- Aptos broke the $14 resistance, signaling bullish momentum with $20 in sight.

- APT showed strong buyer interest as MACD and RSI confirmed growth.

As a seasoned analyst with over two decades of market experience under my belt, I find the current trajectory of Aptos (APT) quite compelling. The recent break above the $14 resistance and strong buyer interest suggest that we could be witnessing the early stages of a significant bull run towards $20.

As a researcher, I’ve been closely observing the trajectory of Aptos [APT], and it’s impressive to see its steady ascension, breaching the $14 threshold recently. Michael van de Poppe, an analyst I follow, proposes a bullish outlook for this coin, anticipating a possible surge toward $20, provided our key support levels remain intact.

As a researcher, I’ve observed an intriguing development with Aptos. It has surpassed its previous resistance zone of $11.30–$11.50, which is now functioning as a supportive region. This transition suggests that the positive market sentiment, or bullish momentum, is persisting.

Analysts suggest that a successful retest of this support would further validate the upward trend.

The level of market activity suggests that buyers’ enthusiasm remains high, as significant volumes are observed during breakouts. This points towards a sense of optimism among traders, coinciding with the ongoing bullish trend.

Key resistance levels

Currently, Aptos is being bought and sold for $14.24 per unit. This comes after a 0.99% upward price adjustment within the last day, and a notable surge of 12.85% over the course of the last week.

Experts have pointed out two significant points where prices might face strong opposition: one close to $13.80-$14.00, which aligns with a past peak, and another approximately at $17.00, an area with a history of resistance.

If APT’s price surpasses its current levels, it might pave the way for an advance towards $20. Yet, investors are keeping a close eye out for possible selling off, as the influx of APT into trading platforms suggests increased deposits, potentially indicating profit-taking activities.

Technical indicators reflect strong momentum

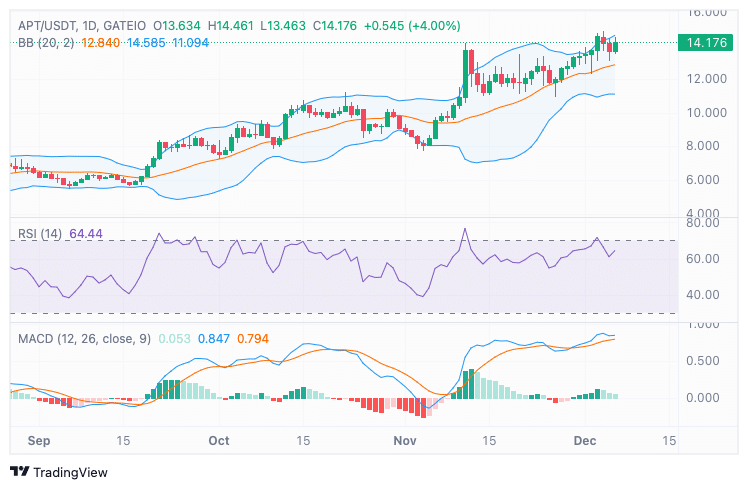

Based on the analysis of technical indicators, it appears that APT’s upward trend could potentially continue expanding. The Relative Strength Index (RSI) is currently at 64.44, indicating a strong bullish movement, but it still falls short of overbought territory. This suggests that there’s still room for the asset to grow without an imminent risk of a sudden reversal.

In simpler terms, the Moving Average Convergence Divergence (MACD) graph showed a bullish trend as the MACD line was positioned above the signal line, while the bars were green. This suggests that there’s increasing demand for buying stocks, indicating a robust market condition.

Furthermore, the cost was approaching the upper limit of the Bollinger Band, indicating robust upward pressure. The midpoint around $13.00 serves as a potential support level should a brief downturn occur.

Market activity and on-chain data signal increased interest

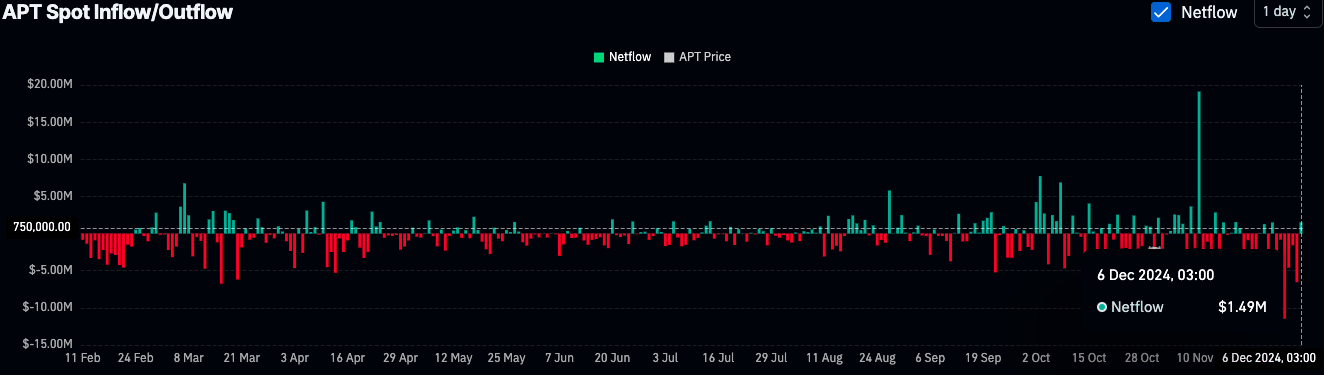

According to information directly on the blockchain from Coinglass, the situation for APT is somewhat ambiguous. The trading volume has dropped by around 28.50% to reach approximately $746.39 million, yet Open Interest has shown a small increase of 0.08%, suggesting that market participation remains consistent.

An increase of about $1.49 million moving into the trading platforms suggests potential signs of sellers offloading their tokens for profits, as they transfer assets to exchanges.

Read Aptos’ [APT] Price Prediction 2024–2025

Regardless of the ups and downs, there’s an overall positive outlook since the asset exhibits a distinctly bullish pattern.

Observers are keeping a close eye on potential crucial retests and resistance points, as APT approaches its upcoming goals.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-07 05:11