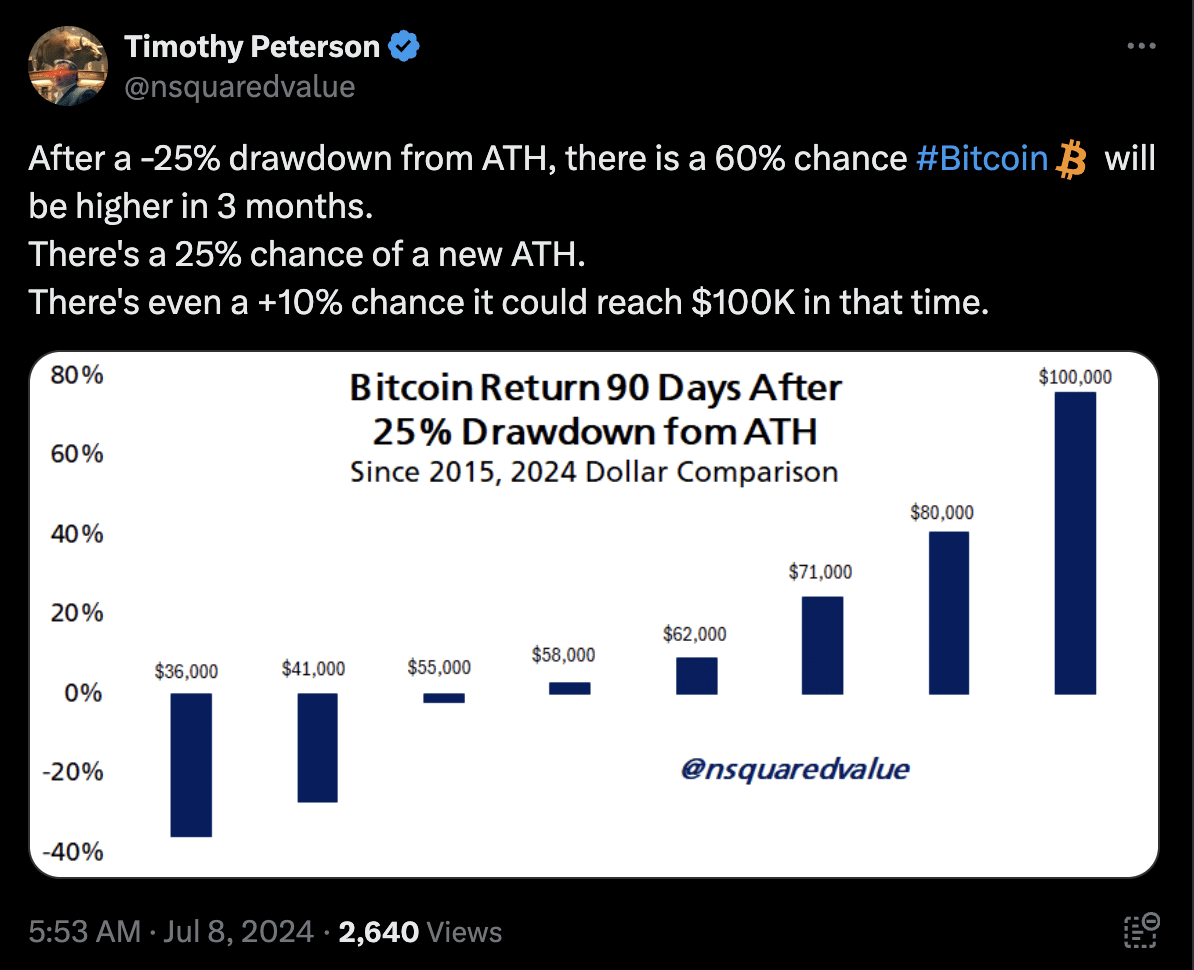

- Bitcoin is predicted to rebound above $50k by October, with a 60% likelihood.

- Peterson also sees a 25% chance of Bitcoin reaching a new all-time high within the same period.

As an experienced analyst, I find Peterson’s prediction for Bitcoin’s rebound above $50,000 by October, with a 60% likelihood, to be a promising outlook. The recent market volatility and the accumulation of large-scale Bitcoin holders indicate strong confidence among investors and could be bullish signals for the market. Furthermore, Peterson’s statistical model suggests a 25% probability that Bitcoin could set a new all-time high within this period.

At the moment of writing, Bitcoin [BTC] had bounced back above $57,000 on the charts, signifying a notable rebound from its previous slide which dropped it to $53,000 – a price level last seen in February.

The recent surge in Bitcoin’s price is remarkable, considering the early indications of a possible downward trend. Today, Bitcoin reached a 24-hour low of $54,320.

Based on current market developments, renowned Bitcoin analyst and economist Timothy Peterson offers a positive outlook on the digital currency’s trend as we approach the last quarter of 2024.

Peterson expressed strong belief in Bitcoin’s resurgence, emphasizing its potential significance during the forthcoming period.

Analyzing Bitcoin’s potential surge

Peterson’s analysis presented a promising outlook for Bitcoin enthusiasts and investors.

If Bitcoin manages to break the $50,000 mark in July, there’s a strong chance it will hold or even surpass this value through October.

Based on my analysis of the statistical model, I found that if Bitcoin experienced a 25% decline from its all-time high (ATH), there is approximately a 60% probability that its price would rise again within the subsequent three-month period.

As a researcher examining Bitcoin’s price trends, I proposed that there was approximately a one in four chance of Bitcoin reaching a new all-time high during the given period.

There’s a significant possibility that Bitcoin could reach $100,000, though this outcome is less probable compared to other predictions, which adds an element of thrill to the ongoing debate about the cryptocurrency’s future prospects.

