-

Traders who purchased AVAX within the last 30 days have seen the highest increase among all holder categories.

Technical analysis showed that the token could see its price jump to $30.05.

As a seasoned crypto investor with a keen interest in fundamental and technical analysis, I find the recent trends of AVAX intriguing. The data from AMBCrypto suggests that traders have shown the highest increase among all holder categories within the last 30 days, which is a positive sign for potential price growth.

Avalanche (AVAX) has been moving laterally among other altcoins during the past week instead of experiencing significant price increases or decreases. However, AMBCrypto’s assessment indicates that this trend might shift soon.

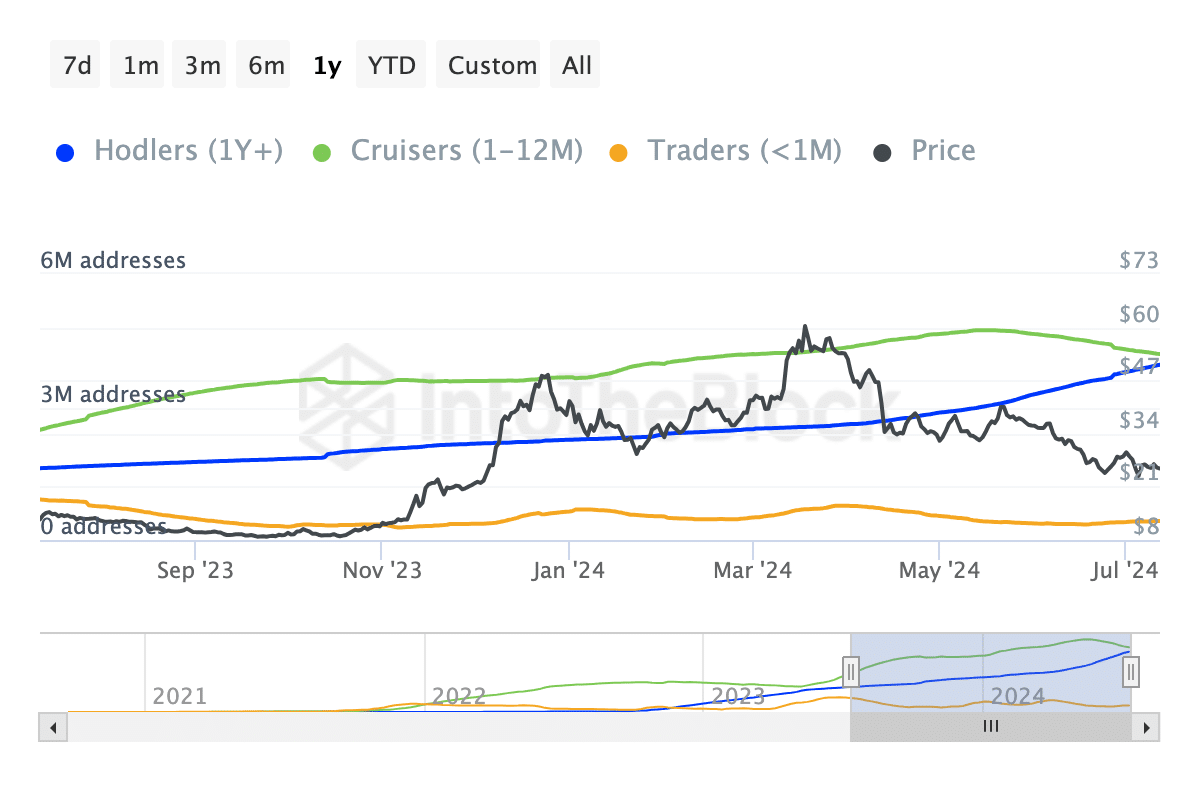

One explanation for this prediction is derived from the trends we noticed in the “Addresses by Time Held” data. This indicator reveals whether short-term, medium-term, or long-term investors are accumulating more of the token or reducing their holdings.

It’s traders’ demand over holders faith

This categorization is carried out by the blockchain analysis platform. It separates token holders into three distinct groups. The initial group consists of individuals who have owned the token for over a year. The second category is referred to as Cruisers.

Investors categorized as cruisers have owned a token for a duration of one to twelve months, while traders represent the most recent group, having bought within the past thirty days.

