this memecoin among investors. However, I remain cautiously optimistic, given my past experiences of bullish surges followed by abrupt declines.

In the past 48 hours, BONK experienced a 7% increase followed by a decrease, primarily due to heavy trading activity as investors took advantage of a recent price drop. At the moment, each unit of BONK is worth approximately $0.00002009 and has a 24-hour trading volume of around $470 million. This surge in value represents an 8.83% growth over the past two days, but it comes after a 19.55% decrease during the last week.

During this timeframe, it appeared that BONK was reflecting the general market sentiment shared by other significant cryptocurrencies.

Technical analysis: Indicators and support levels

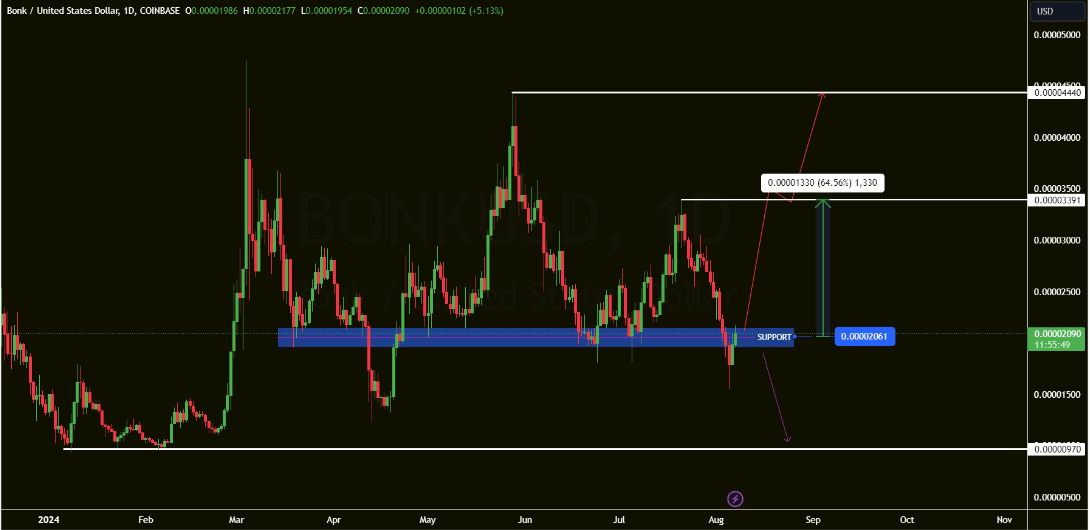

As a researcher examining the crypto market, I’ve noticed an intriguing trend with BONK. After dipping below $0.00001815, which seemed like a critical support level, BONK has shown signs of recovery on its charts. This rebound suggests robust underlying demand for the coin despite the recent downward trends.

Simultaneously, the Aroon indicator showed conflicting signs. Specifically, the Aroon Up, represented by blue, stood at 85.71%, suggesting robust upward movement. On the flip side, the Aroon Down, denoted by orange, was at 21.43%, indicating a decrease in downward pressure.

Indicating a potential change, the difference here suggests that the market might be on the verge of reversing its current trend. However, for a clear confirmation of an ongoing bullish trend, we need to see continuous growth in the Aroon Up indicator.

As of the latest report, the Relative Strength Index (RSI) was at 41.11, bouncing back from oversold territory but still beneath the 50-point mark that signifies a neutral state. This implies that although intense selling has lessened, the market is not yet fully bullish.

Despite the Awesome Oscillator continuing to show a negative reading, the histogram bars suggest a slowdown in pessimistic momentum.

A positive turn in these bars would further validate a bullish reversal.

Price targets and potential gains

The cost of BONK briefly dropped to approximately 0.00001815 dollars, only to bounce back to its current value of 0.00002103 dollars at the moment. This price fluctuation is significant because it managed to surpass a previous support level, suggesting that if buying interest remains strong, there could be more upward momentum in the coming days.

If BONK manages to maintain its current support at around $0.00002061 and subsequently break through the initial resistance at $0.00003391, this could potentially lead to an increase of about 64.56%.

Should the price hit the second resistance point at approximately 0.00004440 dollars, there’s a strong possibility for significant returns.

As reported by Coinglass, the Open Interest for BONK increased by approximately 11.22%, amounting to around $7.16 million. This rise in open interest might indicate that investors are becoming more confident about the possibility of future price increases for BONK.

Liquidation trends and market sentiment

Around early March, there was a remarkable surge in short liquidations that reached over $4 million, coinciding with a steep drop in the value of BONK.

Recently, the liquidation points have become more stable, showing an equal balance between long and short positions, along with minimal price changes. This could indicate a phase of consolidation, where neither the buyers nor the sellers hold a significant upper hand.

Indeed, as per the latest findings from AMBCrypto, it appears that BONK has shaped a symmetrical triangle formation, which is commonly observed before a phase of consolidation leading to a potential breakout.

As a seasoned investor with several years of experience in the volatile world of cryptocurrencies, I find it intriguing to observe the fluctuations of memecoins like the one mentioned in your text. While it appears that this particular memecoin has shown signs of recovery from recent losses as evidenced by its chart, my personal experience tells me to remain cautious. I’ve seen numerous instances where temporary gains have quickly turned into significant losses, leaving investors empty-handed. The strength of the technical indicators might suggest a short-term trend reversal, but it’s essential not to jump to conclusions too hastily. Instead, I would advise keeping a close eye on this memecoin and waiting for more concrete evidence before making any investment decisions.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Quick Guide: Finding Garlic in Oblivion Remastered

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-08-08 09:12