-

BRETT dropped 7.55% from its ATH but sentiment around the token remained bullish.

Indicators revealed that the price might drop to $0.14 before a bounce appears.

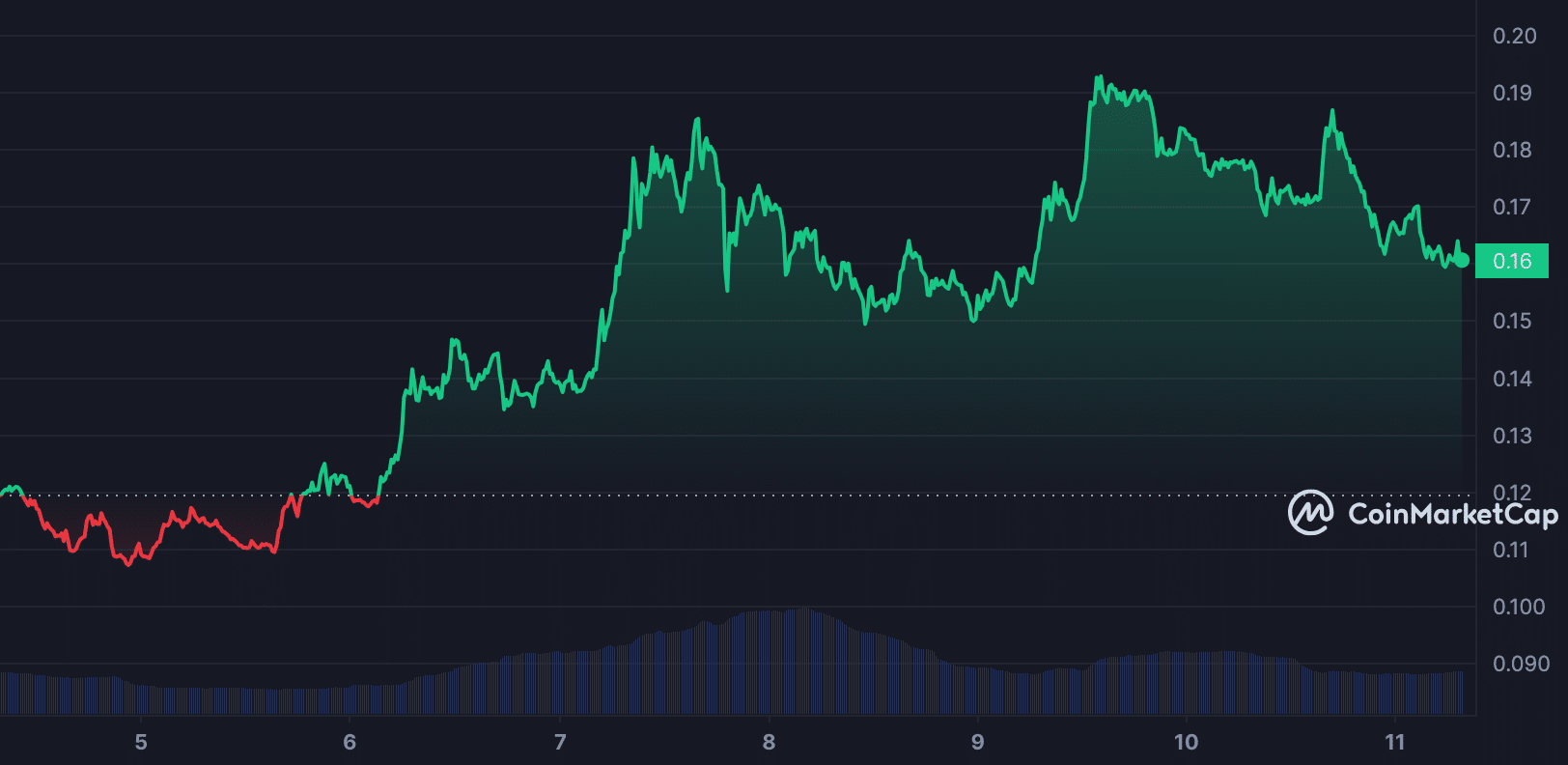

As a researcher with experience in cryptocurrency analysis, I believe that Brett (BRETT) is currently experiencing a correction following its recent All-Time High (ATH) of $0.19 on June 9, 2024. The token’s price dropped by 7.55% to $0.16 at press time, with a market cap of $1.61 billion.

On the 9th of June, I noticed that my investment in Brett, the memecoin built on Base, Coinbase’s layer-2 platform, experienced a significant surge and reached a new all-time high (ATH). At that point in time, the price of Brett was sitting comfortably at $0.19.

As a crypto investor, I’ve observed that the price surge brought us near $2 billion in market capitalization for BRETT cryptocurrency before it corrected. Currently, at the time of writing this, the coin is being traded at $0.16 with a market cap of $1.61 billion.

