-

Bitcoin bear market has consolidated its price within a specific range, jeopardizing the bulls’ chances for a rebound.

If this dominance continues, BTC might drop to $40K. What are the odds?

As a researcher who has navigated through numerous bull and bear markets in Bitcoin, I find the current situation intriguing yet challenging. The consolidation of BTC within a specific range is reminiscent of a game of chess where both players are trying to outmaneuver each other without making any significant moves.

At the moment of reporting, Bitcoin (BTC) was being traded slightly over $57,000, an important threshold for a possible recovery. Should buyers successfully maintain control at this price point, Bitcoin may surge toward the resistance level of around $68,000

In other words, should the Bitcoin bear market prevail and the price falls below the $55K mark, it’s likely to dip down to around $50K – $51K. If even that level of support is broken, Bitcoin could experience a more significant drop, potentially reaching $40K

Historically speaking, September has typically seen a downtrend for Bitcoin, as it’s only shown a positive performance in four instances over the past 13 years. So, will this year continue that trend or could the bullish sentiment manage to reverse it?

BTC faces uncertain bearish outlook

Adding to the uncertainty, analysts are warning that the Bitcoin bear market could regain control.

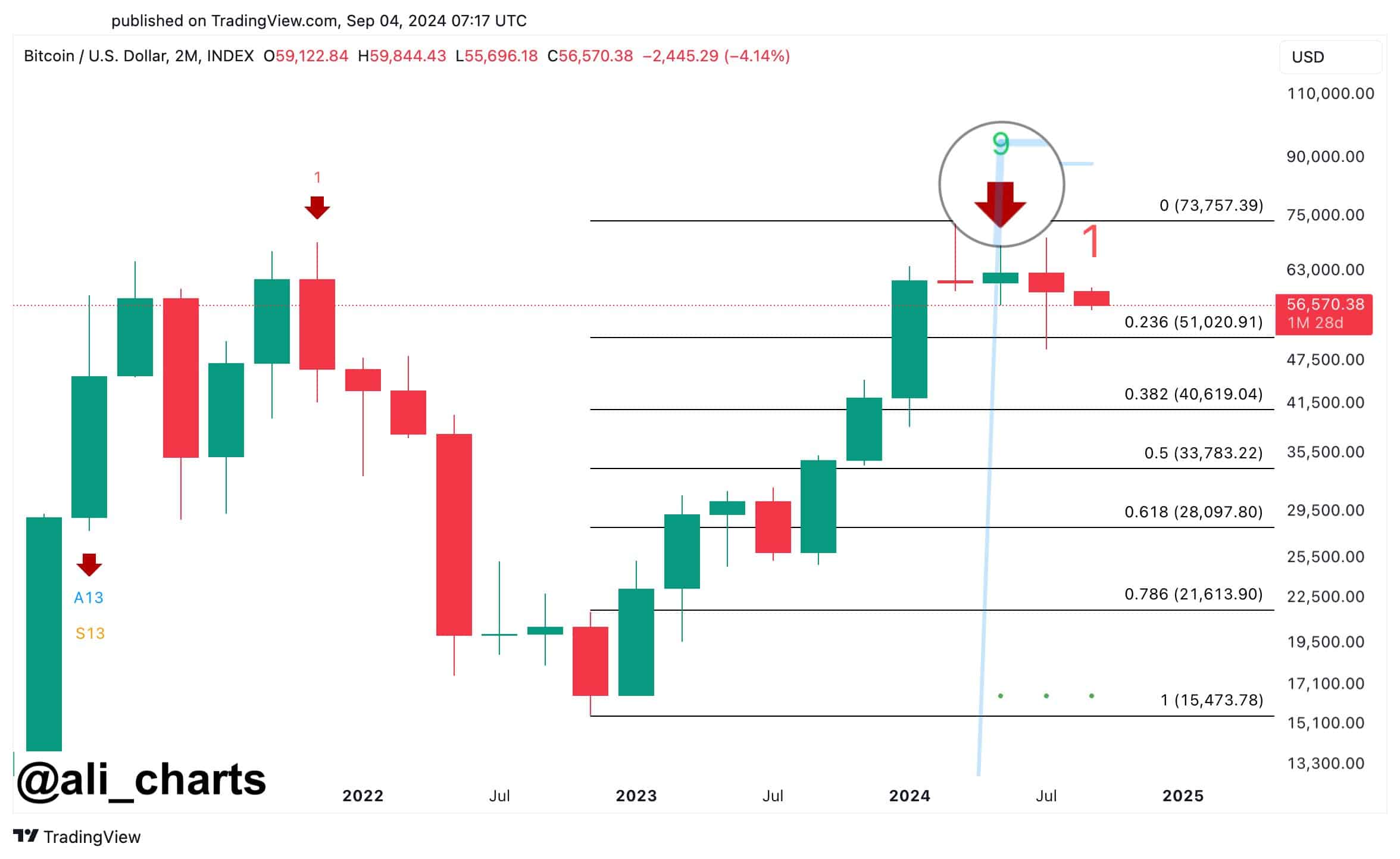

Source : X

According to the TD Sequential indicator on the two-month Bitcoin chart, there’s a possibility of a sell signal, which could lead to a potential decrease. If Bitcoin drops below $51,000, it may further fall to around $40,600 – a situation that the bulls would likely prefer to steer clear of

To prevent this, it’s crucial to maintain the $57K support level. AMBCrypto believes that alleviating overcrowding in leveraged positions is key.

