- Bitcoin demonstrated resistance against the downside despite leveraged longs liquidations.

- The show of strength continues as Bitcoin ETFs accumulate, raising chances of a $70,000 price.

As a seasoned crypto investor with a decade-long journey through the digital asset landscape, I can confidently say that Bitcoin’s [BTC] recent performance is nothing short of impressive. The resilience it demonstrated against the downside despite leveraged longs liquidations is reminiscent of its legendary status in the market.

Bitcoin (BTC) is nearing a potential breakthrough above $70,000. This prediction might appear daring, but it’s important to remember that it wasn’t long ago when Bitcoin had difficulties maintaining its value above $60,000.

A clear shift has occurred in the market, making it easier for the bulls to push higher.

Over the past six days, Bitcoin has shown strong interest from buyers, suggesting that the market dominance is shifting towards the bulls once more. This comes after a brief period of decline in the initial ten days of October.

Essentially, it seems like Bitcoin’s growth is reminiscent of the energy it had back in September.

There are a few reasons why a $70,000 Bitcoin price tag may occur in a matter of days or weeks.

In the past day, Bitcoin showed significant fluctuations, experiencing a surge of selling activity that slightly lowered its value, bringing it close but not quite reaching the $68,000 mark.

Consequently, there was a surge in demand which drove prices back up, preventing any further decline.

Bitcoin snaps back despite leverage shake off

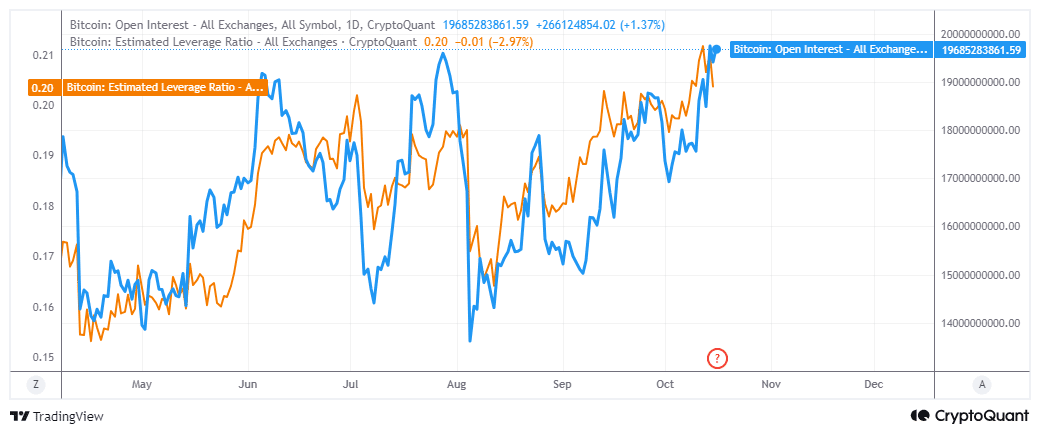

During Tuesday’s trading, Bitcoin’s dramatic price swings suggested a potential unwinding of leveraged positions due to an all-time high in Open Interest.

On top of that, the estimated leverage ratio also soared to a new local high.

In simpler terms, when there’s high investment with a matching level of commitment (open interest), it often leads to liquidations, especially during periods of excessive enthusiasm. Once a pullback happens, it usually dampens the overall mood.

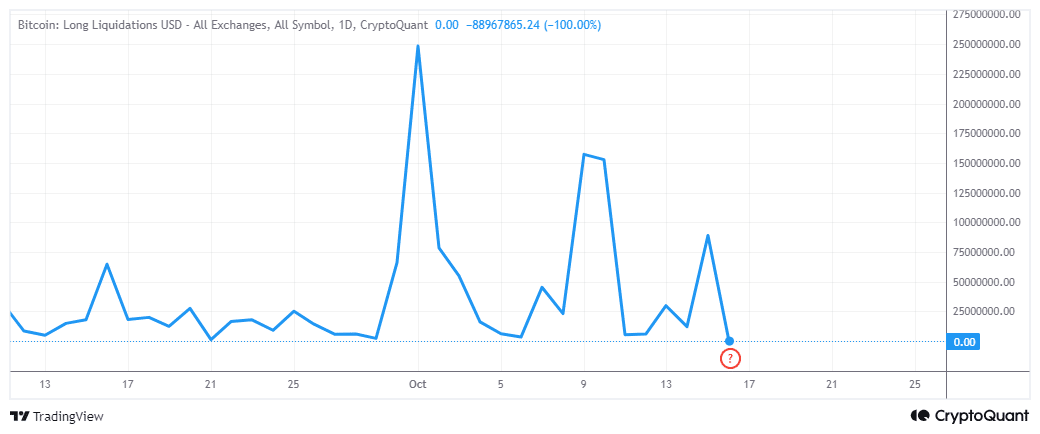

However, that was not the outcome that played out during Tuesday’s trading session.

On September 15th, the highest amount of asset sales totaled approximately $88.9 million. Yet, demand soon rebounded, causing the price to rise again, surpassing $67,000.

The above outcome confirmed the growing optimism in Bitcoin’s ability to capture more gains. On top of that, the recent demand resurgence was characterized by heavy accumulation by Bitcoin ETFs.

In the past day, it has been disclosed that Bitcoin ETFs have amassed approximately half a billion dollars’ worth of Bitcoin.

On October 14th, it’s been found that Exchange-Traded Funds (ETFs) amassed approximately $500 million in Bitcoin. This suggests a growing institutional interest in a positive or bullish market trend for Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This detail clarifies the reason behind the current resistance of the cryptocurrency against a drop in value. Moreover, it strengthens the belief that the bullish trend could propel the price beyond $70,000 shortly.

Additionally, the results of the upcoming U.S. elections could potentially further increase Bitcoin’s soaring prices, depending on the final outcome.

Read More

2024-10-17 03:03