-

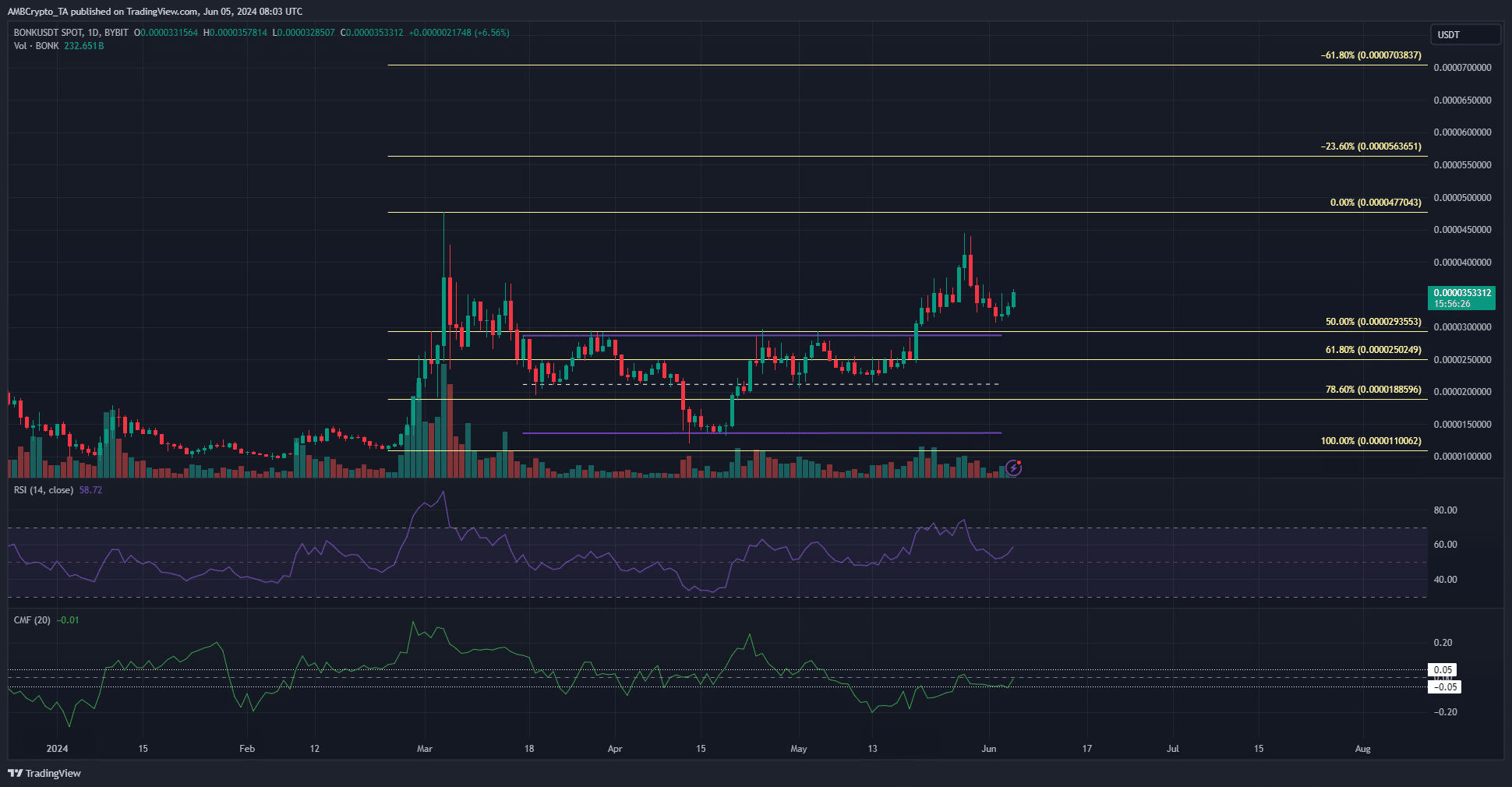

The BONK market structure on the 1-day chart was firmly bullish.

The momentum and volume indicators were not aligned but this might not prevent new ATHs.

As a seasoned crypto investor with a keen eye for market structures and trends, I have closely monitored the BONK market. The bullish structure on the 1-day chart was undeniable, and although there were some discrepancies between momentum and volume indicators, new all-time highs seemed imminent.

