-

BONK has strong capital inflows and bullish momentum at press time.

The resistance zone overhead forced buyers to retreat.

As a crypto investor with some experience under my belt, I’ve seen my fair share of market volatility and price action. And right now, BONK is presenting an intriguing situation.

As a researcher studying the crypto market, I’ve noticed that Bonk [BONK] was among the top-performing assets last week, experiencing a significant surge in trading activity. This strong performance indicated a high level of market confidence. However, this bullish sentiment has since been dampened.

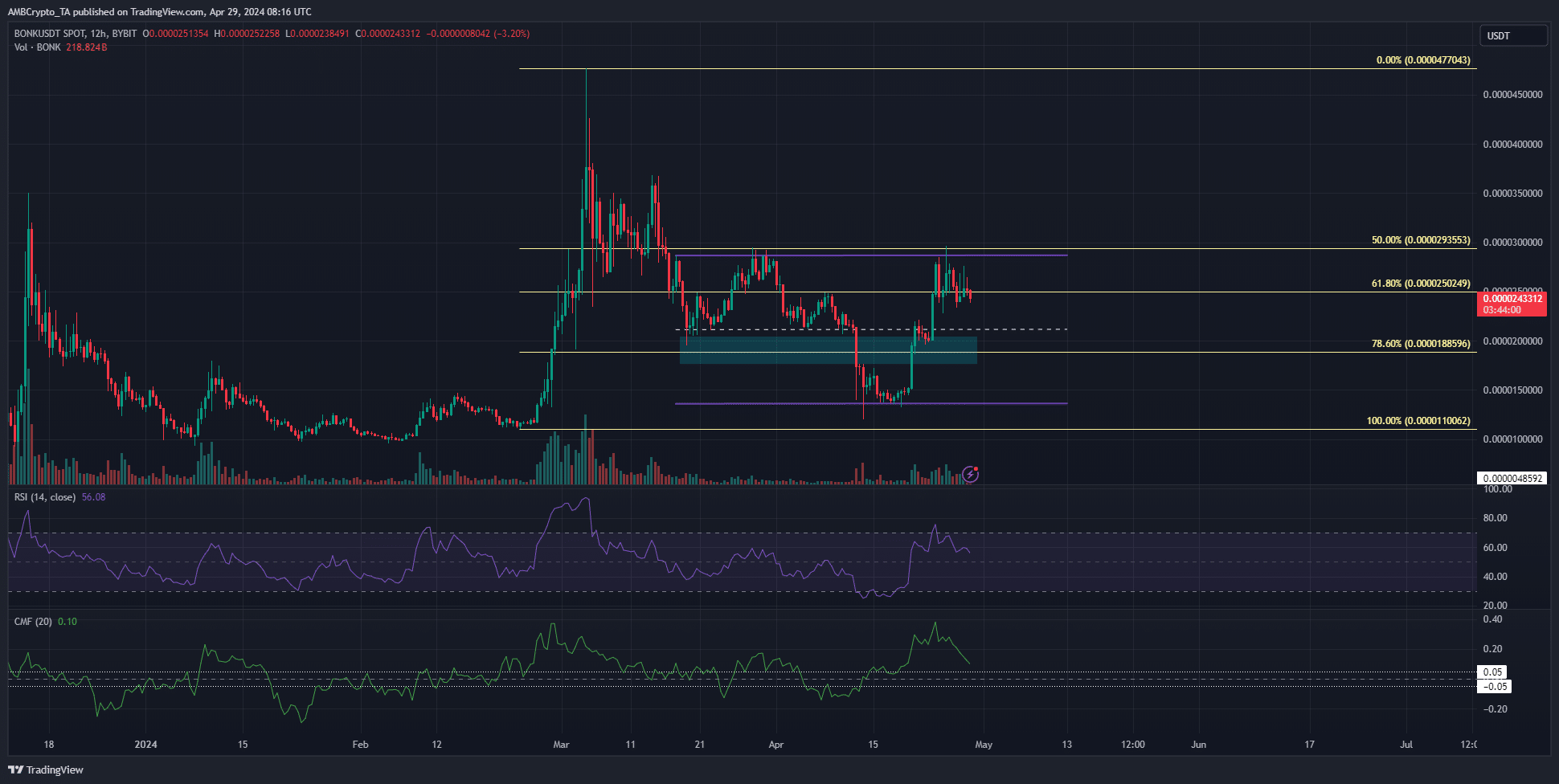

As a market analyst, I examined BONK‘s price action following its early March rally and identified the Fibonacci retracement levels. At the time of analysis, the price was hovering slightly below the 61.8% level.

This meant that further losses were likely after the failed attempt to climb past $0.0000293.

The 50% resistance stood firm yet again

I encountered a setback when BONK failed to break through the significant resistance level at $0.0000293 on the 24th and 25th of April. This level held strong during late March, having functioned as a barrier before.

