- BonkDAO’s token burn reduced supply by 1.8%, yet BONK faced resistance at $0.00003517.

- Market sentiment remained bearish, with high short interest and weak technical indicators for BONK.

As a seasoned crypto investor who has weathered many market cycles, I must admit that the recent token burn by BonkDAO has piqued my interest. However, as I look at the current state of BONK’s price action and market sentiment, it seems we might be facing a challenging time ahead.

The move by BonkDAO to incinerate 1.69 trillion BONK tokens during the “BURNmas” event has sparked intrigue within the cryptocurrency world.

As an analyst, I can express this by saying: I’ve observed a reduction of approximately 1.8% in the circulating supply of BONK, as $54.52 million worth of tokens have been taken out of circulation.

Such a shift might carry substantial impact on the market. Right now, BONK is being exchanged for approximately 0.00003144 USD, marking a 6.50% drop over the last day.

With this deflationary strategy in place, it raises the query: Could it impact the future price and market perception of BONK?

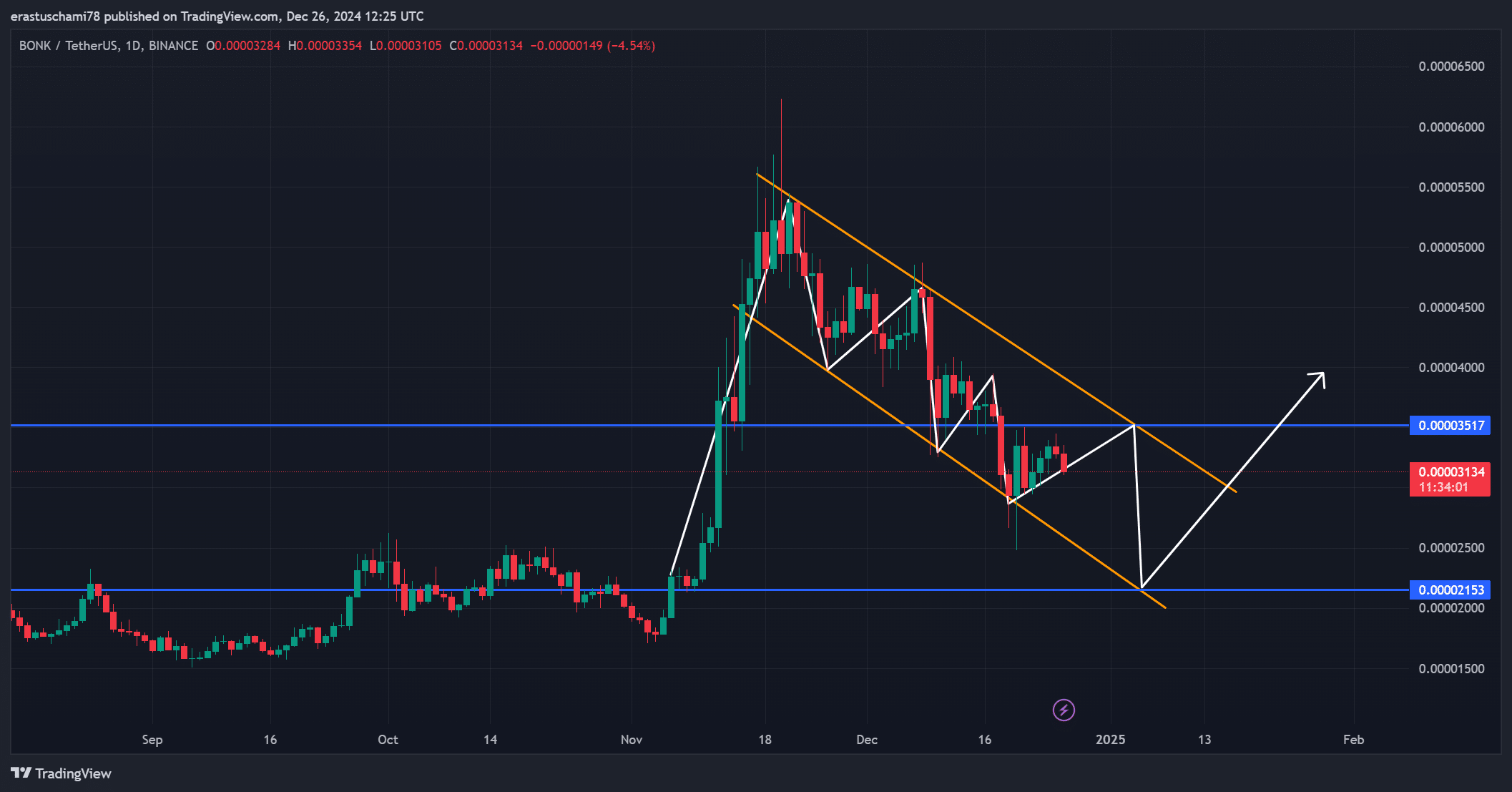

What is the outlook for BONK’s price action?

