- BNB could hit multiple ATHs in a single year if it remains on track.

- The coin faces a critical resistance near $670.

As a seasoned analyst with years of experience navigating the dynamic world of cryptocurrencies, I find myself cautiously optimistic about BNB’s potential to hit multiple all-time highs this year. The coin’s impressive surge last month, coupled with its proximity to its previous ATH, suggests a bullish trend that could potentially continue. However, it’s important to remember the adage, “What goes up must come down,” so I wouldn’t be surprised if we see a temporary correction before BNB truly breaks its all-time high.

Last month, the price of BNB experienced a significant rise, increasing more than 33%. Currently, this recent increase has brought BNB close to its record high, with just a 10% gap remaining.

Consequently, AMBCrypto delved deeper to ascertain if this surge would persist, potentially propelling the coin to a new all-time high.

BNB reaches close to its all-time high

In June of 2024, BNB hit its all-time high (ATH) with a value of $717. Since that time, it has generally stayed within the higher end of its price range.

Moving ahead to November, the worth of the coin significantly increased, largely due to a favorable market trend. Consequently, if the price increases by an additional 10%, the coin could potentially reach its All-Time High again.

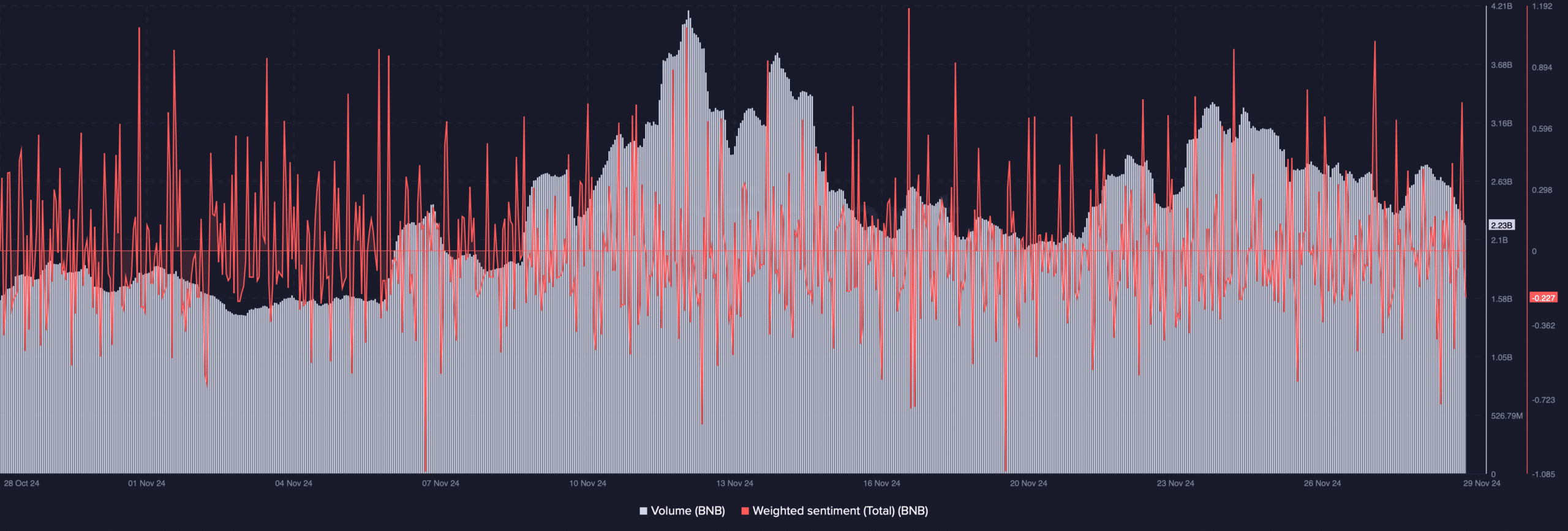

Over the past month, the increase in BNB’s price has been bolstered by a substantial amount of trading activity. For those starting to invest, this high trading volume serves as a solid base for a prolonged bullish trend.

Furthermore, the coin’s sentiment analysis showed peaks on several occasions – an indicator of growing optimism among investors, demonstrating their rising trust and positive outlook towards the digital asset.

Is a new ATH around the corner?

