- Base hit new TVL and stablecoin marketcap highs as bullish excitement returned to the market.

- Performance stats confirmed healthy improvement in confidence and network utility

As a seasoned crypto investor with battle-scarred fingers from riding the rollercoaster of this wild market, I can confidently say that Base has been one of the shining stars in my portfolio lately. Its recent surge in network activity and TVL growth is nothing short of impressive, especially considering its humble beginnings just a year ago.

In September, the tide has turned towards cryptocurrency bulls, and Base is one of the networks benefiting from this shift. This can be seen in the surge of strong network activity, indicating a growth trend.

It’s clear that Base is positioning itself as a rapidly expanding Ethereum layer 2 solution. Its recent achievements suggest that this growth trajectory is likely to continue as the market gains momentum. Therefore, it would be prudent to examine its performance in crucial aspects over the past period.

BASE sees surge in network activity

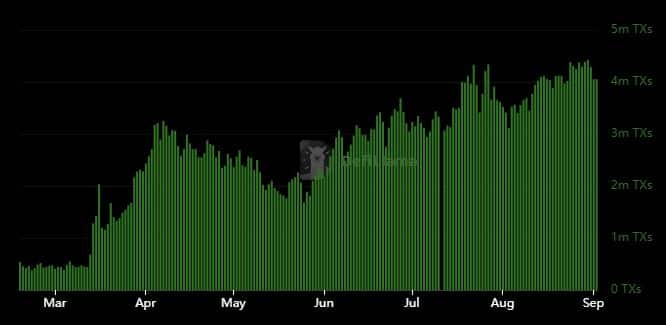

Transactions on the Ethereum Layer 2 network have been consistently increasing over the past few months, with a significant surge starting from March 2024. Interestingly, DeFiLlama reported that this network was processing fewer than half a million transactions daily until around mid-March.

On the contrary, that situation shifted, and transaction volume has been consistently increasing ever since. Lately, it surpassed previous records, peaking at over 5 million daily transactions.

The chart revealed that Base transactions have been growing even during bearish times. However, the resurgence of bullish activity has supercharged its network activity. The impact of market swings was more evident in the volume and stablecoin data.

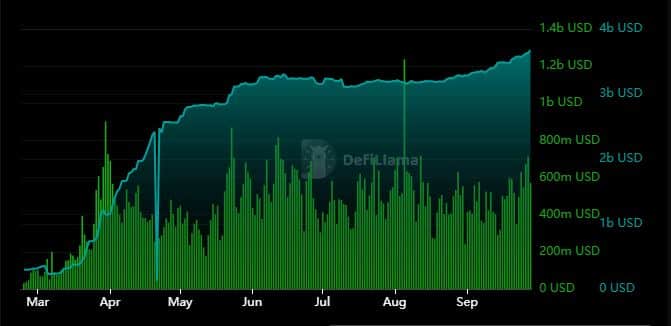

The transactional data on the blockchain showed a strong link to the expansion of stablecoins. To illustrate, from March to April, both the volume and the market capitalization of stablecoins experienced rapid growth. Despite a relatively steady phase between May and August, the rate at which stablecoins were growing quickened in September.

Between August and mid-September, the on-chain volume experienced a substantial drop. However, in contrast, daily volume showed a considerable increase, rising from under $400 million to more than $700 million by September 27th.

The value of the stablecoin market within the network reached an all-time peak of $3.67 billion recently. To better understand this growth, it’s important to note that the market cap of its stablecoins was less than $400 million just before mid-March.

Robust TVL growth confirms user confidence

While the aforementioned metrics highlighted growing network utility, there is one metric that underscored a strong surge in user confidence.

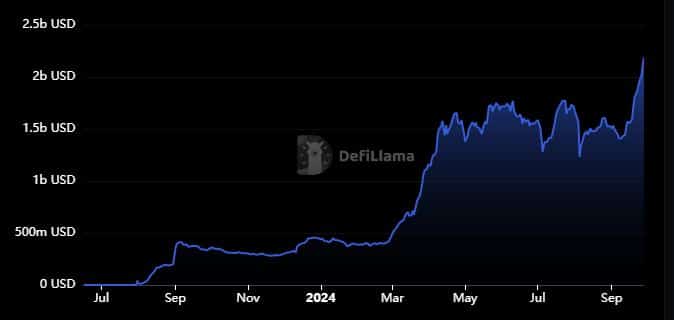

Base’s TVL recently soared to $2.19 billion – Its highest historic level.

A year ago, the total value locked (TVL) in Base was approximately $337 million. Today, that figure has grown more than 548%, indicating robust liquidity and attracting investors who are keen on investing.

The network added $780 million to its TVL over the last 3 weeks. This is around the same time that the market shifted in favor of the bulls. This outcome means that Base may see more robust growth in the coming months. Especially if the market continues to heat up.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-09-29 04:07