Bitcoin, that most modern of speculative bubbles, briefly flirted with the giddy heights of $90,000, prompting the usual chorus of breathless pronouncements about a “bullish yearly close.” One suspects the champagne was already chilling. Alas, the inevitable happened. The price took a precipitous nose-dive below $86,000, creating a ripple effect through the markets that was, if not quite catastrophic, certainly unbecoming. The global crypto market cap, naturally, slumped – almost $140 billion vanished as if by magic, and even the much-vaunted ETFs remain obstinately unimpressed, accumulating assets at a rate that can only be described as…nominal. 😒

The talking heads attribute this latest bout of unpleasantness to liquidations and “high volatility,” a phrase as useful as a chocolate teapot. The truth, however, is far more depressing. It appears the buyers – those enthusiastic participants in the upward spiral – have simply lost their enthusiasm. A perfectly normal correction, one might have thought, but instead, it became a rather undignified rout. One begins to wonder if these digital tulips are not quite as resilient as advertised.

Liquidity Vanishes Before the Bitcoin Price Crash

Even before the unpleasantness commenced on Monday, the order books were looking remarkably sparse. Market makers, those canny individuals, often reduce their holdings over the weekend – a sensible precaution, one might think. But this time, the withdrawal was…pronounced. Bid-side liquidity – the quantity of buy orders lurking near the current price – dwindled by a rather alarming 30-50% for both Bitcoin and, naturally, Ethereum. Thus, the stage was perfectly set for a spot of volatility.

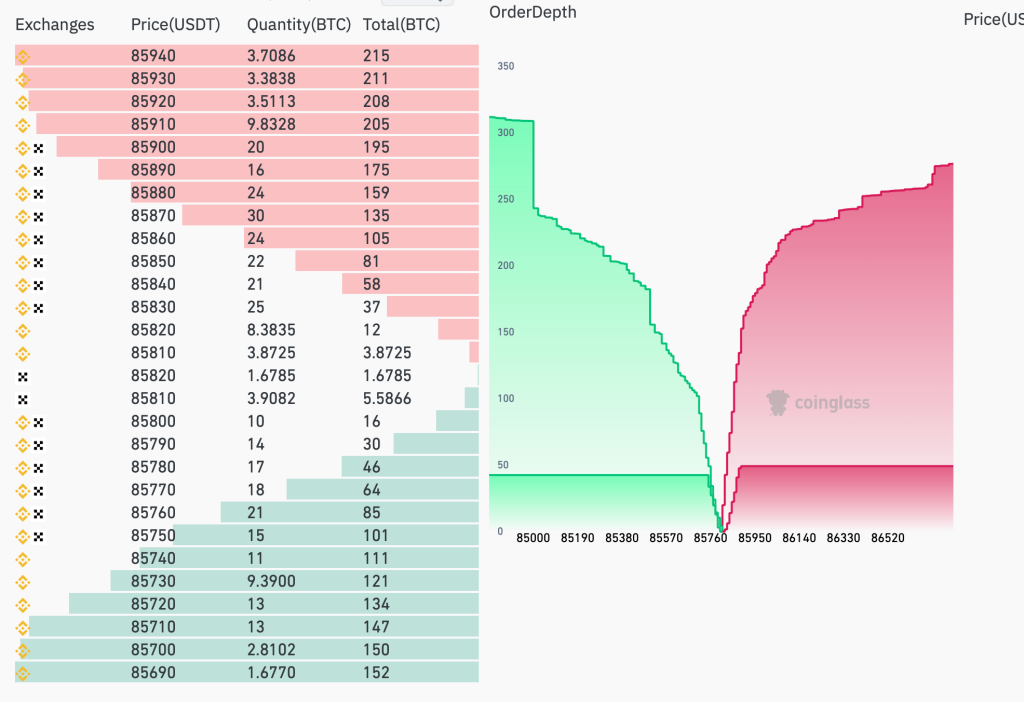

The order book data, observed just as Bitcoin tumbled through $86,000, revealed a stark imbalance:

- Sell orders, rather like eager guests at a buffet, were stacked high.

