-

Bitcoin’s BTC small retail holders dominated the market at press time.

Analysts suggest three conditions for Bitcoin to rally to new highs.

As a seasoned researcher with over two decades of experience observing and analyzing financial markets, I have to admit that Bitcoin’s current market dynamics remind me of a rollercoaster ride more than anything else. The small retail holders dominating the market, as we see now, is not uncommon in such situations, but it does raise concerns about potential volatility and speculative behavior.

As a researcher studying the crypto market, I’ve noticed that Bitcoin, the leading cryptocurrency by market capitalization, has been experiencing a downward trend over the past month. On a day-to-day basis, its price has dipped by 1.01%, currently trading at $56657.

Equally, over the past 30 days, it has dropped by 2.80% suggesting increased volatility.

After reaching its all-time high (ATH) of $73,737 in March 2024, this cryptocurrency has found it challenging to sustain an uptrend and has even touched a recent low of around $49,000.

Due to the heightened unpredictability in the market, there are growing doubts about the future potential of investments, largely due to investor actions. Consequently, analysts at Santiment have proposed three key factors that could lead Bitcoin to reach fresh record highs.

What prevailing market sentiments suggest

Based on Santiment’s analysis, while the overall sentiment among retail traders is optimistic, this alone may not be enough to trigger a Bitcoin rally.

Based on recent analysis, an influx of wallets containing less than 1 Bitcoin has accumulated the most Bitcoin in seven months. Therefore, it appears that a significant portion of the total Bitcoin supply is now being held by smaller individual investors or retail traders.

According to this comparison, a decrease in the amount that small traders are holding would be a more favorable condition for Bitcoin (BTC) to experience a rally.

In an ideal situation, if many individual farmers (small holders) control the market, it often suggests heightened speculation or a vulnerable market, as these individuals tend to act on their emotions when selling goods.

Consequently, it’s more advantageous for a prolonged rally if there are fewer individual investors, as they tend to be more susceptible to panic-selling.

To further elaborate, medium-scale investors managing between 1 to 100 Bitcoins aim for a consistent expansion of their holdings. This continuous growth among medium-scale investors could be indicative of larger, more seasoned investors and financial institutions beginning to participate in the market.

The entrance of such investors is overall bullish, as it shows confidence in long-term prospects.

For a rally to occur, there needs to be significant buying activity by at least 100 major investors (often institutional or high-stakes individuals). This intense buying indicates that these influential investors have a positive outlook on the project’s future potential.

Thus, whales amassing Bitcoin (BTC) likely indicate their faith in a prolonged price growth, as decreasing the amount of BTC available on exchanges often contributes to price escalation.

Bitcoin holder analysis

It’s worth mentioning that small individual investors have been leading the market in the more recent period.