In the past 24 hours, the token’s price dropped by 7.55%. This downturn might be due to investors cashing out their profits, considering the token experienced a remarkable surge of 375% over the past 30 days.

Is the local top in?

In February 2024, a team of developers introduced the BRETT crypto and earned the moniker “PEPE‘s best friend” on the Base Chain. As their community expanded, they sought to challenge the popularity of memcoins established on the Solana [SOL] network.

As a result, the token became the most valuable cryptocurrency in terms of market cap on Base.

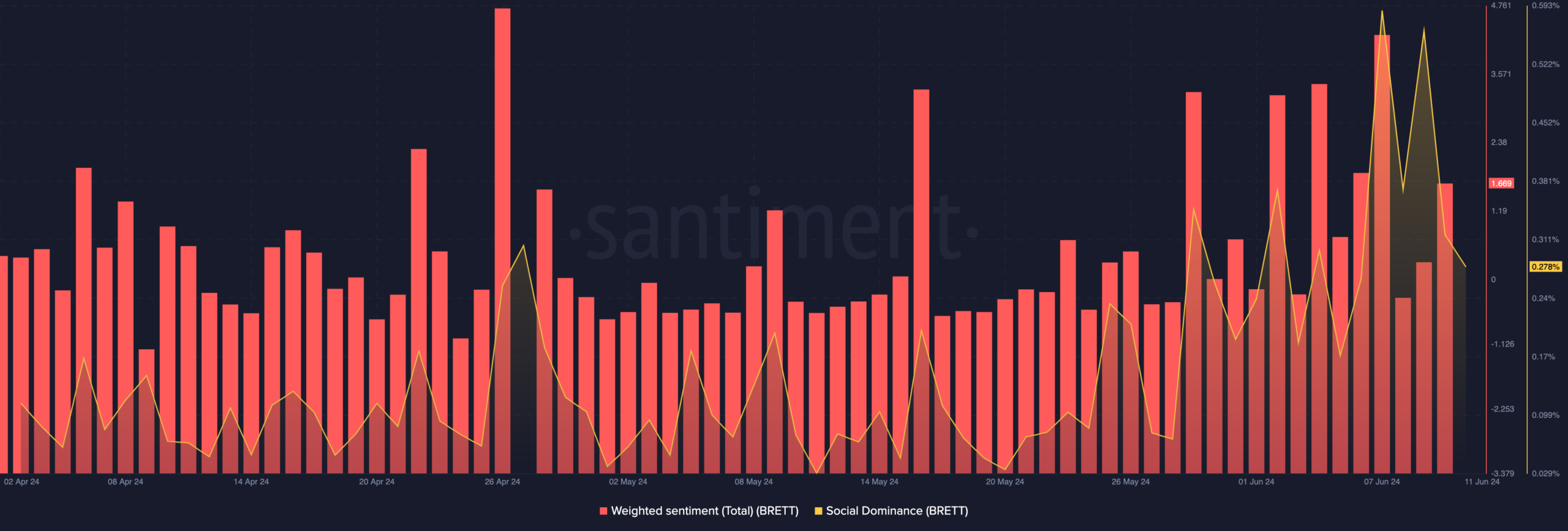

In spite of the price decrease, there was a continued optimistic outlook towards the token based on the public sentiment. This perspective was evident in AMBCrypto’s examination of Santiment’s data analysis.

As an on-chain analysis expert, I utilize the advanced sentiment measurement tool provided by our platform to assess the comments circulating around a particular project. A favorable reading from this Weighted Sentiment analysis indicates a more extensive bullish perspective among online communities.

In contrast, a low value for the metric signifies stronger bearish sentiment towards cryptocurrencies on social media platforms. Another metric worth considering is social dominance, which can potentially impact the price of BRETT crypto.

When the price reached its all-time high, the social dominance soared to 0.56, indicating a significant increase in conversation surrounding the cryptocurrency. This rise in discourse might signal a potential local peak for the price.

After the memecoin had retraced, its social influence decreased as well.

The decline in BRETT‘s conversation isn’t wholly unfavorable, as it might present a buying chance preceding another bull run.

