- Brazil approves second Solana ETF provided by Hashdex.

- Despite Solana ETf approval Sol struggles as ETFs uncertainty rock US market.

As a seasoned researcher with over a decade of experience in the crypto market, I find it intriguing to observe the dynamics between various countries and their approach towards crypto assets. Brazil’s recent approval of the second Solana ETF is an exciting development that underscores its commitment to embracing innovative financial technologies. However, it’s disheartening to see Solana struggling for traction despite this positive news, mainly due to the decline in memecoin frenzy and reduced network activity.

Two weeks ago, Brazil made history by being the first nation to authorize the trading of Solana (SOL) exchange-traded funds. Previously reported by AMBCrypto, Brazil is now recognized globally as a forward-thinking government when it comes to cryptocurrencies.

In contrast to nations like Canada and the U.S., who have submitted applications for Solar ETFs, they are behind in getting these approvals. Notably, a second Ethereum Scalability (Solana) ETF was recently approved in a South American country.

Brazil approves second SOL ETF

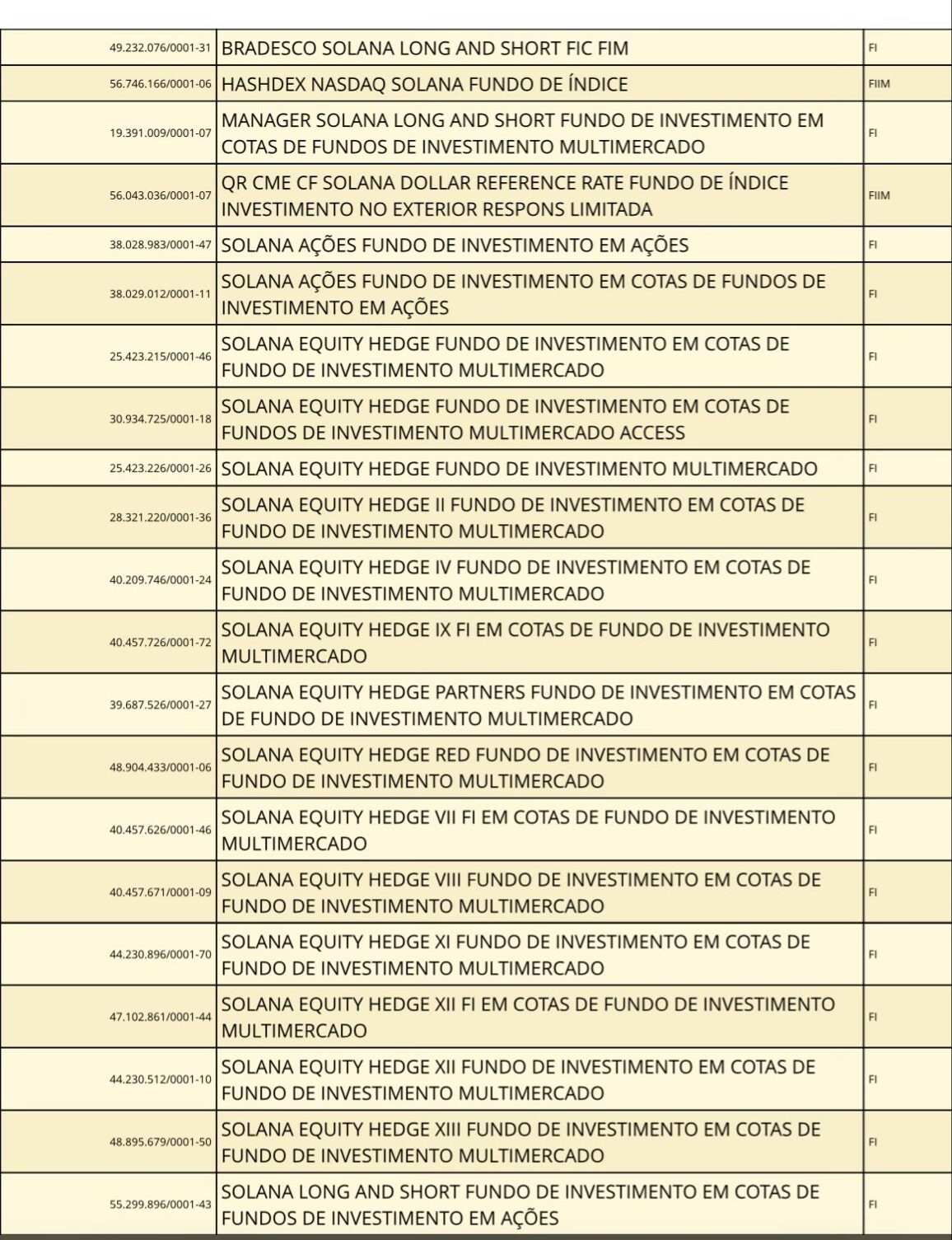

The Brazilian Securities Commission (CMV) has given the green light for another exchange-traded fund (ETF) linked to Solana.

