Well, hold onto your Bitcoin, because California’s Department of Financial Protection and Innovation (DFPI) has just dropped a bombshell! 🎉 On the thrilling date of October 30, 2025-just in time for some Halloween spookiness-they announced a fine of $675,000 against Coinhub. That’s right, folks, the state’s got its hands full with crypto ATM coup-makers, and this is like the fourth time they’ve put on their superhero capes to save the public from crypto chaos.

So, What in the Crypto World Did Coinhub Do Wrong?

Our friends at Nevada-based LSGT Services, LLC, aka Coinhub, have been playing fast and loose since January 2024. They’ve set up Bitcoin ATMs all over the Golden State that convert cash into cryptocurrency quicker than you can say “I regret this purchase.” 😬

According to the “you’ve got to be kidding me” consent order, Coinhub may as well have been handing out cash like it was Halloween candy. They let people drop more than $1,000 a day into those ATMs like they were at a slot machine at Caesar’s Palace. 🍒 Some poor souls even had transactions over $10,000! Yes, you heard right-over ten times the legal limit! And guess who was involved? Mostly our beloved senior citizens. Just lovely.

Oh, but wait! There’s more! Coinhub also thought they could slip in sneaky fees higher than what’s allowed and conveniently forgot to give customers the warning labels before transactions. Receipts? They might as well have written them in invisible ink. Basic details like the operator’s name were mysteriously missing, lending a whole new dimension to the phrase “money for nothing.” 🕵️♀️

“Listen up, crypto kiosk operators in California!” exclaimed DFPI Commissioner KC Mohseni, drumming up some serious drama. “We’re on a mission to kick out the bad actors and those pesky scammers who are putting consumers’ hard-earned cash at risk.” So there you have it-California is basically the crypto police now, ready to slap fines like they’re ordering dessert. 🍰

Enter: California’s New Crypto ATM Rules 📜

In a world where the future of money has become a wild frontiersman, California decided to be the parent we all need by passing the Digital Financial Assets Law (DFAL) in 2023, which is now live and ready for business as of January 1, 2025. This law attempts to rein in the wild crypto wranglers and make sure our dear consumers aren’t treated like piñatas at a birthday party. 🎊

Under this rulebook, operators are only allowed to accept a mere $1,000 in cash per customer each day (sorry, high rollers!), and fees can’t exceed $5 or 15% of the transaction-whichever is higher (because apparently, someone thinks 15% is just a fun number). They also need to throw in some disclosures that are clearer than my last breakup text.

The law requires receipts packed with details like operators’ names and all charges-because who wouldn’t want to keep tabs on their money like it’s a monthly subscription service? 📈 The goal is crystal clear: transparency, people-so you can see your money disappear right before your very eyes.

Why Oh Why Do Bitcoin ATMs Attract Scammers? 😡

Oh, let’s just put on our “duh” hats for a moment. Bitcoin ATMs have turned into playgrounds for scammers, particularly the ones targeting our lovely, not-so-tech-savvy seniors. Quick cash-to-crypto conversions are as appealing as a shiny new trinket, but once you hit send, good luck getting that money back! 🚫

Back in August 2025, FinCEN even issued a warning about these gadgets. Spoiler alert: the FBI’s Internet Crime Complaint Center received nearly 11,000 complaints about the machines in 2024! That’s a $246.7 million loss! Go figure, a 99% increase in complaints. Yikes!

Older Americans are taking the brunt of this punch, more than three times as likely to lose their cash to the crypto circus, with two of every three dollars lost to this fraud. The scammer script plays out like this: they call up pretending to be bank workers or tech support, stirring panic, and sooner than you can say “lost my lunch money,” victims are withdrawing cash and turning it into crypto at a nearby ATM. Poof! The money is gone faster than a New Year’s resolution. 🙈

The Crackdown of All Crackdowns on the Crypto ATM Industry 🔍

California’s smackdown on Coinhub is just the tip of the iceberg, my friends. Since June 2025, the DFPI has been like a dog with a bone, taking action against multiple crypto operators who seem to think laws are just suggestions. Coinme got nailed for $300,000, and Wyoming-based Coin Time LLC and Southern California’s Hermes Bitcoin are in deep trouble too!

And just when you thought this train was only rolling through California, Spokane, Washington, waved its flag to become the very first U.S. city to declare war on crypto ATMs altogether-good heavens! Meanwhile, New Zealand is following suit-banning these machines left and right. Talk about a crypto world tour! 🌍

What Happens Next? 🧐

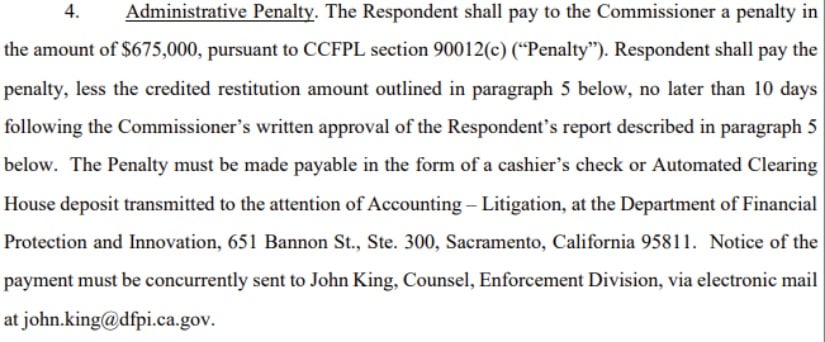

According to the consent order signed on October 30, 2025, Coinhub has exactly 60 days to fork over that hefty $675,000 penalty and compensate their not-so-lucky California customers. They also have to adopt new policies and procedures to avoid the crypto doom train and report back to regulators every two months for a year. Sounds fun, right?

Not only is Coinhub dealing with California, but they’ve already faced legal snafus outside the state. In February 2025, a Wisconsin appeals court slapped them down hard when they found $20,000 in one of their ATMs after a customer got scammed. Poor souls.

Logan Short, the company’s CEO, sent out apologies faster than a Netflix cancellation, stating in an email that Coinhub is doing “everything in its power to protect consumers.” Apparently, they didn’t get the memo that fraud is not something you can “block” on a website. Who knew? 😏

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- Best Controller Settings for ARC Raiders

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Ultimate Spider-Man: Incursion #2 Is the Most Basic Crossover Chapter Imaginable

- James Gunn Teases the Future of the DCU After Netflix Purchase

2025-11-02 02:33