- BRETT showed signs of declining interest as whale flows declined on the charts

- Healthy discount could potentially pave the way for liquidity injection

In the year 2024, BRETT was one of the most rapidly expanding meme-based cryptocurrencies. With this rapid growth, it showed great potential to break into the top 5 meme coins. Yet, the strong upward trend that had been noticed earlier took a significant downturn following a highly bearish December.

At the current price of $0.11 for BRETT, data from IntoTheBlock shows that just over three-quarters (70%) of its holders are actually holding at a loss, as only 38% were in the money. This implies that most holders bought the token at a higher price than what it is currently trading at. Furthermore, half of the traders find themselves out of the money, while another 12% are neither in the money nor out of the money.

As a crypto investor, I’ve noticed a decrease in large holder activity for the memecoin during the past week. The number of transactions exceeding $100,000 dropped significantly, from 1,727 transactions on January 13th to only 138 transactions on January 18th. This trend aligns with the dwindling large holder flows that have been evident over the last few weeks.

As a researcher, I’ve noticed that the inflow of large token holders has decreased to approximately 347.67 million BRETT in the recent period. Simultaneously, the number of these large holders has dipped slightly to around 341.11 million BRETT. For context, the peak inflow was a staggering 3.42 billion tokens on December 12th, while the peak outflow stood at 3.40 billion tokens.

The massive data collector showed a decrease in demand from ‘whales’, indicating waning interest. This development led to BRETT being positioned as the 11th coin on Coingecko’s list of popular memecoins, ranked by market capitalization.

Can BRETT drum up enough demand at consolidation zone?

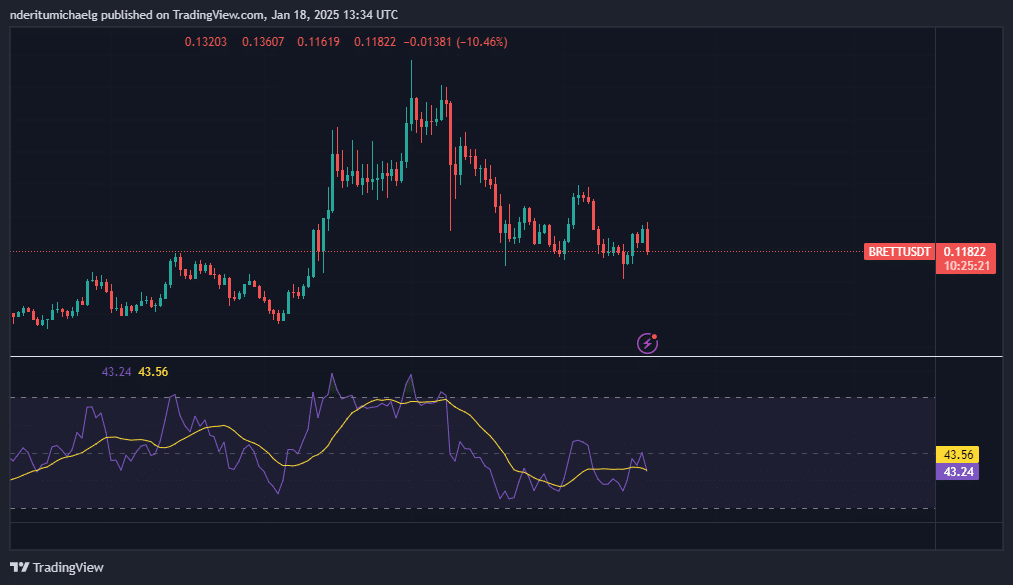

BRETT’s price drop was significant, having fallen around 50% since its highest point in December. Notably, it didn’t recover strongly even when it reached the Fibonacci levels of 0.5 to 0.618 at the time of reporting.

Alternatively, it appears that BRETT is exhibiting indicators of strengthening within its current price range at the moment. Is there a possibility this could initiate a surge of buying activity this week? While its lower price point might appeal to investors, on-chain information has been providing somewhat conflicting messages.

In the past day, BRETT noticed an increase in favorable funding rates. This could imply that traders dealing with derivatives might be expecting some growth. Additionally, there was a substantial rise in Open Interest, increasing from $70.63 million to $86.82 million over the last three days.

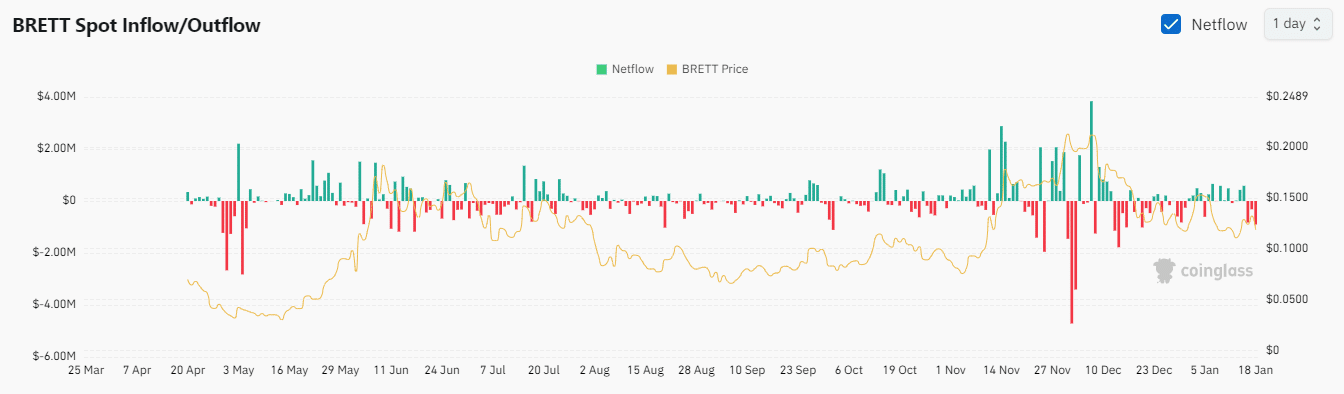

However, BRETT spot flows remained largely negative over the same period.

In the past 24 hours, BRETT experienced outflows totaling approximately $902,000, indicating that relatively small amounts might influence the price movement.

A resurgence in demand by whales might initiate another significant market surge, considering the current heightened interest in meme-based cryptocurrencies.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-19 12:07