- BRETT was unable to match the performances of BTC or DOGE in recent weeks

- Both Open Interest and price action outlined a neutral to bearish long-term outlook

As a seasoned crypto investor with battle-scarred eyes from the volatile rollercoaster that is this market, I find myself in a rather peculiar predicament when it comes to BRETT. While I’ve been able to eke out a modest 25% return since hitting its Monday lows, it pales in comparison to Dogecoin’s 31% surge over the same period.

As I write this, Brett (BRETT) has increased by approximately 25.87% compared to its low points on Monday. Yet, it experienced a downward trend towards the close of last week, resulting in a gain of just 8.1% over a span of 7 days. Conversely, Dogecoin (DOGE), currently the top meme coin in terms of market capitalization, rose by approximately 31% within the same 7-day period.

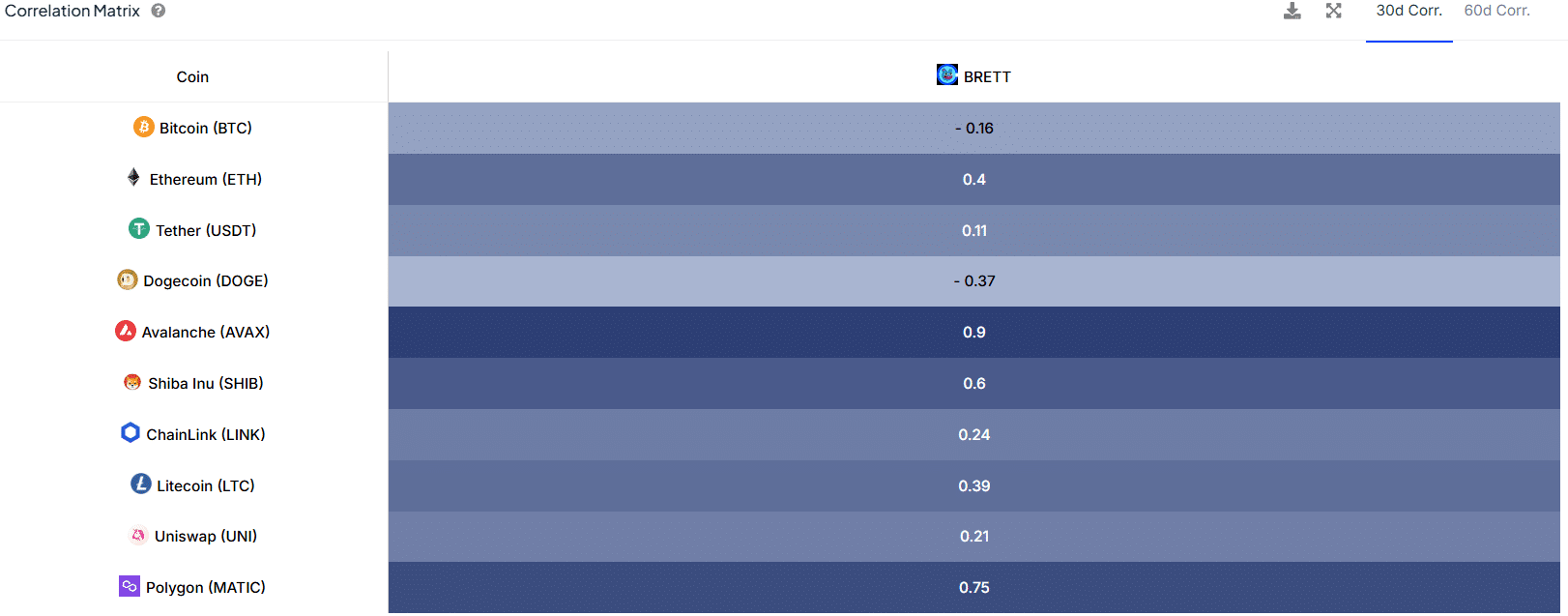

As of the current reporting, there was a weak negative relationship with Bitcoin [BTC], indicated by a correlation coefficient of -0.16. This can be observed when we look at the price movements: While Bitcoin has risen by 15.78% since October 15, BRETT has experienced a decrease in value by 18.46% during the same period.

