- BRETT’s price declined despite a bullish breakout.

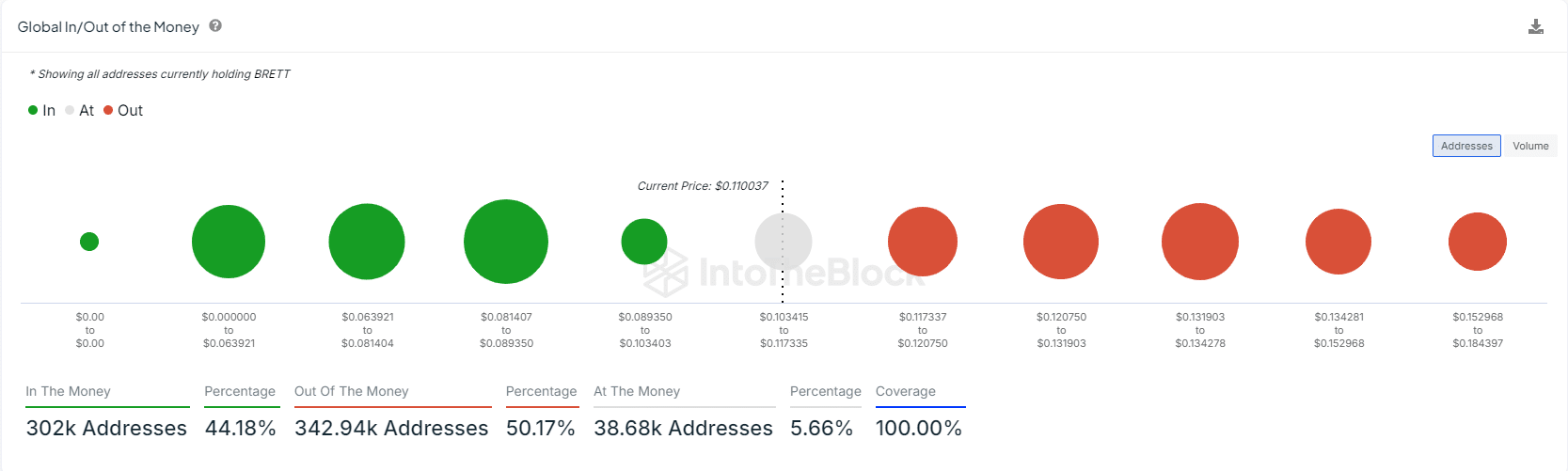

- Almost half of global addresses holding Brett are making money.

As a seasoned crypto investor with years of experience under my belt, I find myself intrigued by the current state of Brett [BRETT]. Despite the recent decline, the bullish breakout and strong performance over the past month have caught my attention.

Brett (BRETT), a well-known memecoin on the Binance Smart Chain, has recently managed to burst free from its period of stability and successfully checked whether its underlying support levels are solid.

Yet, at the moment of publication, it seemed to be finding it challenging to advance further, possibly because of reduced trading activity over the weekend.

Even though it currently stands like this, there’s a sense of hope that the trend will continue climbing due to its robust status and impressive recent achievements.

For the last week, Brett’s value increased by 15%. Over the past month, it has risen by 31%. Notably, major shareholders seem to control a significant portion of the market. This trend implies a rising curiosity as we approach the last quarter of the year.

BRETT price prediction

Brett’s latest market behavior, after escaping the confinement of a narrowing trend line pattern (wedge consolidation), indicates a possibility of more increases when trading resumes during the week.

On Base’s platform, being the primary meme coin implies that it stands to gain a substantial share of the liquidity generated within this ecosystem.

Furthermore, the weekly graph reveals a significant tail, suggesting robust purchasing interest in BRETT. As trading volume picks up, this could potentially drive the price upward.

Profitability and volume

44.18% of traders who own the memecoin are currently experiencing a profit, and the individuals with the highest profits have held their coins within the price range of approximately $0.081407 to $0.089350.

302,000 addresses have profit, as 50% (or 342,000) of traders find themselves in a loss position, with approximately 6% (or 38,000) of the total addresses being neither profitable nor unprofitable at this moment.

Having a total issuance of 9.91 billion units and a cap at 10 billion, the token distribution strategy of BRETT continues to appeal to investors seeking sustained growth over time.

As the largest memecoin on Base, Brett enjoys significant market participation.

The pace of Brett’s market engagement is picking up speed, as its market value surpasses $1.1 billion and its 24-hour trading volume soars to $85.5 million – representing a 12.4% jump according to CoinMarketCap.

The proportion of the project’s volume compared to its market capitalization was 7.7%, showing signs of steady and balanced liquidity movement. This ratio suggested that Brett possessed manageable and consistent liquidity, positioning itself as a reliable investment option within its class.

Over the upcoming trading days, I anticipate the markets will rebound with renewed vigor, fueled by increasing investor enthusiasm.

Read Brett’s [BRETT] Price Prediction 2024–2025

The latest breakout and retest by Brett offers a robust base for potential future expansion, with investors keeping a keen eye on whether the market trends will continue to rise.

Given favorable market signs and robust liquidity levels, it’s likely that BRETT will keep climbing in value, potentially even more so as trading activity picks up again.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-20 14:13