-

AVAX has surged by 3% from a crucial support level at $25.21

Metrics indicates mixed reactions.

As a researcher with extensive experience in the cryptocurrency market, I have closely followed the price action of Avalanche (AVAX) and have observed its recent surge of 3% from a crucial support level at $25.21. However, the metrics indicate mixed reactions to this movement.

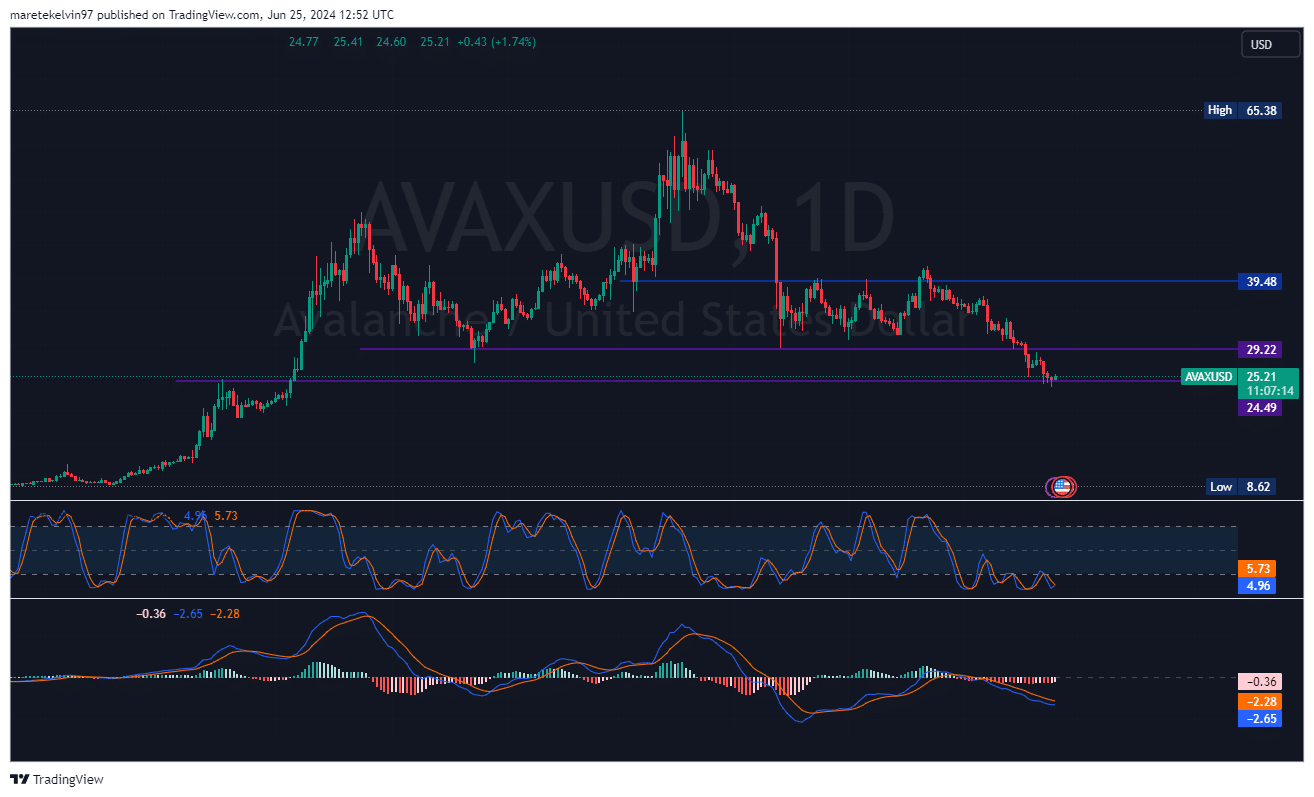

The price of AVAX, or Avalanche, has surpassed its January minimum of $27.3 for the first time. At present, it is attempting to hold above a significant support area around $25.5.

The value of cryptocurrencies in the market as a whole has been unpredictable, and this instability extended to AVAX as well. The price has dropped by more than 40% since the 22nd of May.

As a researcher studying the cryptocurrency market, I’ve observed that AVAX experienced a noteworthy increase of 3% within the past 24 hours. This substantial uptick has ignited apprehension among investors about the potential for a more drastic downturn or a possible correction in the opposite direction.

As of this writing, CoinMarketCap priced AVAX at $25.21. I

According to the stochastic RSI reading of 4.96 on the graphs, the asset appears oversold. This could signal a significant buying opportunity, potentially leading to a price turnaround.

Additionally, the MACD underlined fading bearish pressure across the market too.

What tale do the metrics tell?

