In the tumultuous realm of cryptocurrencies, on this rather unremarkable day of August 27, Bitcoin finds itself languishing beneath the weight of expectation, trading at the rather unexciting sum of $111,036. Though some whispers of short-term accumulation may tickle the ears of hopeful speculators, the broader trend appears akin to that of a faint-hearted suitor retreating into melancholy. The illustrious Bitcoin boasts a market capitalization of $2.21 trillion-a figure which, when one considers the unexpected volatility, may elicit both admiration and derision. Trading volumes reached a dizzying $39.66 billion, accompanied by an intraday range that flirts between $109,526 and $112,279. 🍵

Bitcoin

//static.news.bitcoin.com/wp-content/uploads/2025/08/bitstamp_btc_usd-wed_27_aug_07_03_48.jpg”/>

Turning our bemused attention to the 4-hour chart, we find that Bitcoin dons a rather unremarkable sideways-to-bearish disposition. Following a dizzying ascent to $117,421, the recent retreat suggests not a mere coincidence but rather a classic bull trap, or, if one is feeling particularly cynical, a distribution phase. The price remains notoriously range-bound between $110,000 and $112,000, with our reliable support at $108,717 being revisited more times than a guest returning to a delightful soirée. Should the asset manage to conquer the formidable barrier of $112,400, we may witness a return to the exalted vicinity of $114,000 to $116,000. However, a failure to break above $112,000 casts an ominous shadow over potential retests of our supportive embrace. One would do well to monitor this level intently for signs of a flourishing breakout or the dreariness of renewed selling pressure. 🍃

