- The recent drop in ETH’s price appeared to be a retracement.

- Market sentiment indicated a likely pullback, driven by weakening buying pressure.

As a seasoned analyst with years of market observation under my belt, I must admit that the recent dip in Ethereum [ETH] seems to be more than just a retracement—it appears to be a subtle reminder of the market’s unpredictable nature, much like a well-timed surprise party that no one asked for. The current sentiment suggests a likely pullback, driven by weakening buying pressure, which is a common occurrence in this rollercoaster ride known as crypto trading.

In the last day, Ethereum [ETH] has experienced a short-term drop, which is commonly referred to as a correction, and is typically followed by a continued upward trend in bullish economies. This temporary decrease amounted to approximately 2.70%.

According to AMBCrypto, there’s a possibility that the downtrend may continue, which might undo the 1.62% increase in Ethereum’s value that it experienced over the last seven days.

ETH faces continued weakness

Currently, the ETH chart is not showing signs that suggest a rise (bullish signals), which could mean that its value may decrease more, as it tries to find the right amount of market activity (liquidity) needed to boost its price.

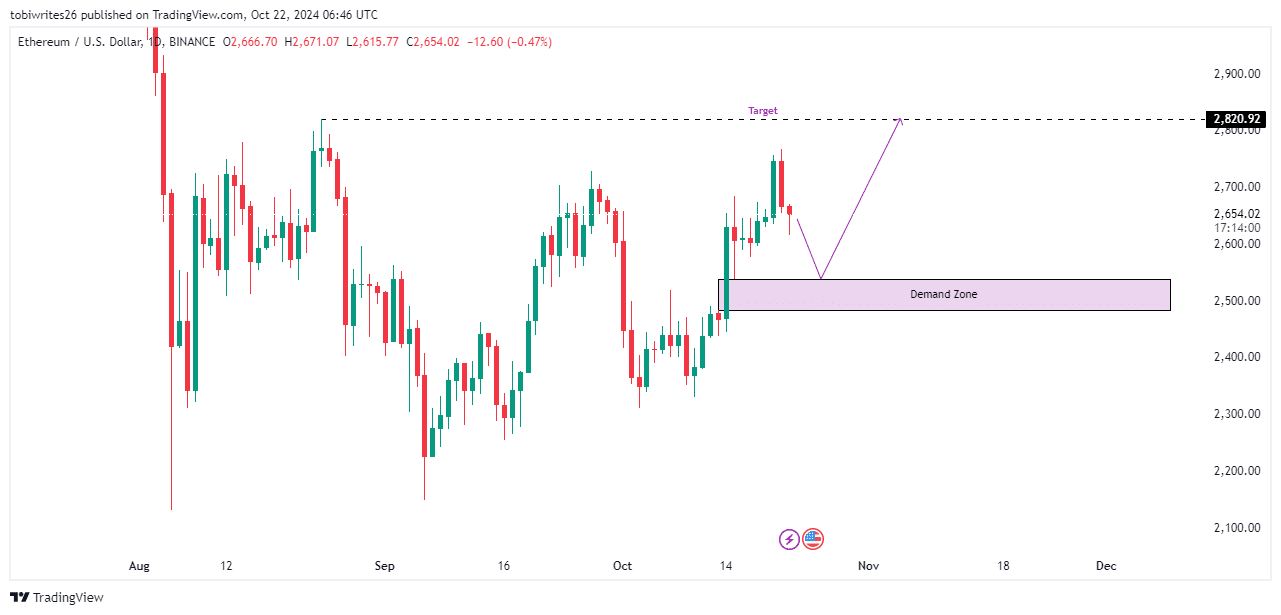

Currently, the closest potential trading area for Ethereum is located between approximately $2,536.47 and $2,484.44. Should the price reach this range, it might provide a platform for ETH to rebound towards its significant goal of around $2,820.92.

In other words, should ETH drop beneath this support area, it could initiate a “stop hunt” – a strategy in which traders aggressively search for more trading volume to amplify their subsequent bullish move.

Prolonged downward movement would suggest that ETH has entered a bearish trend.

Traders seek momentum in ETH market

Recent trading activity indicates that the market is seeking momentum, suggesting a potential decline from its current price of $2,654.02.