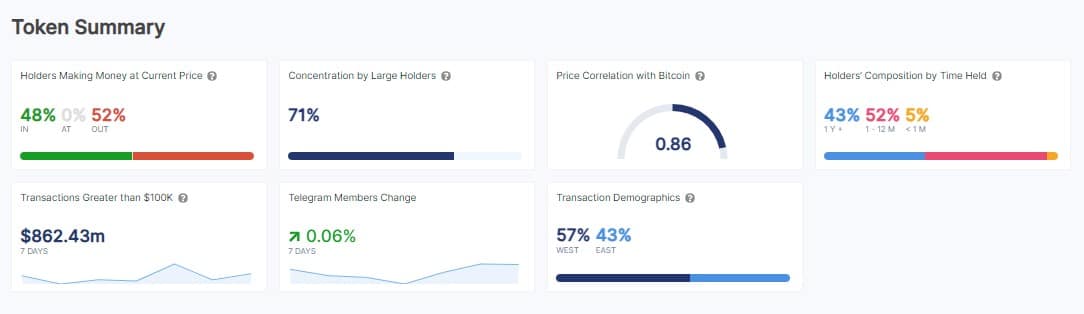

Based on IntoTheBlock’s analysis of holder data, approximately half of the investors, around 52%, are experiencing losses, whereas nearly equal numbers, roughly 48%, are currently making a profit. This situation suggests a relatively even distribution between gains and losses.

As an analyst, I’ve observed that over 70% of the cryptocurrency supply is held by major investors. This substantial concentration implies active “whale” participation in the market, which could potentially lead to considerable price fluctuations.

In simpler terms, the strong connection between Bitcoin‘s price and Avalanche’s (AVAX), with a correlation coefficient of 0.86, implies that AVAX’s future value could heavily depend on Bitcoin’s short-term market trends.

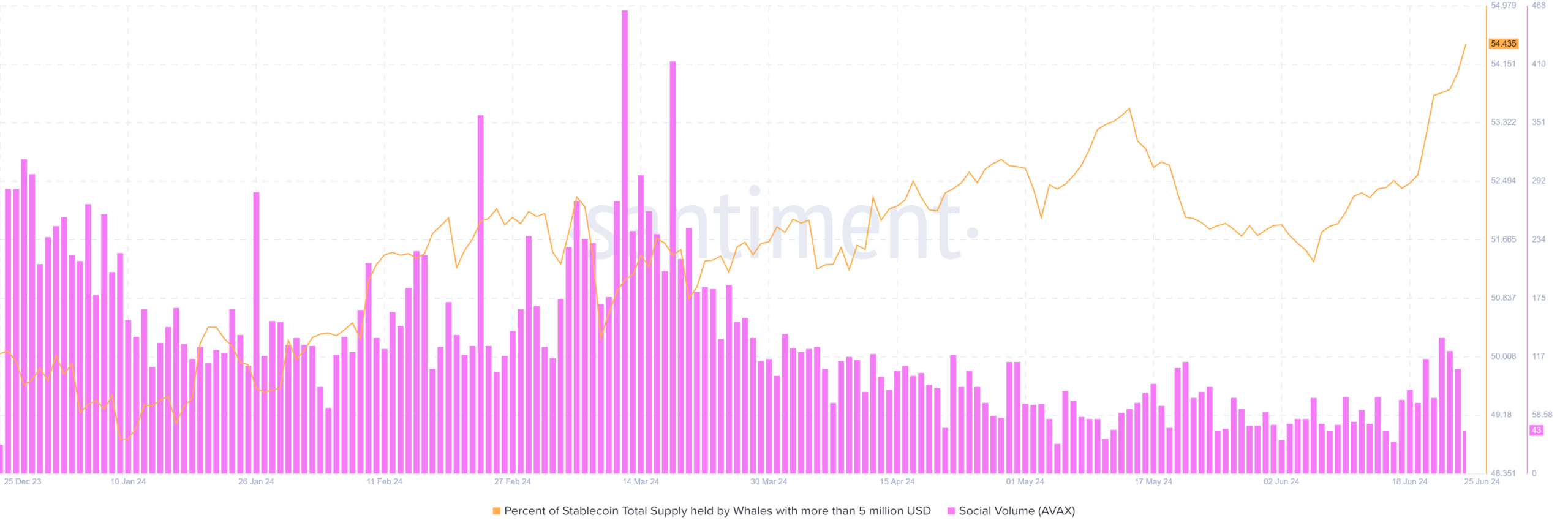

Santiment’s analysis of social media activity and whale transactions revealed some significant findings, as evidenced by the noticeable surges in social volume.

Traders’ enthusiasm and involvement have significantly increased, as evidenced by the surge in interest and transactions. Additionally, the top holder’s holdings of stable coins have been on an upward trajectory.

Several individuals are closely monitoring this crucial level of support for AVAX, potentially indicating a bullish outlook.

A tug of war between bulls and bears?

The Coinglass long/short data shows several fluctuations between long position and short positions.

As a researcher observing current market trends, I’ve noticed a progressive decline, suggesting that market participants holding short positions have gained the upper hand in the short term.

Realistic or not, here’s AVAX market cap in BTC’s terms

What is ahead for AVAX?

As a crypto investor, I’m keeping a close eye on Avalanche’s price action right now. It seems to be holding steady around the important support level of $24.49. However, if this level gives way and AVAX falls below it, we could potentially see further price declines unfold.

If the current price stabilizes and then decreases, there’s a good chance we’ll see a price reversal. The next significant resistance level would be around $29.22.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-26 14:15