- AAVE has declined over the past month by 20.52%.

- An analyst predicted a potential decline to $203 amidst increased selling.

Over the past week, Aave’s price momentum has been sluggish after reaching $361, with its value subsequently dipping to as low as $272.

Currently, AAVE is being traded for approximately $282, representing a 2.61% decrease in its value over the course of today. Interestingly, this downward trend can also be observed on weekly and monthly charts, with a drop of 17.17% and 20.52% respectively.

In simpler terms, the current economic climate has led experts to become quite cautious, forecasting another drop. Notably, well-known cryptocurrency analyst Ali Martinez proposes that we might see a decline down to $203, based on a warning sign he’s identified.

Market sentiment

According to Martinez’s examination, the TD Sequential Indicator suggested a sell for AAVE on its weekly charts. (In simpler terms, Martinez found that the TD Sequential Indicator recommended selling AAVE based on its weekly graphs.)

Based on his explanation, the signal seems to indicate a possible drop in price, with potential levels at $264 and even $203 if things worsen. The TD sequential suggesting a ‘sell’ indicates that the current upward trend may have reached its limit, making a downward trend more likely.

If more sellers join the market, it might increase the selling pressure, potentially leading to a continued drop.

What AAVE’s charts suggest

While the analysis presented serves as a warning for owners, it’s crucial to examine other market signals as well.

The AAVE’s Relative Strength Index (RSI) has fallen to 41, indicating a persistent downward trend since the bearish crossover. This suggests that there’s significant selling pressure in the market, as sellers appear to be in control.

Similarly, it’s worth noting that the Advance-Decline Ratio (ADR) has dipped to reach a monthly minimum of 0.31. When ADR falls below 1, it generally means that the cryptocurrency AAVE is experiencing more downswings than upswings.

With the altcoin closing with lower lows, this reflects strong downward pressure.

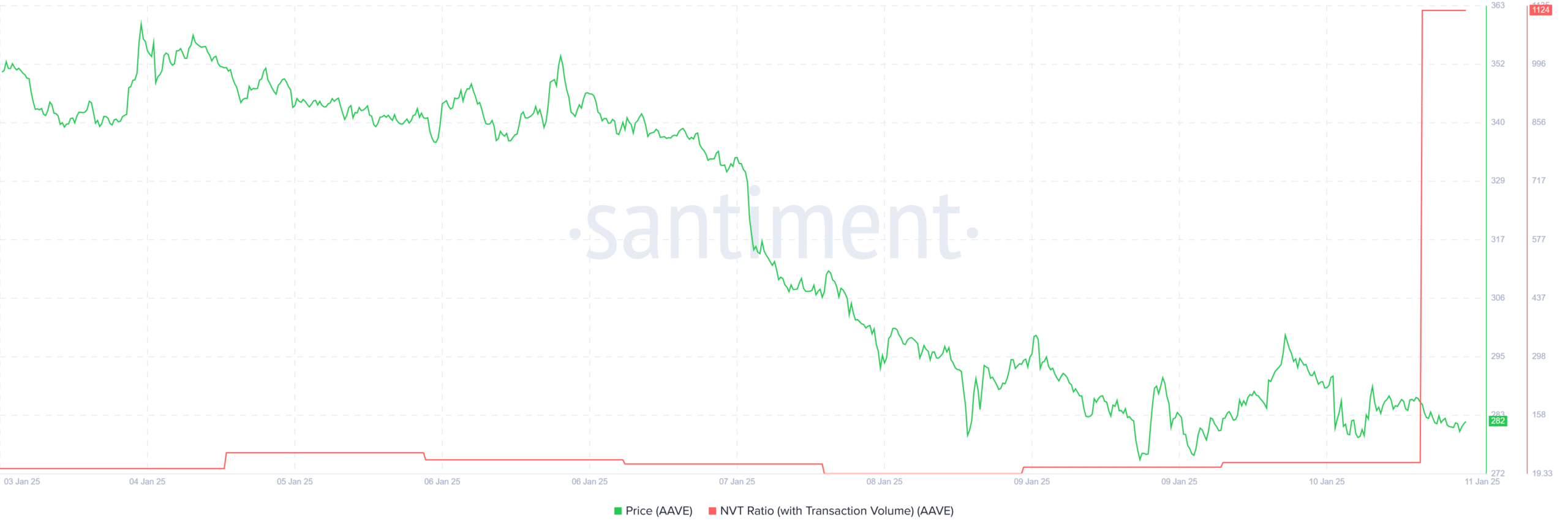

Upon closer examination, it appears that Activity on the AAVE network has significantly decreased, mirrored by an increasing Non-Value Transactions (NVT) Ratio. This ratio has peaked at 1124, signifying that the altcoin’s market capitalization is considerably larger than its transaction activity level.

This indicates that the altcoin is overvalued relative to its usage.