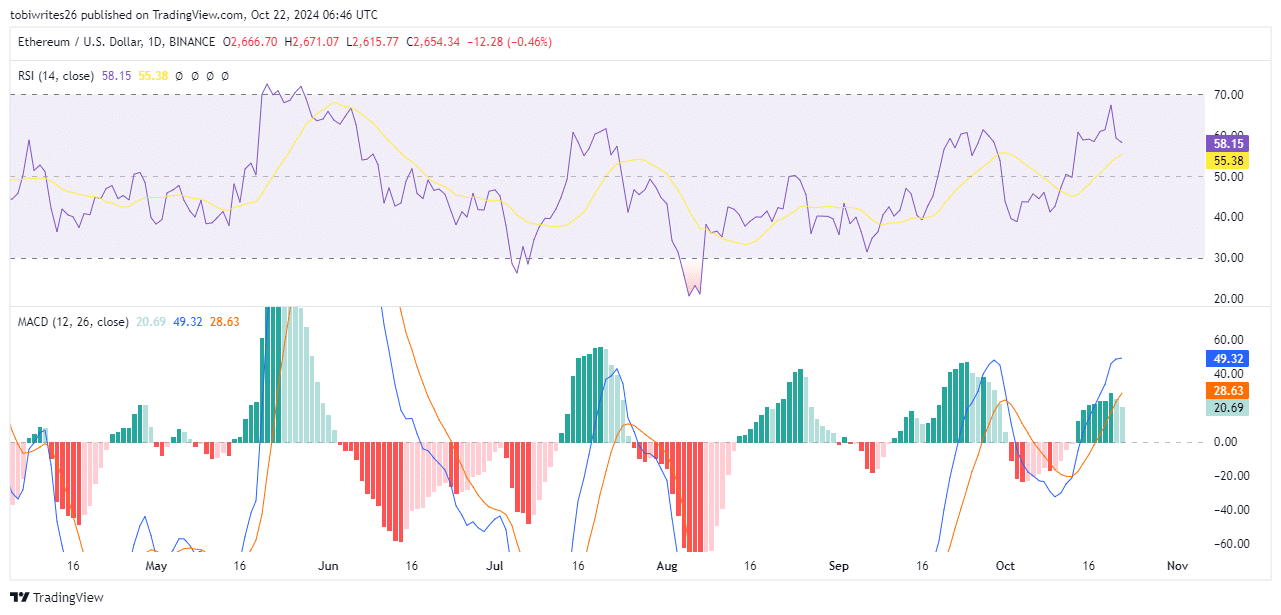

As a crypto investor, I find it useful to keep an eye on the Relative Strength Index (RSI). This index runs from 0 to 100, with 50 being the neutral point. Readings above 50 suggest a positive trend, while numbers between 50 and 60 indicate a moderate increase in buying pressure, which could be an opportunity for investment.

From my perspective as an analyst, readings under 50 point towards significant selling pressure, with a range between 30 and 50 indicating a moderately strong sell-off. Readings exceeding 70 hint at overbought conditions, while values below 30 might indicate oversold conditions in the market.

At present, ETH’s Relative Strength Index (RSI) stands at 58.15, yet it appears to be moving in a descending pattern, suggesting that its value could potentially drop since it seems to be searching for a demand area. However, it continues to exhibit bullish activity.

In a similar manner, the MACD (Moving Average Convergence Divergence) indicator, currently staying above zero, is showing a decrease in its momentum, as suggested by the diminishing green sections on the graph.

It appears that although the market as a whole is thriving, the demand for purchases seems to be slowly decreasing over time.

Temporary retreat from sellers

In simpler terms, the Open Interest metric, a tool for gauging market sentiment, suggests that most traders are preparing to sell (short) the asset rather than buy it.

Read Ethereum’s [ETH] Price Prediction 2024–2025

According to Coinglass, Open Interest has declined to $13.56 billion, reflecting a 2.89% decrease.

If this pattern persists, it implies a potential increase in selling activity which might push the value downwards. However, there’s still a possibility that the overall upward momentum, or bullish trend, could be sustained.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-10-23 01:43