The trend in BONK’s price suggests a recurring barrier for growth around the $0.00003517 mark. If significant purchasing activity doesn’t increase, this hurdle might prevent additional increases in price.

Yet, even though BONK is currently priced at $0.00003144, it struggles to surpass this resistance level without additional backing from the market.

The 6.50% decrease over the past 24 hours suggests that the current trend is continuing its period of stabilization or consolidation.

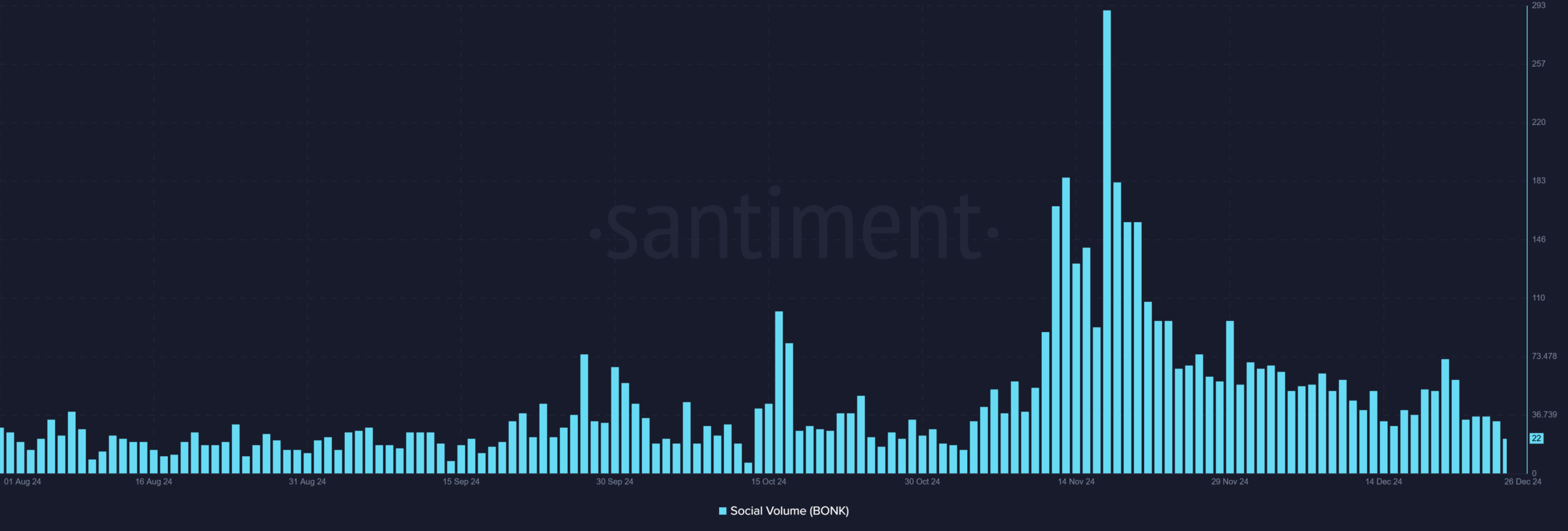

Of Social Volume

The social media buzz around BONK showed a clear decline. At its peak in mid-November, there were more than 290 mentions, but by the 26th of December, this figure had fallen drastically to only 22 mentions.

The noticeable decrease in social interaction implies that the enthusiasm for the token burn event seems to be dwindling.

When Social Volume is high, it usually means there’s strong market activity, but this dip might be hinting that the market is shifting away from BONK and is waiting for a new catalyst to rekindle its growth.