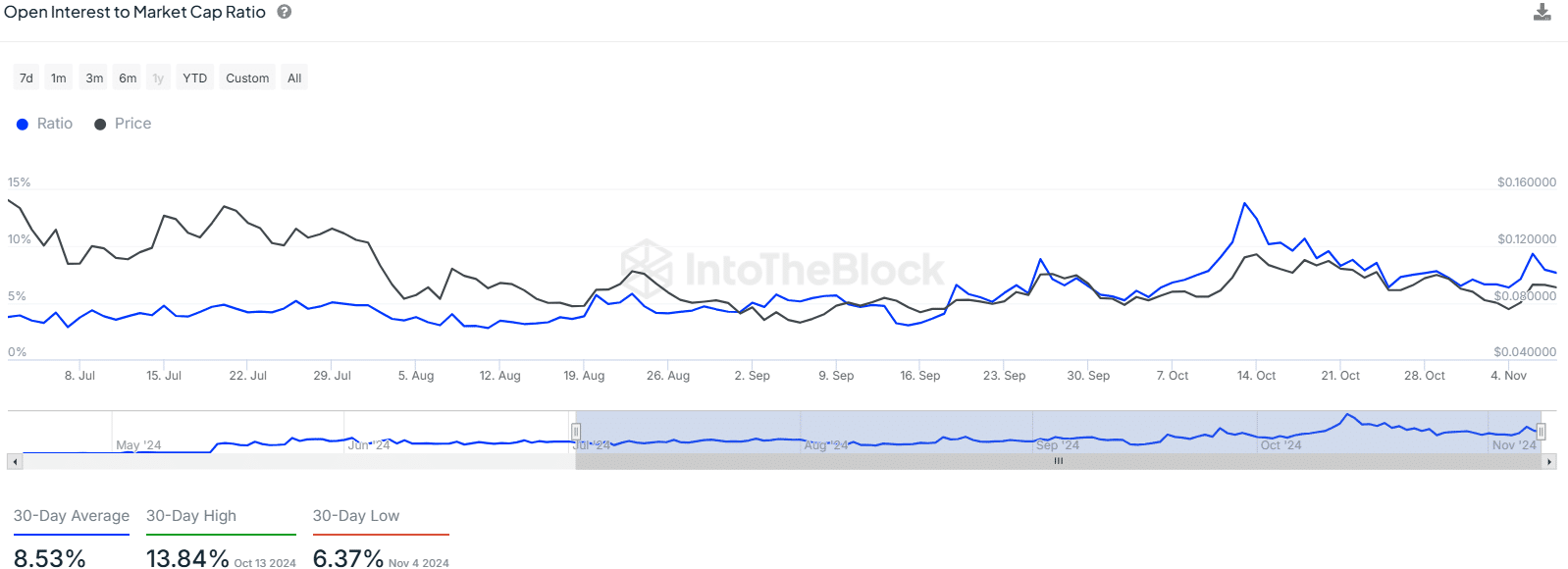

Speculative interest behind BRETT is falling

As a crypto investor, I’ve noticed a steady decrease in the Open Interest to Market Cap ratio since October 13. During that period, it appeared that BRETT was poised to surge beyond its 10-week price range, but fell short right above the local highs.

The slump in OI has not recovered either. This suggested that Futures market participants were not bullish on BRETT and preferred to remain sidelined.

Essentially, meme coins tend to gain value when they receive attention and interaction on social media platforms. High Open Interest indicates a short-term market feeling, and if there’s less bullish enthusiasm compared to other markets, it might be disheartening for investors.

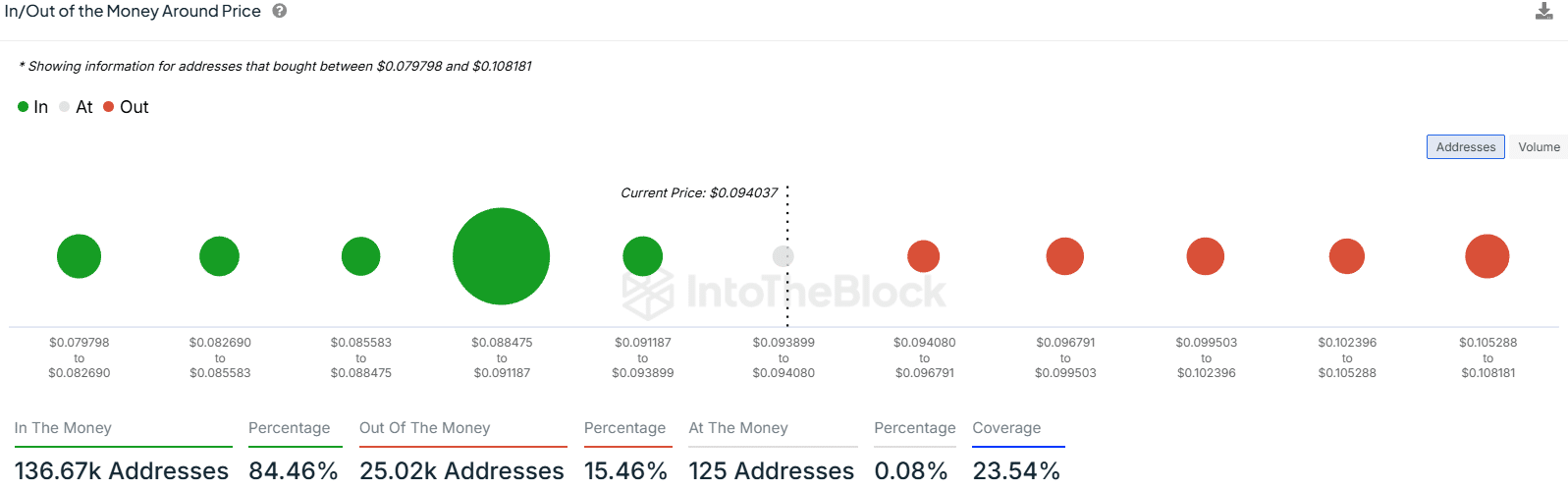

As an analyst, I’ve noticed that the $0.088-$0.091 range served as a crucial support area based on the In/out of the Money around Price metric. Furthermore, the resistance levels higher than the current market price appeared to be relatively insignificant at the time of analysis.

