-

Analysis showed that fear has gripped the Bitcoin market.

BTC continued to break critical support levels.

As a researcher, I have closely monitored the Bitcoin market’s recent trends and sentiment. The analysis shows that fear has indeed gripped the market, with the BTC price experiencing consecutive daily declines exceeding 5%, resulting in substantial liquidation volumes.

The drop in Bitcoin’s [BTC] value recently has led traders to feel pessimistic, causing a significant increase in the amount of Bitcoin being sold.

In spite of the obstacles, consumers have persisted in holding the dominant role in the market, retaining their influence despite incurring losses.

Fear dominates Bitcoin’s sentiment

As a researcher studying the cryptocurrency market trends, I’ve observed an alarming increase in fear among investors based on the analysis of the BTC Fear and Greed Index on Coinglass. The index currently stands at approximately 29, signaling a strong sense of apprehension within the market.

This suggested a significant prevalence of fear among traders and investors.

In approximately one-third of the observed market trends, fear holds the leading position as the predominant emotion.

The prevalence of fear is more evident with the large amount of selling taking place. This serves to highlight the reason behind the widespread caution.

More long positions get liquidated

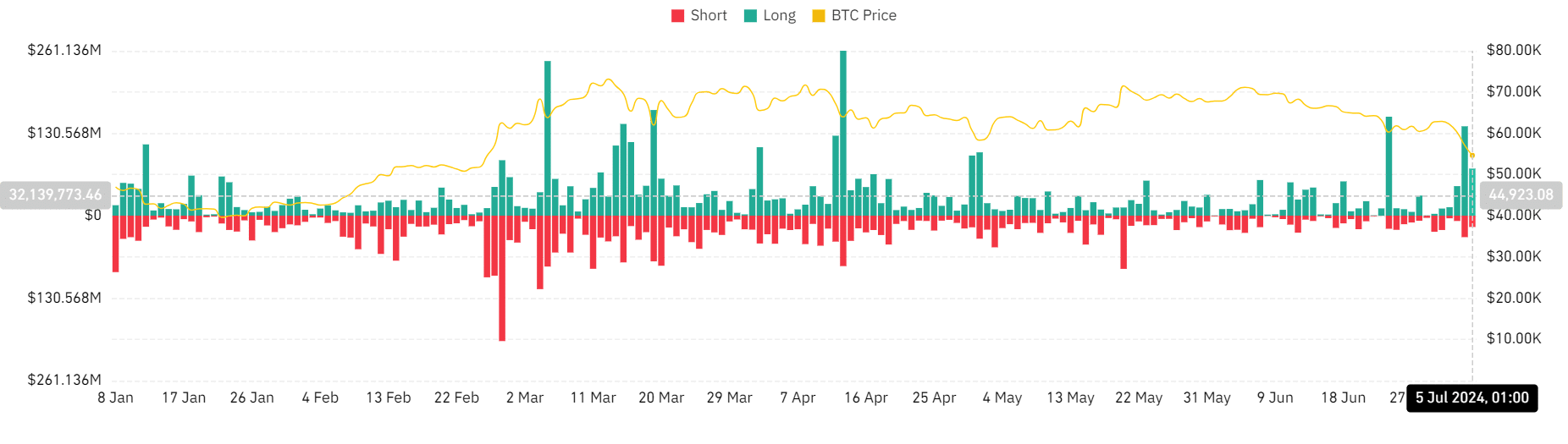

As a researcher studying the cryptocurrency market trends, I recently discovered through AMBCrypto’s analysis that over $256 million worth of Bitcoin positions were liquidated within the last 24-hour period.

This period has predominantly seen long positions being liquidated, with the most volume.

On the 4th of July, I observed that long liquidations amounted to approximately $142 million, whereas short liquidations reached around $34 million. The combined total came in at over $170 million.

In simpler terms, this figure ranks as the second largest among recent monthly liquidation volumes. Currently, the long liquidation total stands at more than $73 million, while the short liquidation amount surpasses $16 million.

As a researcher observing the cryptocurrency market, I’ve noticed a decrease in Bitcoin’s derivative volume within the past 24 hours. The current volume hovers around $29 billion, which is a significant drop from the $31 billion recorded on July 4th.

The current level of the Bitcoin Fear and Greed Index can be attributed in large part to the recent decrease in cryptocurrency trading activity.

