Okay, so Bitcoin had a bit of a, shall we say, *situation*. Forty-seven THOUSAND Bitcoins went *poof*. Disappeared. Like my motivation to go to the gym. But the price? Barely flinched. What is this, a mime convention? 🫥

- Bitcoin lost 47K BTC, but the price remained…chill? Like a cucumber in a spa.

- Exchange reserves are shrinking faster than my patience on a Monday morning.

So, everyone’s freaking out, wondering if this is a “supply shock.” Which sounds like something you’d get after eating too much gas station sushi. 🍣 Or is it just, you know, a Tuesday for crypto bros moving their digital Monopoly money around? Historically, big exits mean people are hoarding Bitcoin like squirrels with nuts, which *should* make the price go up. But…plot twist!

We need to dive deeper. Like into a vat of discounted Nutella. Let’s look at the numbers!

Analyzing Bitcoin exchange reserves – Is accumulation in play? Or are they just redecorating their digital wallets?

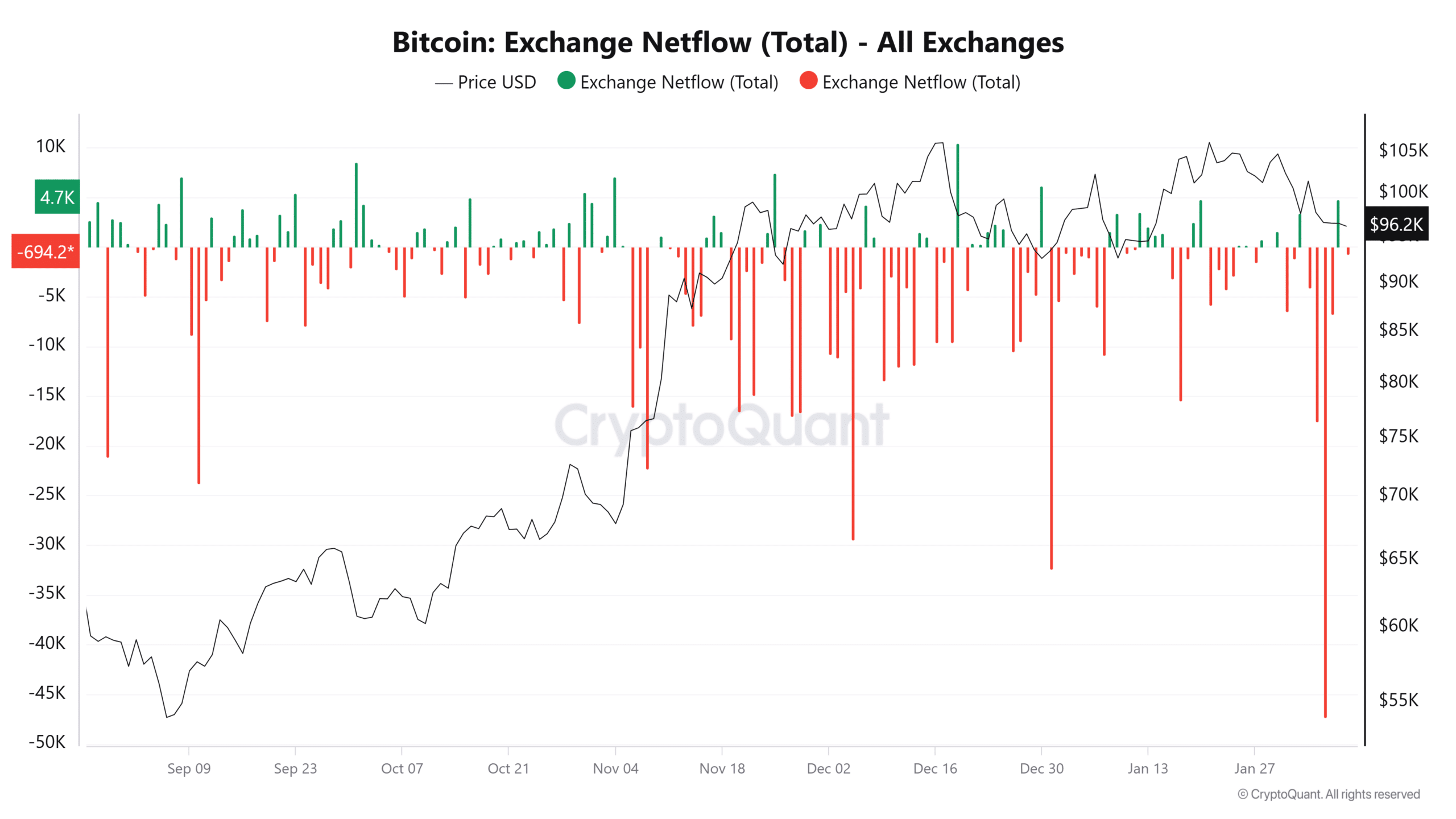

Apparently, Bitcoin’s been having a steady stream of “goodbyes,” but then BAM! That 47,000 BTC exodus. The largest since 2022. Which, let’s be honest, feels like a lifetime ago. Like before avocado toast became a thing. 🥑

This led to talk about a supply shock. Dramatic, right? But a supply shock only confirms that the supply is shocked, and not necessarily anything else. It is like when you buy a gift for someone, and they don’t really react. Did they like it? Are they surprised? No one knows!

