- Bitcoin was up 3% over the last seven days, at press time.

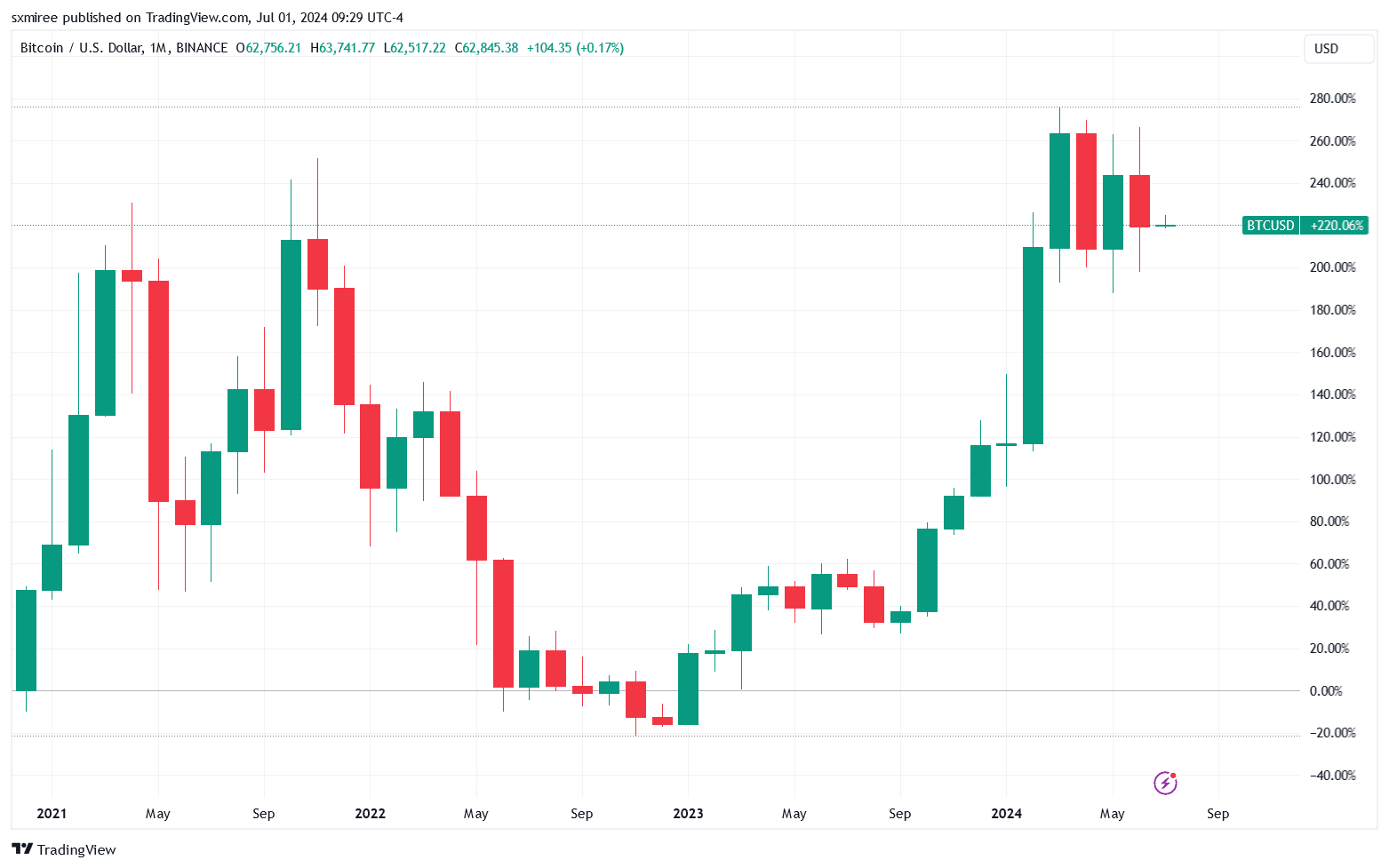

- June’s lackluster action ultimately saw Bitcoin register negative returns of almost 7%.