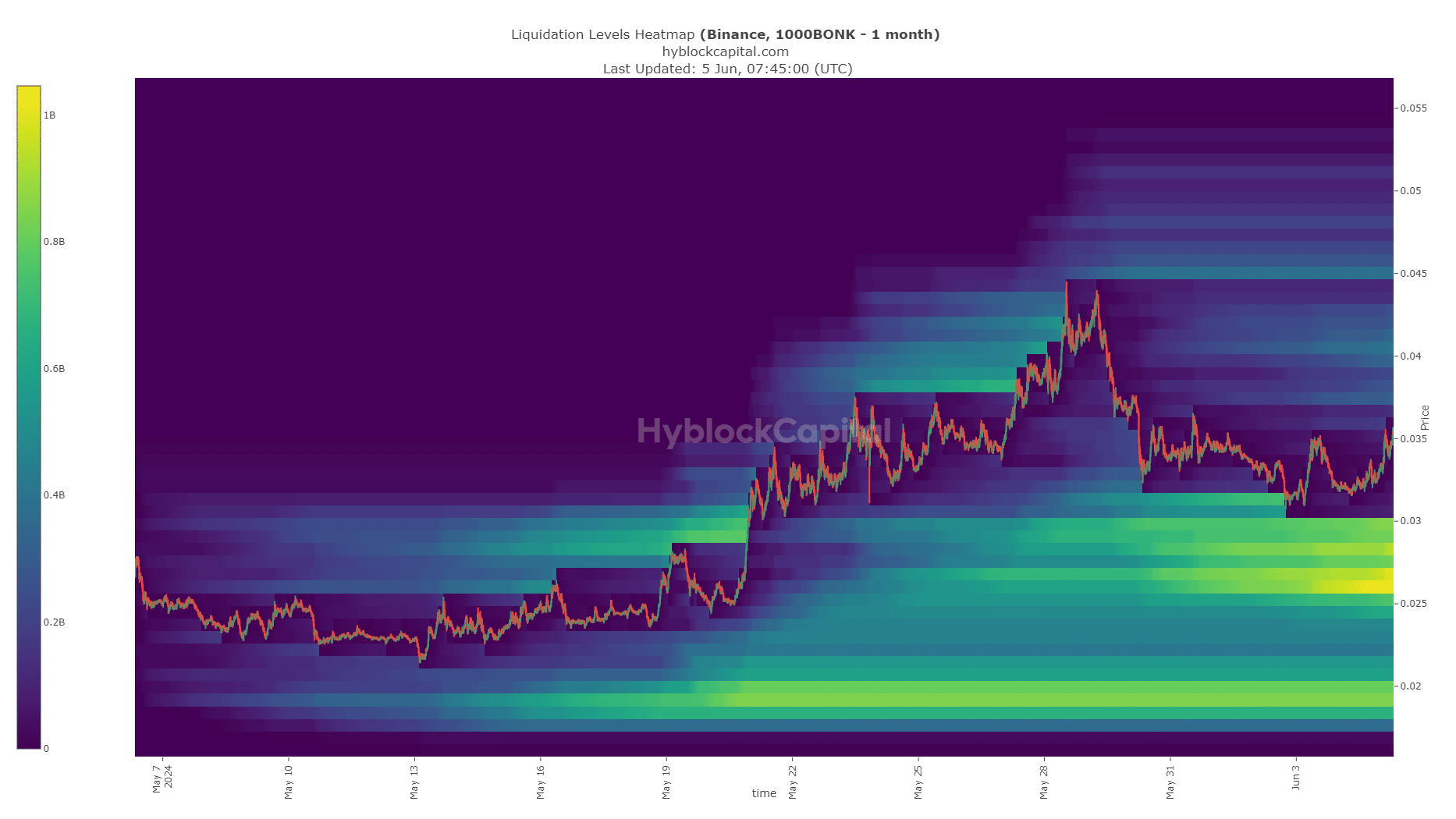

Bonk [BONK] noted record Open Interest as it neared its all-time high toward the end of May.

After experiencing a price correction, the memecoin has retreated back towards the peaks of its previous range.

As a crypto investor, I’ve witnessed a challenging six-day stretch where BONK experienced a significant correction, resulting in a 30.15% price drop. However, the last two days have brought some positive signs as BONK has started to recover. Looking ahead to June and beyond, it’s essential to consider various factors such as market trends, project development, and community sentiment. I personally believe that the price of BONK could rebound and potentially reach new highs if these positive indicators continue. Nevertheless, investing in cryptocurrencies always involves risks, so it’s crucial to do thorough research and stay informed before making any investment decisions.

The bullish market structure meant there was only one way forward

I analyzed the cryptocurrency market trends and noticed that towards the end of February and beginning of March, BONK experienced a significant rally, reaching its All-Time High (ATH) at $0.0000477. Over the subsequent six weeks, however, there was a notable reversal in this uptrend, with BONK nearly returning to levels that represented a 100% retracement from its ATH.

The range formation (purple) gave the bulls time to recover and gather strength for the next push.

As a researcher analyzing financial data, I noticed that the Relative Strength Index (RSI) on the daily chart surpassed the neutral 50 threshold, indicating positive momentum. Simultaneously, the Composite Money Flow (CMF) indicator stood at -0.01, suggesting a lack of substantial capital inflows recently despite the bullish trend.

It was a positive sign for bulls when the price surpassed its previous highs, which coincided with the 50% Fibonacci retracement level.

As a researcher examining BONK‘s price trends over the last quarter, I’ve observed a series of significant events that point towards a bullish outlook. Firstly, there was a notable retracement, which provided an opportunity for buyers to enter the market at lower prices. Following this, a period of consolidation ensued, allowing for price stability and potential accumulation by investors. Lastly, we’ve witnessed a powerful breakout above key resistance levels, signaling a shift in market sentiment towards optimism and upward momentum.

As a market analyst, I can confidently assert that BONK is poised to reach new all-time highs (ATHs) in the near future based on my analysis of its price movements. According to the Fibonacci extension tool, the potential levels for further upward momentum are at $0.000056 and $0.00007.

Will the magnetic zone pull BONK earthward?

A large collection of prolonged asking prices, spanning from $0.00003 to $0.00026, attracted potential selling pressure and might drag the prices downward.

Read Bonk’s [BONK] Price Prediction 2024-25

However, it is not a guarantee that every large liquidity pool will be swept before the next move.

Traders might consider purchasing assets during a price drop as a potential investment opportunity. However, considering shorting those same assets in expectation of a further decline seems unwise given the current information available.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-06 03:03