Also, the Bitcoin Exchange Reserve chart shows that exchanges are holding less and less Bitcoin. Like my bank account after a weekend in Vegas. We’re talking a drop from 3 million BTC in mid-2024 to 2.45 million BTC in February 2025. Whoa. 📉

Usually, less Bitcoin on exchanges means people are shoving it into their digital mattresses for the long haul. Which is cute. But is it meaningful? 🤔

How did Bitcoin’s price react? Like a teenager being told to clean their room?

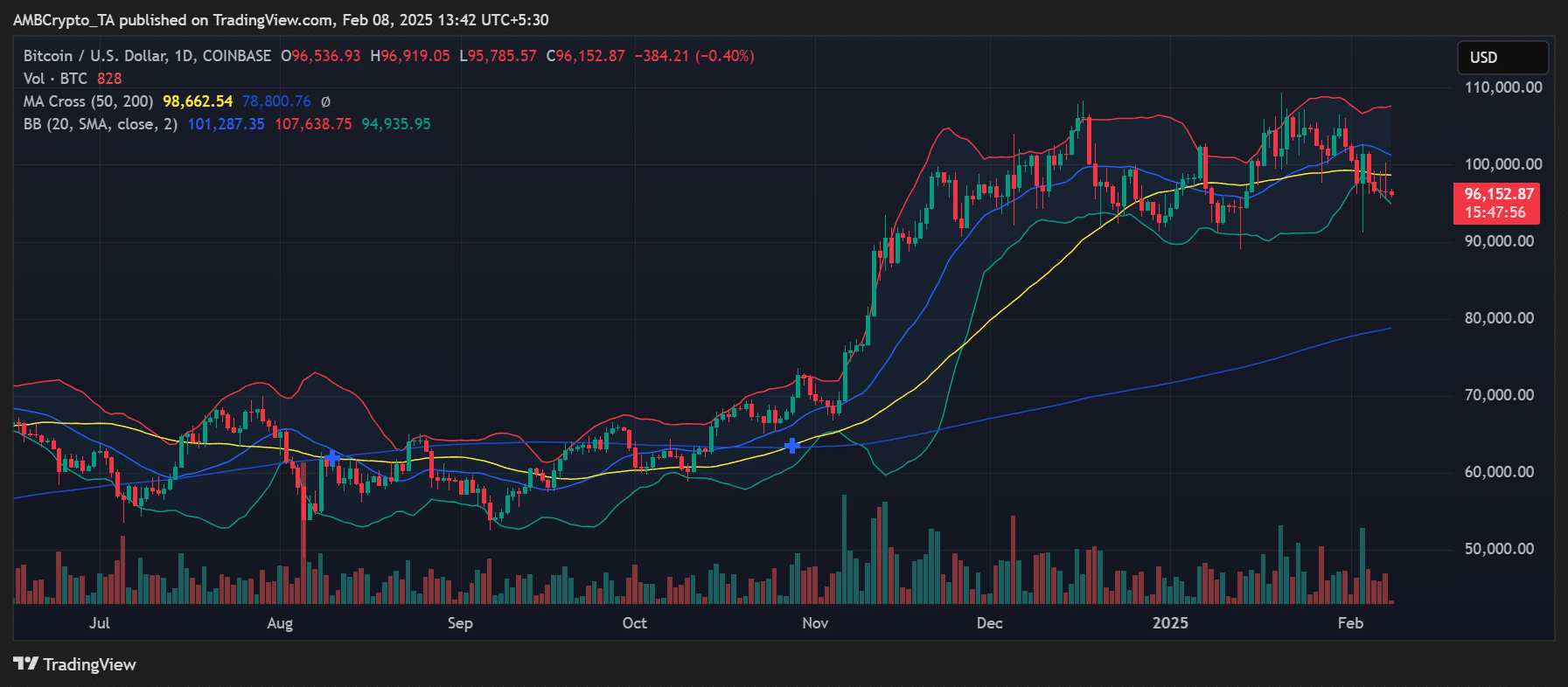

After all that drama, Bitcoin’s price stayed around $96,152. Seriously? That’s like throwing a party and nobody shows up. 🎈 Where’s the outrage? The volatility? The existential dread?!

The Bollinger Bands (whatever those are) showed some moderate wiggles, with the price hanging out between $94,935 and $107,638. And apparently, some moving average is acting as a “resistance level.” Sounds exhausting. 😴

So, big outflows = potential accumulation, BUT no price spike = nobody cares? At least not yet. Maybe they’re all just waiting for the next season of *The Real Housewives of Crypto*. 🥂

Futures market underlines speculation. Or, “Gambling: The Crypto Edition!”