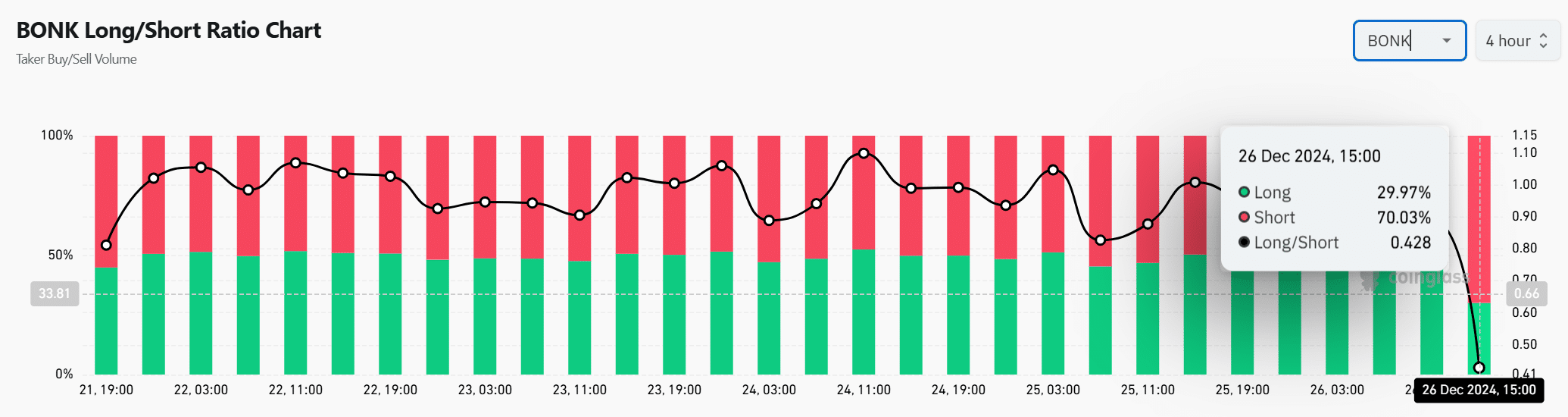

Are traders betting on a further decline?

The current trend suggests that most traders are favoring a decrease in the market, as indicated by the significantly higher number of short positions (70.03%) compared to long positions (29.97%) as of December 26th.

This shows that traders are expecting a further decline in BONK’s price.

A significant number of investors betting against the stock might indicate a pessimistic viewpoint. However, if the market takes an unforeseen turn, it could result in a situation known as a “short squeeze,” where those who have shorted the stock are forced to buy back shares quickly at a higher price.

