- Bitcoin short-term holders were still selling their coins at a high profit suggesting a correction could be in play.

- However, Funding Rate, Premium and OI fractal for 2024 suggested that BTC could hit a peak of $160k if it rebounds.

As a seasoned analyst with years of experience navigating the crypto market, I find myself both intrigued and cautiously optimistic about Bitcoin’s near-term trajectory. The consistent profit-taking by short-term holders suggests potential corrections, but historical trends hint at a possible rebound.

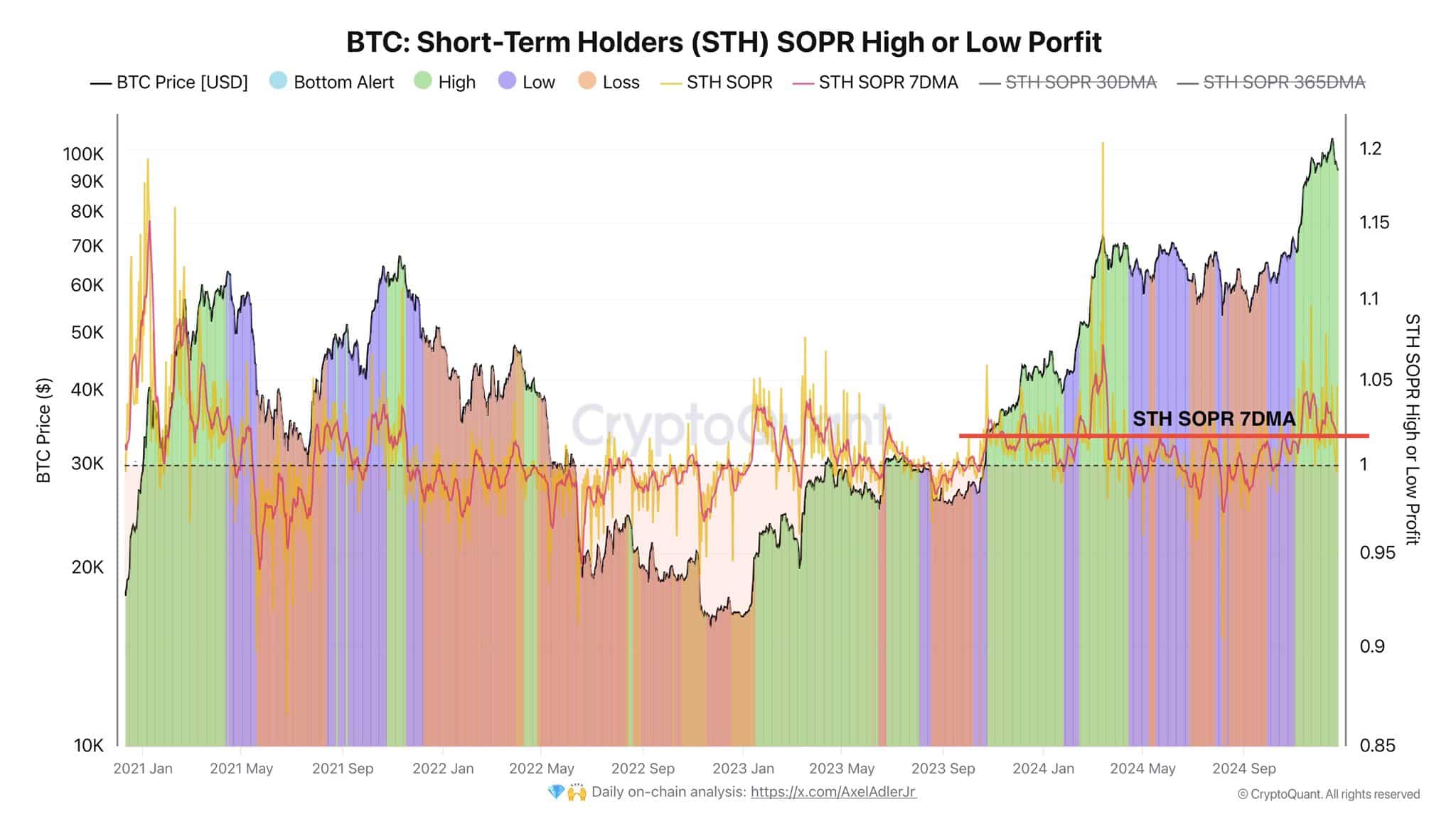

Short-term Bitcoin [BTC] holders (STH) were typically selling their assets at a profit, as suggested by the elevated Spent Output Profit Ratios (SOPR). This trend often coincided with peaks in the Bitcoin prices.

If SOPR falls below 1, it typically indicates that investors are selling at a loss, often during periods of market corrections or downturns.

Regular selling by short-term investors might signal possible changes ahead. Should demand decrease as the number of sellers remains significant, the price could experience a drop due to increased downward pressure, potentially triggering corrections.

On the flip side, if SOPR values suggest losses and keep falling, this might mean less selling pressure is at play. In such a scenario, Bitcoin could seek stability or potential support at approximately $90K.

Thus STHs influenced the market’s short-term direction based on their profit or loss realization.