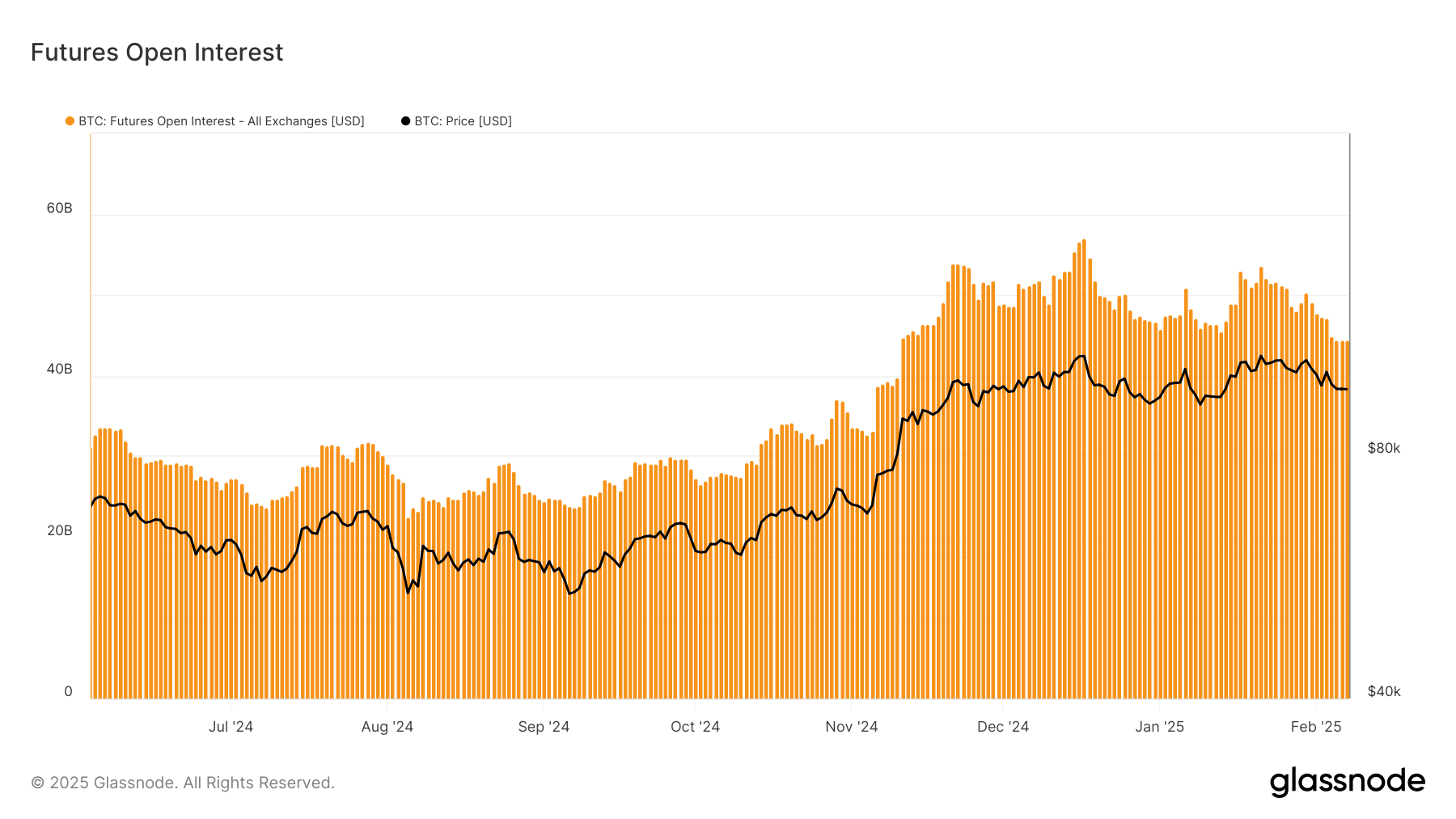

Glassnode’s Futures Open Interest chart shows people are betting big in January, almost $60 billion big! Which is more than my student loan debt, thankfully. 😅

Rising Open Interest and significant exchange outflows often mean traders are anticipating a “supply squeeze.” Which sounds like a bad date. At the time of writing, the OI was around $44 billion. So, less dating, more watching from the sidelines?

But, if things get *too* positive, the whole thing could collapse faster than a soufflé in a wind tunnel. Bitcoin becomes vulnerable to “liquidation-driven pullbacks.” Ouch.

Supply shock or routine move? Or just another reason to stress out?

So, the 47K BTC thingy aligns with fewer Bitcoins on exchanges, BUT… the market didn’t even raise an eyebrow. 🤨

Maybe it’s not a supply shock. Maybe it’s just a bunch of whales rearranging their digital furniture. Who knows? Crypto is weird. And sometimes, it just does weird stuff.

– Read bitcoin (BTC) Price Prediction 2025-26 (Spoiler alert: I have no idea.)

That being said, if Bitcoin withdrawals and whale activity continue like this, a supply squeeze could emerge in the coming months. The trend will gradually exert upward pressure on Bitcoin’s price. So, HODL on tight, folks! Or don’t. I’m not your financial advisor. And I still regret that perm I got in 1987.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Moana 3: Release Date, Plot, and What to Expect

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

2025-02-09 02:15