Bitcoin, that elusive specter of the digital age, now drifts deeper into the realm of correction, its price whispering secrets to the lower echelons of the demand region. The market, that fickle lover, approaches an area where long-term lovers have historically begun their dance, yet the short-term lovers remain decisively bearish, as if they’ve lost their way in the dark.

Technical Analysis

By Shayan

The Daily Chart

BTC, that wayward child, has wandered into the $90K-$92K domain, completing a full circuit of the October liquidity pocket. The asset, now a weary traveler, interacts with the lower half of a multi-week Fair Value Gap, where previous macro re-accumulation phases have bloomed like flowers in the frost.

Both the 100-day and 200-day moving averages, those steadfast sentinels, continue their descent above the price, confirming that buyers remain under siege. The recent breakdown below $96K produced no meaningful reaction, suggesting that momentum is still with the sellers, who now wield their power like a sledgehammer.

What is becoming more notable, however, is the growing separation between the price and its mean trend. The RSI, that oscillating soul, has reached deeply oversold historical levels, matching the conditions seen during the mid-cycle retracements of April and August. If buyers manage to defend the $89K-$92K band, this zone could form the base of a multi-week consolidation, potentially marking a higher-timeframe accumulation zone before the next structural reversal. Or perhaps it’s just a mirage, as the market dances on the edge of a knife.

Confirmation of strength would only come if the market reclaims the $98K-$100K region. Failure to do so keeps the door open toward the lower demand zone near $85K, a place where even the bravest souls might hesitate to tread.

The 4-Hour Chart

On the lower timeframe, the asset continues to move within a bearish formation, with each lower high forming closer to the support boundary. This compression often appears in the later stages of a downtrend, as if the market itself is holding its breath.

Bitcoin is testing the $90K-$92K support box for the second time, and the reactions remain weak. A clean bullish reversal above $96K would indicate a shift in short-term momentum, allowing a corrective rally toward the unfilled inefficiency at $102K. But let’s not get too excited-this is Bitcoin, after all.

If sellers maintain control, a deeper sweep of the $88K liquidity layer becomes likely. The structure remains vulnerable, but the clustering of lows within this region suggests that buy orders may be absorbing supply quietly, a common feature of early accumulation phases, even if the price volatility persists. Or perhaps it’s just the market playing its usual tricks.