Buy BRETT or wait for conditions to change?

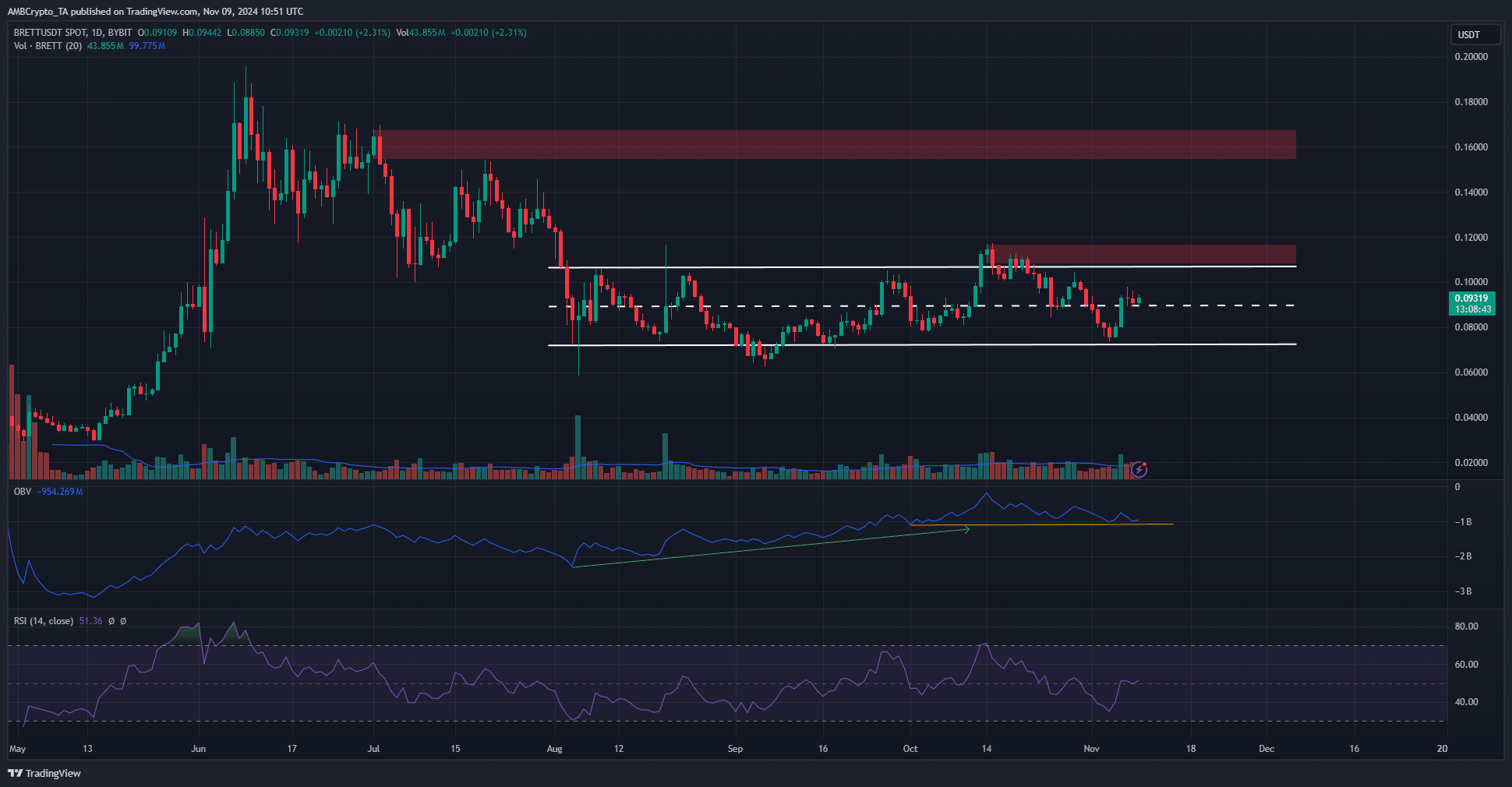

Over the last three weeks, the OBV has been gradually decreasing, having previously been on an upward trajectory since August. However, this downward trend seems to be shifting, and it presents a potential buying chance for those who trade based on swings in the market.

The token reclaimed the mid-range level at $0.089 as support. A stop-loss below $0.088 and a take-profit target of the range highs at $0.107 would be a feasible course of action.

Realistic or not, here’s BRETT’s market cap in BTC’s terms

On the other hand, investors might be more conflicted. Other major coins registered bullish gains and broke their range formations, while BRETT languished within one. The more pragmatic course would be to HODL, instead of chasing the early runners.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-10 04:07