- Analyst forecasts a 40% rally for Bitcoin before cycle top.

- The Fibonacci extension levels show targets of $109k and $132k.

As a seasoned cryptocurrency researcher with over a decade of experience in this volatile market, I have seen bull runs come and go, each one more unpredictable than the last. The latest forecasts and technical analysis pointing towards a potential 40% rally for Bitcoin before the cycle top are intriguing, to say the least.

In early 2024, there was a significant increase in Bitcoin [BTC] addresses holding substantial amounts. The mindset of ‘HODLing’ or long-term holding became more prevalent. As of the start of 2024, these particular Bitcoin addresses (those that had never sent out any coins and held at least 10 BTC) were in possession of about 1.5 million coins. However, as we stand now, they hold approximately 2.9 million coins, indicating a significant rise in accumulation.

The Bitcoin Rainbow Chart gave ultra-optimistic forecasts for the current cycle, targeting $288k or higher. However, historical trends showed that a cycle top could be closer to $100k this time.

Bitcoin set for another 40% rally before the cycle top?

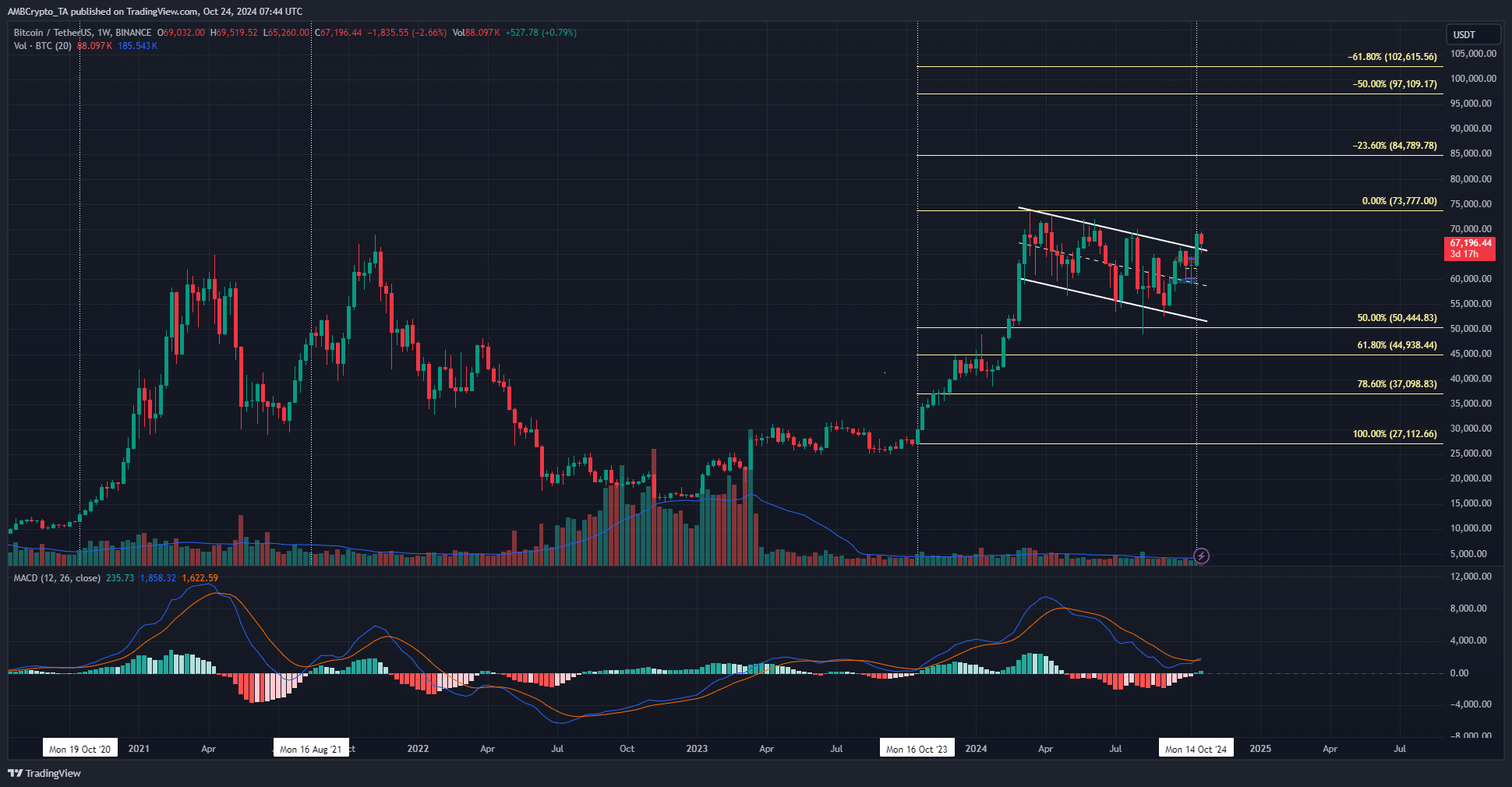

On platform X, crypto expert CryptoBullet pointed out in a recent post that the MACD (Moving Average Convergence Divergence) showed a bullish crossover for the first time since late October 2023. Interestingly, a similar pattern in October 2023 preceded a significant increase of 172% over the next five months.

Prior to the Bitcoin halving, this rally took place. Currently, there’s a discussion about whether we can anticipate comparable growth, or if the subsequent increase might result in a lower peak on the MACD, signifying the potential conclusion of the bull market.

In simpler terms, the analyst preferred the second scenario over the first. This second scenario predicts a prolonged period of stability followed by an upward MACD crossover after a strong surge in price, but it’s unlikely to result in triple-digit percentage increases. As per CryptoBullet’s analysis on his charts, another 40% increase could be a possible and realistic target.

Gauging the current targets for Bitcoin

History may echo, yet it doesn’t always replay. In the 2017-2018 market surge, the weekly MACD crossover yielded a massive 617%, and the 2020 occurrence brought about a 468% gain. However, in 2023, this event only resulted in a 172% return, happening prior to the halving date.

Is your portfolio green? Check the Bitcoin Profit Calculator

In 2019 and 2020, Bitcoin surged by an impressive 190% following its $3,200 lows, which were reached approximately 18 months prior to the halving event. However, there’s a possibility that this pre-halving price surge might not hold true for future occurrences. The extension target of 40% in price increase suggested by CryptoBullet for the next phase could potentially be off the mark.

Given the current situation, it appears to be a logical assumption. Furthermore, it aligns quite neatly with the Fibonacci extension lines visible on the chart displayed above.

Read More

2024-10-25 03:03