- The Bitcoin price crash has been sudden, catching many investors off guard.

- As the market braces for what’s next, stablecoins could be poised to step in.

The recent fall in Bitcoin’s value has caused a split in the market, with bullish investors suggesting that this drop is actually a “deceptive move” by bears, hoping for a surge of liquidity to ignite a rebound.

Meanwhile, fear is creeping in, with greed hanging by a thread.

With the increasing volatility in Q1, will the “Trump effect” potentially stabilize Bitcoin’s price once more, or is a significant drop in its value imminent instead?

Fear of Bitcoin price crash mounts

1) In the past three days, Bitcoin has dropped by approximately 9%, causing some investors to wonder if this could be the beginning of a more significant downturn. Furthermore, as the Department of Justice is now authorized to sell $6.5 billion worth of Bitcoin, worries about the market have grown even stronger.

It appears that an increase in available funds might be just around the corner, yet with over half a billion dollars withdrawn from Bitcoin ETFs in recent weeks (the second significant withdrawal this month), it seems that a sudden decrease in the supply of Bitcoin may take some time to materialize.

Furthermore, Binance‘s stablecoin outflow is now in the red, indicating a withdrawal of approximately $383 million from the platform.

Indeed, considering the current economic trends, it’s plausible that by 2025, stablecoins might emerge as preferred “secure investments” due to their stability. It’s worth monitoring this development as events progress.

In essence, as retail and institutional investors seem to pause their investments, apprehension is growing. Should this pattern persist, there’s a possibility that the value of Bitcoin could plummet even more, possibly dropping under the $90K threshold in the near future.

Nevertheless, it remains uncertain what the future holds for the longer term perspective. You may recall the significant surge of Bitcoin (BTC) during the fourth quarter of last year, which saw its price skyrocket to a record high of $108,000 within only 60 days, often referred to as the “Trump pump.

As Donald Trump’s inauguration approaches in only ten days, might there be renewed excitement reminiscent of the rally, potentially stirring up a sense of missing out (FOMO) and invigorating the market once more?

It might be harder than it sounds

Considering the overall context, there’s still much to explore. The Dollar Index (DXY) remains strong without any hints of relaxation, and Treasury yields continue to attract a substantial number of investors.

As Bitcoin’s price crash stirs up fear, these traditional assets are poised to benefit.

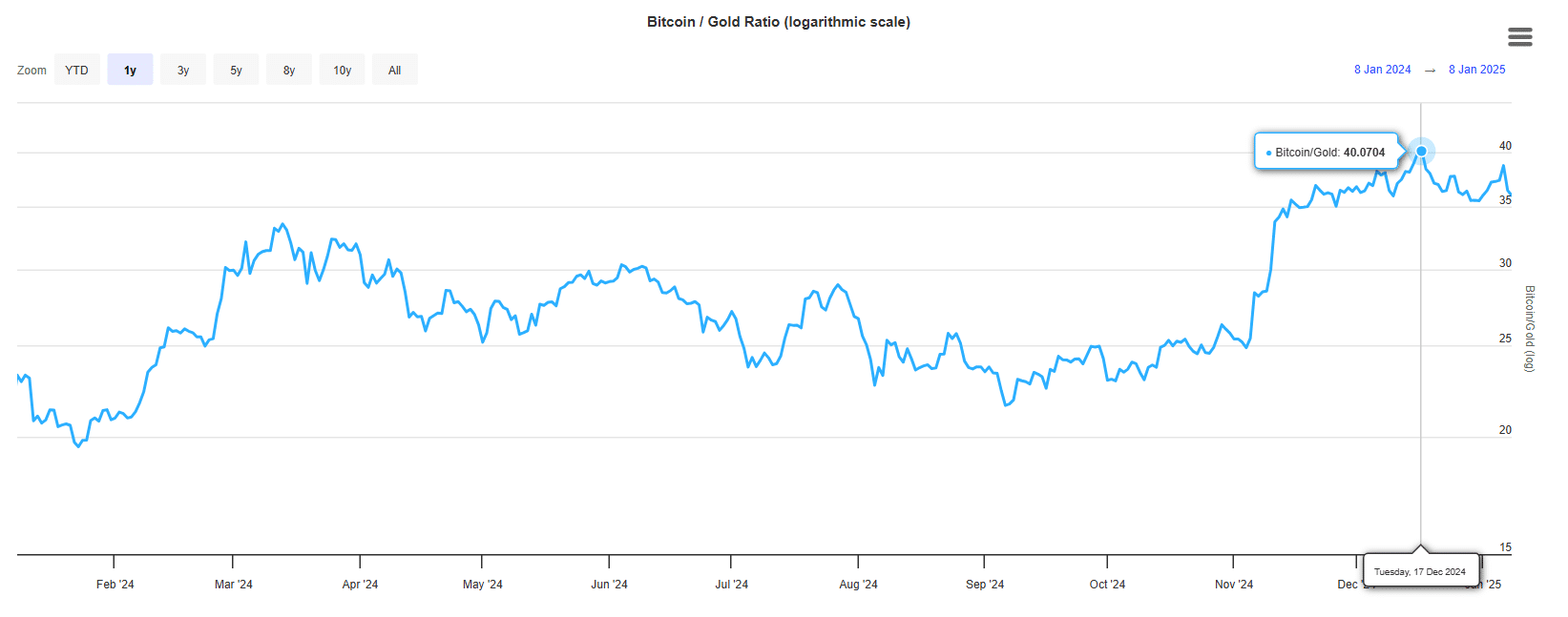

As an analyst, I find it intriguing that we might only be scratching the surface here. The Bitcoin-to-Gold ratio, which peaked at a historic high of 40 when Bitcoin was trading at $108,000, has now fallen below 35. This could hint at further price fluctuations and hidden dynamics within the market that are yet to unfold.

Currently, the price of gold (XAU) hasn’t shown much movement, but if Bitcoin’s price were to significantly drop below $88K, it might trigger a shift in everything we’ve seen so far.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

In light of increasing American debt and international inflation concerns, the role of gold as a secure investment option has never been stronger.

With markets becoming increasingly risky, it’s possible that investors might shift their focus towards gold, which could diminish the allure of Bitcoin as a safe haven for values.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-01-10 01:11