-

AVAX saw some bullish momentum following its bounce from the wedge support line at $25

On-chain key metrics, active addresses, and development activity underlined the likelihood of an upside breakout

As a seasoned researcher with years of experience under my belt, I find myself quite intrigued by Avalanche (AVAX) at this juncture. The bullish momentum that AVAX has been gathering since its bounce from the wedge support line at $25 is reminiscent of a coiled spring about to be released.

At the moment, the value of Avalanche (AVAX) is holding steady inside a contracting trend known as a “falling wedge formation” – an often-encountered setup that typically signals a potential bullish turnaround.

Following a drop against the psychological resistance level at $25, the cryptocurrency began to build up positive momentum. This development triggered increased demand among buyers from long positions, as evidenced by a 16% rise in AVAX‘s value since its dip below the resistance.

Bullish momentum in play

The increase in buying activity has been steadily building up ever since the reversal, suggesting robustness among those holding long positions. Often, a descending wedge shape on the chart hints at an impending change in direction for the long term.

To summarize, that pattern highlighted the likelihood of an upcoming price increase in the future.

AVAX’s key metrics

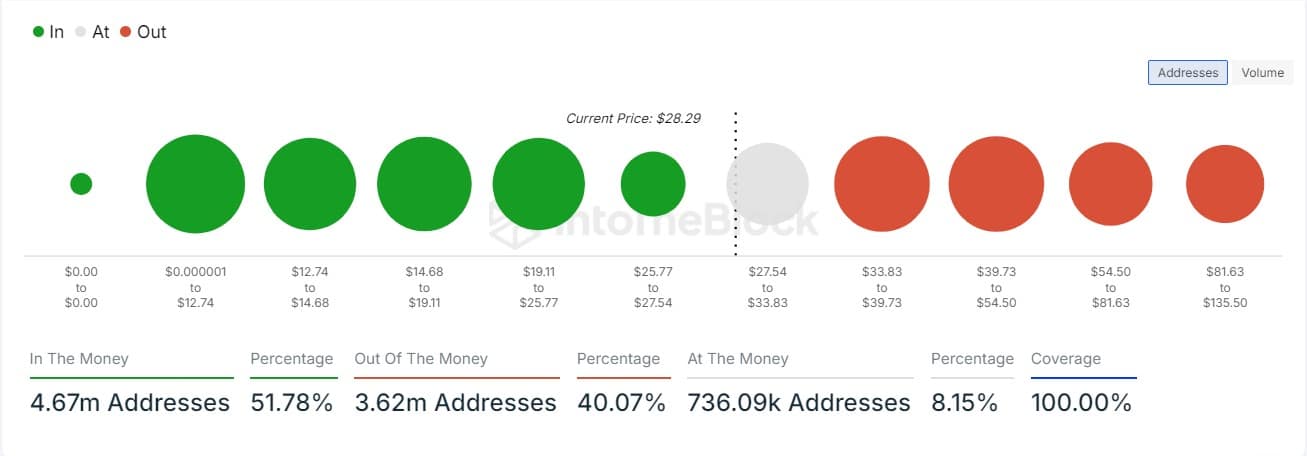

According to AMBCrypto’s evaluation, the positive forecast is supported by their analysis of crucial on-chain data points. Notably, the number of active addresses experienced a 2.75% surge, which in turn boosted the proportion of “in the money” addresses to 49.42%.

At the current prices, it indicates that a higher number of owners are making profits, which is an indication of optimistic market feelings.

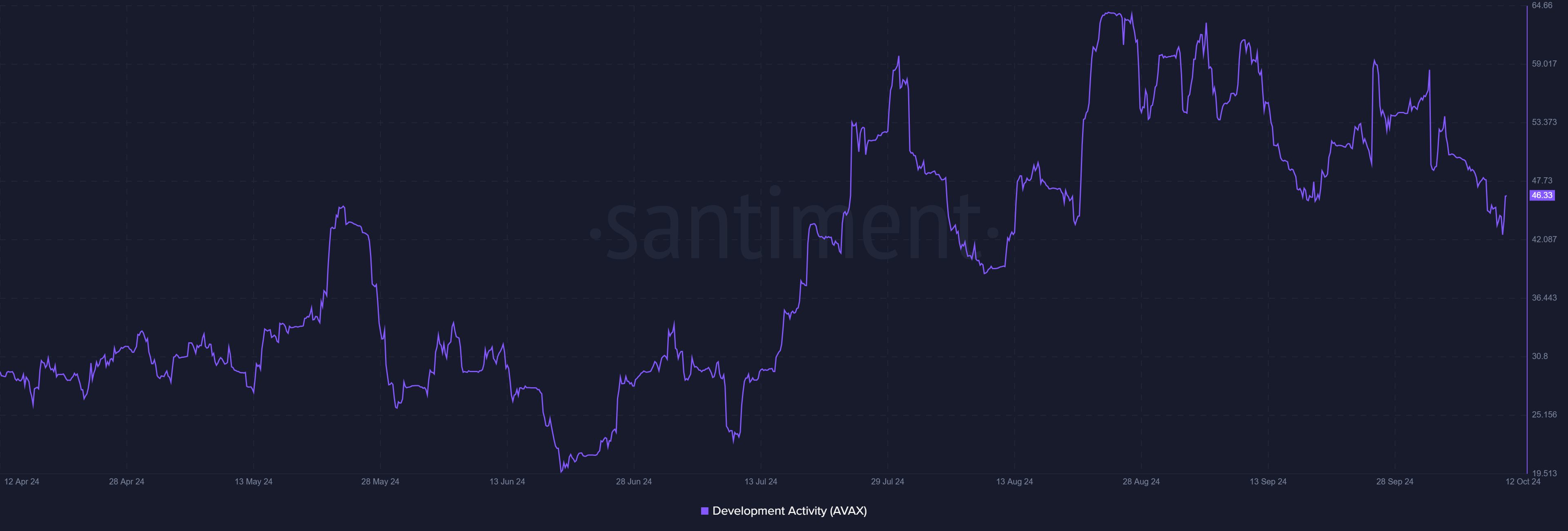

Another key metric, development activity, spiked by 4% in the last 24 hours.

As a crypto investor, I’d like to point out that the level of development activity serves as a strong indicator of confidence within the developer community. This optimism, in turn, piques the interest of investors like myself. Similar to the previous statistic, this insight positions AVAX for a possible surge on the charts, hinting at a potential breakout.

What to expect from AVAX?

Given the increasing bullish energy and optimistic signs from on-chain indicators, it’s probable that the demand for AVAX will exceed the resistance level of the falling wedge pattern, potentially driving its price upward.

After AVAX surpasses its resistance price point, it’s likely that the market will see a notable upward trend, potentially reaching between $30 and $35.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-12 11:03