As of the current news update, traders experienced the greatest price surge among the three groups, indicating a buoyant outlook among short-term investors towards AVAX.

From my perspective as a crypto investor, if the current upward trend in the number persists, Avax’s price might surge and potentially reach or even exceed $30. At present, the token is priced at $25.81. The question remains whether this target is achievable.

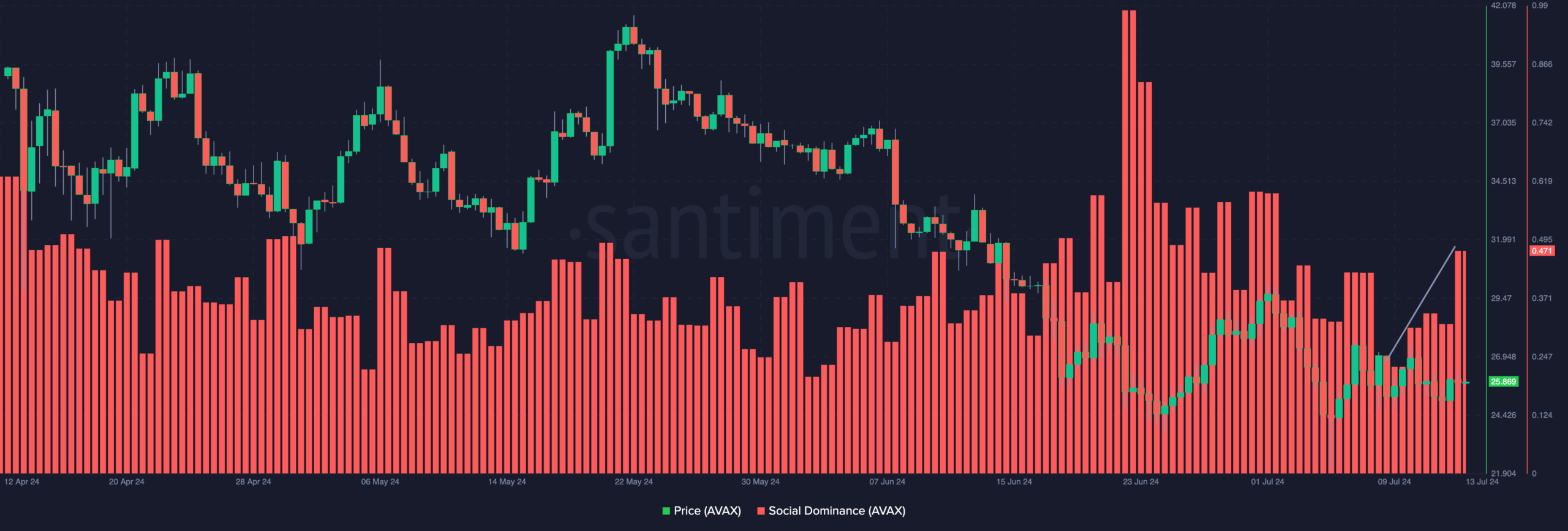

One method for anticipating this trend is by examining the desire for the token. A relevant indicator for evaluating this is the social influence or dominance.

The degree of prevalence of a particular cryptocurrency in social discourse relative to other leading cryptocurrencies is referred to as social dominance. A decrease in social dominance signifies a reduction in online conversations and searches pertaining to that specific token.

Yet, a rise in the metric appears to tell a different story. According to Santiment’s latest update, the dominance had climbed up to 0.471 at the time of reporting. Consequently, this signifies a notable escalation in conversations surrounding AVAX.

Breakout on the cards?

