- BONK’s price has fallen by almost 30% in the last month.

Readings from its price charts suggest the possibility of a further decrease.

Despite the surge in the memecoin market over the past month, Bonk (BONK), which runs on the Solana blockchain, went against the flow and experienced a 27% price drop based on CoinMarketCap’s figures.

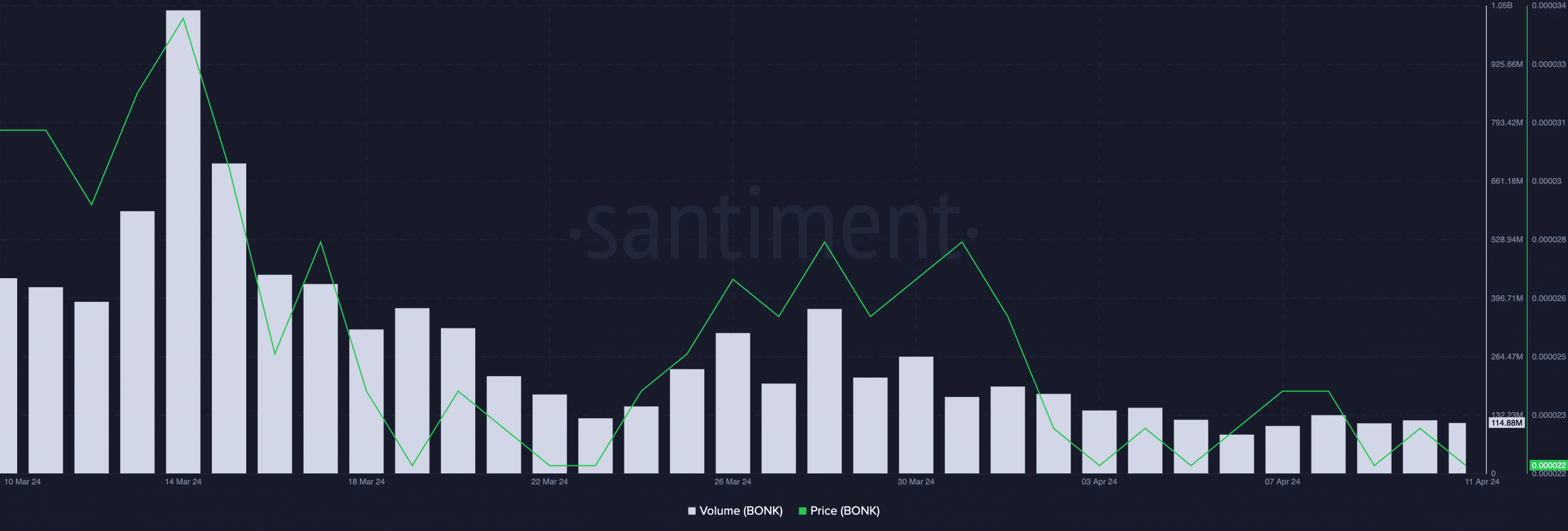

During the past month, there has been a substantial decrease in the daily trading volume of the token, BONK, with Santiment reporting a 73% drop compared to previous levels.