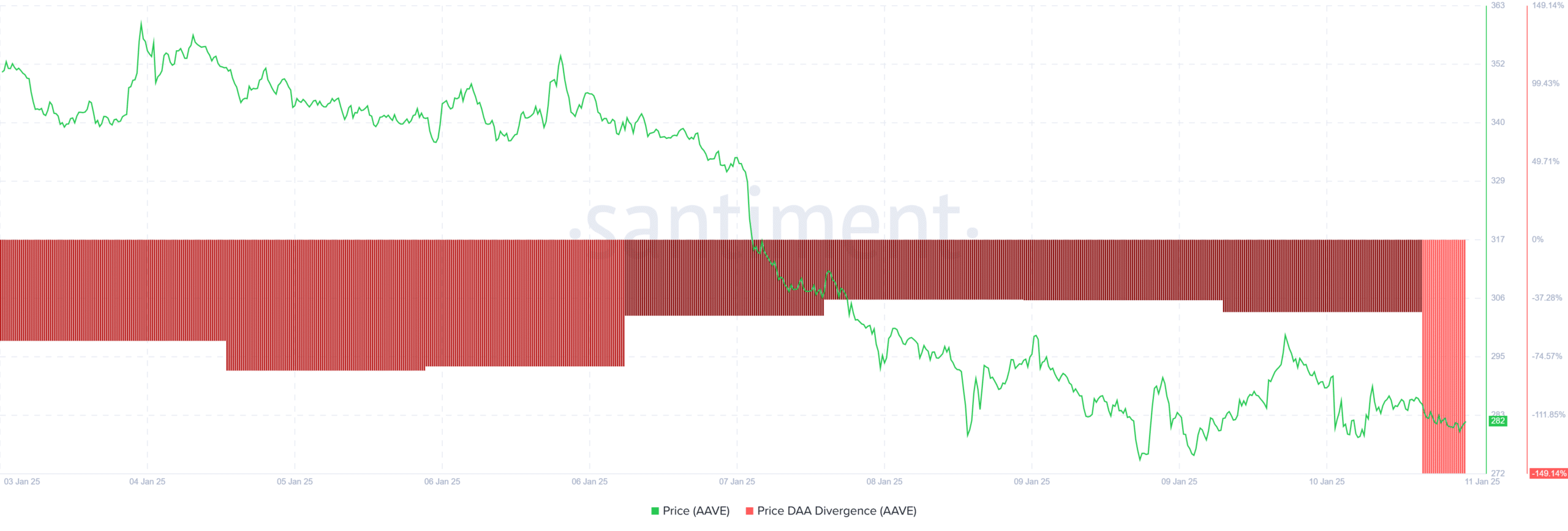

This occurrence is additionally supported by a prolonged Negative Demand-Supply (DAA) Divergence. Over an extended period, such a negative divergence indicates decreasing network activity and suggests a possible adjustment to align with the true demand levels.

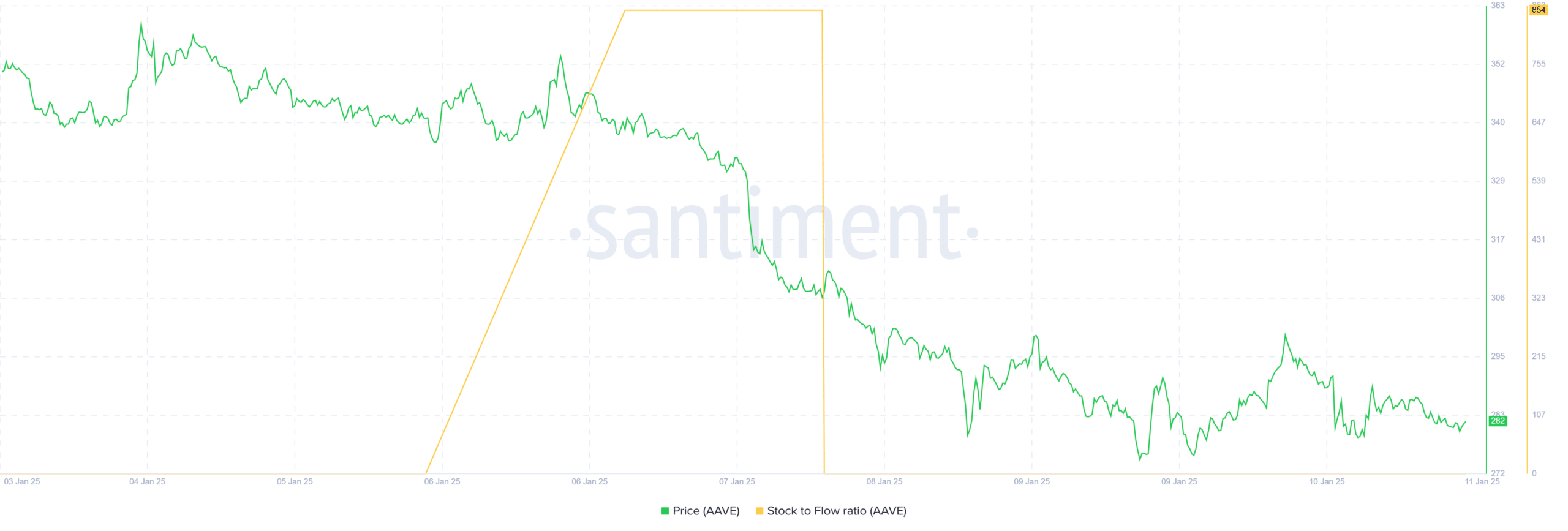

Ultimately, there’s been an oversupply of AAVE, indicating a rise in deposits onto exchanges. Consequently, the stock-to-flow ratio has plummeted to zero and it has stayed that way for the past three days.

With the altcoin showing oversupply, it could decline as a result of excessive selling pressure.

Read Aave’s [AAVE] Price Prediction 2025–2026

Simply put, AAVE is experiencing strong downward momentum as sellers dominate the market.

Under these circumstances, the altcoin seems poised for a potential downward trend. If selling pressure persists, AAVE might decrease to around $272, with a possible additional drop to $246. On the contrary, if we witness a change in trend, AAVE could regain its $300 price point.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2025-01-11 16:08