On-chain Analysis

By Shayan

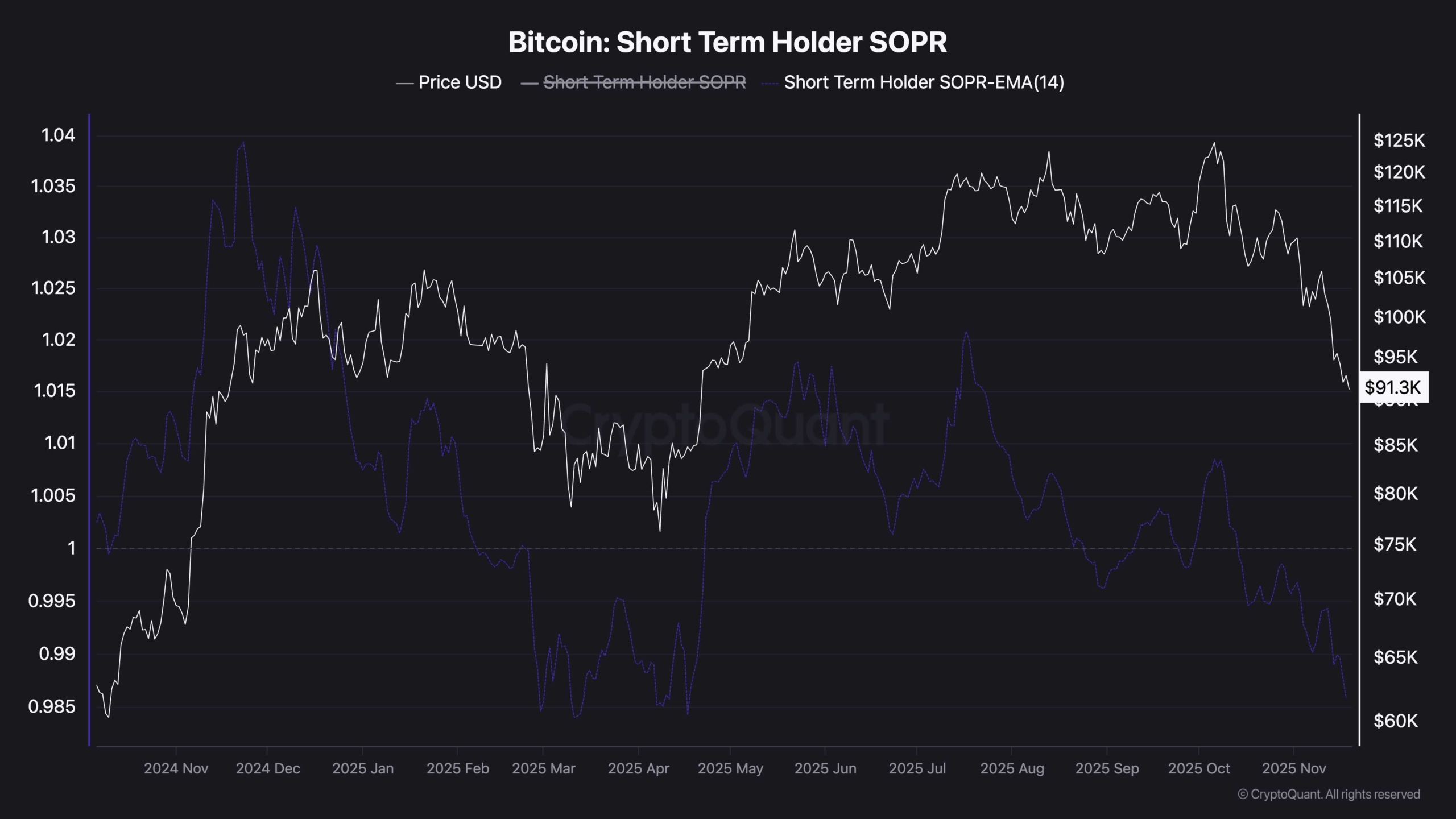

Bitcoin is entering one of the most intense short-term capitulation phases of this cycle. The Short-Term Holder SOPR, that fragile spirit, has dropped sharply toward 0.97, confirming that short-term holders are now realizing losses on a persistent basis. SOPR has remained below the critical 1.0 threshold for several weeks, forming a clear capitulation band.

Historically, such periods represent fear-driven liquidations rather than informed long-term distribution. This behavior tends to emerge not at the beginning of corrections but near their later stages, when weak hands are flushed out and stronger holders begin absorbing supply. It’s like watching a circus act-dramatic, but ultimately predictable.

While this does not guarantee an immediate reversal, it reflects an important structural shift. The ongoing loss-taking by short-term investors resets cost bases and clears out speculative positioning, allowing the market to transition toward a healthier foundation for the next macro move. Or perhaps it’s just the market’s way of saying, “I’m not done with you yet.”

If price stabilizes above the $89K-$92K zone while SOPR remains suppressed but begins curling upward, it would indicate that capitulation has reached exhaustion and that accumulation is underway. A sustained breakdown of this zone, however, would open the path toward a deeper sentiment reset before recovery can develop. But let’s not hold our breath-Bitcoin is a fickle friend.

Read More

- Gold Rate Forecast

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Thanos Comics (September 2025)

- Resident Evil Requiem cast: Full list of voice actors

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- Best Shazam Comics (Updated: September 2025)

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The 10 Best Episodes Of Star Trek: Enterprise

2025-11-19 17:37