As an experienced analyst, I have closely followed Bitcoin’s price action over the past few months. The recent upswing of 3% in the last seven days was a welcome relief after the dismal performance in June, which saw negative returns of almost 7%. However, the monthly and quarterly candles printed red, indicating a bearish trend for the leading cryptocurrency.

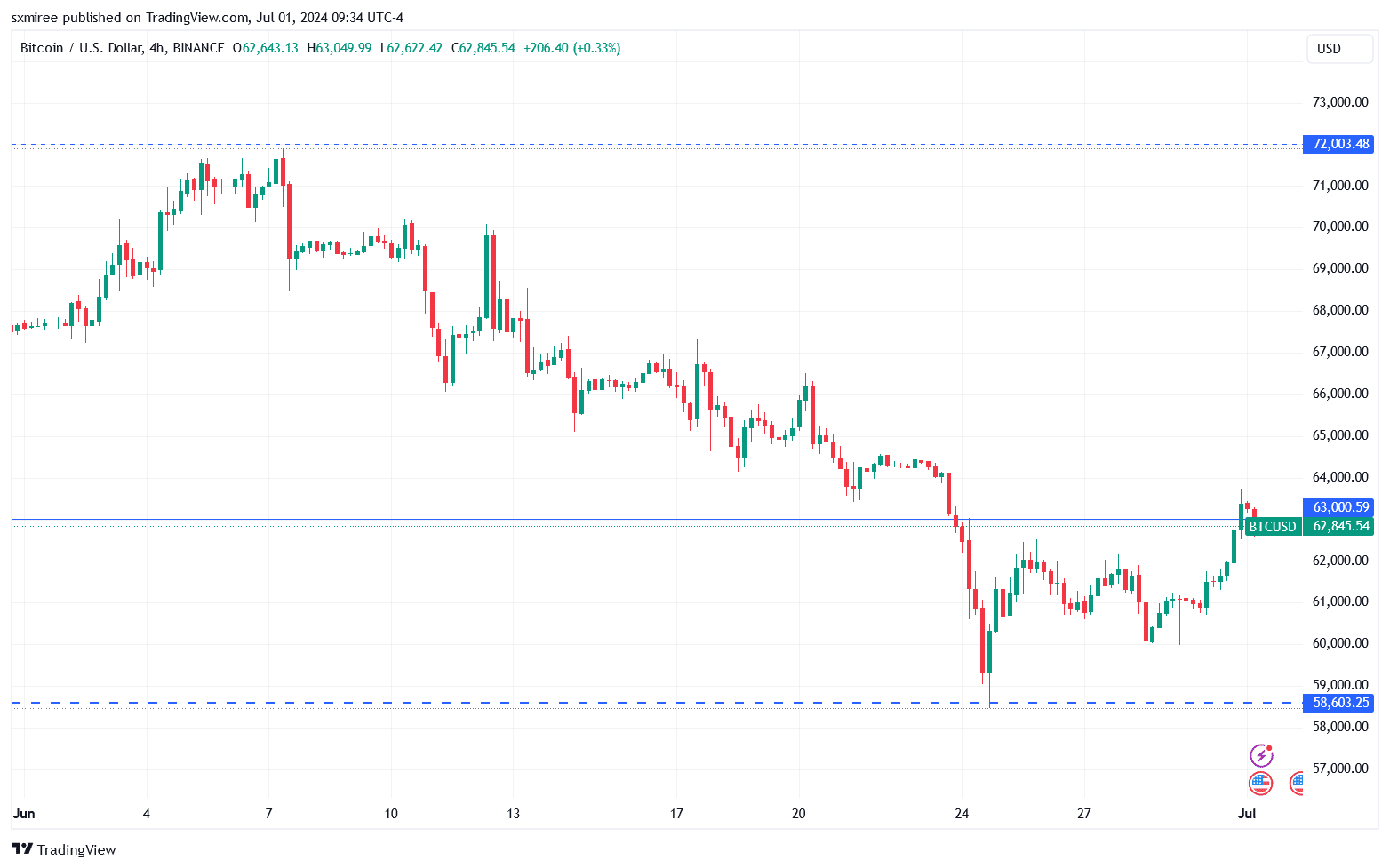

Bitcoin’s price showed signs of strength, trading above $63,000 early in the week following a robust weekend performance. Bullish investors were actively trying to push the market upwards in anticipation of a favorable monthly closing figure.

Despite managing to protect the significant $60,000 psychological barrier due to price increases on the final day of the month, the BTC/USD chart ended the month and quarter with negative candles.

Here is what is ahead for the leading cryptocurrency:

Bitcoin price action

As a financial analyst, I’d rephrase that sentence as follows: The sluggish performance in June resulted in a nearly 7% decline in Bitcoin’s value during that month, and a significant 12% loss for the quarter that just ended.

As a crypto investor, I’m bracing myself for increased price fluctuations in the BTC/USD pair during the second half of the year. The market showed signs of instability in the previous quarter, with the pair dipping below the $60,000 mark on two occasions.