BONK to extend losses

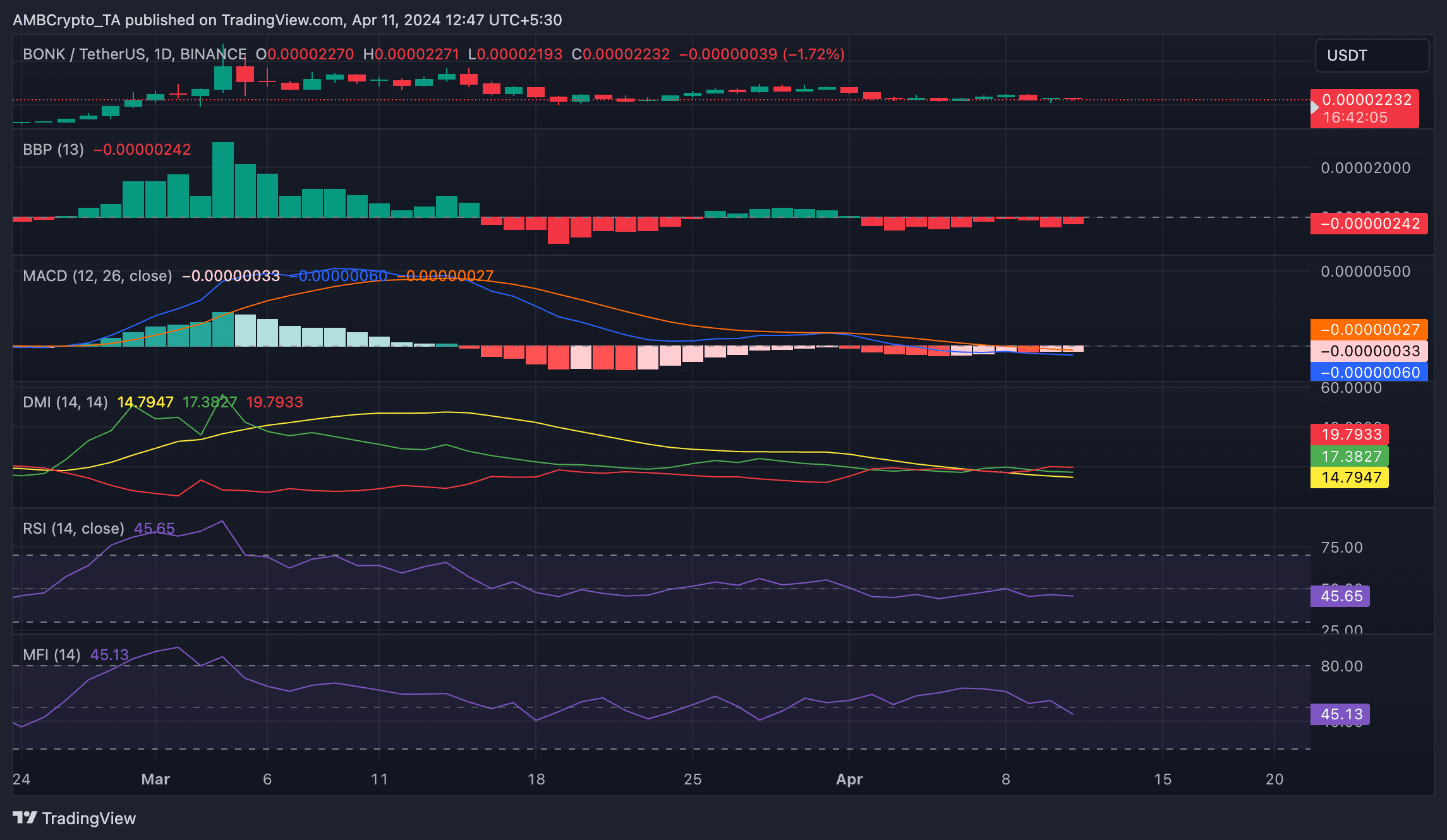

Looking at BONK‘s crucial tech signs on a daily scale, there were signals suggesting a potential drop in the memecoin’s price.

The Directional Movement Index (DMI) indicated that bears were currently leading the market’s trend, as the negative index (in red) was lower than the positive index (in blue) since the 9th of April.

When the DMI (Directional Movement Index) of an asset is configured in this manner, it implies that the asset’s downward trend is more robust than any prospective uptrend.

Additionally, when I last checked, the important indicators for BONK‘s altcoin showed values below their neutral thresholds. The Relative Strength Index (RSI) was at 45.28, while the Money Flow Index (MFI) stood at 45.09.

The distribution of BONK values surpassed their accumulation, leading to a decrease in its price due to the supply exceeding demand.

Further, the Elder-Ray Index has shown only negative readings since April 2nd. This metric signifies the balance of power between buyers and sellers in the market.

When the value is negative, this signifies a rise in selling transactions, making the influence of bears stronger.

As of now, the MACD line of BONK‘s chart indicates that the bears are prevailing, with the MACD line resting below both the signal and zero lines.

When the MACD line for an asset drops below its signal line and displays a negative value, this is considered a bearish indication. Essentially, it implies that the short-term momentum of the asset has weakened compared to its long-term trend. As a result, traders may choose to sell their existing long positions and consider opening short positions based on this signal.

Is your portfolio green? Check the Bonk Profit Calculator

Traders refuse to relent

The open interest for BONK‘s derivatives on its market has dropped by 65% according to Coinglass, dating back to March 5th. However, it’s worth noting that despite this significant decrease, the funding rate for BONK‘s cryptocurrency trades across various exchanges has continued to be positive.

Participants in the futures market have been buying contracts, indicating their belief in an upcoming price increase.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-12 03:03