Based on their records, it appears that the fresh ETF has commenced operations and will be distributed by Hashdex. Notably, this distributor, Hashdex, is a Brazilian asset manager overseeing approximately $963 million in managed assets.

Through the launch of the innovative ETF, the asset management company will collaborate with BTG Pactual, a prominent bank based in Brazil. Given Hashdex’s previous experience in managing the Nasdaq Crypto Index, they are ideally equipped to tackle the challenges posed by the Sol ETF.

SOL struggles for traction

Although two Solana ETFs have been approved in Brazil and the network has seen growth, the price of SOL remains unchanged. The cryptocurrency’s performance on price charts continues to be lackluster and it fails to meet expectations.

One reason for Solana’s difficulties could be the decrease in popularity surrounding meme coin crazes. The excitement around meme coins built on Solana has waned, leading to a drop in network usage.

The primary cause is intense rivalry with the Tron network, particularly due to its explosive growth in meme coin popularity.

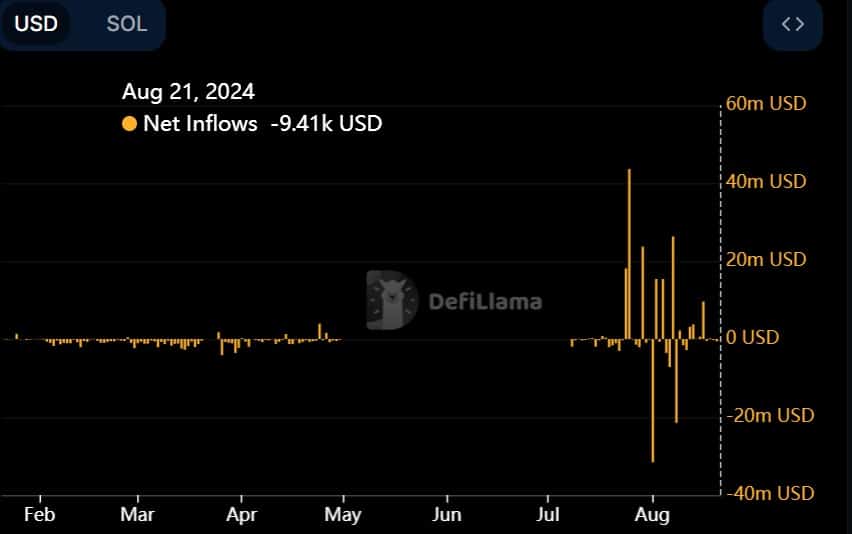

As an analyst, I’ve observed a notable decrease in activity across DeFi, NFTs, and gaming sectors on our network, which has consequently led to a reduction in investor confidence. This shift has significantly impacted the influx of funds into our system, as we’ve been reporting more outflows than inflows. The net result is a negative flow of approximately -9.4K, indicating a significant drain from our network.

Consequently, the price of SOL is falling by 2.5% and currently stands at $143.57 on charts, as reported now.

ETFs uncertain in the USA

As Brazil advances with more Solana ETFs, there’s a potential threat to the U.S. market because, as per the report, the filing for additional Sol ETFs in the U.S. has failed to progress into the next stage.

According to Eric Balchunas, the Securities and Exchange Commission has not taken notice of the shortcomings in Sol ETFs. He believes this negligence is the reason for their failure, and if Trump gets re-elected, this situation may persist until 2025 as per his prediction, which he shared via his online platform.

The SEC did not acknowledge Solana ETF filings at Step 2, which essentially meant they were dead on arrival. Consequently, the exchanges withdrew their 19b-4 applications, even though the issuers’ S-1 registrations remain active. It’s highly unlikely that approval will be granted unless there is a change in leadership at the SEC.

Based on recent reports, Solana ETF filings disappeared from the Cboe website.

In June, both VanEek and 21Shares submitted applications for Solana ETFs. The subsequent withdrawal of these applications has raised questions, as this action takes place during heightened discussions at the SEC regarding whether Solana should be classified as a security.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-08-21 15:04