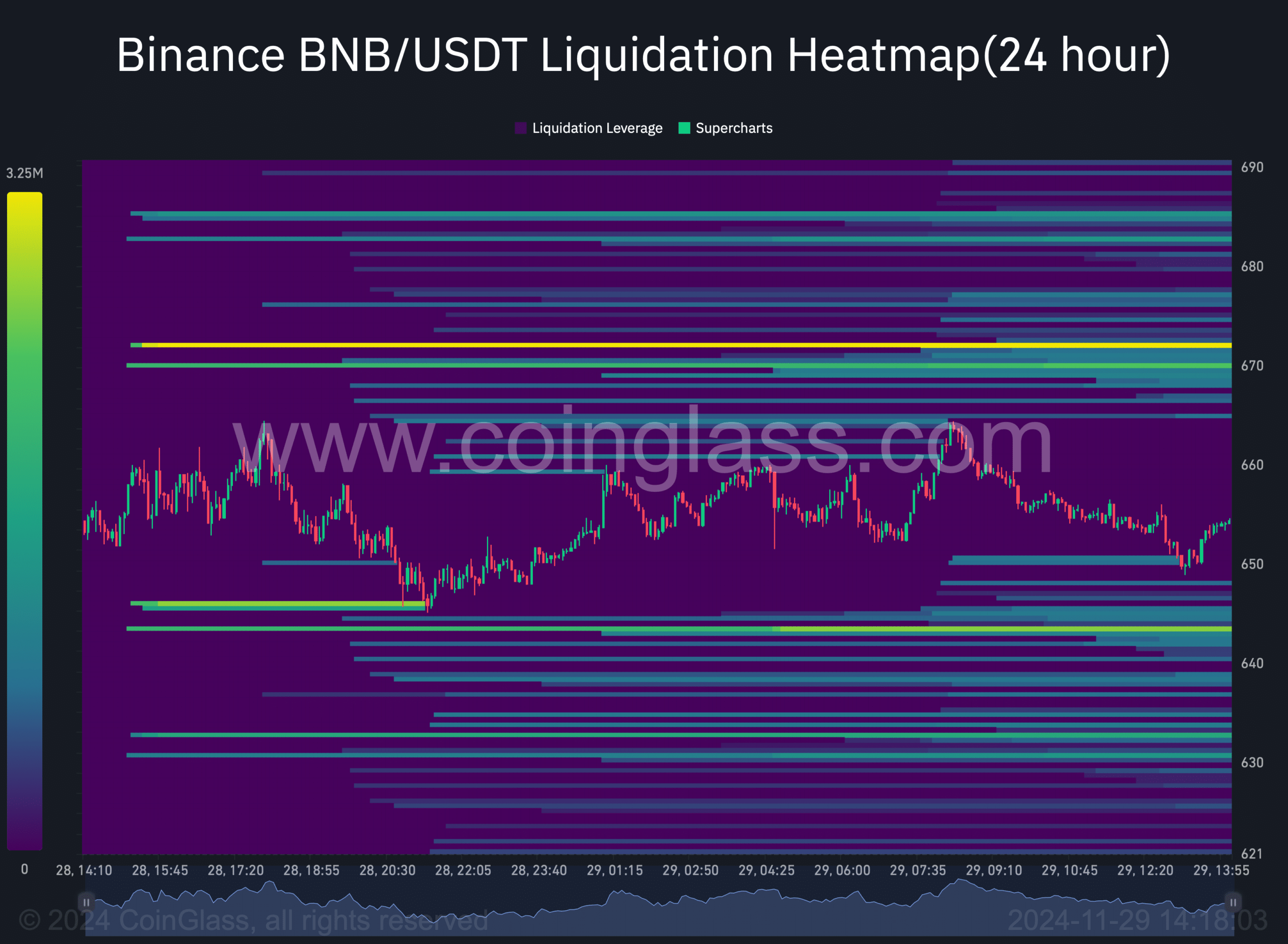

Given that the value of the coin was nearing its all-time high, AMBCrypto decided to explore further details about BNB’s blockchain activity. Over the past 24 hours, there had been a significant increase in the long/short ratio associated with this coin.

This situation signified that there were more traders taking long positions, or betting on prices rising, compared to those taking short positions, or betting on prices falling. This imbalance strongly suggests a surge in optimistic or bullish attitudes among traders.

Beyond this point, there have been several instances where demand for purchasing BNB has significantly risen during the past fortnight. According to data from Hyblock Capital, the buying volume of the coin peaked at 93 on November 14th.

Subsequently, there was an increase in demand for the coin on the 24th and 25th of November, but recently, the situation has become less heated as the figure fell to 10.4.

Notably, should BNB aim to surpass its record peak, it would need to overcome a significant hurdle. At the price level of $670, the coin’s liquidation leverage is estimated to be approximately $3.25 million.

When there’s an increase in liquidation (selling off large amounts of assets), it often leads to price adjustments. Consequently, if the coin manages to rise above that threshold initially, it could potentially aim for a fresh record high.

Significantly, as the value of the coin rose significantly in the past month, there was also a noticeable increase in activity on the blockchain’s network. It was found through Artemis’ data analysis that the number of active addresses on BNB Chain remained high. Consequently, this led to an upward trend in its daily transaction volume as well.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Strong network activity frequently bolsters price increases, implying that the surge towards BNB’s All-Time High (ATH) is being propelled by various underlying factors.

Read More

2024-11-30 03:03