- Bitcoin ETFs shine with $307M inflows, overshadowing Ethereum’s $186M outflows.

- Shifting trends hint at growing BTC dominance over ETH in ETF markets.

Attention has shifted towards crypto-based Exchange Traded Funds (ETFs) as the investment pattern for Bitcoin (BTC) and Ethereum (ETH) diverges. In contrast to Bitcoin spot ETFs seeing substantial investments, Ethereum ETFs are experiencing considerable withdrawals of funds.

This difference suggests a change in investor opinions, posing significant questions concerning the elements influencing these movements.

Or, more informally:

The gap shows that investors are changing their minds, leading us to wonder what’s causing these shifts.

BTC ETFs: A beacon of strength?

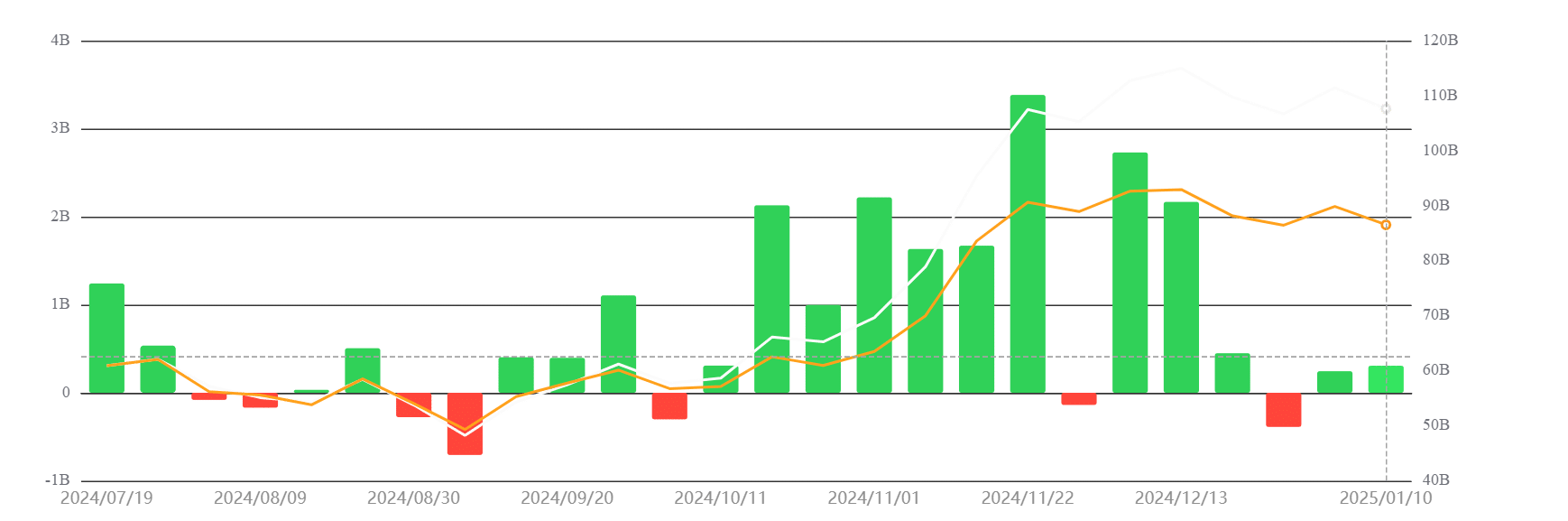

Last week, on January 6th, there was a significant surge in investments towards Bitcoin spot ETFs totaling approximately $307 million, indicating growing investor faith in the primary cryptocurrency. Among these ETFs, BlackRock’s IBIT ETF was the top performer, attracting an impressive $498 million in inflows.

As a crypto investor, I can’t help but marvel at Bitcoin’s impressive performance, underscoring its increasing allure as a dependable store of value. Amidst lingering macroeconomic uncertainties, this digital coin seems to be standing tall and firm, offering an attractive alternative for those seeking stability.

Yet, not every Bitcoin ETF mirrored this favorable trajectory. In contrast to the general upswing, the Ark & 21 Shares ARKB ETF saw a net withdrawal of $202 million, suggesting that although institutional investments are propelling the market as a whole, certain funds struggle to maintain capital.

Examining the graph demonstrates a persistent increase in Bitcoin ETF investments, highlighting BlackRock’s significant influence on shaping the market’s direction.

