-

BONK’s symmetrical triangle suggested a breakout, with potential for a major bullish wave.

Volume and Open Interest surged as traders positioned themselves for a possible price explosion.

As a seasoned analyst with over two decades of market observation under my belt, I find myself intrigued by the current state of Bonk [BONK]. The symmetrical triangle formation hints at an imminent breakout, which could trigger a substantial bullish wave, as per my analysis. However, the technical indicators present a slightly bearish outlook in the short term.

At the current moment, the value of [BONK] is holding steady within a narrow band, poised for a potential breakout. Over the past period, its price movement has been reminiscent of a symmetrical triangle formation, which often indicates an upcoming significant shift.

According to Analyst World of Charts, a potential breakout on the horizon for BONK might trigger an upward trend over the next few weeks. Importantly, BONK appears to be nearing the peak of its triangle formation, suggesting that the breakout could occur imminently.

In simpler terms, the analysis by World of Charts points out the possibility of a significant price shift due to the symmetrical triangle structure in the chart. This shape typically appears before substantial price fluctuations, as it signifies a period of consolidation before major upward or downward shifts occur.

For BONK, the consolidation within the triangle has been ongoing for several months.

As the cost approaches the peak of the triangle, many traders and analysts are on high alert, waiting to see if there might be a breakout. If this occurs, it could lead to an immediate increase in prices.

Technical indicators signal bearish momentum

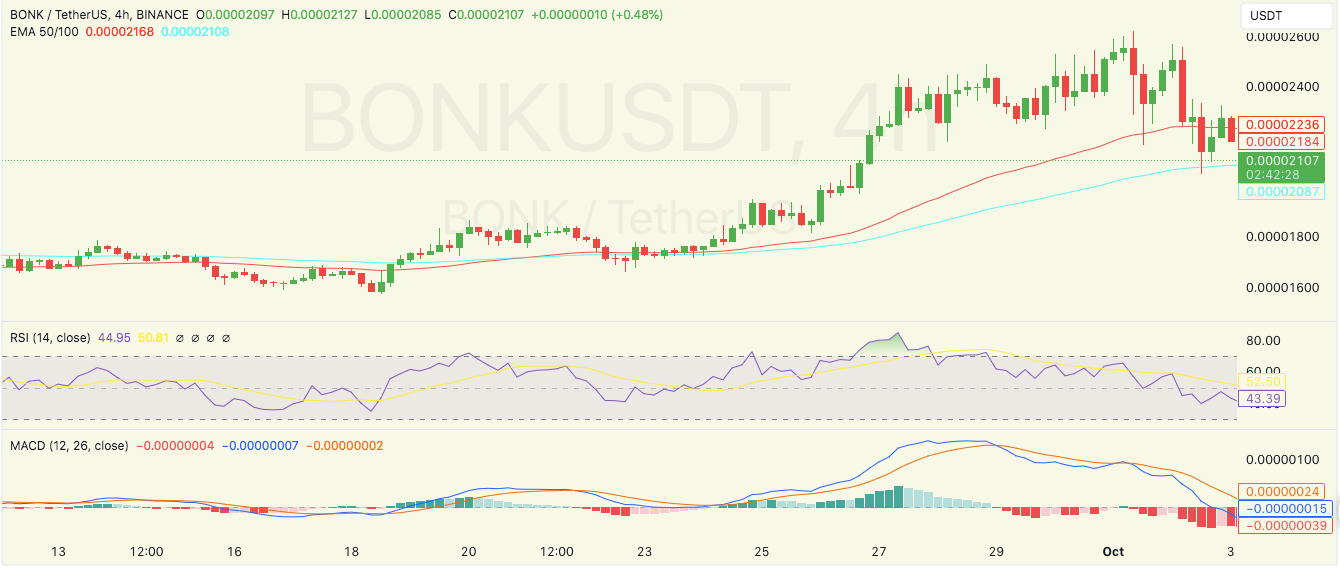

As I examine BONK‘s 4-hour chart at this moment, I notice that the price is maintaining a position above the crucial support level of $0.00002107.

As a crypto investor, I’ve noticed that my 50-day and 100-day Exponential Moving Averages (EMAs) have been serving as dynamic supports for my investments. However, recently, the price has dipped to challenge the 50 EMA, which could indicate a potential period of consolidation ahead.

If the price drops beneath the 100 Exponential Moving Average (EMA) at $0.00002108, it might indicate a potential short-term bearish trend.

At a level of approximately 44.95, the Relative Strength Index (RSI) suggested that the stock of BONK was nearing an oversold state.

A recovery in the RSI above 50 could indicate renewed buying pressure, though the current downward trend suggested that the price may continue consolidating.

As an analyst, I’ve noticed that the Moving Average Convergence Divergence (MACD) on the 4-hour chart has displayed a bearish crossover. This suggests a possible bearish trend ahead, unless the price manages to pick up speed and reverse course.

BONK: current market performance

Currently, one Bonk is worth approximately 0.00002124 dollars, marking a 6.31% drop over the past day and a more substantial decrease of 15.59% in the last week. The current circulating supply of Bonk tokens stands at around 69 trillion, giving it a market capitalization of roughly $1.47 billion.

Regardless of the temporary drop in prices, World of Charts remains hopeful that a breakthrough could occur, as long as crucial support thresholds remain intact.

Read Bonk’s [BONK] Price Prediction 2024–2025

Recent data from Coinglass revealed an increase in both trading volume and Open Interest for the memecoin. Volume has risen by 5.58% to $91.07 million, while Open Interest surged 1.57% to $9.94 million.

Based on these signs, it seemed like traders were preparing for a possible market breakout by adjusting their positions.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-09 03:03