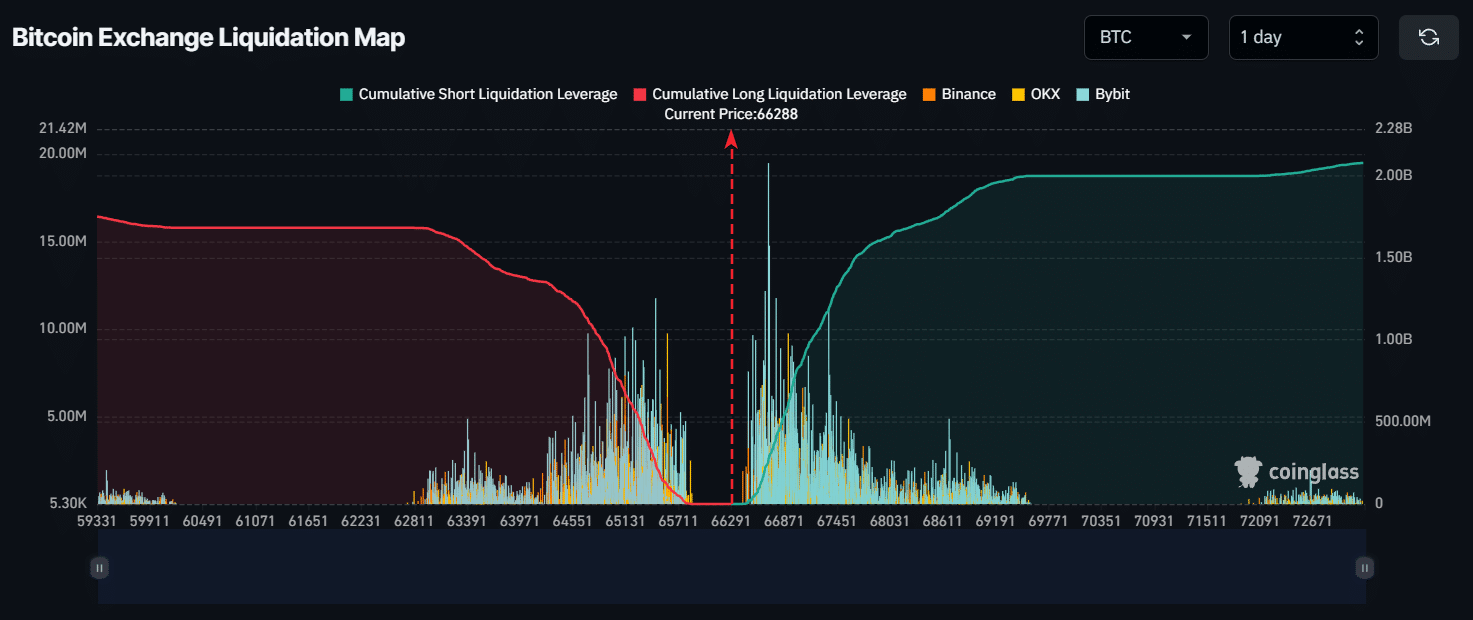

- Bitcoin’s major liquidation levels were $66,700 on the higher side and $65,450 on the lower side.