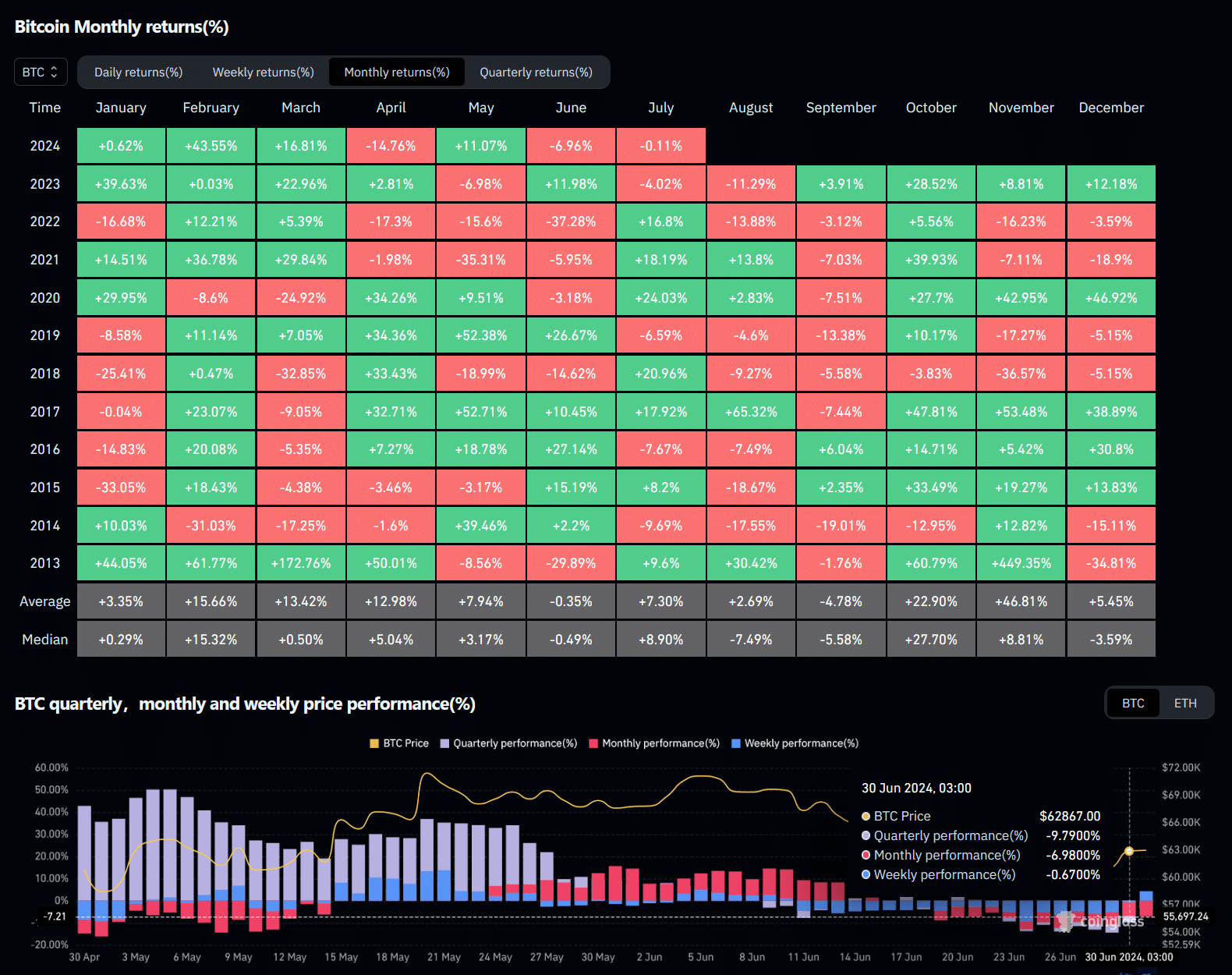

Based on past trends, Bitcoin’s price may surge by around 7.3%, on average, or even reach a median gain of 8.9% in July following a downward trend in June. In simpler terms, Bitcoin has a history of bouncing back in July after experiencing losses in June, with an average increase of 7.3% and a median rise of 8.9%.

According to historical data from Coinglass, Bitcoin showed signs of recovery in July following a subdued performance in June. However, not all market players are convinced by this bullish outlook.

Macroeconomic picture

There are still question marks regarding the bigger economic landscape as we enter a new month. This week, investors are looking for clues from US economic reports, which may shed light on the perspectives of central banks concerning inflation and borrowing costs.

As an analyst, I would put it this way: I anticipate that Federal Reserve Chair Jerome Powell will deliver a speech at the European Central Bank’s annual conference in Sintra, Portugal, which is scheduled for Tuesday. Additionally, we are due to receive the minutes from the Federal Reserve’s last meeting on Wednesday.

On Friday, stock markets will reopen and welcome the US jobs June report.

Market analysts are optimistic that the Federal Reserve will reduce interest rates at some point in 2023 based on current indications of decreasing inflation.

As an analyst, I’d interpret the markets’ prediction based on the Federal Reserve’s (Fed) expected actions according to CME’s FedWatch tool. The forecast indicates two rate cuts of 25 basis points each by the end of this year. These anticipated rate reductions from the Fed might lead investors to seek alternative investment opportunities, such as cryptocurrencies.

As a crypto investor, I’ve noticed that in their yearly economic update published on the 30th of June, the Bank for International Settlements (BIS) cautioned against hasty loosening of monetary policies.

The BIS advised at its annual general meeting,

As an analyst, I would rephrase it as follows: “Prematurely easing monetary policy could lead to a resurgence of inflation and necessitate expensive policy corrections – the expense being compounded by damage to our credibility. The risks of unmoored inflation expectations persist, with pressure points still present.”

As a researcher, I would advise keeping a close watch on the upcoming Federal Open Market Committee (FOMC) meeting slated for July 30-31. This gathering will provide valuable insights into the Federal Reserve’s monetary policy direction.

Read Bitcoin’s [BTC] Price Prediction 2024-25

BTC/USD technical analysis

During the trading on July 1st, Bitcoin regained control of the $63,000 mark, reaching an intraday peak of $63,700. However, from a technical perspective, Bitcoin’s price remains uncertain within the broader range of $58,500 to $72,000, despite Monday’s price fluctuations.

As an analyst, I would recommend keeping a close eye on the cryptocurrency market. If the price falls below the 20-exponential moving average (EMA) around $63,650, it could signal a potential downturn. This may lead to further declines towards the critical support level at approximately $60,000.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-02 13:11