NAV premium for STHs and MACD signals

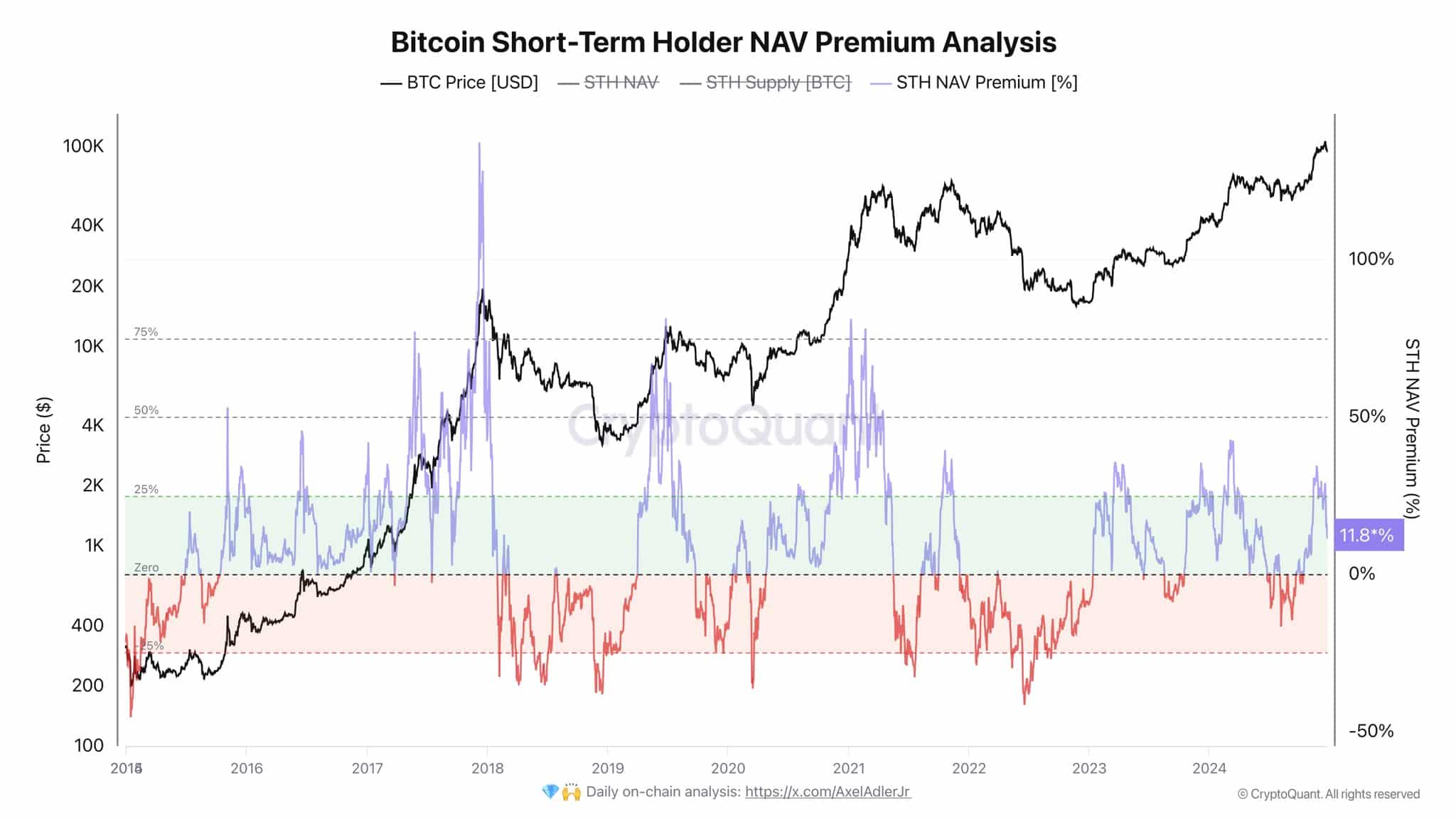

Furthermore, the STH NAV Premium decreased to 11.8%, down from levels exceeding 30%. This decline supports the expected adjustment in pricing.

Previously, when the STH NAV premium approached zero, a slowdown in selling activity was evident.

Holders typically kept their investments due to anticipation of better market circumstances, as the consistent pattern saw the Net Asset Value (NAV) Premium approaching zero, aligning with decreased market fluctuations.

If the current value falls below zero, this situation might lead to less demand for selling Bitcoin, as indicated by reduced selling pressure. This decrease in selling pressure could potentially bolster the price of Bitcoin if past trends continue.

In this situation, it’s observed that the price either remains steady or rises after falling below zero in relation to the Net Asset Value (NAV) of the STH (Specified Token Holder).

Furthermore, the MACD (Moving Average Convergence Divergence) displayed bearish crossings at substantial values, a pattern that typically precedes price adjustments. In the past, these bearish crossings have been followed by approximately 30% drops in the value of Bitcoin.

bitcoin’s value reached highs close to past resistance points, which lines up with pessimistic indicators. This implies that if bitcoin follows its usual trends, a significant price drop might occur in the near future.

Based on the present bearish crossover, Bitcoin (BTC) might drop below the $90K price point, approaching its fourth target.

Bitcoin’s Funding Rate, Premium and OI

As an analyst, I’ve noticed that Bitcoin’s Open Interest (OI) seems to be moving back towards a supportive trendline, which could indicate potential price stability or even a rise in the near future.

The recent trend mirrors past adjustment patterns, and if it continues, we might see Bitcoin’s value climbing towards $160K during the first quarter of 2025.

During the previous market correction, the Funding Rate, Premium, and Open Interest (OI) tended to be comparable to their historical values.

Read Bitcoin (BTC) Price Prediction 2024-25

Significantly, the Realized Profit/Loss Ratio and the STH Realized Price, presently valued at approximately $86,000, suggest significant points where investor sentiment may change. This shift could possibly prevent further declines and strengthen the path toward a potential price of $160,000.

From this analytical viewpoint, rooted in past trends and present blockchain statistics, we anticipate a modestly positive trajectory for Bitcoin’s short-term evolution.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-12-24 21:12