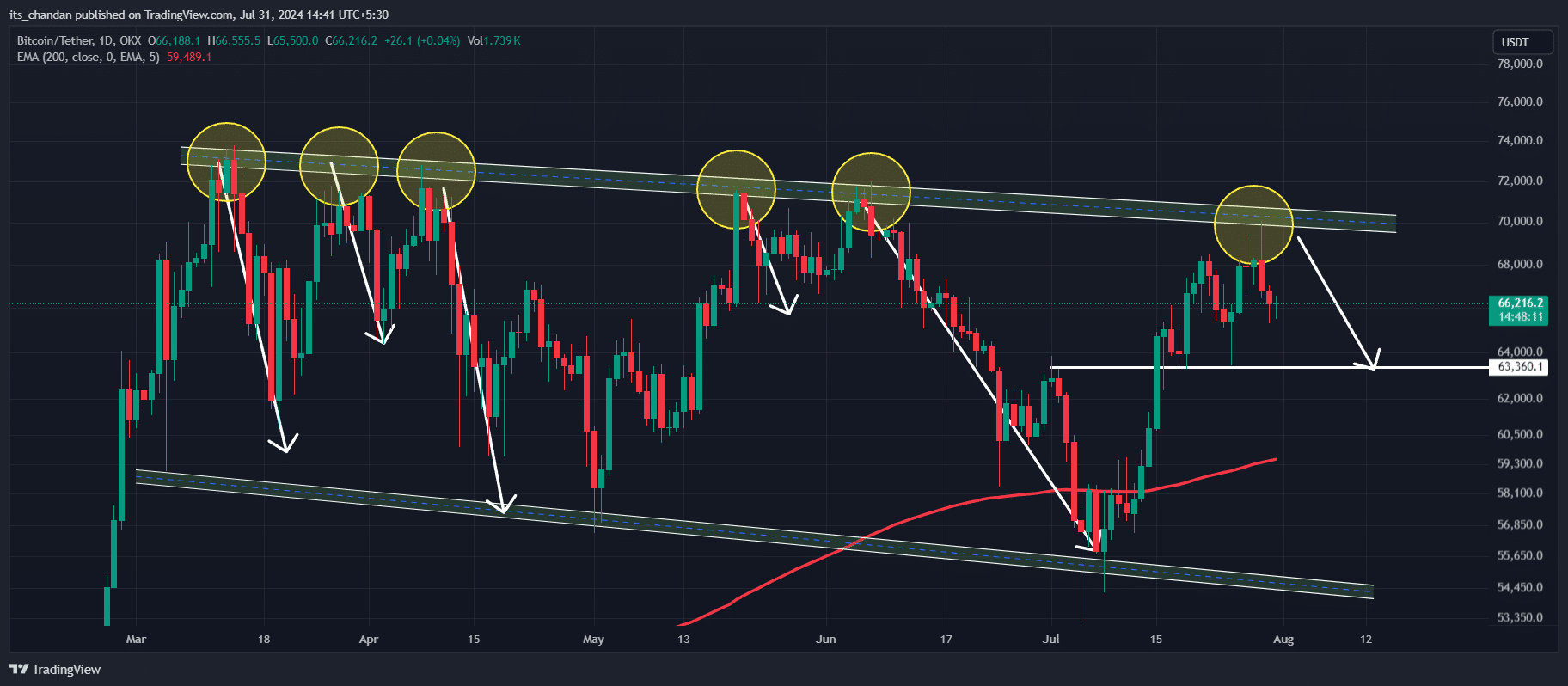

- However, historical data suggested that Bitcoin could fall to the $63,000 level.

As a seasoned crypto investor with a decade of experience navigating the volatile waters of the digital asset market, I find myself intrigued by the latest developments surrounding Bitcoin (BTC). The recent price drop to $65,500 has undoubtedly stirred up emotions among investors, and the lofty prediction of $428,000 from James Lavish certainly adds an exciting twist.

In simple terms, a significant wave of sellers caused stress across the entire cryptocurrency market, causing Bitcoin (the world’s largest digital currency) to drop down to approximately $65,500.

In the midst of this price decrease, ex-hedge fund manager James Lavish recently shared an opinion on platform X (formerly known as Twitter), predicting that Bitcoin might reach a staggering $428,000 if it manages to secure just 1% of the entire global investment market.

What it will take for BTC to hit $428K

Based on Lavish’s statement, the global total investment assets currently stand at an impressive $900 trillion. BitCoin (BTC) represents only 0.15% of this amount, which equates to around $67,000 per BTC. If BTC were to capture a mere 1% of these global assets, its value could skyrocket to an astounding level of approximately $428,000 per BTC.

Additionally, both investors and large-scale Bitcoin holders (often referred to as “whales”) have shown optimism towards Bitcoin. Notably, cryptocurrency expert Julien Bittel recently foretold that the value of BTC could potentially reach $190,000.

I’ve learned that the current state of the Bollinger Band Indicator indicates a complete compression, which could potentially trigger a substantial bull rally, given my understanding as a crypto investor.

Moreover, as stated by AMBCrypto on July 30th, whales have amassed approximately 5,900 Bitcoins, which equates to a staggering $397 million in value.

Price-performance analysis

Currently, Bitcoin is approximately valued at around $66,000 per coin, marking a 1.35% decrease in its price over the past day. Additionally, trading volume has decreased by about 28% within the same timeframe.

The fall in trading volume signals lower participation from traders and investors.

In a similar vein, CoinGlass, an on-chain analytics company, noted a decrease of 4% in Bitcoin’s Open Interest (OI), potentially indicating apprehension among market participants.

In other words, the significant points for selling or buying a large amount of the asset occurred at approximately $66,700 (higher) and $65,450 (lower).

If the general opinion about the market stays the same and Bitcoin drops down to around $65,450, it would result in approximately $275 million worth of long positions being forced to close.

Conversely, if the sentiment shifts and Bitcoin’s price surges to $66,700, it would lead to the liquidation of about $233 million in short positions.

Bitcoin price prediction

Based on current technical assessments by experts, Bitcoin appears to be trending downward (bearish) at present and could potentially rise to approximately $63,300 over the next few days.

“The likely cause for this bearish trend might stem from the latest price reversal at a significant resistance point of $70,000.”

Read Bitcoin’s [BTC] Price Prediction 2024-25

Historically, Bitcoin (BTC) has hit this point on five occasions since March 2024, only to be turned away and suffer significant price decreases. The current scenario mirrors such speculations suggesting another potential drop for BTC.

As a crypto investor, I noticed that the Relative Strength Index (RSI) reinforced the bearish perspective at the current moment. Specifically, the RSI was indicating an overbought state, suggesting potential future price reversals for the assets under consideration. This means that the high level of buying activity could soon lead to a shift in market direction, possibly toward a downturn.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-07-31 21:11