Putting it simply, decreasing open interest by 10% may aid in preventing swift, dramatic changes in asset prices

Additionally, as open interest decreases, there’s a chance that the market could become more stable. This stability might lead to a bear market reversal (pullback) or a bull market surge (bullish swing). In other words, there may be a potential decline in the near future

Bitcoin bear market reigns supreme

Furthermore, the Bitcoin bear trend has been more dominant than the bull trend since early September, with prices fluctuating between roughly $59,000 and $57,000

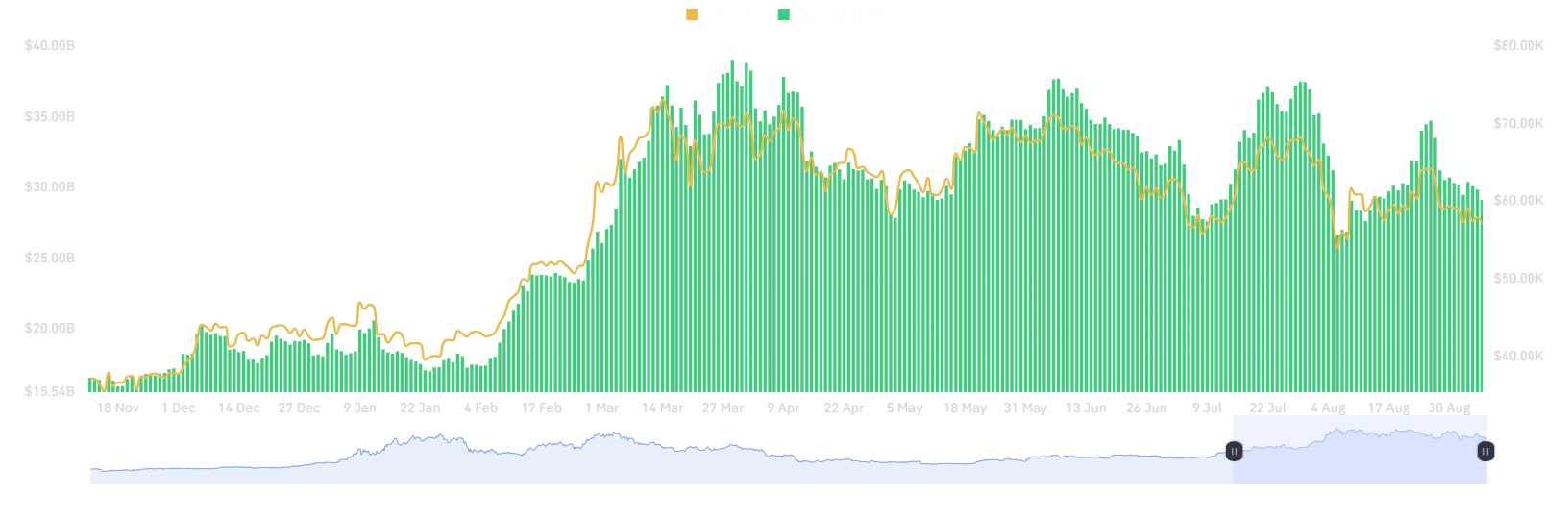

Source : Coinglass

As per AMBCrypto’s examination, on the 26th of August, when Bitcoin reached approximately $64,000, the Open Interest (OI) was around $34.72 billion. However, since then, both Bitcoin and OI have seen a substantial decrease, indicating that traders have actively taken advantage of profit-taking opportunities in the future market

In other words, re-entering a high OI area might boost market turbulence. When multiple traders near the break-even point and decide to leave, this could potentially slow down the trend and cause Bitcoin’s price to drop