- Buy orders, however, were conspicuously absent, resembling more a rather pathetic scattering of crumbs.

- Total bid liquidity near $85,760 evaporated almost entirely. A ghostly apparition, indeed.

The depth chart, as any fool can see, conclusively demonstrates that the market simply ran out of willing purchasers. The green side representing buyers, plunged downward with a dispiriting lack of resistance, while the red side, representing the sellers, thickened ominously.

A textbook example of how a minor setback transforms into a full-blown cascade. How terribly predictable. 🙄

Spot CVD Confirms Buyers Stepping Back, Not Sellers Attacking

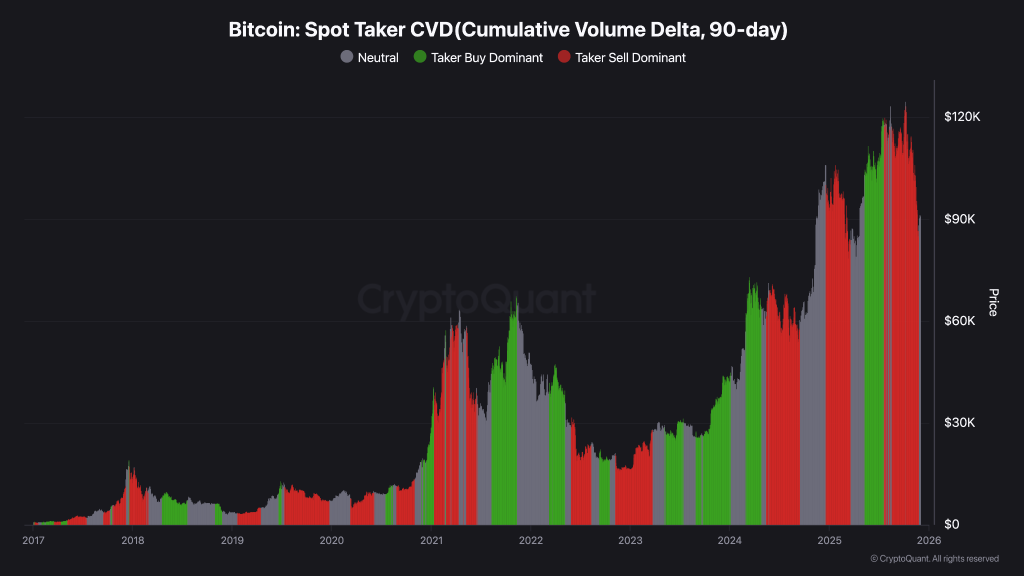

To confirm that this wasn’t merely a frenzy of panic-selling – though one always suspects the presence of panic – one turns to the Spot Taker Cumulative Volume Delta (CVD). A rather grand term for a simple calculation that measures the relative enthusiasm of buyers and sellers.

The chart, as any discerning analyst will observe, reveals a rather definite decline in buy-side aggression. Taker-buy volume dried up precisely around the time of the drop. Crucially, there was no sudden surge in taker-sell dominance, suggesting that Bitcoin’s woes were not caused by a stampede of sellers, but by a simple lack of participants.

A most regrettable state of affairs. Price didn’t fall because traders dumped; it fell because nobody, it appears, was particularly keen to catch it. 🤷♀️

Is Recovery Possible From Here?

Today’s debacle wasn’t the result of any discernible “risk-off event” or liquidation cascade. History suggests that similar liquidity-driven dips tend to recover-eventually-once market makers restore some sense of order and spot buyers regain a modicum of composure. The key levels to observe are:

- $85,800 – a faint hope of resistance

- $86,500-87,000 – a short-term rallying point, should one materialize

- $83,500 – the next major demand zone, assuming anyone is still demanding anything at all

If fresh bids and positive CVD readings return, a rebound is conceivable. But if buy-side liquidity remains stubbornly weak, Bitcoin’s price may continue its downward trajectory until some semblance of demand emerges. One wouldn’t wager heavily on a swift recovery, of course. 🍷

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Best Controller Settings for ARC Raiders

- Goat 2 Release Date Estimate, News & Updates

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- 10 Movies That Were Secretly Sequels

2025-12-01 08:24