- Prominent figures like Vinnik, Bankman-Fried, and Zhao have faced DOJ charges for money laundering

- Popular crypto-exchange KuCoin was also slapped with similar charges

As a crypto investor with some experience in the industry, I’m deeply concerned about the recent developments surrounding money laundering in the cryptocurrency space. The cases of prominent figures like Alexander Vinnik and the closure of exchanges like BTC-e and KuCoin have left me feeling uneasy.

Cryptocurrencies have been linked more and more to money laundering schemes, as notable individuals such as Sam Bankman-Fried and Changpeng Zhao have recently faced jail time for related offenses. Now, another individual can be added to this infamous roster, with Alexander Vinnik, the co-founder of the unlawful crypto exchange BTC-e, admitting to comparable wrongdoings.

According to a press release from the U.S. Department of Justice (DoJ),

A Russian individual admitted guilt today for his involvement in a money laundering conspiracy linked to managing the cryptocurrency exchange BTC-e between the years 2011 and 2017.

Alexander Vinnik, age 44, is identified as one of the key figures in the day-to-day operations of BTC-e, a well-known and large virtual currency exchange around the world.

BTC-e under DoJ’s radar

From approximately 2011 to its shutdown by law enforcement in July 2017, BTC-e handled transactions totaling over $9 billion and served more than one million users globally. A significant portion of this user base was located in the United States.

In its statement, the DoJ claimed,

“Cyber criminals globally relied heavily on BTC-e as a means for moving, cleaning up, and safeguarding the ill-gotten gains from their unlawful operations.”

As a financial analyst, I’ve discovered that BTC-e’s business model was heavily dependent on unregistered shell companies and affiliate entities with FinCEN. Additionally, they failed to implement fundamental anti-money laundering (AML) and Know Your Customer (KYC) procedures.

Alexander Vinnik established multiple shell companies and financial accounts globally for handling Bitcoin-e’s transactions.

A federal district court judge is now responsible for handing down a sentence for Vinnik, taking into account several factors as outlined in the U.S. Sentencing Guidelines.

Back in 2017, I analyzed a notable case where the Financial Crimes Enforcement Network (FinCEN) imposed hefty civil penalties amounting to approximately $122 million on BTC-e and Alexander Vinnik. These penalties were levied for willfully disregarding U.S. Anti-Money Laundering (AML) regulations.

KuCoin too?

Recently, the Department of Justice (DoJ) accused major cryptocurrency exchange KuCoin and its founders, Chun Gan and Ke Tang, of conspiring to break the Bank Secrecy Act and running an unlicensed money-transmitting business.

The DoJ claimed,

“KuCoin, established in 2017, has handled transactions totaling over $5 billion that later raised suspicions or were identified as criminal proceeds, amounting to over $4 billion.”

Collectively, these advancements underscore the persistent hurdles that regulators encounter when trying to curb financial misdeeds in the realm of cryptocurrencies.

What do the figures say?

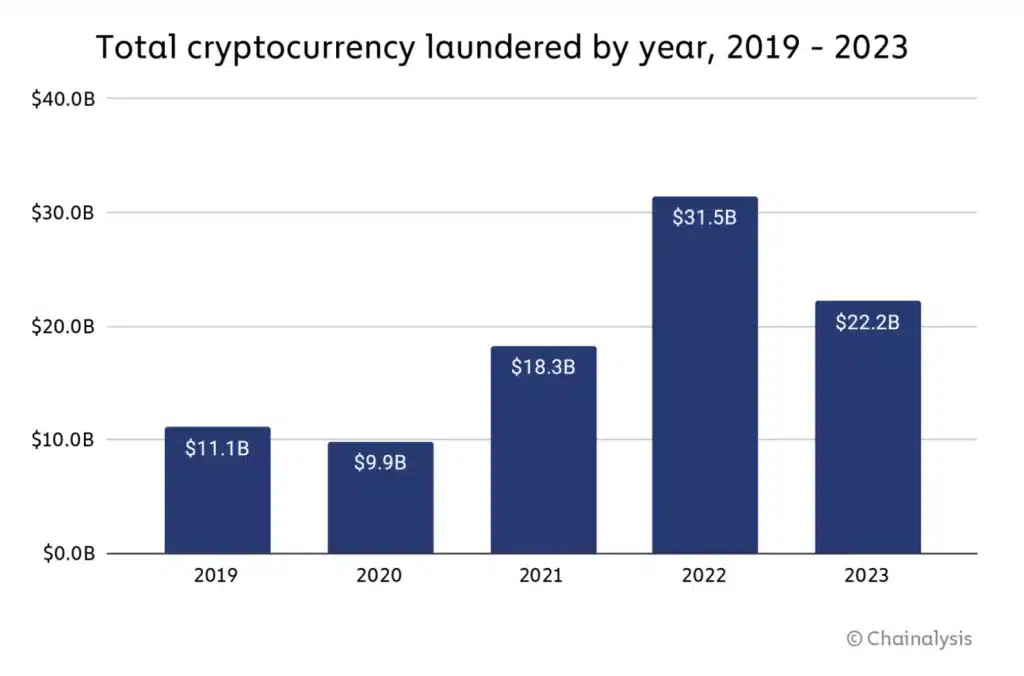

As a researcher examining the crypto-sphere’s current landscape, I’ve come across an intriguing finding from Chainalysis’ latest report. Contrary to some concerns, this blockchain data platform indicates a notable decrease in money laundering incidents in 2023. When compared to the previous year, this reduction is quite substantial.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-04 20:07