- BONK could soar by 30% to the $0.000021-level if it closes a four-hour candle above $0.0000165

- Coinglass’s BONK long/short ratio suggested that traders’ sentiments have been bullish

As a seasoned researcher with a knack for deciphering the cryptocurrency market’s nuances, I find myself intrigued by BONK’s current trajectory. The memecoin’s resilience amidst the bearish market and its impressive outperformance of heavyweights like Bitcoin, Ethereum, and Solana are indeed noteworthy.

As a crypto investor, I’ve noticed an exciting development in the memecoin scene – BONK, the widely recognized coin built on the Solana network. This token seems primed for a substantial price increase, fueled by its robust on-chain metrics and potential breakout. In contrast to the current bearish market trends, BONK has managed to outshine heavyweights like Bitcoin (BTC), Ethereum (ETH), and even Solana (SOL) themselves.

BONK’s price performance

Currently, BONK is approximately at $0.0000161, rising by more than 2.5% in the past day. Simultaneously, its trading volume has grown by around 46% during this timeframe, suggesting increased interest among traders.

Technical analysis and upcoming levels

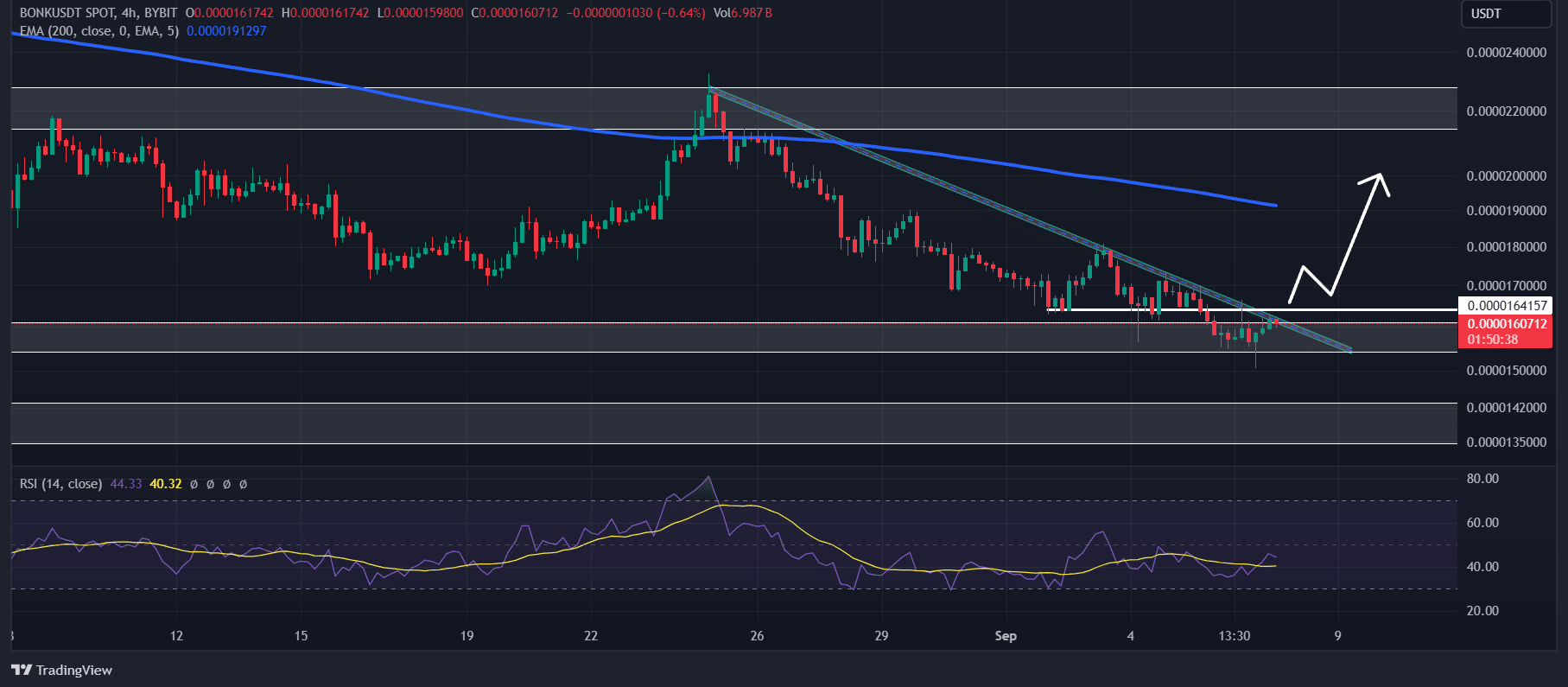

Glancing at the graphs for memecoin BONK, it appears that its price is hovering around a vital support point of approximately $0.0000155. The coin’s current trade suggests a downward trend as it falls below the 200 Exponential Moving Average (EMA) on a daily timeframe.