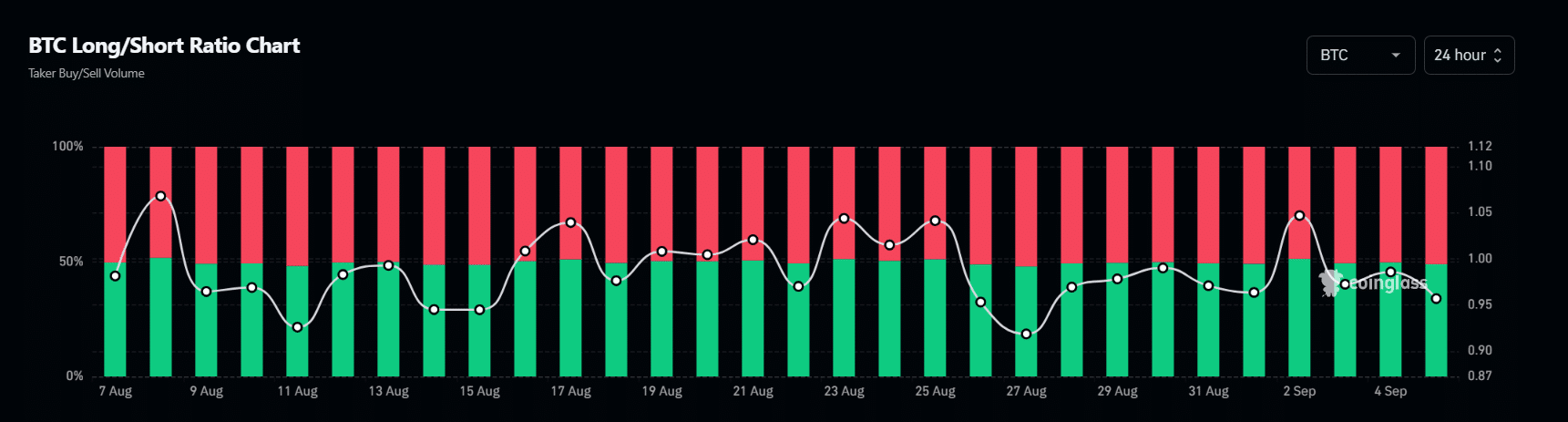

Source : Coinglass

Consequently, it’s been short positions that have been leading long ones over the last three days. At present, these short positions make up about 52% of the total market share

If the Bitcoin bear market takes control and BTC tests the $56,572 price range, about $45 million in 100x leverage positions could be liquidated, potentially pushing the price closer to $51K.

If Bitcoin (BTC) approaches the price of $57,400, it could potentially trigger the liquidation of approximately $67 million worth of short positions

As a crypto investor, I’ve been observing the market closely, and it seems that a high open interest (OI) with a predominance of shorts in the derivatives sector could indicate a prolonged Bitcoin bear market. Maintaining the $56K – $57K support level is pivotal for any potential breakout to occur. So, I’m wondering – what are the odds of this happening?

Bitcoin institutions face bear threat

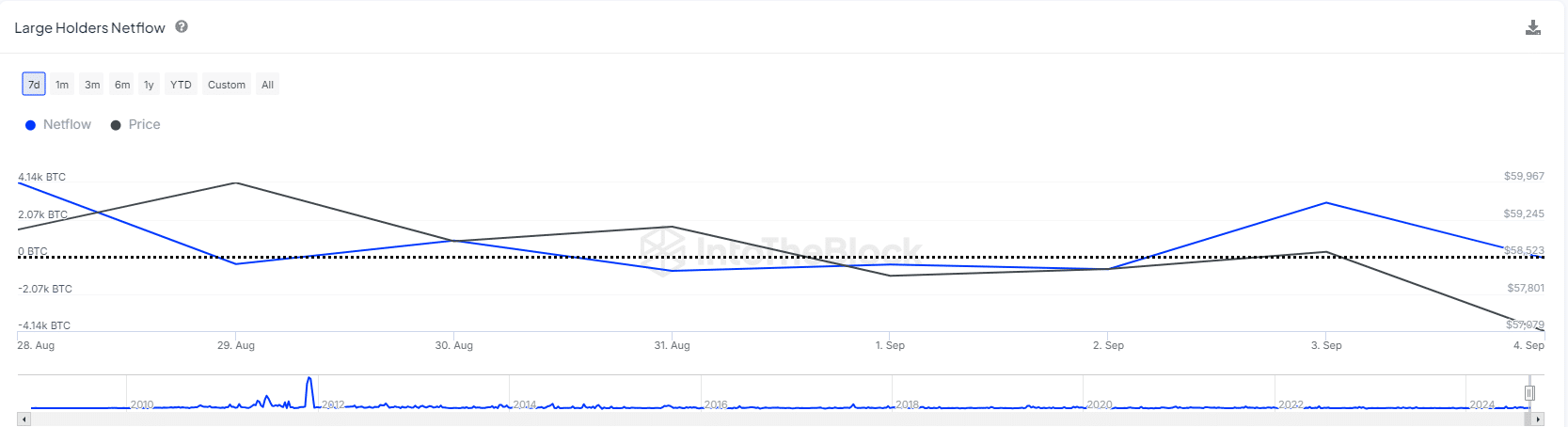

It seems like some institutions might be offloading Bitcoin. Since August 26th, a crypto asset management firm named Ceffu has transferred 3,063 BTC, equivalent to around $182 million, into Binance. Notably, on September 3rd, a substantial influx of Bitcoin resulted in a decrease of about 3% in its value

Source : IntoTheBlock

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The graph appears to indicate that major asset owners are not overly optimistic about the current market situation. If this pessimism persists, it might lead to widespread market anxiety, as reported by AMBCrypto

Long-term investors should resist selling their Bitcoin in large quantities, or else there’s a risk of a price drop. If they don’t, short sellers could take control, pushing the price down from its current target of $68K to as low as $51K, and potentially even lower to around $40K

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2024-09-05 18:17