- BitMEX co-founder envisioned Bitcoin rising to $1 million.

- Arthur Hayes believed that BTC’s deflationary nature made it an attractive hedge against inflation.

As a seasoned researcher with a keen interest in the digital asset space, I find Arthur Hayes’ Bitcoin prediction intriguing. Having closely followed his career and BitMEX’s journey, I can appreciate his insights drawn from his extensive experience in the crypto market. His comparison of the potential future economic landscape under Trump’s administration to “American Capitalism with Chinese Characteristics” is both insightful and thought-provoking.

In the midst of the current market surge, various Bitcoin [BTC] price prognostications have been shared by analysts. The latest estimate was made by Arthur Hayes, a co-founder of BitMEX.

In the article titled “Black or White?”, the executive explored potential reasons that might push the cryptocurrency known as the ‘king coin’ up to a value of nine figures (i.e., one billion).

His prediction centered around the future economic landscape under the returning Donald Trump administration and its potential impact on traditional financial markets, inflation, and the U.S. dollar.

Trump’s policies and economic impact

In the essay, Hayes posited that it’s probable the Trump administration might resort to a monetary policy strategy known as Quantitative Easing (QE).

To put it simply, Quantitative Easing (QE) refers to a monetary strategy used by central banks, such as purchasing government securities. This action increases the money supply within an economy, thereby reducing interest rates and stimulating lending and spending activities.

The approach to generating credit, designed to boost American manufacturing and industry, could potentially trigger increased prices. Consequently, it may result in a decrease of the dollar’s value.

As a crypto investor, I’ve noticed that the current debt-driven investment strategies bear striking resemblances to certain elements of China’s economic expansion plan, as pointed out by the co-founder of BitMEX. He aptly referred to this approach as…

“American Capitalism with Chinese Characteristics.”

Hayes’ $1 million Bitcoin target

Instead, Could the effect on BTC be that investors might shift towards it more when inflation outpaces traditional investments, as suggested by Hayes?

Unlike traditional currencies that can be increased in amount during times of economic stress, Bitcoin is limited to just 21 million units, giving it an innate characteristic of being deflationary.

The fact that Bitcoin isn’t controlled by any central bank and has limited supply makes it more attractive as a form of long-term savings or “store of value”. He further explained…

As the available supply of Bitcoin that can be freely traded decreases, an unprecedented amount of traditional currencies from countries like America, China, Japan, and Western Europe are seeking a secure investment haven. Consider investing in it extensively and maintaining that investment.

Emphasizing Bitcoin’s role as a safeguard against the depreciation of traditional currencies, Hayes pointed out its significant increase by approximately 400% from the year 2020.

To achieve a debt-to-GDP ratio of 115% from its current 132%, approximately $4 trillion is needed. On the other hand, bringing the ratio back to the pre-2008 levels around 70% would necessitate an additional $10.5 trillion.

Such credit expansion, the exec suggested, would fuel BTC’s growth, stating,

“This is how Bitcoin goes to $1 million.”