There’s a potential for an upward trend with BONK. On the four-hour chart, it appears that BONK might be about to break free from a downward trendline. If it manages to do so and ends a candlestick above $0.0000165, there’s a strong likelihood it could surge by approximately 30% to reach around $0.000021 in the near future.

According to the RSI by BONK, which shows whether a stock is overbought or oversold, the current state being oversold suggests a possible shift toward bullishness, implying a potential reversal of the downward trend.

In other words, for this optimistic outlook on BONK to hold true, the cryptocurrency needs to finish a trading period (candle) above $0.0000165. Conversely, if it fails to surpass this mark and slips below $0.0000152, there’s a strong possibility that it could shift into a bearish trend and decline by approximately 12% to reach $0.0000134.

On-chain metrics signal bullish sentiment

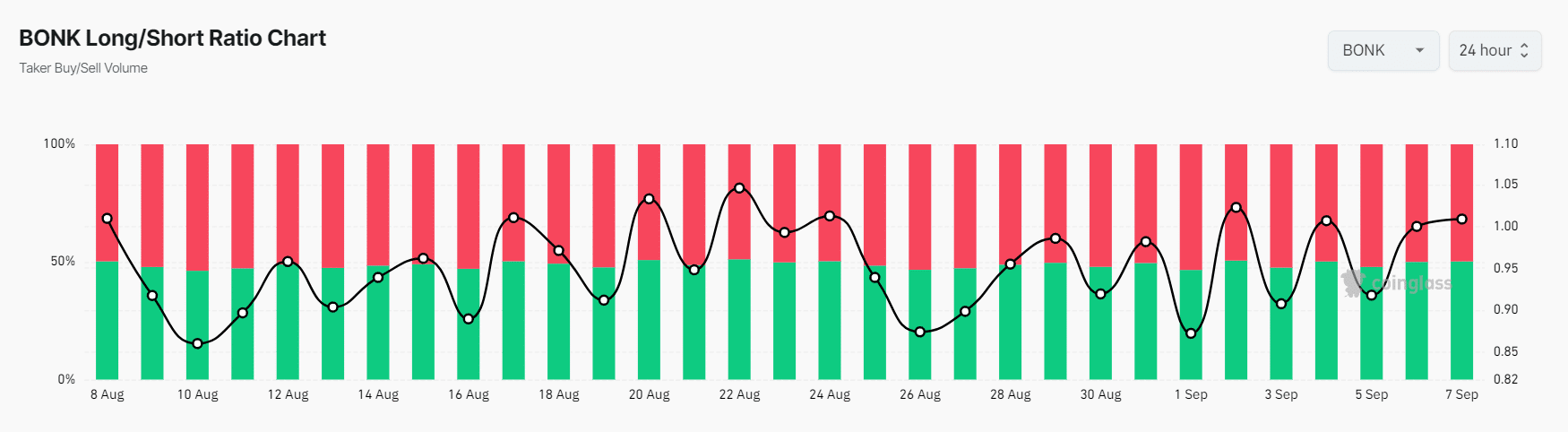

According to Coinglass’s BONK long/short ratio, it appears that traders are currently feeling optimistic, as the ratio recently stood at 1.0264 (a number greater than 1 usually indicates a bullish outlook).

Furthermore, over the past 24 hours, the open interest in BONK’s Futures has experienced a significant increase of approximately 11%.

A walk in the Open Interest and a long/short ratio greater than 1 could serve as promising buy indicators. Many traders tend to utilize this pairing to make trades, regardless of their chosen direction.

At press time, 51.05% of top traders held long positions while 48.98% held short positions.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-09-07 18:15