-

Binance’s 20th regulatory milestone in Argentina bolsters global compliance, but market challenges remain.

BNB’s price tests key support as open interest drops, signaling cautious market sentiment.

As an analyst with over a decade of experience in the financial markets, I’ve seen my fair share of regulatory milestones and market challenges. Binance’s latest achievement in Argentina is undeniably a positive step for the exchange, demonstrating their commitment to global compliance standards. However, it’s important to remember that every regulatory win doesn’t automatically translate into price stability.

Binance’s BNB token gains strength following Binance’s 20th regulatory achievement, which granted approval in Argentina. This milestone represents an important advancement in Binance’s overall plan for adhering to regulations worldwide.

Yet, the fundamental query remains as to whether this regulatory achievement will lead to price stability for BNB, specifically in terms of keeping its value above the significant $500 mark during market fluctuations.

Regulatory success: A positive step for BNB?

By joining Argentina’s Virtual Asset Service Providers Registry, supervised by the National Securities Commission (CNV), Binance now has a chance to broaden its service offerings throughout South America.

As a result, this victory highlights the company’s dedication to maintaining strong regulatory principles, such as rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols. Furthermore, Binance’s ongoing growth in various international markets is designed to encourage investor confidence.

Nevertheless, though this regulatory success is significant, it occurs amidst some substantial market difficulties that BNB currently encounters.

BNB price action: Will $500 hold as a critical support level?