Bitcoin continues to decline

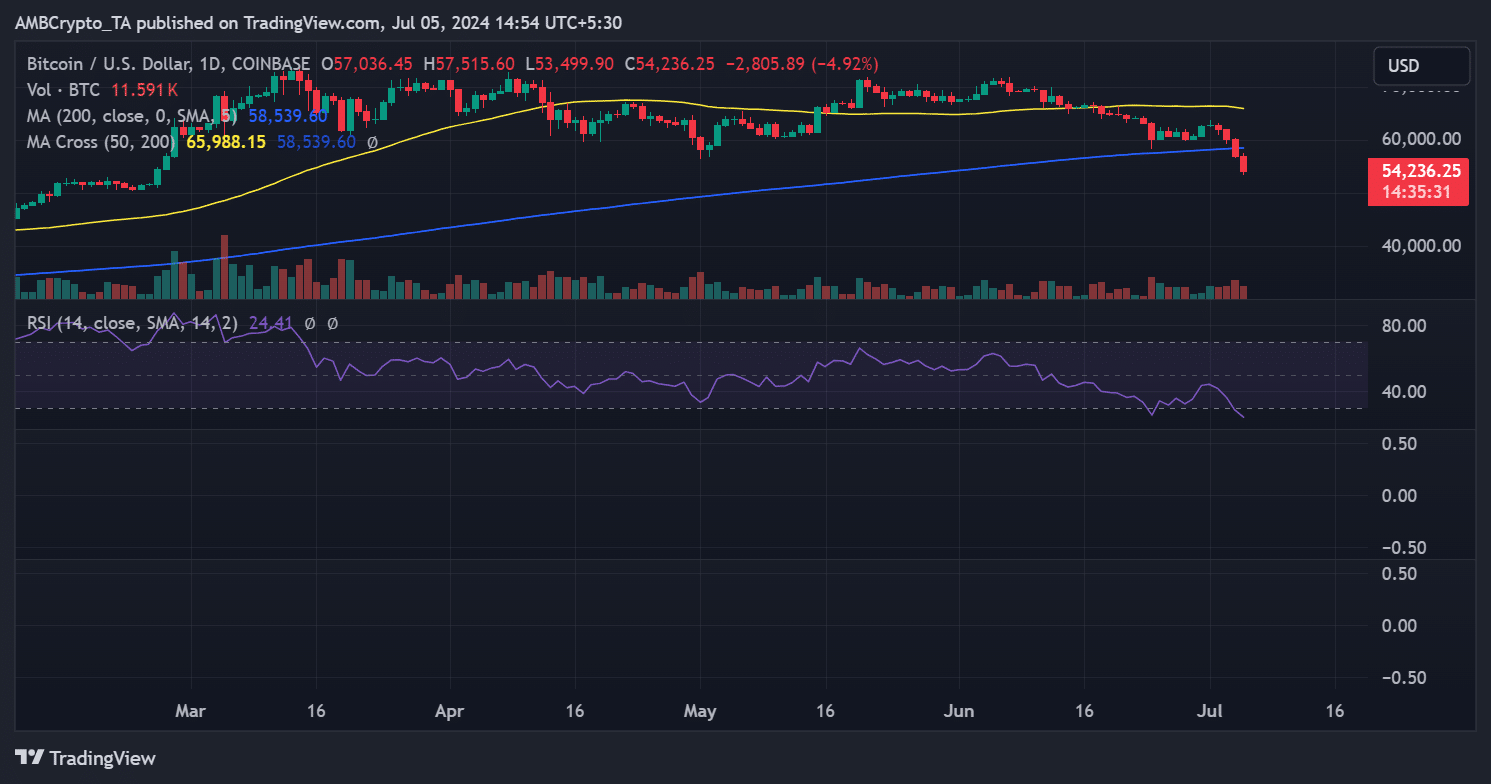

As an analyst, I’ve examined Bitcoin’s price action on a daily basis according to AMBCrypto’s assessment. The prevailing sentiment in the market, as indicated by the Bitcoin Fear and Greed Index, is currently driven by fear rather than greed.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Observed currently, Bitcoin (BTC) was experiencing a drop exceeding 5% and was valued approximately at $54,240. The preceding trading day also ended with a significant decrease of more than 5%.

As a researcher studying cryptocurrency markets, I’ve observed an intriguing development: Bitcoins have faced two successive daily decreases surpassing the 5% mark for the first time in over six months. This turn of events has noticeably intensified the prevailing market anxiety.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-05 19:03