-

There has been a growth in new demand for BTC over the past week

The last 12 hours have seen a decline in the same though

According to Santiment’s data, the number of Bitcoin [BTC] wallets with a balance other than zero has increased, even though the price of the coin has experienced some recent drops.

Based on information from a data provider that specializes in on-chain analysis, approximately 370,000 new Bitcoin wallets have emerged over the past six days. As a result, there are now around 52.94 million individuals or entities holding Bitcoin, representing a slight increase of 0.1% since the beginning of the year.

Currently, Bitcoin was priced at $67,734 in the markets. Due to pessimistic sentiments in conventional investments and political instability, Bitcoin declined and dragged the entire market lower. As per CoinMarketCap’s information, it had dropped more than 5% within the past 24 hours.

More decline in the short term?

Based on my analysis of the coin’s price movements on the daily chart, it seemed that there was a higher chance of the price dropping in the near future. The major signals I detected suggested that selling activity was much stronger than buying activity in the Bitcoin market. If Bitcoin’s value continues to decline, it’s possible that its price could fall below $65,000.

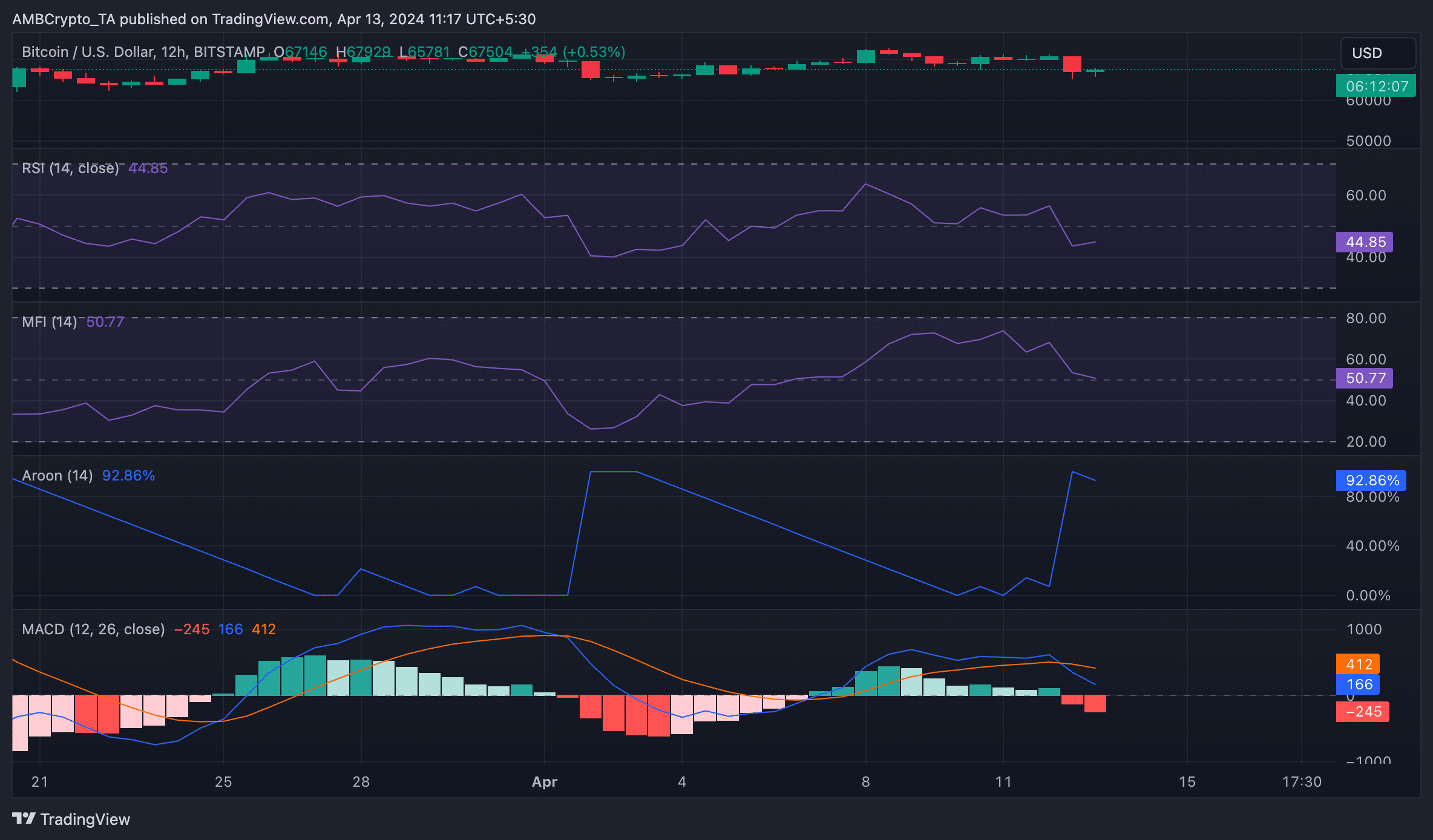

At the current moment, the Aroon Down Line (represented by the blue line) showed a value of 92.86%. The Aroon indicator is utilized to assess an asset’s trend strength and detect possible price reversal points. When the Aroon Down Line approaches 100, such as in this instance, it signifies that the downtrend is robust and that the latest low was attained not too long ago.

According to CoinMarketCap data, BTC last traded around the $67,000-zone a month ago.

On April 12th, during daily trading, the coin’s MACD line fell beneath its signaling line, indicating a continuing downward trend for the coin.

When the MACD line of an asset crosses below its signal line, this signifies that the short-term trend is losing strength compared to the long-term trend. Historically, this occurrence has been followed by price decreases. Many traders view it as a potential warning to consider selling their assets or going short.

Based on the recent drop in Bitcoin’s price, it comes as no surprise that there has been a decrease in overall interest or demand for the cryptocurrency. This trend was further supported by the data from the Relative Strength Index and Money Flow Index. In particular, the Money Flow Index was close to crossing below the mid-line at the time of reporting – an indication suggestive of a bearish market.

Based on the data from these indicators, it appears that market users are currently preferring to distribute Bitcoin rather than accumulate it. However, this does not necessarily mean that Bitcoin will experience a prolonged price increase at this time, despite the upcoming halving event.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-04-14 05:11