-

September proved to be a record-breaking month for Aerodrome’s ecosystem

AERO price has moved up more than 80% in the last 30 days

As a researcher who’s been tracking DeFi protocols and their native tokens for quite some time now, I must admit that Aerodrome Finance’s performance in September has left me quite impressed. The 80% surge in AERO price within the last 30 days is nothing short of remarkable, especially considering it’s happening on Coinbase’s relatively new Base network.

On Coinbase’s newly introduced Base network, Aerodrome Finance has solidified its status as the top protocol, surpassing its competitors in significant decentralized finance (DeFi) benchmarks.

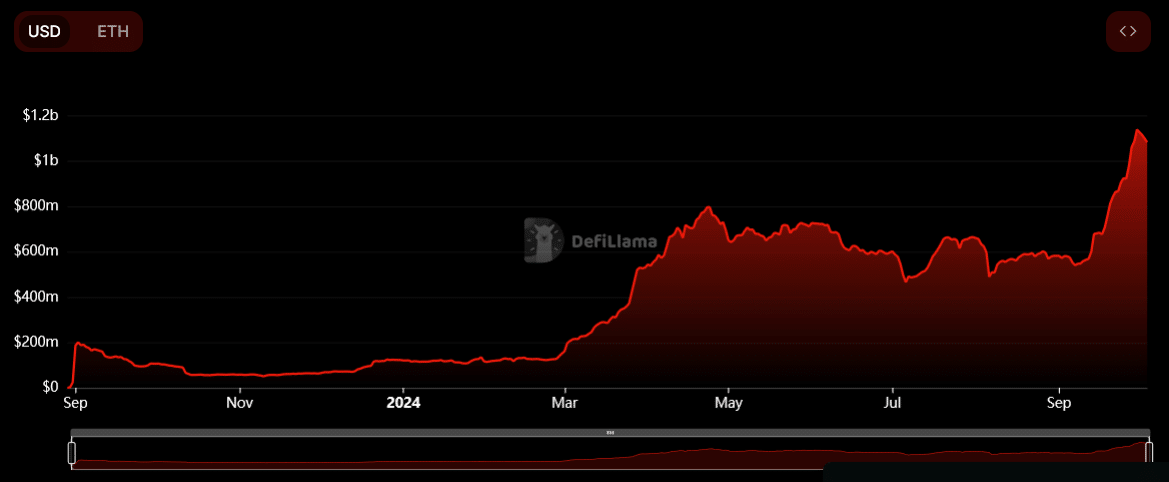

As a matter of fact, the trading and liquidity marketplace of Aerodrome currently holds a staggering $1.088 billion in Total Value Locked (TVL), as reported by DeFiLlama. What’s even more impressive is that the TVL of Aerodrome is almost double the combined total value locked of the five largest protocols on Base.

In comparison to other leading decentralized exchange (DEX) protocols operating on existing networks, Aerodrome’s recent performance is noteworthy; however, there are still opportunities for further development and improvement.

The trading volume on its DEX amounted to approximately $9.02 billion in September, which is similar to the top decentralized exchanges operating on Solana during the same timeframe. However, it lags behind Uniswap and PancakeSwap, the most prominent DEXs on Ethereum and BNB Chain respectively.

Sustained boom on Base network

This year, the Airfield has experienced significant expansion, propelled by its knack for drawing investments through its incentive structures and the rising popularity of the Base platform. The Decentralized Exchange (DEX) protocol continued to shine in September, as its Total Value Locked (TVL) expanded by an impressive 87.75% over the course of the month.

The superiority of Aerodrome over Base can be more clearly demonstrated through its 30-day charges, which are significantly higher than those of competitors. Moreover, it is predicted that Aerodrome will continue to lead on the Base network as the DeFi sector picks up speed again.

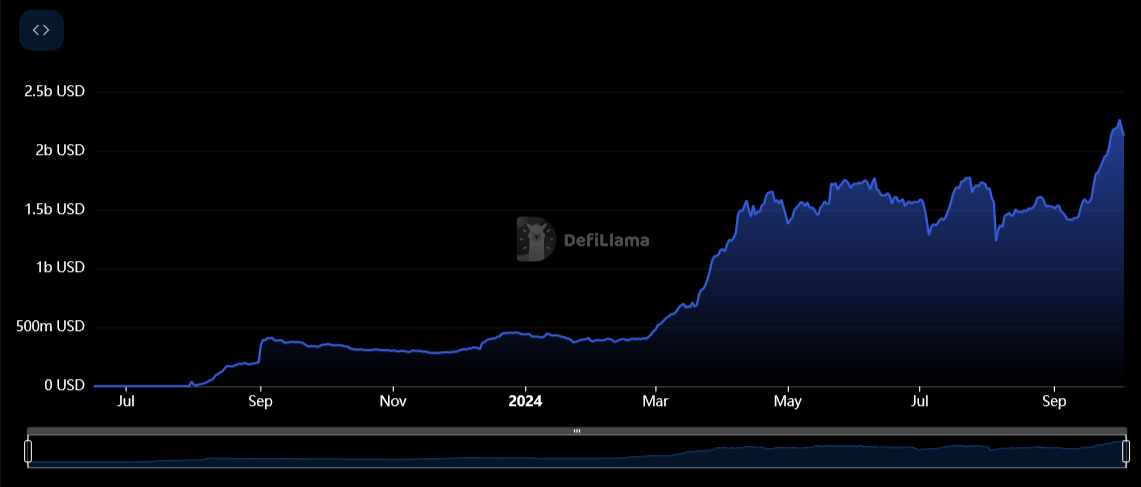

Currently, as I’m typing this, DeFiLlama data indicates that Base ranks sixth among blockchains with the most Total Value Locked (TVL). Notably, it is rapidly approaching the fifth position currently held by Arbitrum, which boasts a TVL of approximately $2.348 billion.

It’s noteworthy that out of the top 10 chains listed by TVL (Total Value Locked), only SUI has shown a larger increase in TVL than Base’s 38% growth over the past month.

AERO price outlook

The growing success of Aerodrome within Decentralized Finance (DeFi) has fostered a favorable opinion about its native token, which in turn has supported the token’s value.

At this moment, the stock price for AERO stood at $1.03, representing a 4.58% decrease in today’s trading compared to yesterday. However, over the past month, it has shown an impressive increase of 85%.

Over the course of a typical day, AERO seemed to move beyond its $0.49 to $1.02 holding pattern around the end of the previous week. This price range was where it had been moving since July.

Attempts to find backing at approximately $1.04 (a price that was once resistance in mid-July) on the AERO/USD pair were unsuccessful. Since then, the pair has slipped and returned to this range.

As an analyst, I’m keeping a close watch on the potential short-term target for AERO, which currently stands at $1.30. This price point has eluded AERO’s convincing reclamation since May, making it a focal point for speculators’ attention.

Read More

2024-10-04 12:07