Dearest reader, Bitcoin’s latest antics are as volatile as a diva’s temper in a financial ballet. The crypto crowd is abuzz with whispers of institutional sharks circling, while retail traders fiddle with their portfolios like guests at a cocktail party who forgot to bring a life jacket. Spoiler: the whales are playing chess, and we’re all just pawns. 🐟

BTC Price Today: A Tangled Web of Liquidity

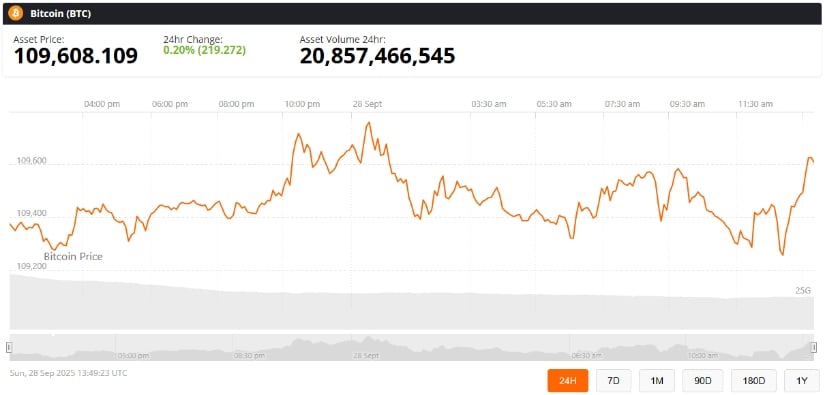

Bitcoin flirts with $109,423, a figure so pedestrian it could sleepwalk through a press conference. Yet, the market’s obsession with the $110K-$115K range is as thrilling as watching paint dry… until the whales decide to splash some color on the canvas. CoinGlass reports a 15% volume spike on September 27, a number so unremarkable it might as well be a love letter written in hieroglyphs. 📊

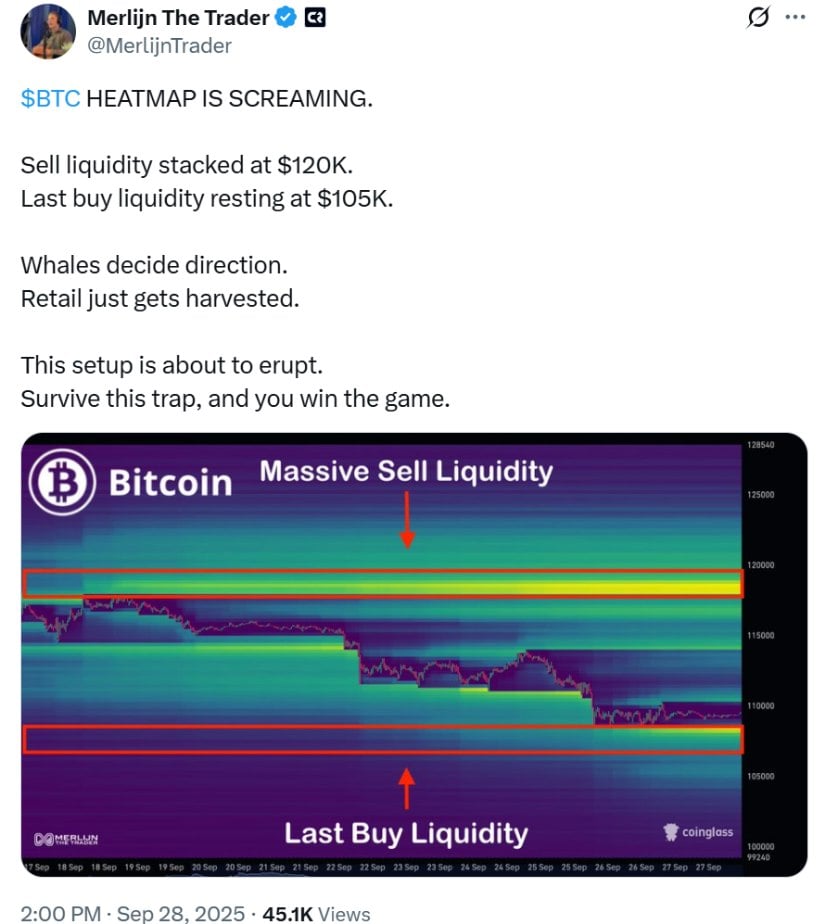

Merlijn The Trader, a name that sounds like a pirate but probably owns a Tesla, warns of a liquidity trap: sell orders at $120K and buy bids at $105K. A game of tug-of-war, really, where the ropes are made of stop-loss orders and the prize is your portfolio. Retailers? They’re just the snacks at the party. 🎭

Academic studies confirm what we’ve all suspected: 68% of crypto’s chaos is caused by whales, and 73% of their fun involves herding little fish into traps. MIT Sloan, bless their algorithmic hearts, has given this madness a 2024 stamp of approval. 🎓

Key Levels: A Game of Inches (and Dollars)

Analysts are now playing “Where’s Waldo?” with Bitcoin’s support and resistance levels. $107K? A mere footnote. $100K? The emotional support level for bulls everywhere. But let’s not forget the holy grail of $112K-reclaim it, and the bulls throw a parade; fail, and we’re all back to sipping tea and sighing. 🎉

BitBull, a name that should be a luxury brand, insists a break above $111,972 is the difference between a champagne toast and a vinegar bath. Meanwhile, $105,100 looms like a specter in a pinstripe suit, ready to drag BTC into a bearish ballroom. 🕺

Technical Analysis: Moving Averages and Midlife Crises

Bitcoin sits below its 50-day SMA like a teenager avoiding eye contact with their parents. The 100-day SMA? A stodgy old friend who won’t stop reminding you about your mortgage. The descending channel is intact, a metaphor for life itself: always leaning downward unless you muster the energy to climb. 🧗

If buyers don’t defend $109K, BTC might join the 200-day SMA for a reunion dinner at $100K. Shorter timeframes? A bullish flag flutters like a desperate plea for hope, while the 4-hour chart whispers, “Either defend the line or pack your bags.” 🚩

Sentiment and Whale Shenanigans

Binance’s BTC/USDT heatmap is a masterclass in drama: aggressive selling at $117K turned longs into liquidation casualties, a bloodbath more tragic than a Shakespearean tragedy. Below $110K, liquidity is thinner than a Brit’s patience at a queue. Unless new sellers arrive, the downside might just… politely decline. 🙅

History suggests consolidation is the calm before the storm, a prelude to a rally so fierce it could make a hurricane jealous. For now, Bitcoin behaves like a stablecoin on Valium, but don’t be fooled-this is just the overture. 🎵

Final Thoughts

The crypto stage is set for a grand finale: whales versus retailers, liquidity traps versus hope, and moving averages versus sanity. As institutions sip their espresso and plot their next move, BTC remains a tightrope walker in a hurricane. Will it soar to $112K or plummet to $105K? Only the market-and perhaps a therapist-can say. 🧠

Dear investors, brace yourselves for the next act in this operatic disaster. The $105K-$120K trap isn’t just a price range-it’s a metaphor for life in the fast lane of crypto chaos. Buckle up, darling. The show’s about to get *very* expensive. 💸

Read More

- Best Controller Settings for ARC Raiders

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- James Gunn & Zack Snyder’s $102 Million Remake Arrives Soon on Netflix

- IT: Welcome to Derry Review – Pennywise’s Return Is Big on Lore, But Light on Scares

- Ashes of Creation Rogue Guide for Beginners

- Holstin to be published by Team17

2025-09-29 00:19