BRETT may go lower before another rally

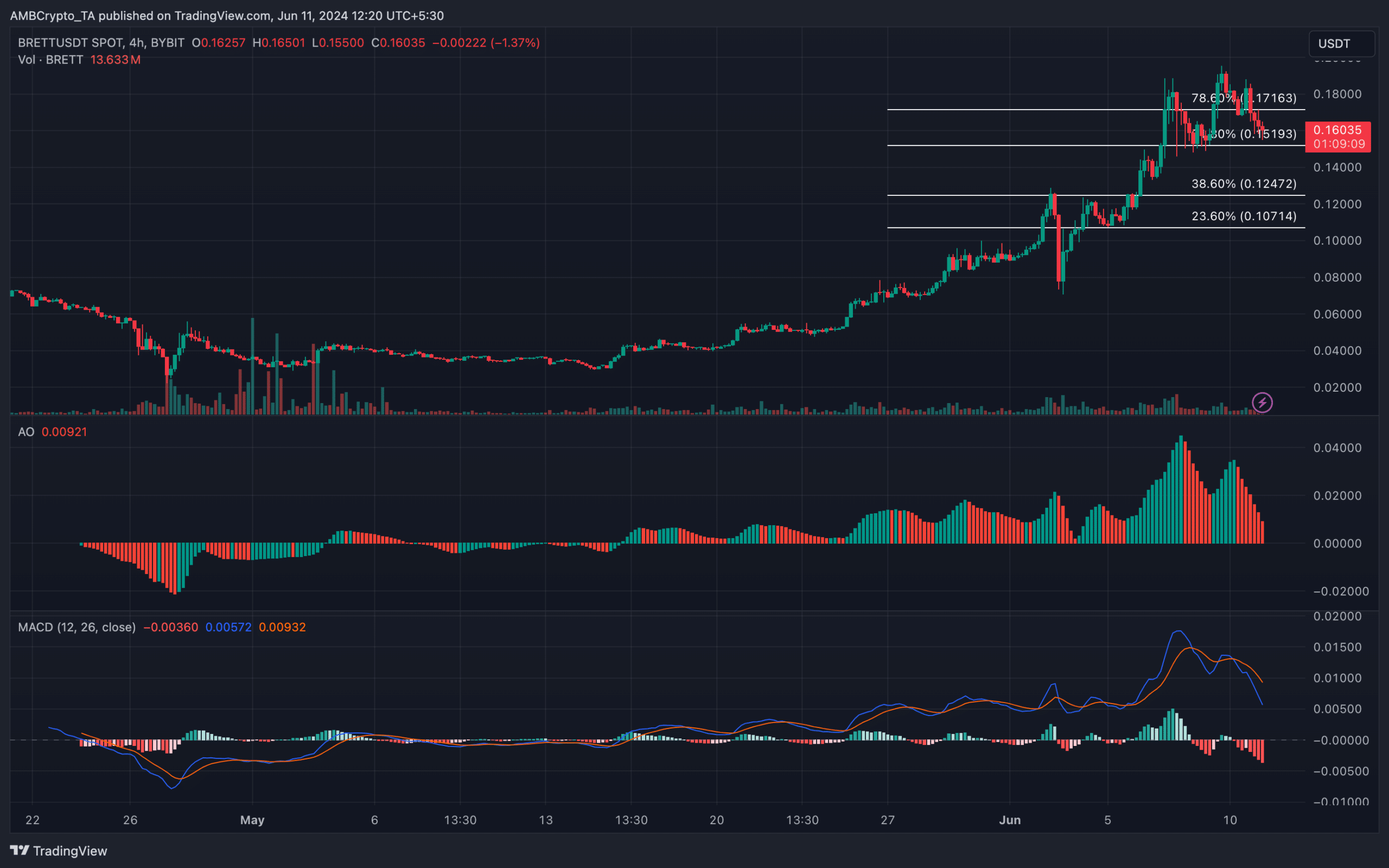

Simultaneously, there’s a chance that the token’s value could decrease further. Hence, $0.16 might not represent the absolute lowest point. Nonetheless, let’s examine BRETT‘s trend based on technical indicators for a more informed perspective.

Based on my analysis of the 4-hour chart for my crypto investment, the 0.382 Fibonacci level was at $0.12. This price level represented a minor correction or pullback. If selling pressure intensified in the future, the value of BRETT could experience a significant drop. However, it’s important to note that this level might act as a potential support point.

Additionally, the 0.618 Fibonacci level, located around $0.15, may serve as an excellent entry point for buyers if they manage to keep Brett crypto’s price afloat. Nevertheless, it is important to note that the Awesome Oscillator (AO) indicator has shown a decline in value.

The AO’s histogram, marked with vivid red bars, underscored the decreasing momentum of the token. Additionally, the MACD indicator, which assesses momentum, supported this observation.

Currently, the MACD indicator shows a negative value, and the positioning of the Exponential Moving Averages (EMAs) aligns with a downward trend. Specifically, at the present moment, the 12-day EMA (represented by the blue line) has dropped below the 26-day EMA (signified by the orange line).

In this scenario, the sellers were more active than the buyers, leading to the observed price movement. Conversely, if the buyers had been more active, the price trend could have favored them instead.

Realistic or not, heres’ BRETT’s market cap in PEPE terms

Based on current appearances, the price of BRETT could potentially decrease to around $0.14 or even hit $0.12. Nevertheless, this pessimistic view may be disproved if purchasing activity picks up again.

Should this be the case, the price could rise higher than $0.20.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

2024-06-11 18:16