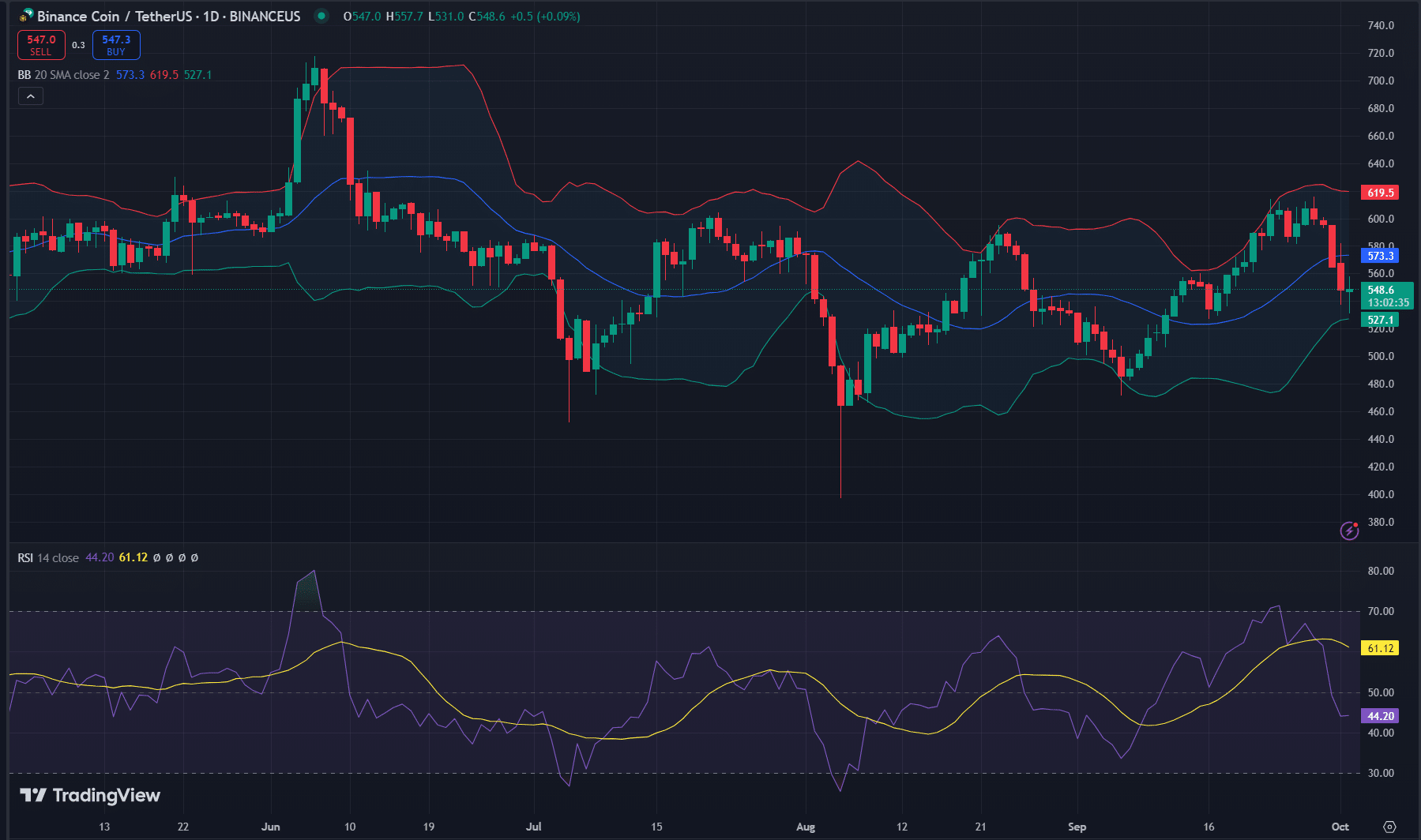

Currently, Binance Coin (BNB) is being traded at approximately $549.47, marking a decrease of 5.16% over the past 24 hours. The token is currently testing significant support near the lower limit of the Bollinger Band, around $527.1.

Furthermore, the resistance is holding steady at the 20-day Simple Moving Average (SMA) of $573.3, which makes it difficult for any significant price increase in the immediate future. If BNB cannot maintain this support, the potential next drop might take it to the psychologically important level of $500.

If bulls manage to break through the current barrier, they might find the upper Bollinger Band around $619.5 as their next goal.

BNB Open interest analysis: What does it reveal?

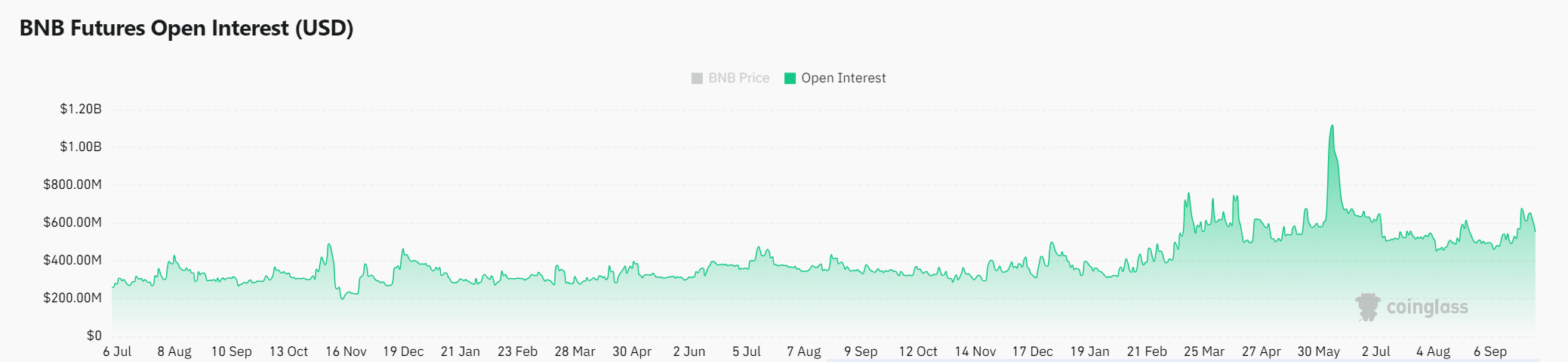

The current open interest for BNB is down by 6.98%, amounting to approximately $553.42 million as of now. This decrease suggests that traders are lessening their holdings, indicating a more conservative attitude among market participants.

Furthermore, a decline in open interest might suggest that traders have doubts about the immediate bullish prospects of BNB. Consequently, this decrease may add to ongoing downward pressure unless trading volume increases significantly.

Can regulatory wins drive market confidence?

In Argentina, Binance has made a significant stride in regulations, boosting its international reputation. However, considering the present market trends, it’s unclear if BNB will consistently stay above the $500 mark.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

According to the technical analysis, important floors (areas where the price is expected to find support) are being checked, suggesting a decrease in trader confidence as indicated by the fall in open interest.

Consequently, while regulatory victories can have a favorable influence in the long run, BNB might face challenges holding its value above $500 in the near future, unless there’s a substantial increase in buying activity.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-10-03 04:07