Moreover, the retracement in mid-April took the meme coin nearly to the February lows.

If the price drops below the prior swing low of $0.0000176 on the larger timeframe chart, then the market structure could potentially shift to a bearish trend.

The purple range on the chart may cause prices to pause and possibly form a temporary price range before continuing their upward trend.

With an RSI of 56 and a CMF of +0.1, these technical indicators pointed towards buying activity and robust investment inflows. Yet, they may not be sufficient to prevent a short-term drop in the meme coin.

A range within a range?

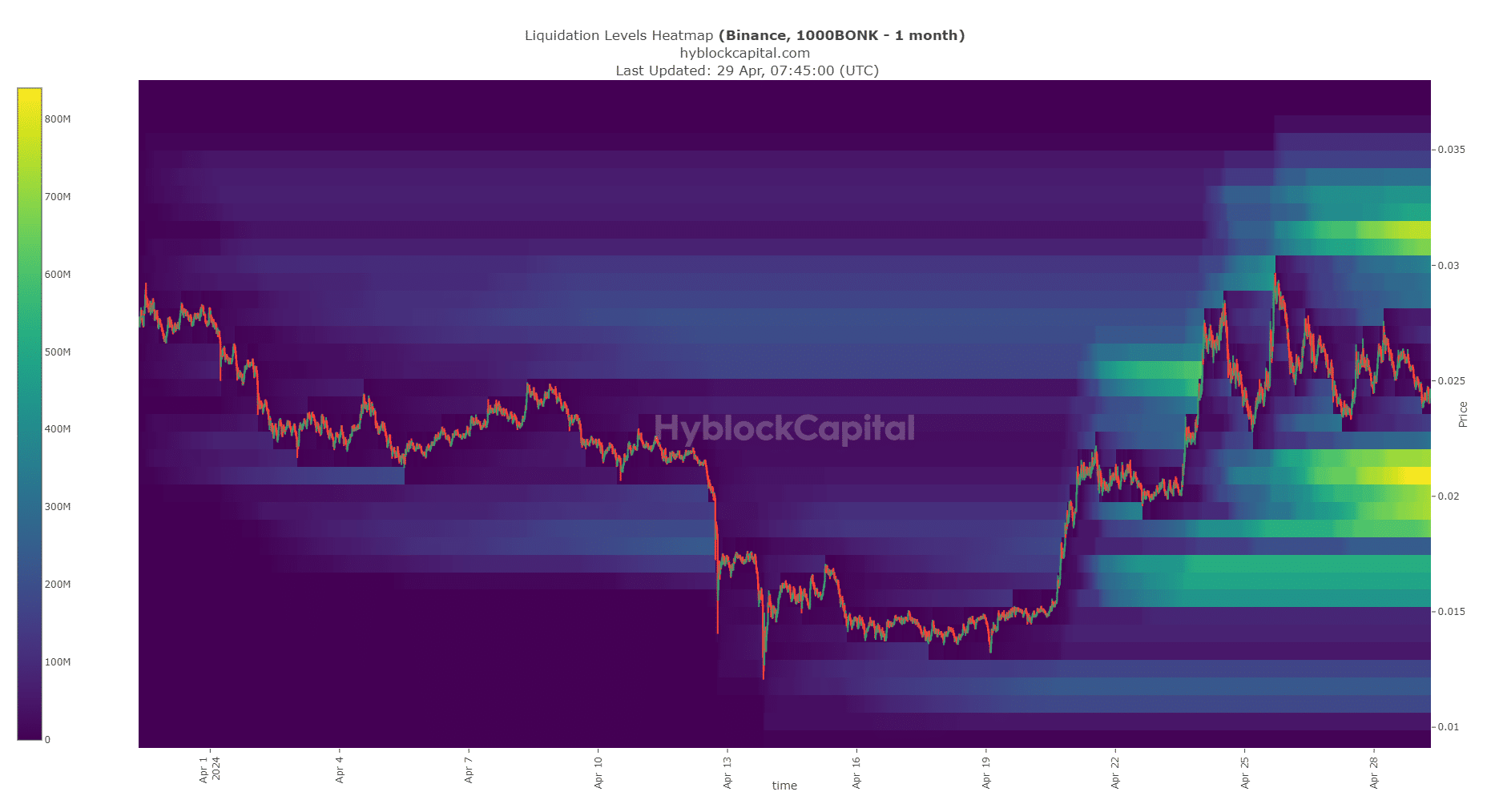

According to the price chart, the technical range indicated that the lowest points were at $0.000014. Meanwhile, the liquidation heatmap revealed significant clusters of liquidation levels at $0.000021 and $0.0000315.

Is your portfolio green? Check the BONK Profit Calculator

Based on the current market conditions, it’s more probable that BONK will fluctuate around these prices rather than dropping down to the $0.000014 support level within the next week or so.

Hence, swing traders could use this information to form their trading biases.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-04-30 00:07