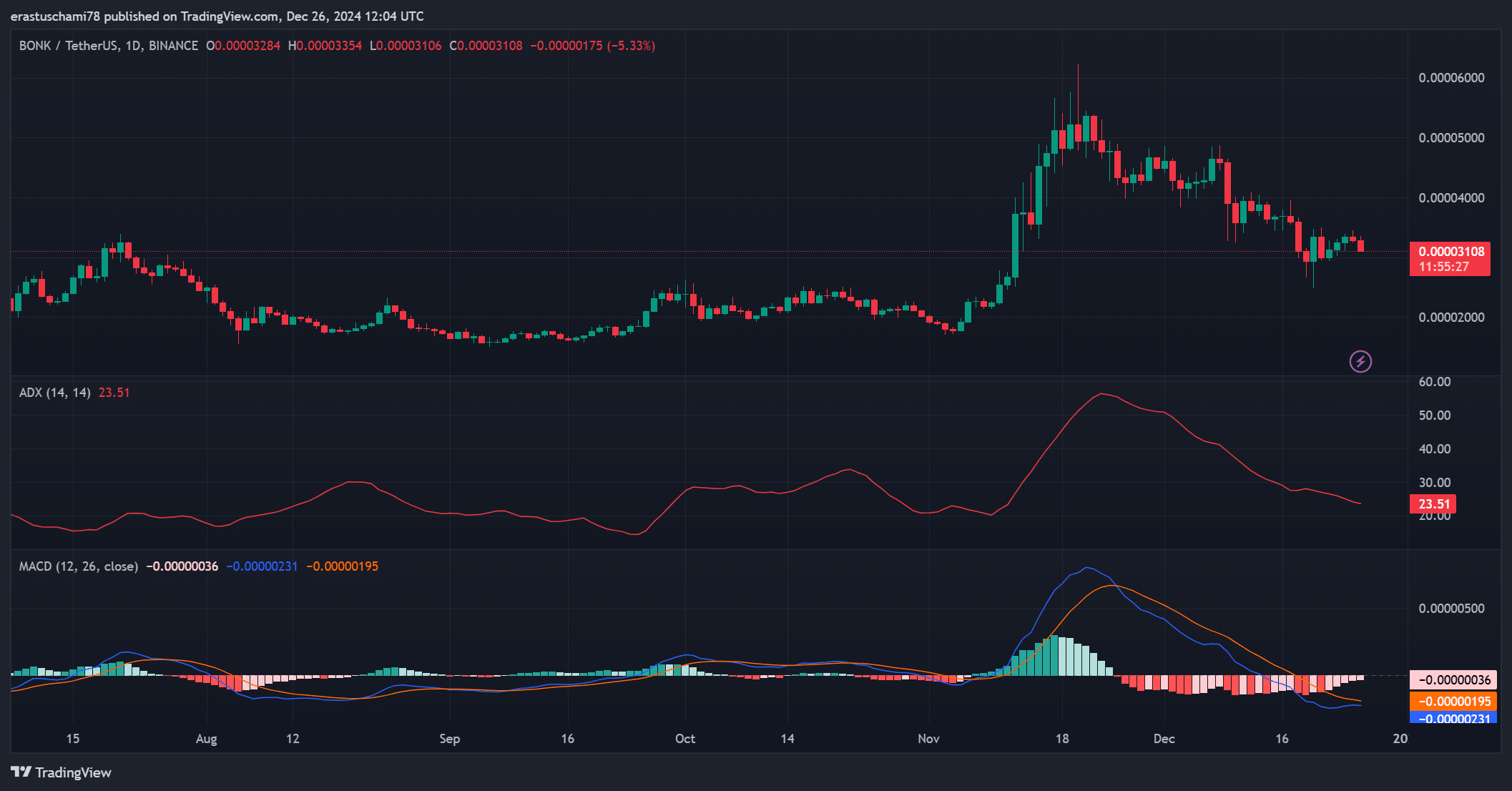

What do technical indicators suggest for the price trend?

According to the technical indicators, there’s some confusion in the market trends. The Average Directional Index (ADX) stands at 23.51, suggesting a feeble trend, whereas the Moving Average Convergence Divergence (MACD) is showing a negative value of -0.00000036, which typically indicates a downward momentum.

Based on these signs, it seems like while a brief surge might occur, the market currently appears to be lacking the robust drive necessary to support a substantial price increase over the short period ahead.

Market sentiment

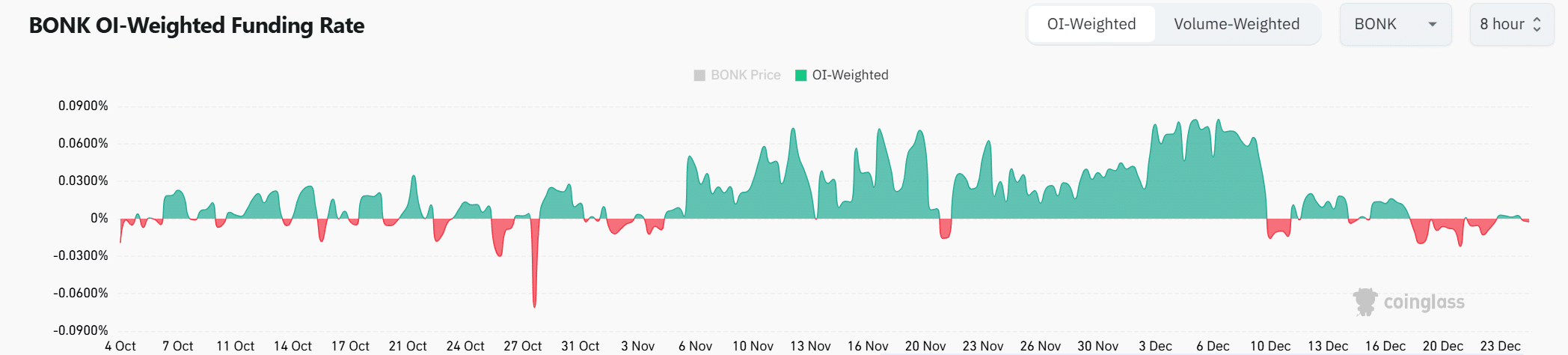

Over the past few months, the Funding Rate for the OI-Weighted system has varied from a low of -0.09% to a high of 0.09%, and it currently stands at zero percent as we speak.

This suggested that traders were uncertain about the market’s movement and tended to avoid significant investments, leading to a stance of neutrality in the market.

Read Bonk’s [BONK] Price Prediction 2024–2025

As a crypto investor, I’ve noticed that BonkDAO’s token burn event has reduced the circulation supply of BONK. However, despite this potentially positive development, the prevailing bearish sentiment, as indicated by low Social Volume, unfavorable Long/Short Ratios, and weak technical indicators, seems to suggest that a substantial price surge in the near future is unlikely.

Therefore, without new catalysts, BONK is unlikely to experience a substantial price increase.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-26 22:16