BTC market state

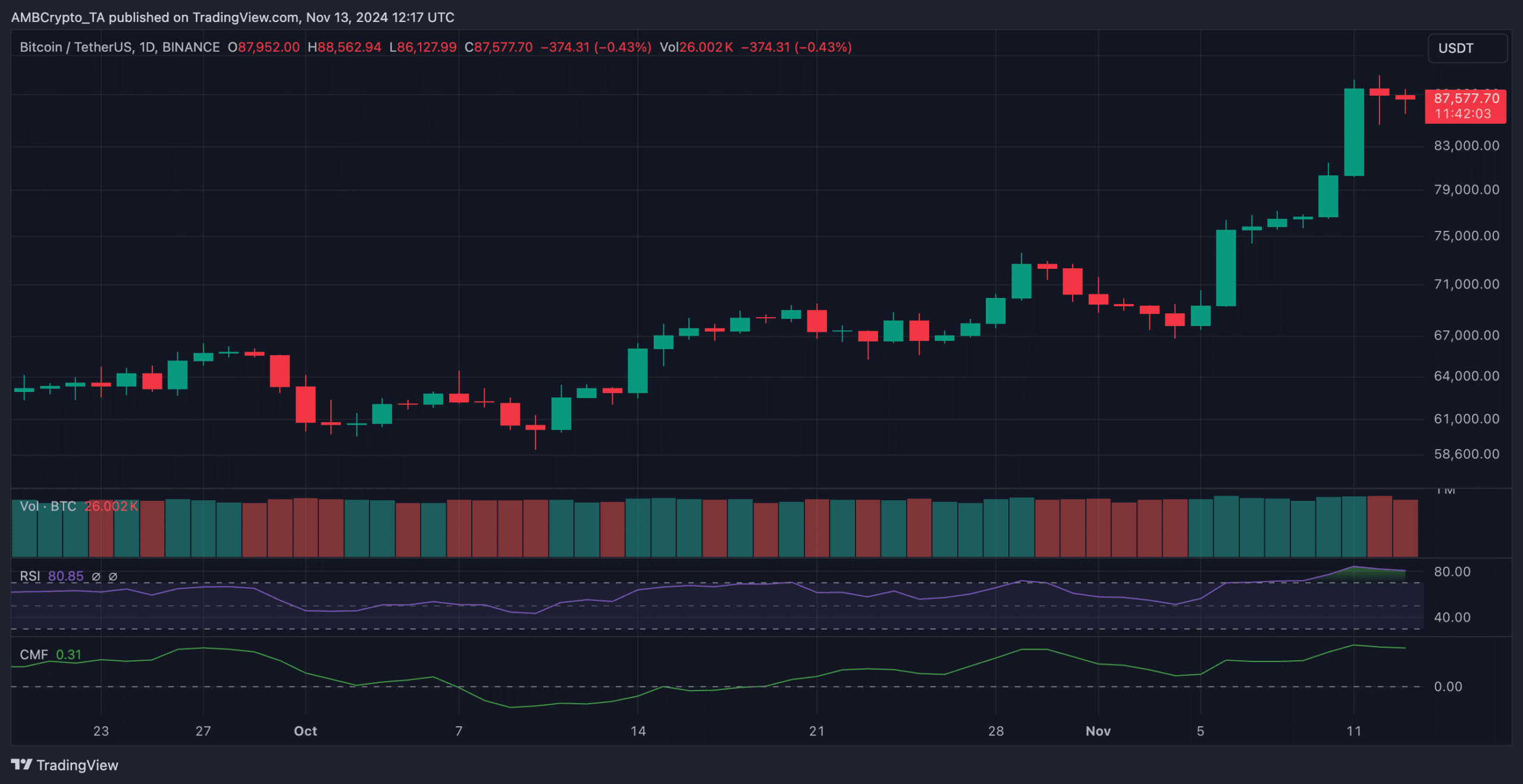

Currently, after approaching nearly $90,000, the leading cryptocurrency has experienced a drop. At the moment of writing, it is being traded at $87,577, which represents a 2.63% decrease from its all-time high of $89,940.

According to data from CoinMarketCap, Bitcoin’s price experienced a 0.17% rise over the past day, and its weekly growth remains approximately 17%.

Nevertheless, technical indicators seem to hint at an upcoming cooling-off period. For instance, the Relative Strength Index (RSI) has dropped from its peak of 84.51 yesterday to 80.85 today, implying a potential decrease in bullish energy.

The Capital Movement Fund (CMF) saw a decrease, but it still held a positive value at 0.31, suggesting less money flowing into the country than in the past few days.

In summary, these signs suggest that Bitcoin might experience a temporary decrease or minor adjustment due to some investors cashing out after a significant weekly increase. However, the underlying positive momentum towards Bitcoin remains strong.

Read More

2024-11-14 08:08