Over 60% of addresses lost money in Pump.fun trades, with 1,700 wallets down over $100,000. Because nothing says “fun” like losing a small fortune and wondering if you’ve accidentally invested in a particularly elaborate prank.

Meanwhile, the hype train for the PUMP token launch is chugging along, even as it seems to be putting some serious pressure on Solana’s fragile ego. 🎢

Over 60% of Addresses Lost Money in Pump.fun Transactions

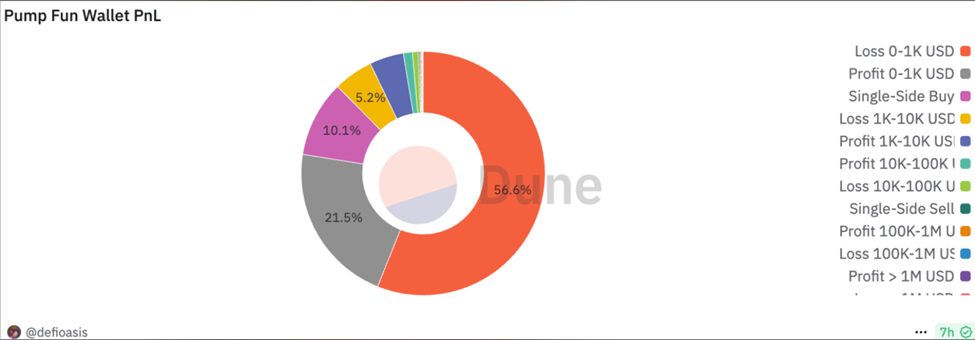

Diving into the digital treasure chest of Pump.fun trading data, it turns out behind all the memes and hype, there’s a harsh reality: most traders are just donating to the meme coin gods. According to Dune Analytics, more than 60% of addresses involved in the Solana-based token circus have suffered substantial wallet erosion.

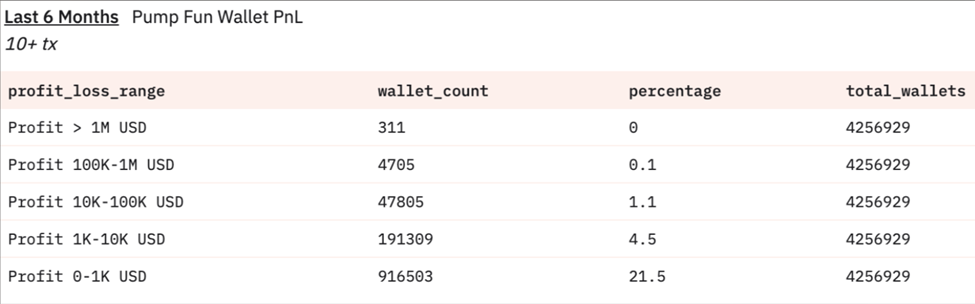

Specifically, out of 4.257 million (because who doesn’t love a number that makes you feel small), about 2.4 million (or 56.6%) posted losses between the modest “ouch” and the “seriously, I could have bought a small island for this” — basically under $1,000.

Meanwhile, nearly 1,700 addresses are probably crying into their digital pillows after losing more than $100,000, and 46 wallets have suffered hits exceeding the $1 million mark — because why not aim high when losing at this game? 💸

In stark contrast, only about 5,000 traders managed to stroll away with over $100,000 in their digital pockets, and a mere 311 somehow turned a profit exceeding $1 million. The pool of winners is about as vast as a penny in the ocean.

The most common “profit,” if you can call it that, is between $0 and $1,000, enjoyed by 916,500 wallets (or roughly 21.5% of the brave, or perhaps the foolish).

The takeaway? Most winners are just slightly better than losers, which maybe isn’t the most inspiring message. These numbers underscore the extreme income disparity fueled by meme coin speculation — a modern-day Robin Hood story but with fewer heroes and more zeroes.

Analyst Miles Deutscher chimed in with a chart (because charts make everything seem more official), showing that over half of wallets (51.06% or 166,590, because unremarkable numbers are full of surprises) lost more than $500. On the flip side, a magical five wallets (yes, five) managed to rake in between $50,000 and $100,000, proving there’s always a rainbow after a flood of losses.

In a classic dose of sarcasm, Miles remarked that “Pump.fun is good for crypto.” — because what better way to fuel skepticism than by saying “trust us, it’s good” while everyone’s crying into their keyboards? 😅

pUmP fUN Is GooD fOR CryptO

— Miles Deutscher (@milesdeutscher) June 5, 2025

Bot Blunders, Skewed Profits, and the High Cost of Meme Coin Madness

Pump.fun, the supposedly user-friendly platform for creating meme tokens for pennies (probably less if you include the cost of a CIA-level cover-up), is allegedly riddled with shady activities. Reports say trading bots are inflating volumes, making it look like everyone’s winning — until you realize it’s all just digital smoke and mirrors. 🧙♂️

Further investigations reveal that a whopping 98% of tokens on Pump.fun are either scams pretending to be real or outright fraudulent, with a paltry 1.4% actually holding decent liquidity — a fact that probably made the founders think “Well, at least we tried, right?”.

As the PUMP token launch approaches, the platform plans to raise a dazzling $1 billion, which sounds impressive until you realize it’s probably just another way to burn investor hopes faster than a campfire in a hurricane. 🔥

“Pump.fun was the darling of the 2025 crypto bull run, but the memecoin frenzy has fizzled out now, so it may find demand for the token sale is much more lackluster than it is anticipating— not least because retail investors are still sitting on the sidelines, probably hoping for a sign from the universe that this is all just a very elaborate joke,” — Alice Shikova, marketing lead at SPACE ID.

As if that weren’t enough, the hype has already started to affect Solana’s native token, SOL, which is feeling the heat as traders move their digital chips elsewhere — largely into the PUMP unknown. Deutscher comments that “Pump.fun token might be doing a little dance on SOL’s short-term outlook, as investors rotate out in search of the next shiny thing, which might be a tiny bit more trustworthy, or at least less likely to evaporate overnight.”

“[Pump.fun token] has some negative impact on SOL (at least in the short term), as there will be some rotation into PUMP – as many people used the SOL token as a proxy to get upside to the on-chain fee generation derived from Pump Fun,” Deutscher elaborated — basically, it’s not so much a pump as a nap in the market’s lounge.

Despite its seemingly simplistic appeal, Pump.fun is embroiled in regulatory messes — it was banned in the UK last year and faced lawsuits that could probably fill a small library. So, the dreams of democratized finance are more like a fragile bubble waiting for the slightest pin. 📚

Most wallets (95.6%) have either broken even or, more likely, lost hope entirely. The sad truth is that for every rags-to-riches story, there are hundreds of tales of despair — a reminder that in Meme Coin Land, the house always wins, and it’s often your house that’s losing.

And as the launch draws near, a wise crypto enthusiast might suggest that profits are about as common as honest politicians, and just as elusive. The reality:

“Pump fun revenues are down almost 90% — they’re finished and they know it. This is where OPENSEA messed up. They didn’t run a final token exit scam and just faded into irrelevance with a zero dollar revenue. After or before Otherside if Opensea launched a token, their investors would have… well, you know the rest.”

So, as the circus prepares for its next act, traders might want to double-check whether they’re riding a rocket or just setting fire to their hard-earned digital cash. 🚀🔥

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-06-05 15:20