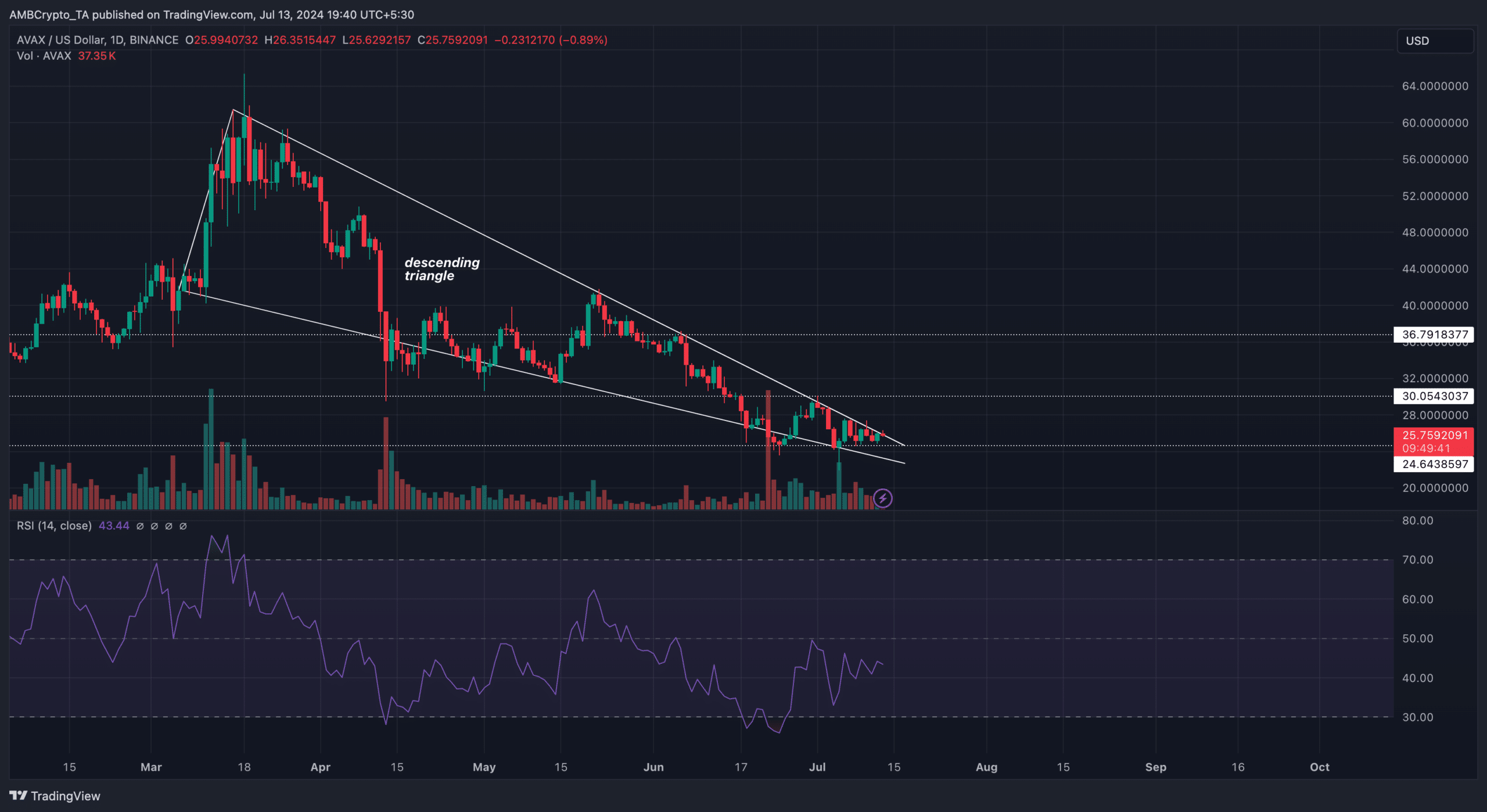

From a technological standpoint, the AVAX-USD daily graph exhibited the development of a descending triangle. A descending triangle emerges on the chart when the value of a token reaches successively lower peaks and troughs, signaling a bearish trend.

Based on the chart below, the identified pattern for AVAX suggests a possible seller exhaustion. This means that there may be a shift in market sentiment from selling to buying, potentially leading to a price increase.

Furthermore, the Relative Strength Index (RSI) indicated that the token left the oversold territory it was in on July 4th. The RSI is a tool used to gauge momentum.

In simpler terms, readings under 30 suggest the altcoin is being sold heavily, while figures above 70 suggest it’s being bought heavily. A rising figure indicates growing buying pressure and momentum for the altcoin.

Is your portfolio green? Check the AVAX Profit Calculator

If the current trend persists, AVAX‘s price may reach a minimum of $30.05 in the near term. However, this prediction is valid only if buyers manage to hold the support level at $24.64.

If market conditions become extremely bullish, the price could potentially reach $36.79. Yet, a resurgence of selling pressure may prevent this forecast from materializing.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-07-14 09:11