ETH ETFs: A struggle to keep up

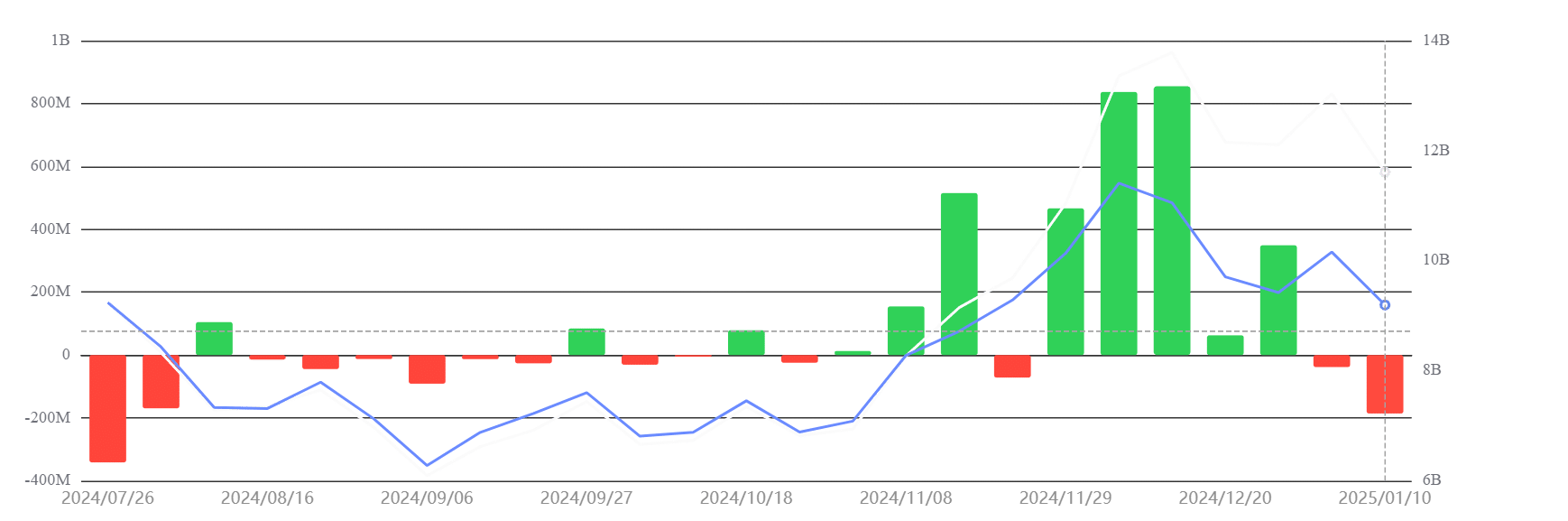

Despite Bitcoin’s continued growth, there was a significant drain of $186 million from Ethereum ETFs during the same timeframe. This trend mirrors Ethereum’s ongoing challenge in capturing investor attention.

Contrary to most other funds, BlackRock’s ETHA ETF went against the norm, gaining a small inflow of $124 million. On the flip side, Fidelity’s FETH ETF experienced significant outflows amounting to $276 million, suggesting that Ethereum is encountering some difficulties.

The analysis of the flow chart for ETH ETF reveals a noticeable decrease in inflows, starting from the end of 2024. Potential reasons for this shift in investor sentiment might include worries about staking risks, Ethereum’s leading role in DeFi, and intense competition from other tier-1 networks.

The data paints a picture of investors reassessing Ethereum’s long-term prospects.

What BTC ETH ETF trends reveal about market sentiment

Analyzing the contrast in investments flowing into Bitcoin and Ethereum Exchange Traded Funds (ETFs) provides significant insights into investor mindsets and market trends. The persistent influx of funds into Bitcoin suggests that it is increasingly seen as a reliable haven for investors, signaling its growing status as a secure asset.

Institutional confidence, spearheaded by major players like BlackRock, reinforces this narrative.

Instead, the performance of Ethereum leaves room for debate regarding its upcoming prospects. Despite being the second most prominent cryptocurrency, it’s been lagging behind Bitcoin, and an increasing number of competitors are making their presence felt.

With Bitcoin strengthening its stance, Ethereum is under increasing scrutiny to tackle these issues and reestablish its ground.

Broader implications for the crypto market

The patterns in the growth of Bitcoin (BTC) and Ethereum (ETH) Exchange-Traded Funds (ETFs) aren’t just numerical data points; they mirror significant movements within the broader market. The robust inflows towards Bitcoin suggest its potential to act as a buffer against market fluctuations, drawing interest from both institutional and retail investors alike.

For Ethereum, the high volume of withdrawals indicates a requirement for more convincing arguments to establish it as a reliable choice for investment in diverse asset categories.

The significant control that BlackRock holds over Bitcoin and Ethereum Exchange-Traded Funds (ETFs) demonstrates the increasing power of conventional financial entities within the cryptocurrency sphere, suggesting a maturing market. However, this development also sparks concerns about the preservation of the decentralized principles that have historically characterized digital currencies.

– Read Bitcoin (BTC) Price Prediction 2025-26

The most recent ETF figures suggest a story contrasting two digital currencies: Bitcoin’s robust investments underscore its leadership role within the market, whereas Ethereum encounters difficulties that underscore the hurdles it must overcome to retain investors’ trust.

With cryptocurrencies continuing to develop, exchange-traded fund (ETF) movements will continue to serve as an essential gauge of public opinion and a helpful tool for interpreting the changing market dynamics.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-14 07:04