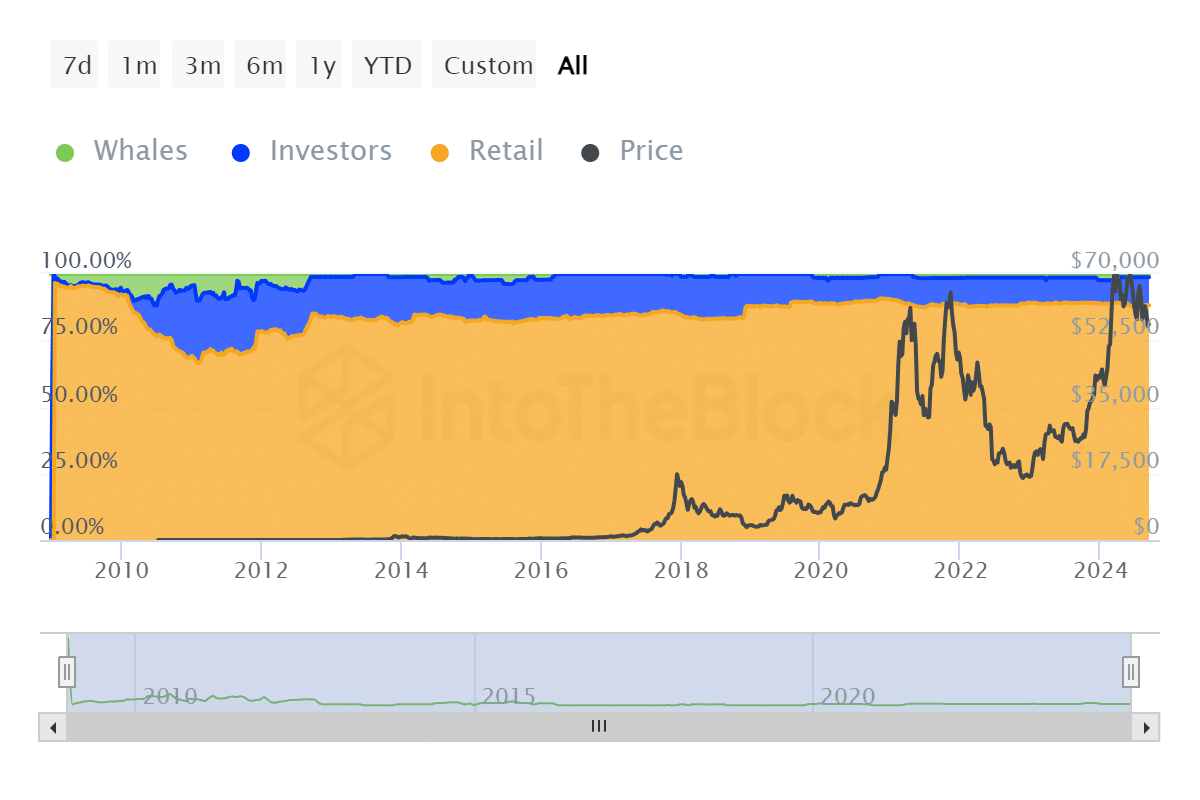

Initially, it’s important to note that about 88.24% of all Bitcoin, amounting to approximately 17.44 million coins, is owned by retail traders. On the other hand, investors own around 10.5%, and a smaller group known as “whales” control about 1.26%.

In this scenario, it’s clear that retailers hold significant influence over the market, leading to speculative trading. Consequently, this dynamic has been causing the market to exhibit recent volatility and instability.

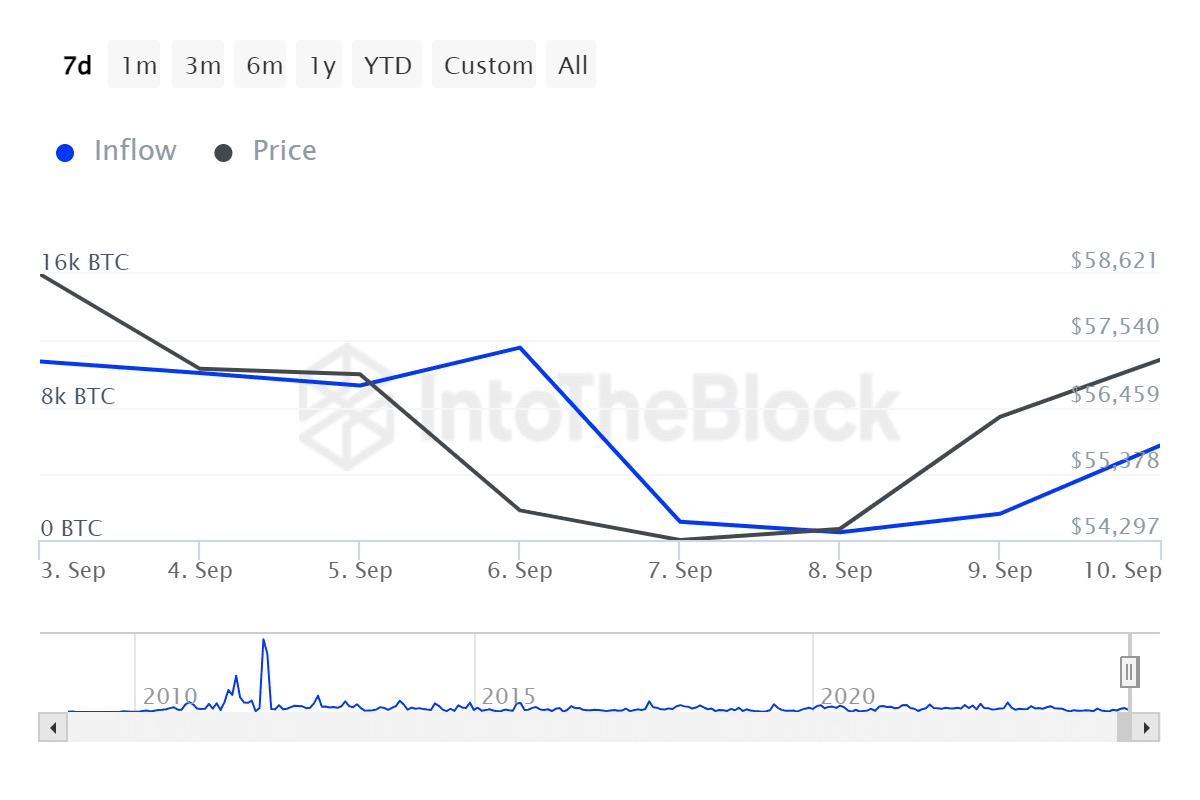

Over the last seven days, there’s been a significant decrease in the amount of cryptocurrency flowing into the hands of major holders. This figure dropped from 11,570 units to just 1,580 units.

This implies that whales are selling off due to a perceived decrease in market demand, as they are exiting their positions during the market decline. A decrease in whale ownership suggests optimism about the future outlook.

Therefore, the increase in small retail traders holding reflects the current market fluctuations.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In times of economic decline, retail traders often decide to liquidate their investments because they primarily operate on a speculative selling basis. This action can further lower the market prices.

Consequently, a rise in significant and medium-sized investors could maintain market stability and potentially boost prices. If, on the other hand, retail traders persistently control the markets, Bitcoin might drop to around $54,587.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-11 20:08