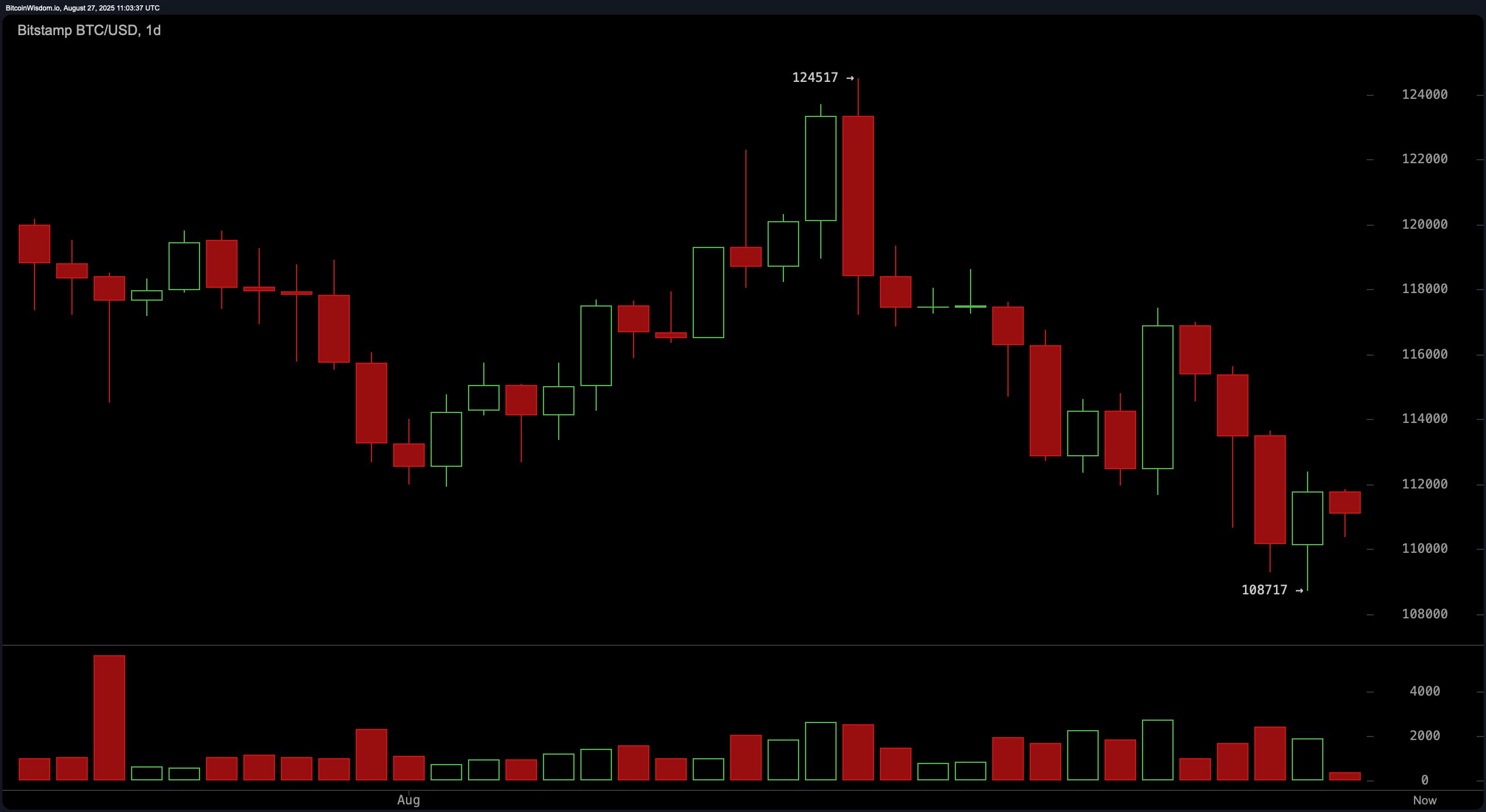

Upon inspecting the daily chart, one cannot help but observe a conspicuous downtrend, rife with lower highs and lower lows; reminiscent of a tragic love story peaking at an unfortunate incident hardly forgotten. The volume data reflects moderate selling-albeit not unaccompanied by flickers of buyer support, particularly in the $109,000 to $111,000 range. Should fortunes arise and grant a romantic glimpse of positivity, a long entry may present itself near the $108,700-$110,000 realm, but only if crowned with bullish candlestick confirmations, perhaps a hammer or an engulfing pattern, each accompanied by spirited volume upticks. Resistance levels are firmly established at $116,000 and $124,000, both of which would serve as rather sensible exit zones for our more adventurous long recovery endeavors. 🏰

Our esteemed technical indicators offer a rather cautious interpretation of sentiments. Amongst the oscillators, the relative strength index (RSI) reads a neutral 41-indicative of an audience more inclined toward light applause than grand ovations-while the Stochastic indicator languishes at 13, together with the average directional index (ADX) at 17, which suggest that the crowd remains rather unthrilled by strong trends. Furthermore, the commodity channel index (CCI) at −126 delivers a bullish whisper, while the momentum oscillator at −6,467 and the MACD level at −1,219 echo a bearish lament. This divergence among momentum indicators perhaps advises our traders to pause momentarily, thumbing through their options rather than hastily committing to significant positions like a suitor forgetting their manners at a ball. 🎩

Moving averages only serve to reinforce the present bearish pressure, as all short- to medium-term exponential and simple moving averages are aligned in a manner most discouraging. The 100-period EMA, resting at $110,859, offers a modicum of hope amidst the gloom, but the 100-period SMA at $111,663 continues to reflect the unyielding burden of resistance. However, let us not forget that the longer-term 200-period EMA and SMA, positioned at $103,847 and $101,011 respectively, maintain a firm footing in positive territories-suggesting that regardless of the short-term theatrics, a broader bullish outlook still lingers in the corners of optimism. Traders, pray be vigilant around these pivotal levels and manage risk with the kind of tight stop-losses befitting a gentleman experienced in navigating the complexities of high society. 💫

Bull Verdict:

If our beloved Bitcoin can muster the audacity to break decisively through the $112,400 resistance amidst confirmed volume and an array of bullish candlestick patterns, it may well open the proverbial doors to a recovery toward $114,000 and possibly $116,000-should the stars align and alignment permit. The presence of accumulation signals on those elusive lower timeframes, coupled with the support offered by long-term moving averages, offers but a glimmer of faith in a bullish continuation-a hope that dances ever so tantalizingly upon the tip of the tongue! 💖

Bear Verdict:

Conversely, should our noble Bitcoin once again falter before the $112,400 resistance, becoming ensnared in a web of rejection, the downtrend may very well be reinforced-scandalously casting our currency back towards the realms of $110,000 and even $108,700. We must reckon with the fact that weak momentum indicators and persistent sell signals across the majority of moving averages proclaim a narrative of bearish dominance, a tale that shall persist unless our bullish companions can reclaim the key resistance zones with some swiftness and flair! 🐻

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Goat 2 Release Date Estimate, News & Updates

- 10 Movies That Were Secretly Sequels

- Best Werewolf Movies (October 2025)

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Korean fantasy action adventure game Woochi the Wayfarer announced for PS5, Xbox Series, and PC

2025-08-27 14:58