Is BTC ready for the potential surge?

Bitcoins underlying factors offered valuable perspectives on its potential to reach such encouraging goals.

According to data obtained from market intelligence platform Santiment, wallets containing more than 10,000 Bitcoins have experienced substantial gains during recent market fluctuations.

Over the past six weeks, these large-scale holders have increased their holdings by 12,450 BTC.

The 1.05% growth in the Bitcoin stockpile controlled by significant investors signifies robust faith in the cryptocurrency and might serve as an optimistic indicator for the market.

These types of actions by major investors, possibly including market makers, may indicate their expectation of price increases or substantial market changes ahead.

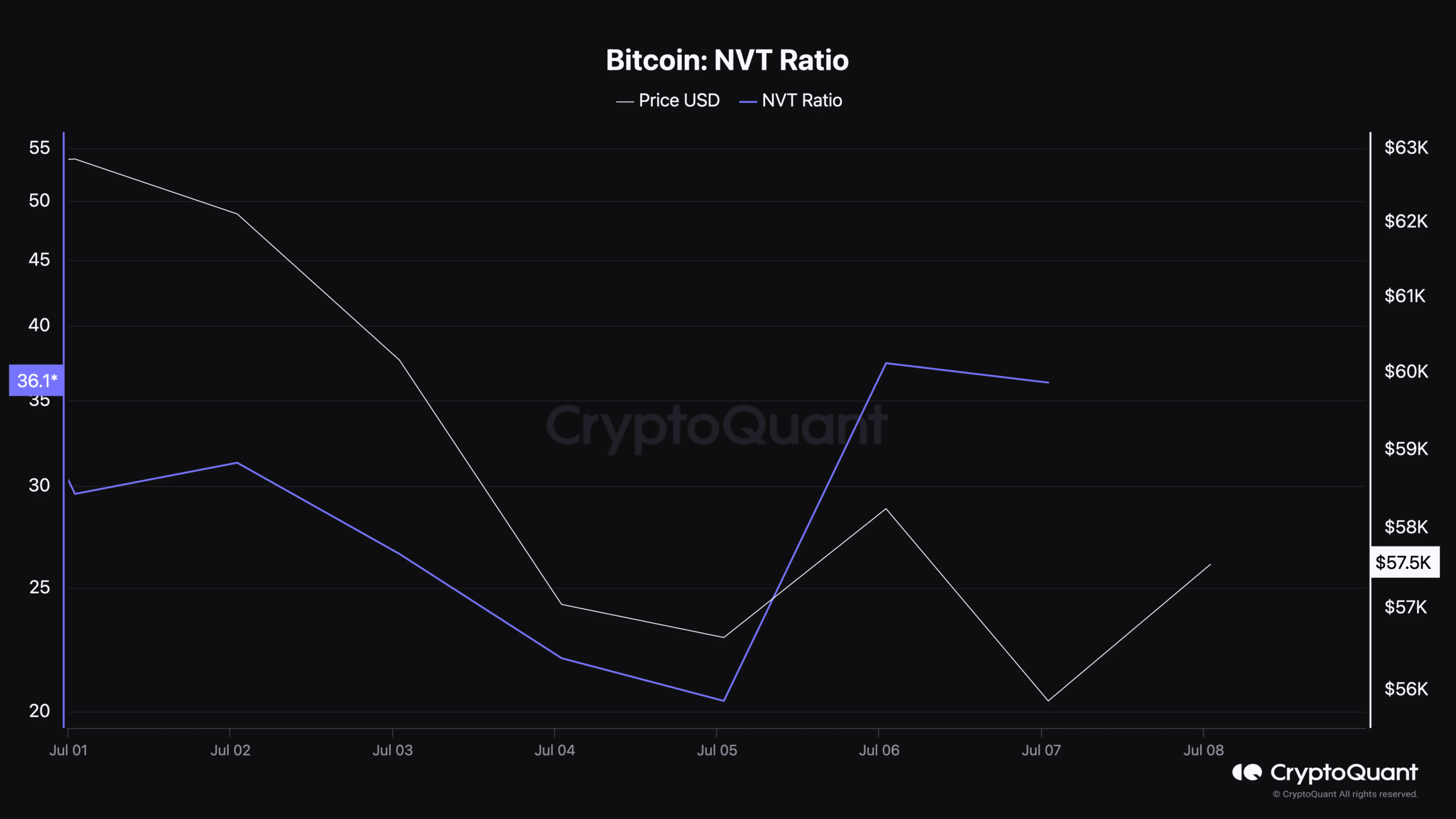

As a financial analyst, I would interpret Bitcoin’s current Network Value to Transactions (NVT) ratio of 36.1 in a straightforward way: This metric suggests that the value of all transactions on the Bitcoin network is relatively low compared to its current market capitalization. In other words, each Bitcoin transaction represents less value than it typically has in the past. This observation could be an indicator of market saturation or decreased investor sentiment towards Bitcoin, potentially signaling a need for caution when making valuation estimates.

By examining the relationship between a cryptocurrency’s market capitalization and its transaction volume on the blockchain, the NVT ratio offers insight into whether the coin appears to be overvalued or undervalued.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher studying the dynamics of cryptocurrency networks, I’ve observed that a lower NVT (Network Value to Transactions) ratio can be an indicator of network health and transactional activity that outpaces market capitalization. This observation implies that the asset in question might be undervalued based on current market prices. Furthermore, such a situation could potentially set the stage for a price increase as more investors become aware of this undervaluation.

Based on my analysis as a crypto investor, I’ve noticed that AMBCrypto reports a lack of sufficient demand in the short term for Bitcoin to push its price above $60,000.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-07-09 03:36